想通过我们针对美国公司的 2023 亿美元以上风险交易的新精选清单来跟踪 100 年最大的创业融资交易吗? 查看我们的新 Megadeals Tracker 相关信息.

这是一个每周专题,列出了本周在美国公布的前 10 大融资轮次 查看上周最大的融资轮次 相关信息.

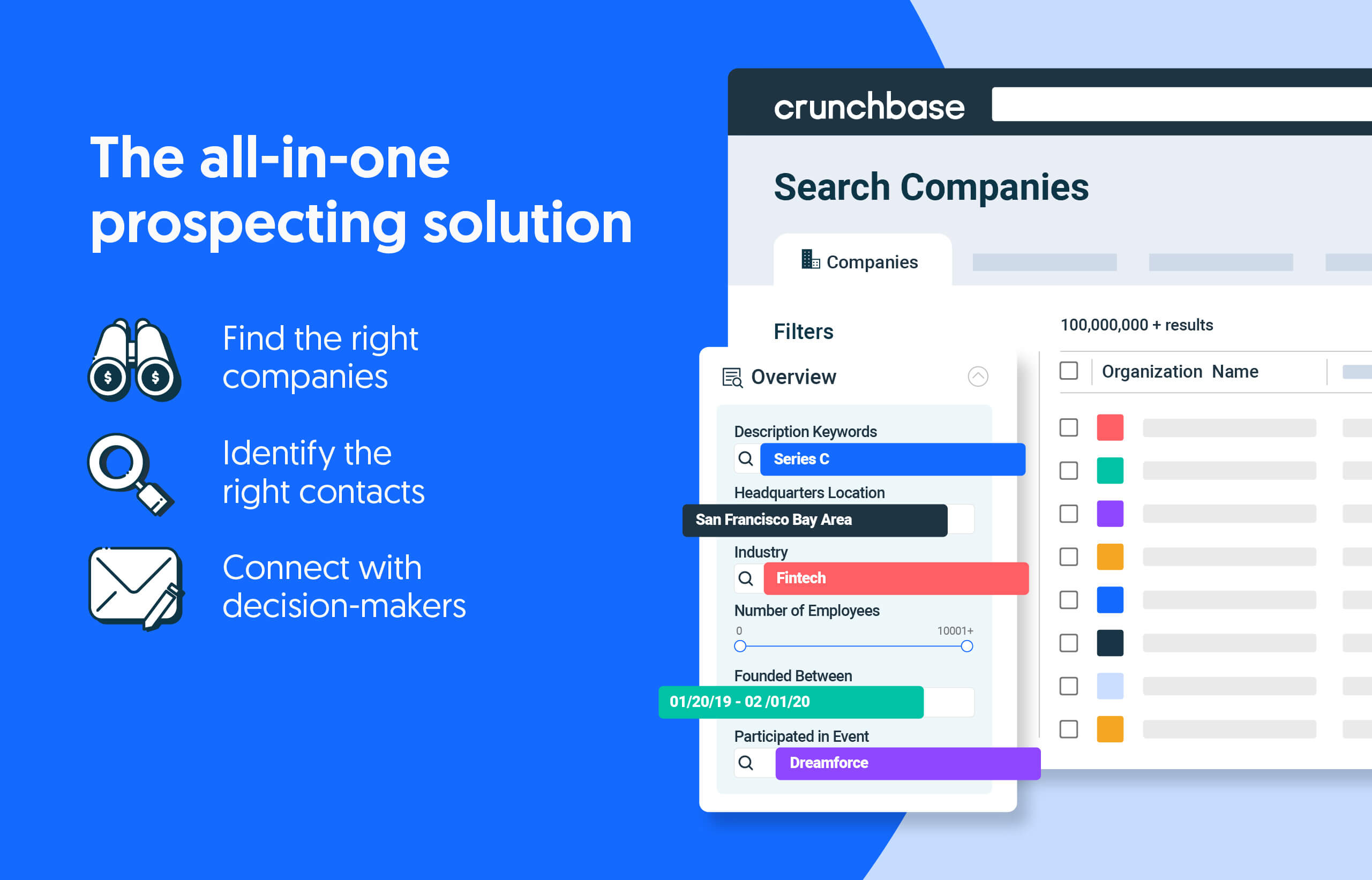

少搜索。关闭更多。

通过由私营公司数据领导者提供支持的一体化勘探解决方案来增加您的收入。

After several weeks of just having one or two rounds of nine figures, this week saw an explosion. Eight rounds hit $100 million or more as big rounds seemed to pour in. No one sector cleaned up, as the money was spread around from cleantech to biotech to fintech to even restaurant-centric software.

