<!–

<!–

->

Kripto Piyasa Haberleri: ABD Federal Rezervi‘s target rate decision may likely come on the expected lines but the market would be keenly looking at whether the Federal Open Market Committee (FOMC) shows any signs of cooling down the monetary policy. Amid pressure from the ongoing US regional banking crisis, the markets are expecting that the central bank implements a 25 bps rate hike for the last time in a series of target rate raises. This would take the current target of 475-500 bps to the 500-525 bps range.

Ayrıca Oku: US SEC Has A Bad Precedent From XRP Lawsuit Judge Analisa Torres

The CME FedWatch Tool indicates that 85% of respondents feel the Fed go for a 25 bps hike. Meanwhile, if Fed Chair Jerome Powell announces any indication of slowing down the rate hikes in upcoming meetings, the Bitcoin fiyatı may climb at the back of some correction in recent times.

Ayrıca Oku: SUI Price Slumps By 72% Amid Mainnet Launch

<!–

->

Aktif

2023-05-03T00:00:00+5:30

S&P500 & Crypto Markets Turn Green Following FED Hike

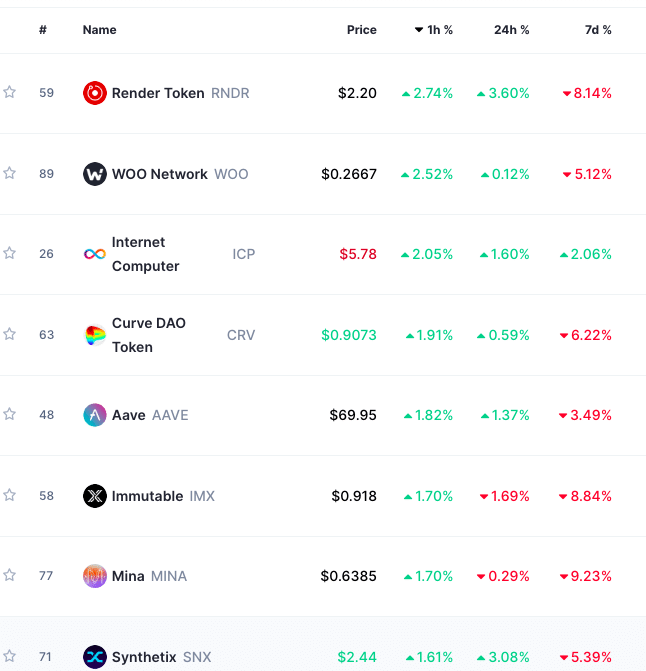

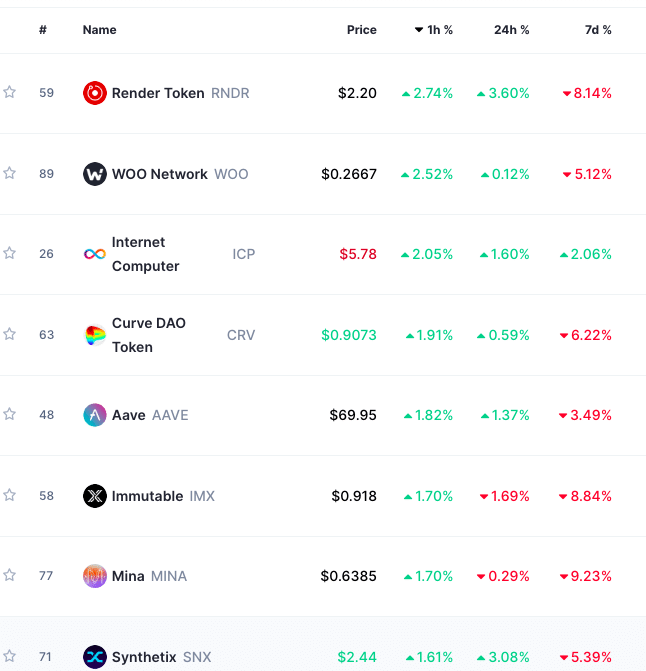

Both S&P 500 and crypto markets are steady following FED rate hike of 25 bps. Bitcoin price is hovering at $28,600 while S&P500 index is up by 20 basis points at the time of reporting. In crypto markets top gainers are Render Token, Woo Network and Curve Dao.

Bu güncellemeyi paylaşın:

2023-05-03T23:41:00+5:30

Rate Cuts In September

In the wake of a 25 bps rate hike, traders are pricing in rate cut possibility in September 2023, as per US interest rate futures.

Bu güncellemeyi paylaşın:

2023-05-03T23:35:00+5:30

Bitcoin Fiyat Reaksiyonu

As an initial reaction, the Bitcoin price showed a 0.50 rise to the news of Fed rate hike on expected lines. However, the scenario could change after Jerome Powell’s speech.

