比特币 slumped to as low as $40,280 on Jan. 19, its lowest level since Dec. 12, 2023, before rebounding to $41,979 after four hours of consistent sell pressure that liquidated most long positions on major exchanges.

As of press time, Bitcoin traded at $41,609 after failing to breach $42,000. Meanwhile, long liquidations stood at roughly $30 million and made up 85% of all liquidations over the period, based on CoinGlass data.

桥梁 主要加密货币 saw similar price movements and are trading in the red for the day. However, the rebound from a crucial support level indicates resilience as investors continue to buy at that key price level.

持有$40,000

比特币 has held above the $40,000 threshold despite facing significant sell pressure over the past week after spot ETFs for the flagship cryptocurrency were 批准 on Jan. 10, resulting in a “sell the news” event.

ETF initially caused the price to surge to $49,000 before investors began taking profit on short-term positions, causing the price to dip back to levels seen in mid-December.

Initial speculation blamed the downward pressure on 灰度, dumping tens of thousands of its Bitcoin on the market. However, data shows that the nine new ETFs — led by BlackRock and Fidelity — have bought up more Bitcoin than GBTC 甩了.

根据现有数据, 灰度 has sold roughly 60,000 Bitcoin since the ETF began trading, while the “Newborn Nine” have bought roughly 72,000 BTC over the same period. This means that the downward pressure is unrelated to the ETFs, as the newer issuers seem to be actively holding the $40,000 price line.

The nine newly issued spot Bitcoin ETFs are experiencing sustained interest from investors. 贝莱德 和 富达的 ETF have already hit 的美元1亿元 in assets under management, equating to more than 25,000 BTC.

鲸鱼获利了结

加密量化研究主管 Julio Moreno 说过 抛售主要来自短期交易者,他们专门根据 ETF 批准“买入谣言”而建仓,而比特币鲸鱼则在一年的上涨后获利了结。

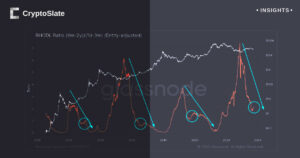

Meanwhile, the dynamics between long-term and short-term Bitcoin investors are becoming increasingly distinct, as evidenced by recent market activities, according to CryptoSlate 研究.

据观察,长期持有者(通常是那些持有比特币超过 155 天的人,其中包括鲸鱼)将其资产转移到交易所以实现利润。这一趋势出现在 2023 年 30,000 月左右,当时比特币的价值从 26,000 美元大幅下跌至 XNUMX 美元。

具体来说,17 月 18 日和 25,000 月 1 日,这些长期投资者将大约 XNUMX BTC(价值约 XNUMX 亿美元)转移到交易所,此举被解读为在不遭受损失的情况下兑现了投资。

相反,短期比特币持有者(持有投资时间少于 155 天)则表现出更加不稳定的模式。 18 月 2.4 日,他们将价值 XNUMX 亿美元的大量比特币亏本转移到交易所。

这表明这些投资者的活动水平较高,但利润却下降了。特别是那些原本希望利用比特币飙升至 49,000 美元的人似乎已经获利了结或面临损失。

- :具有

- :是

- 的美元1亿元

- $UP

- 000

- 10

- 12

- 17

- 19

- 2023

- 25

- 60

- 72

- a

- 以上

- 根据

- 积极地

- 活动

- 活动

- 后

- 所有类型

- 已经

- 其中

- 量

- an

- 和

- 批准

- 保健

- 围绕

- AS

- 办公室文员:

- At

- 可使用

- 背部

- 基于

- BE

- 成为

- 很

- before

- 开始

- 之间

- 亿

- 比特币

- 比特币持有人

- 比特币投资者

- 比特币鲸鱼

- 贝莱德

- 买

- 违反

- BTC

- 购买

- 买家

- by

- 兑现

- 造成

- 造成

- 如何

- 一贯

- 继续

- 关键

- cryptocurrency

- CryptoSlate

- data

- 天

- 一年中的

- 十二月

- 下降

- 尽管

- 蘸酱

- 不同

- 向下

- 动力学

- 出现

- 估计

- ETF

- ETF

- 活动

- 证明

- 换货

- 有经验

- 经历

- 面对

- 失败

- 保真度

- 旗舰

- 针对

- 四

- 止

- 收益

- GBTC

- 得到了

- 民政事务总署

- 有

- 头

- 保持

- 更高

- 击中

- 举行

- 持有人

- 保持

- HOURS

- 但是

- HTTP

- HTTPS

- in

- 包括

- 日益

- 表示

- 原来

- 兴趣

- 成

- 投资

- 投资者

- 发行

- 发行人

- 它的

- 一月三十一日

- JPG

- 七月

- 键

- 导致

- 减

- Level

- 各级

- 杠杆作用

- Line

- 清算

- 清算

- 长

- 长期

- 离

- 损失

- 低

- 最低

- 最低级别

- 制成

- 主要

- 主要

- 颠覆性技术

- 市场

- 手段

- 与此同时

- 百万

- 更多

- 最先进的

- 移动

- 运动

- 移动

- 全新

- 较新

- 新

- 九

- 观察

- of

- on

- or

- 超过

- 尤其

- 过去

- 模式

- 期间

- 柏拉图

- 柏拉图数据智能

- 柏拉图数据

- 职位

- express

- 压力

- 车资

- 利润

- 利润

- 如

- 实现

- 反弹

- 最近

- 红色

- 研究

- 弹性

- 导致

- περίπου

- 同

- 锯

- 似乎

- 看到

- 出售

- 卖房

- 短期的

- 如图

- 作品

- 显著

- 类似

- 自

- 出售

- 特别是

- 推测

- Spot

- 站在

- 大量

- 痛苦

- SUPPORT

- 支持水平

- 浪涌

- 持续

- 拍摄

- 服用

- HAST

- 比

- 这

- 其

- 博曼

- 他们

- Free Introduction

- 那些

- 数千

- 门槛

- 次

- 至

- 交易

- 交易商

- 交易

- 转移

- 趋势

- 一般

- 下

- 折扣值

- 价值

- 周

- 为

- 鲸鱼

- ,尤其是

- 这

- 而

- WHO

- 也完全不需要

- 年

- 和风网