1. 渐变色,225 亿美元,清洁技术: Gradiant became one of the newest unicorns this week after raising a fresh D轮融资225万美元 由...领着 博尔特洛克控股公司 和 半人马资本。这家水科技初创公司目前估值为 1 亿美元。该初创公司为制药、半导体、食品和饮料以及其他需水行业的公司开发减少用水量并建造废水处理系统的技术。至少自 2022 年初以来,这笔资金是废水处理领域最大的一笔资金。成立于 2013 年 麻省理工学院. The company has now raised more than $392 million, 根据Crunchbase.

2. Tipalti,150 亿美元,金融科技: Automated payment solution Tipalti raised big this week with a $150 million “incremental growth financing” round, as the company called it. Back in 2021, the Foster City, California-based fintech raised a $270 million Series F funding led by G平方 at a valuation of $8.3 billion. No valuation was given this time around — although that is not unusual in this time of slowing venture funding and declining valuation. The latest round was from 摩根大通银行 和 大力神资本, which specializes in venture debt, although no distinction between debt and equity was announced by Tipalti. Founded in 2010, Tipalti has now raised about $700 million, according to the company’s 释放.

3. 餐厅365,135 亿美元,会计: It’s hard to run a restaurant — as anyone who has watched several reality shows based on doing so knows. Restaurant365 tries to make that a little easier and this week the Irvine, California-based startup added some big-named backers. The company nailed down a $135 million round co-led by KKR 和 卡特顿。根据其新一轮融资,该公司估值为 1 亿美元 释放. Restaurant365 offers enterprise management software for restaurants, helping them take care of accounting, payroll, supply chain and more. The company has surpassed $100 million in revenue and is used in more than 40,000 restaurant locations. Founded in 2011, the company has raised more than $260 million, 每个Crunchbase.

4.(并列) 第一大道, $100M, property management: New York-based Avenue One also joined the unicorn herd this week with a $100 million raise led by 西开普. The cash infusion gave the company a valuation of $1 billion. The startup, founded in 2020, provides a handful of services to single-family rental investors — such as finding their next property or financing. Institutional investors started buying up single-family homes during the pandemic as interest rates remained low and families sought more space. Even as interest rates have climbed back up, there clearly is still enough interest in the market to mint a property management startup as a unicorn.

4.(并列) 无限的生物,100亿美元,生物技术: It seems every week a biotech startup or two raise a huge round. This week is no different. First off is Boundless Bio, a clinical stage, next-generation precision oncology startup, which raised a $100 million Series C co-led by 拜耳的飞跃 和 RA资本管理. The San Diego-based startup is developing therapeutics directed against extrachromosomal DNA for patients with oncogene amplified cancers. In the past, targeted therapies have been mostly ineffective in treating patients with oncogene amplified cancers, according to the company. Founded in 2018, the company has raised more than $250 million, 每个Crunchbase.

4.(并列) 鹰眼网络,100 亿美元,安全: When a security company raises a nine-figure round, it is normal to assume it is referring to cybersecurity. However, not in this case. Eagle Eye Networks is an actual physical security company — although with a tech twist. The company offers cloud-based video surveillance. Perhaps not the sexiest of industries, but still a significant market. The Austin, Texas-based startup locked up $100 million in a round led by Japan-based 世强. Founded in 2012, the firm has now raised $195 million, 根据Crunchbase.

4.(并列) Ray Therapeutics,100亿美元,生物技术: Another biotech was able to raise a nine-figure round this week. San Francisco-based Ray Therapeutics locked up a $100 million Series A led by 诺和控股公司. The startup is looking to restore vision for people with the rare blinding disease retinitis pigmentosa. While some companies are looking to stop the disorder before it results in blindness, Ray differentiates itself by looking into therapeutics to actually bring back vision. Founded in 2021, the company has now raised $110 million, 每个Crunchbase.

