IPO 评级(1.75 星,满分 5.0 星)

版权所有@http://lchipo.blogspot.com/

在脸书上关注我们:https://www.facebook.com/LCH-Trading-Signal-103388431222067/

日期

开放申请:27/02/2020

截止申请:06/03/2020

上市日期:18/03/2020

股本

市值:84亿令吉

Total Shares: 300mil shares (Public :15 mil, Company Insider/Miti/Private Placement: 43 mil)

企业

Distribution of electrical products and accessories.

Industrial User: 74.46%

Reseller: 25.54%

基本

市场:王牌市场

价格:RM0.28 (EPS:0.0247)

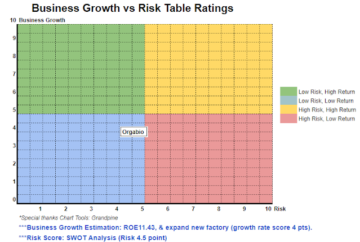

P/E & ROE:PE11.34(招股说明书是)ROE13%

首次公开募股后的现金和定期存款:每股 RM0.05

IPO后不适用:RM0.19

Total debt to current asset after IPO: 1.644 (Debt: 63.657 mil, Non-Current Asset: 38.712 mil, Current asset: 81.368mil)

股利政策:无固定股利政策。

财务比率

应收账款:80 天

应付账款:103 天

库存周转:105天

过去的财务业绩(收入、每股收益)

2019 (until Nov): RM104.084 mil (EPS: 0.0237)

2019 年:134.373 万令吉(每股收益:0.0275)

2018 年:124.193 万令吉(每股收益:0.0173)

2017 年:114.509 万令吉(每股收益:0.0153)

净利润率

2019:5.52%

2018:4.03%

2017:3.89%

上市后增持

Ir. Tang Pee Tee @ Tan Chang Kim: 62.79%

Jin Siew Yen: 7.85%

Tan Yushan: 7.85%

2021 财年的董事薪酬(来自 2019 年的毛利润)

Ir.Tang Pee Tee: RM0.502 mil

Tan Yushan: RM0.437 mil

Chai Poh Choo: RM0.218 mil

Yap Koon Roy: RM68k

Dr.Tee Chee Ghee: RM68k

Ir. Dr.Ng Kok Chiang: RM56k

来自毛利的董事薪酬总额:1.349万6.07令吉或XNUMX%

2021 财年主要管理层薪酬(来自 2019 年毛利润)

Ooi Gin Hui: RM250k-300k

Chong Su Yee: RM150k-200k

Lim Lee Hua: RM150k-200k

Low Swee Ching: RM150k-200k

Foong Kah Hong: RM150k-200k

key management remuneration from gross profit: RM0.85mil-RM1.1 mil or 3.83%-4.95%

资金用途

New Sales Outlet: RM4.2 mil (25.86%)

New head office & distribution in Johor: RM2.5 mil (15.39%)

Purchase new trucks & upgrade IT system: RM2 mil (12.32%)

营运资金:4.24万令吉(26.11%)

上市费用:3.3万令吉(20.32%)

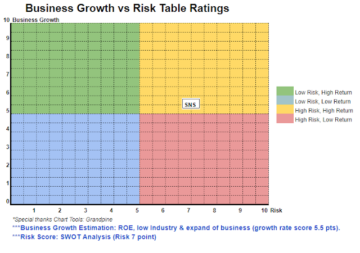

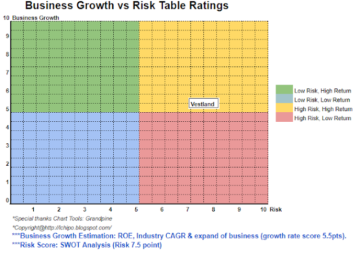

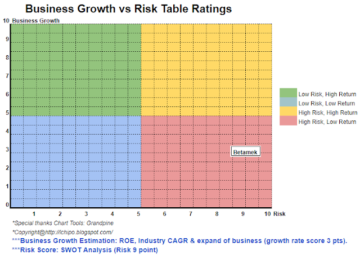

行业复合年增长率%

Cables & wires CAGR: 0.4% (2015-2019)

Electrical Distribution, Protection, & Control Devices: 16.5% (2015-2019, *2019 drop -5.8%)

Lighting Equipment: -0.6% (2015-2019)

结论

好事是:

1. PE11.34 & ROE13% is reasonable.

2. Set up new sales outlet & office will impove sales but will not have fast impact on revenue.

坏事:

1. Debt to currnet asset ratio is high.

2. No fix dividend policy.

3. Revenue grwoing around 8% per year, but after deduct inflation will have only little improvement.

3. Net profit margin is low than 10%.

4. Director fee is expensive.

5. CAGR% of their industry grow rate is not at healthy level.

6. Listing expenses 20.32% is too expensive.

7. Doesn’t explain more on how to improve business line with online sales, because business should not too depend on normal distribution method.

结论

Is not a attractive IPO. Unable to expect high grow in the company revenue in 1-2 year.

IPO价格:RM0.28

美好时光:RM0.32 (PE13)

糟糕的时间:RM0.19 (PE8)

*估值仅在新季度业绩发布之前有效。读者应该做好自己的功课,跟踪每个季度的业绩,以调整公司基本价值的预测。

Source: http://lchipo.blogspot.com/2020/03/aco-group-berhad.html