Bu güncellemeyi paylaşın:

2023-05-03T23:30:00+5:30

Fed Faiz Artışı

The FOMC hiked the Federal funds target rate by 25 bps, on expected lines. The hike effectively brings the current target rate to 500-525 bps range.

Bu güncellemeyi paylaşın:

2023-05-03T23:15:00+5:30

ABD Doları Endeksi

The US Dollar Index (DXY) has been on a declining path in the lead up to the Fed rate hike decision announcement, with a 0.53% drop in the day.

Bu güncellemeyi paylaşın:

2023-05-03T22:45:00+5:30

Peter Brandt Agrees

Peter Brandt, another veteran analyst, kararlaştırılmış with Tom’s analysis on Fed’s rate hike plans.

Bu güncellemeyi paylaşın:

2023-05-03T22:30:00+5:30

More Rate Hikes Are A Mistake

Tom McClellan, a veteran analyst, yorumladı that further hiking of interest rate would be fatal for the markets. They should instead cut to 4% immediately, he said.

Bu güncellemeyi paylaşın:

Feragatname

- SEO Destekli İçerik ve Halkla İlişkiler Dağıtımı. Bugün Gücünüzü Artırın.

- PlatoAiStream. Web3 Veri Zekası. Bilgi Genişletildi. Buradan Erişin.

- Adryenn Ashley ile Geleceği Basmak. Buradan Erişin.

- Kaynak: https://coingape.com/fomc-jerome-powell-fed-interest-rate/

- :vardır

- :dır-dir

- ][P

- $UP

- 1

- 20

- 2023

- 30

- 50

- 500

- a

- Hakkımızda

- İlanlarım

- Sonra

- Ortasında

- an

- analiz

- analist

- ve

- duyuru

- duyurdu

- Başka

- herhangi

- ARE

- AS

- At

- Oto

- Arka

- arka fon

- Kötü

- Banka

- Bankacılık

- bankacılık krizi

- temel

- BE

- olmuştur

- Bitcoin

- Bitcoin Fiyatı

- boş

- Getiriyor

- fakat

- by

- Merkez

- merkezi

- Merkez Bankası

- Sandalye

- değişiklik

- tırmanmak

- CM uzantısı

- Coingape

- renk

- nasıl

- komite

- olabilir

- kriz

- kripto

- Kripto Pazarı

- Kripto Piyasaları

- akım

- eğri

- Eğri DAO

- kesim

- keser

- DAO

- gün

- karar

- azalan

- masaüstü

- ekran

- Dolar

- Dolar endeksi

- aşağı

- Damla

- Dxy

- etkili bir şekilde

- Eter (ETH)

- beklenen

- bekliyoruz

- Fed

- Fed Başkanı

- Fed Başkanı Jerome Powell

- Federal

- Federal Açık Piyasa Komitesi

- hissetmek

- Şamandıra

- takip etme

- FOMC

- İçin

- itibaren

- para

- daha fazla

- Vadeli

- Kazananlar

- Go

- Yeşil

- he

- yükseklik

- Yürüyüş

- zamları

- yürüyüş

- Ancak

- HTTPS

- if

- hemen

- uygular

- in

- indeks

- gösterir

- belirti

- ilk

- yerine

- faiz

- FAİZ ORANI

- jerome

- jerome powell

- yargıç

- Soyad

- dava

- öncülük etmek

- sol

- Muhtemelen

- hatları

- yaşamak

- bakıyor

- mainnet

- Kenar

- pazar

- Piyasalar

- piyasalar dönüyor

- piyasalar yeşile dönüyor

- Mayıs..

- Bu arada

- toplantı

- toplantılar

- Telefon

- parasal

- Para politikası

- ağ

- haber

- of

- on

- devam

- açık

- yol

- ağladım

- Platon

- Plato Veri Zekası

- PlatoVeri

- noktaları

- politika

- pozisyon

- olasılık

- Powell

- Powell adlı

- Örnek

- basınç

- fiyat

- fiyatlandırma

- yükseltmeler

- menzil

- oran

- Zam oranı

- oran artışları

- tepki

- Okumak

- son

- bölgesel

- Raporlama

- katılımcıların

- Yükselmek

- S&P

- S&P 500

- S & P500

- Adı geçen

- senaryo

- SEC

- Eylül

- Dizi

- paylaş

- meli

- Gösteriler

- İşaretler

- Yavaşlama

- biraz

- konuşma

- istikrarlı

- Bizi daha iyi tanımak için

- Hedef

- o

- The

- Fed

- onlar

- Re-Tweet

- zaman

- zamanlar

- için

- simge

- araç

- üst

- Tüccarlar

- şeffaf

- DÖNÜŞ

- yaklaşan

- Güncelleme

- us

- Amerikan Doları

- ABD Doları Endeksi

- bizi besledi

- emektar

- Wake

- olup olmadığını

- süre

- ile

- Kur yapmak

- woo ağı

- olur

- XRP

- xrp davası

- zefirnet

✓ Paylaş: