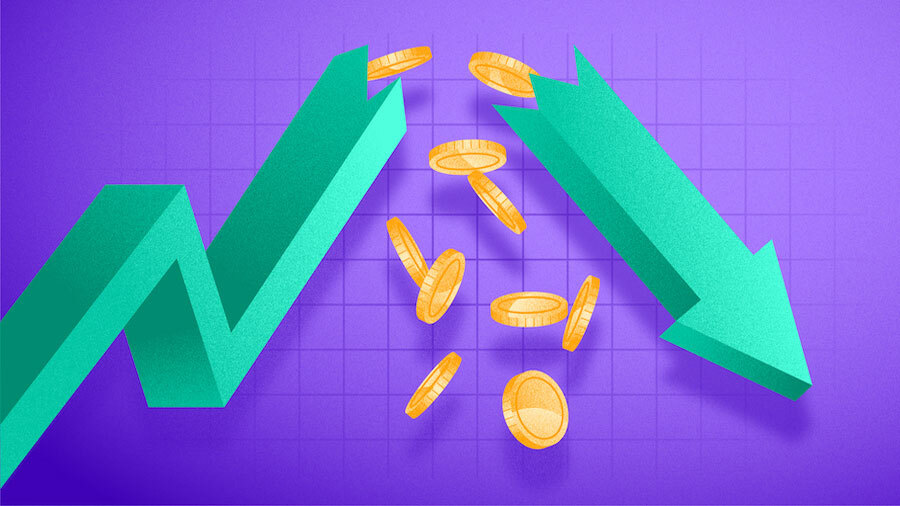

کوٹیو — one of the highest-flying investors back in the record-shattering venture days of 2021 — came back down to earth last year, curtailing the number of deals it did by 82% from just two years ago.

In 2023, the crossover investor giant took part in only 29 completed and announced venture deals — per Crunchbase اعداد و شمار — a steep decline from the 168 deals it took part in in 2021 and a 57% drop from the 70 deals in 2022.

As deal-number dropped, so did the total value of all deals Coatue was participating in. The 168 deals Coatue took part in came to nearly $43 billion. (That was the total dollar amount of all the deals, not what Coatue invested. Individual investments in rounds are not typically revealed.)

Last year, the total dollar amount for the 29 deals the firm participated in came to only $4.1 billion, فی Crunchbase.

سرخیوں میں

Coatue, whose more noteworthy investments include Lyft, اٹ اور باکس among others, has made recent headlines for closing its London office earlier this month — the firm still plans to invest in European startups — as well as خبر کہ مائیکل گلروئے, a general partner at the firm who co-led its growth team and focused on fintech companies, is leaving.

However, it also has been رپورٹ کے مطابق the firm has raised about $3 billion for a structured equity fund — which allows private companies to raise money through structured financings and avoid down rounds.

Such financings would not be new to Coatue. Back in 2022, it was رپورٹ کے مطابق کوموڈو ہیلتھ raised a “structured equity infusion” of $200 million led by the firm. Coatue also conducted a $150 million debt financing for نواں — then called TripActions — that same year.

Just last August, Coatue also took part in a $2.3 billion debt financing for AI cloud infrastructure startup کور ویو. That round actually represented the largest round involving VC-backed companies Coatue took part in last year.

However, the firm also participated in two $300 million funding rounds — for both ریمپ اور ہماری اگلی توانائی — as well as a $290 million funding for سیرا اسپیس. Coatue did not lead any of those rounds.

مختلف وقت

Of course, Coatue is not alone in its pullback in investing. Other large crossover investors that made a huge splash in the venture market like ٹائیگر گلوبل اور ڈریگنیر also have severely reduced their investment cadence.

As venture started to explode in 2020, many large firms with deep pockets looked at the startup sector as a viable investment that could produce home-run returns. As money turned more expensive after the end of 2021 and startup valuations started to fall, many firms were left with significant markdowns.

So far 2024 does not seem like it will be a big rebound year. For example, Coatue has been part of only one announced round this calendar year — a venture round for Montreal-based software startup Valsoft.

However, things can change fast in venture — just look at how quickly the market turned after 2021.

متعلقہ Crunchbase Pro استفسار:

متعلقہ پڑھنا:

کے ساتھ حالیہ فنڈنگ راؤنڈز، حصول اور مزید کے ساتھ تازہ ترین رہیں

کرنچ بیس ڈیلی۔

کرنچ بیس نیوز کے مطابق 191,000 میں امریکہ میں مقیم ٹیک کمپنیوں میں 2023 سے زیادہ کارکنوں کو ملازمتوں میں بڑے پیمانے پر کٹوتیوں میں نکال دیا گیا تھا، اور کٹوتیوں میں…

ان رپورٹوں کے صرف ایک ماہ بعد کہ xAI $1 بلین اکٹھا کرنے کی کوشش کر رہا ہے - ایک سیکیورٹیز فائلنگ کے مطابق - ایسا لگتا ہے کہ ایلون مسک کے اسٹارٹ اپ کے بڑے منصوبے ہیں۔

فنڈنگ کے بڑے اعلان کے لیے کوئی برا ہفتہ نہیں ہے، کیونکہ توانائی اور وفاداری کے انعامات میں دو نو فگر راؤنڈز تھے، لیکن بہت سے تھوڑا سا…

2021 کی وینچر فنڈنگ کے بعد اور اس کے نتیجے میں واپسی کے نتیجے میں، سرمایہ کاروں کا کہنا ہے کہ جب کہ بیج کی فنڈنگ دیگر کے مقابلے میں بہتر رہی ہے…

- SEO سے چلنے والا مواد اور PR کی تقسیم۔ آج ہی بڑھا دیں۔

- پلیٹو ڈیٹا ڈاٹ نیٹ ورک ورٹیکل جنریٹو اے آئی۔ اپنے آپ کو بااختیار بنائیں۔ یہاں تک رسائی حاصل کریں۔

- پلیٹوآئ اسٹریم۔ ویب 3 انٹیلی جنس۔ علم میں اضافہ۔ یہاں تک رسائی حاصل کریں۔

- پلیٹو ای ایس جی۔ کاربن، کلین ٹیک، توانائی ، ماحولیات، شمسی، ویسٹ مینجمنٹ یہاں تک رسائی حاصل کریں۔

- پلیٹو ہیلتھ۔ بائیوٹیک اینڈ کلینیکل ٹرائلز انٹیلی جنس۔ یہاں تک رسائی حاصل کریں۔

- ماخذ: https://news.crunchbase.com/venture/coatue-deal-count-down-2023/

- : ہے

- : ہے

- : نہیں

- ارب 1 ڈالر

- $3

- $UP

- 000

- 1

- 2020

- 2021

- 2022

- 2023

- 2024

- 29

- 70

- a

- ہمارے بارے میں

- حصول

- اصل میں

- کے بعد

- بعد

- پہلے

- AI

- تمام

- کی اجازت دیتا ہے

- اکیلے

- بھی

- کے درمیان

- رقم

- اور

- کا اعلان کیا ہے

- اعلان

- کوئی بھی

- کیا

- AS

- At

- کوشش کرنا

- اگست

- سے اجتناب

- واپس

- برا

- BE

- رہا

- بہتر

- بگ

- بڑا

- ارب

- بلومبرگ

- دونوں

- لیکن

- by

- Cadence سے

- کیلنڈر

- کہا جاتا ہے

- آیا

- کر سکتے ہیں

- تبدیل

- بادل

- کلاؤڈ بنیادی ڈھانچے

- کوٹ

- کمپنیاں

- مکمل

- منعقد

- سکتا ہے

- شمار

- جوڑے

- کورس

- CrunchBase

- کمی

- روزانہ

- تاریخ

- دن

- نمٹنے کے

- ڈیلز

- قرض

- قرض کی مالی اعانت

- کو رد

- گہری

- DID

- کرتا

- ڈالر

- نیچے

- چھوڑ

- گرا دیا

- اس سے قبل

- زمین

- یلون

- ایلون مسک کی

- آخر

- توانائی

- ایکوئٹی

- یورپی

- مثال کے طور پر

- مہنگی

- گر

- دور

- فاسٹ

- فائلنگ

- فنانسنگ

- فن ٹیک

- فنٹیک کمپنیاں

- فرم

- فرم

- توجہ مرکوز

- کے لئے

- سے

- فنڈ

- فنڈنگ

- فنڈنگ راؤنڈ

- جنرل

- جنرل پارٹنر

- وشال

- ترقی

- ہے

- خبروں کی تعداد

- Held

- اعلی

- کس طرح

- HTTPS

- بھاری

- in

- شامل

- انفرادی

- انفراسٹرکچر

- سرمایہ کاری

- سرمایہ کاری کی

- سرمایہ کاری

- سرمایہ کاری

- سرمایہ کاری

- سرمایہ کار

- سرمایہ

- شامل

- IT

- میں

- ایوب

- ملازمت میں کمی

- فوٹو

- صرف

- بڑے

- سب سے بڑا

- آخری

- آخری سال

- قیادت

- چھوڑ کر

- قیادت

- چھوڑ دیا

- کی طرح

- لندن

- دیکھو

- دیکھا

- وفاداری

- بنا

- بہت سے

- مارکیٹ

- ماس

- دس لاکھ

- قیمت

- مہینہ

- زیادہ

- تقریبا

- نئی

- خبر

- اگلے

- قابل ذکرہے

- تعداد

- of

- بند

- on

- ایک

- صرف

- دیگر

- دیگر

- حصہ

- حصہ لیا

- حصہ لینے

- پارٹنر

- فی

- کی منصوبہ بندی

- پلاٹا

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو ڈیٹا

- جیب

- نجی

- نجی کمپنیاں

- فی

- پیدا

- pullback

- جلدی سے

- بلند

- اٹھایا

- پڑھنا

- بغاوت

- حال ہی میں

- حالیہ فنڈنگ

- کم

- رپورٹیں

- نمائندگی

- واپسی

- انکشاف

- انعامات

- منہاج القرآن

- چکر

- s

- اسی

- کا کہنا ہے کہ

- شعبے

- سیکورٹیز

- بیج

- بیج کی مالی اعانت

- لگتا ہے

- لگتا ہے

- کئی

- شدید

- اہم

- So

- سافٹ ویئر کی

- شروع

- شروع

- سترٹو

- رہنا

- ابھی تک

- منظم

- بعد میں

- ٹیلی

- ٹیم

- ٹیک

- ٹیک کمپنیوں

- سے

- کہ

- ۔

- ان

- تو

- وہاں.

- چیزیں

- اس

- ان

- کے ذریعے

- کرنے کے لئے

- لیا

- کل

- طرابلس

- تبدیل کر دیا

- دو

- عام طور پر

- ویلنٹائنٹس

- قیمت

- وینچر

- وینچر فنڈنگ

- قابل عمل

- تھا

- ہفتے

- اچھا ہے

- تھے

- کیا

- جس

- جبکہ

- ڈبلیو

- کس کی

- گے

- ساتھ

- کارکنوں

- گا

- سال

- سال

- زیفیرنیٹ