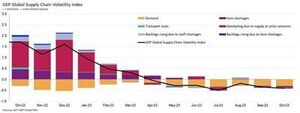

The GEP Global Supply Chain Volatility Index — the indicator tracking demand conditions, shortages, transportation costs, inventories and backlogs based on a monthly survey of 27,000 businesses — decreased again in October to -0.41, from -0.35 in September, indicating a 7th successive month of rising spare capacity across the world’s supply chains.

Additionally, the extent to which supplier capacity went underutilised was even greater than in September and August. Coupled with October’s downturn in demand for raw materials, components and commodities, this shows rising slack in global supply chains.

“While the shrinking of global suppliers’ order books is not worsening, there are no signs of improvement,” explained Jamie Ogilvie-Smals, vice president, consulting, GEP. “The notable increase in supplier capacity in Asia, which was driven by China, provides global manufacturers with greater leverage to drive down prices and inventories in 2024.”

A key finding from October’s report was the strongest rise in excess capacity across Asian supply chains since June 2020. Sustained weakness in demand, coupled with falling pressures on factories in Asia, indicates that the global manufacturing recession has further to run. With the exception of India, which continues to perform strongly, large economies in the region, such as Japan and China, are losing momentum.

Suppliers in Europe continue to report the largest level of spare capacity. In fact, the lower levels in GEP’s supply chain index for the continent have only been seen during the global financial crisis between 2008 and 2009. They highlight sustained weakness in economic conditions across the continent. Western Europe, particularly Germany’s manufacturing industry, is a key driver behind the region’s deterioration.

相对亮点是北美,该地区的供应链产能过剩,但由于美国经济继续展现其韧性,其程度比其他地区要小得多,这与欧洲形成鲜明对比。

2023 年 XNUMX 月 主要发现

Demand: Demand for raw materials, components and commodities remains depressed, although the downturn seems to have stabilised. There are still no signs of conditions improving, however, as global purchasing activity fell again in October at a pace similar to what we’ve seen since around mid-year.

Demand: Demand for raw materials, components and commodities remains depressed, although the downturn seems to have stabilised. There are still no signs of conditions improving, however, as global purchasing activity fell again in October at a pace similar to what we’ve seen since around mid-year.- 库存:随着需求下降,我们的数据显示全球企业又进行了一个月的去库存,这表明了现金流保护的努力。

- 物资短缺:物品短缺报告仍处于 2020 年 XNUMX 月以来的最低水平。

- Labour shortages: Shortages of workers are not impacting global manufacturers’ capacity to produce, with reports of backlogs due to inadequate labour supply running at historically typical levels.

- Transportation: Global transportation costs held steady with September’s level, although oil prices have declined in recent weeks.

区域供应链波动

-

北美:该指数从-0.34跌至-0.30。这仍然远低于全球平均水平,并继续暗示美国。经济有望软着陆。

- 欧洲:该指数从-0.90升至-1.01,但仍保持在表明经济相当脆弱的水平。

- 英国:该指数从-0.93小幅上涨至-0.98。尽管如此,数据表明英国市场供应商的过剩产能大幅上升。

- Asia: Notably, the index dropped to -0.38, from -0.20, highlighting the biggest rise in spare supplier capacity in Asia since June 2020 as the region’s resilience fades.

- SEO 支持的内容和 PR 分发。 今天得到放大。

- PlatoData.Network 垂直生成人工智能。 赋予自己力量。 访问这里。

- 柏拉图爱流。 Web3 智能。 知识放大。 访问这里。

- 柏拉图ESG。 碳, 清洁科技, 能源, 环境, 太阳能, 废物管理。 访问这里。

- 柏拉图健康。 生物技术和临床试验情报。 访问这里。

- Sumber: https://www.logisticsit.com/articles/2023/11/21/supply-chains-worldwide-remain-significantly-underutilised-gep-global-supply-chain-volatility-index

- :具有

- :是

- :不是

- :在哪里

- 000

- 01

- 121

- 20

- 2008

- 2020

- 2023

- 2024

- 27

- 30

- 300

- 35%

- 41

- 7日

- 90

- 98

- a

- 横过

- 活动

- 再次

- 尽管

- 美国

- 和

- 另一个

- 保健

- 围绕

- AS

- 亚洲

- 亚洲的

- At

- 八月

- 基于

- 很

- 背后

- 之间

- 最大

- 书籍

- 光明

- 企业

- 但是

- by

- 容量

- 链

- 链

- 中国

- 商品

- 组件

- 条件

- 大量

- 咨询

- 大陆

- 继续

- 继续

- 对比

- 成本

- 再加

- 危机

- data

- 下降

- 需求

- 屏 显:

- 向下

- 低迷期

- 驾驶

- 驱动

- 司机

- 下降

- 两

- ,我们将参加

- 经济

- 经济情况

- 经济

- 经济

- 工作的影响。

- 别处

- 醚(ETH)

- 欧洲

- 甚至

- 例外

- 过剩

- 解释

- 程度

- 事实

- 工厂

- 淡入淡出

- 落下

- 金融

- 金融危机

- 寻找

- 针对

- 脆弱性

- 止

- 进一步

- 德国

- 全球

- 全球金融

- 全球金融危机

- 更大的

- 有

- 保持

- 更高

- 近期亮点

- 突出

- 历史

- 但是

- HTTPS

- 影响

- 改进

- 改善

- in

- 增加

- 指数

- 印度

- 表示

- 说明

- 指示

- 指示符

- 行业中的应用:

- 它的

- 杰米

- 一月

- 日本

- JPG

- 六月

- 键

- Labour

- 着陆

- 大

- 最大

- 较小的

- Level

- 各级

- 杠杆作用

- 失去

- 降低

- 最低

- 制造商

- 制造业

- 制造业

- 市场

- 物料

- 动力泉源

- 月

- 每月一次

- 许多

- 没有

- 北

- 北美

- 显着

- 特别是

- 十月

- of

- 油

- on

- 仅由

- 秩序

- 订单

- 我们的

- 步伐

- 尤其

- 演出

- 柏拉图

- 柏拉图数据智能

- 柏拉图数据

- 点

- 准备

- 保存

- 总统

- 价格

- 生产

- 提供

- 购买

- 原

- 最近

- 不景气

- 地区

- 相对的

- 留

- 遗迹

- 报告

- 业务报告

- 弹性

- 上升

- 上升

- 粉色

- 运行

- 运行

- s

- 似乎

- 看到

- 九月

- 短缺

- 作品

- 显著

- 迹象

- 类似

- 自

- 松弛

- 软

- Spot

- 与之形成鲜明

- 稳定

- 仍

- 最强

- 非常

- 大量

- 这样

- 建议

- 供应商

- 供销商

- 供应

- 供应链

- 供应链

- 调查

- 持续

- 比

- 这

- 世界

- 其

- 那里。

- 他们

- Free Introduction

- 至

- 跟踪

- 交通运输或是

- 普遍

- Uk

- us

- 美国经济

- Ve

- 副

- 副总裁

- 挥发性

- 是

- we

- 虚弱

- 周

- 去

- 西式

- 西欧

- 什么是

- 这

- 而

- 工人

- 世界

- 全世界

- 和风网