4.(并列) 压缩, $100M, procurement: Procurement software certainly is not the sexiest of industries, but there is no denying the need for systems that help companies with the burdensome process of buying new software and hardware. San Francisco-based Zip helps companies do just that and this week it raised a $ 100百万系列C 来自投资者 Y组合, CRV 和 老虎环球. The startup also bucked the trend of declining valuations. The new cash gives the procurement startup a $1.5 billion post-money valuation. While many companies are seeing stagnant or falling valuations, the new valuation represents a slight bump from its previous $1.2 billion valuation last May after the company raised a $43 million Series B. Zip helps companies with sourcing, approving and paying for needed business tools, ideally helping to streamline the process to make it less taxing. Founded in 2020, Zip has raised $181 million to date, per the company.

9. Nido Biosciences,87亿美元,生物技术: Watertown, Massachusetts-based Nido Biosciences, a biotech startup developing medicines for debilitating neurological diseases, announced it has raised a total of $109 million in seed, and Series A and B financings. Previous SEC filings (相关信息 和 相关信息) indicate the Series B — led by 生物发光企业 — likely was around $87 million.

10. 十五,77亿美元,电子商务: San Francisco-based luxury retailer Quince raised a $77 million Series B led by 惠灵顿管理. 公司成立于 2018 年,已融资 141.5 万美元, 根据Crunchbase, positioning it for accelerated growth and expansion.

全球大交易

Even though the U.S. saw some big funding rounds, none came close to the biggest this week.

研究方法

我们追踪了 Crunchbase 数据库中美国公司在 13 月 19 日至 XNUMX 日这 XNUMX 天期间筹集的最大已宣布融资轮数。尽管大多数已宣布的融资轮次都出现在数据库中,但可能会有一小段时间滞后,因为一些回合报告在本周晚些时候进行。

深入阅读

插图: 唐·古兹曼

通过Crunchbase Daily随时了解最新的融资,收购等信息。

Hong Kong wants to strengthen its reputation as a forward-looking financial hub.

这家电子商务独角兽在疫情期间迅速赢得了美国消费者的芳心,但 Shein 现在面临着重重阻碍。

SoftBank 在其机会基金成立三周年之前更改其名称,同时它宣布了一个新的 150 亿美元的第二只基金。

今年到目前为止,几家专注于人工智能的公司已经宣布与跨领域的 SPAC 合作,包括教育、诊断和数据……

- SEO 支持的内容和 PR 分发。 今天得到放大。

- 柏拉图爱流。 Web3 数据智能。 知识放大。 访问这里。

- 与 Adryenn Ashley 一起铸造未来。 访问这里。

- 使用 PREIPO® 买卖 PRE-IPO 公司的股票。 访问这里。

- Sumber: https://news.crunchbase.com/venture/biggest-funding-rounds-gradiant-tipalti/

- :具有

- :是

- :不是

- 的美元1亿元

- 100 百万美元

- $UP

- 000

- 10

- 13

- 2011

- 2012

- 2013

- 2018

- 2020

- 2021

- 2022

- 2023

- 40

- a

- Able

- 关于

- 加速

- 根据

- 基本会计和财务报表

- 收购

- 实际

- 通

- 添加

- 后

- 驳

- 向前

- 一体

- 还

- 尽管

- 美国人

- 放大

- an

- 和

- 周年

- 公布

- 公布

- 另一个

- 任何人

- 保健

- 围绕

- AS

- At

- 奥斯汀

- 自动化

- 大街XNUMX号

- 背部

- 支持者

- 基于

- BE

- 成为

- 很

- before

- 开始

- 之间

- 饮料

- 大

- 最大

- 亿

- 生物技术

- 失明

- 苍茫

- 带来

- 建立

- 商业

- 但是

- 买房

- by

- 被称为

- 来了

- 资本

- 关心

- 案件

- 现金

- 当然

- 链

- 改变

- 追逐

- 查

- 城市

- 清洁技术

- 明确地

- 爬上

- 临床资料

- 关闭

- 公司

- 公司

- 公司的

- 消费者

- 可以

- 外壳

- 的CrunchBase

- 策划

- 网络安全

- 每天

- data

- 数据库

- 日期

- 交易

- 债务

- 下降

- 发展

- 发展

- 不同

- 疾病

- 疾病

- 紊乱

- 的DNA

- do

- 做

- 向下

- ,我们将参加

- 电子商务行业

- 更容易

- 教育

- 结束

- 更多

- 企业

- 公平

- 甚至

- 所有的

- 扩张

- 爆炸

- 眼

- 面孔

- 落下

- 家庭

- 远

- 专栏

- 图

- 申请

- 金融

- 融资

- fintech

- 公司

- 姓氏:

- 流动

- 食品

- 针对

- 前瞻性的

- 培育

- 公司成立

- 新鲜

- 止

- 基金

- 资金

- 资金交易

- 融资回合

- 特定

- 给

- 全球

- 事业发展

- 撮

- 硬

- 硬件

- 有

- 有

- 帮助

- 帮助

- 帮助

- 击中

- 控股

- 家园

- 但是

- HTML

- HTTPS

- 中心

- 巨大

- in

- 包含

- 表明

- 行业

- 注入

- 研究所

- 机构

- 机构投资者

- 兴趣

- 利率

- 成

- 投资者

- IT

- 它的

- 本身

- 加盟

- JPG

- 只是

- 保持

- 香港

- 最大

- 名:

- 晚了

- 最新

- 领导者

- 最少

- 导致

- 减

- 容易

- 清单

- 小

- 地点

- 锁定

- 寻找

- 低

- 奢华享受

- 使

- 颠覆性技术

- 许多

- 市场

- 可能..

- 研究方法

- 百万

- 薄荷

- 钱

- 更多

- 最先进的

- 大多

- 姓名

- 需求

- 打印车票

- 网络

- 全新

- 总部位于纽约

- 最新

- 下页

- 下一代

- 没有

- 正常

- 现在

- 众多

- 障碍

- of

- 折扣

- 优惠精选

- on

- 肿瘤

- 一

- ZAP优势

- or

- 其他名称

- 我们的

- 输出

- 流感大流行

- 过去

- 患者

- 付款

- 付款

- 付款解决方案

- 工资发放

- 员工

- 也许

- 期间

- 制药

- 的

- 物理安全

- 柏拉图

- 柏拉图数据智能

- 柏拉图数据

- 定位

- 供电

- 平台精度

- 以前

- 美通社

- 过程

- 财产

- 提供

- 很快

- 提高

- 凸

- 提高

- 提高

- 罕见

- 价格表

- RAY

- 现实

- 最近

- 最近的资金

- 减少

- 保持

- 报道

- 代表

- 代表

- 声誉

- RESTAURANT

- 优选餐厅

- 恢复

- 成果

- 零售商

- 收入

- 圆

- 轮

- 运行

- s

- 圣

- 证券交易委员会

- 其次

- 扇形

- 行业

- 保安

- 种子

- 看到

- 似乎

- 似乎

- 半导体

- 系列

- A系列

- B系列

- C系列

- 特色服务

- 几个

- 申

- 作品

- 显著

- 自

- 放缓

- 小

- So

- 软件

- 方案,

- 解决方案

- 一些

- 采购

- 太空

- SPAC

- 专业

- 传播

- 阶段

- 开始

- 启动

- 启动资金

- 留

- 仍

- Stop 停止

- 精简

- 加强

- 这样

- 供应

- 供应链

- 超越

- 监控

- 产品

- 采取

- 针对

- 科技

- 高科技启动

- 专业技术

- 比

- 这

- 其

- 他们

- 疗法

- 那里。

- 第三

- Free Introduction

- 本星期

- 今年

- 虽然?

- 绑

- 次

- Tipalti

- 至

- 工具

- 最佳

- 返回顶部

- 合计

- 跟踪时

- 治疗

- 治疗

- 趋势

- 捻

- 二

- 我们

- 独角兽

- 独角兽

- 异常

- 用法

- 用过的

- 评估

- 估值

- 价值

- 价值观

- 冒险

- 风险投资

- 视频

- 视频监控

- 愿景

- 希望

- 是

- 水

- 周

- 每周

- 周

- 为

- ,尤其是

- 这

- 而

- WHO

- 韩元

- XML

- 年

- 您一站式解决方案

- 和风网

- 压缩