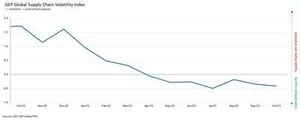

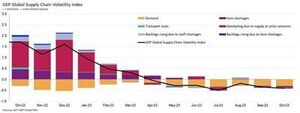

The GEP Global Supply Chain Volatility Index — the indicator tracking demand conditions, shortages, transportation costs, inventories and backlogs based on a monthly survey of 27,000 businesses — decreased again in October to -0.41, from -0.35 in September, indicating a 7th successive month of rising spare capacity across the world’s supply chains.

Additionally, the extent to which supplier capacity went underutilised was even greater than in September and August. Coupled with October’s downturn in demand for raw materials, components and commodities, this shows rising slack in global supply chains.

“While the shrinking of global suppliers’ order books is not worsening, there are no signs of improvement,” explained Jamie Ogilvie-Smals, vice president, consulting, GEP. “The notable increase in supplier capacity in Asia, which was driven by China, provides global manufacturers with greater leverage to drive down prices and inventories in 2024.”

A key finding from October’s report was the strongest rise in excess capacity across Asian supply chains since June 2020. Sustained weakness in demand, coupled with falling pressures on factories in Asia, indicates that the global manufacturing recession has further to run. With the exception of India, which continues to perform strongly, large economies in the region, such as Japan and China, are losing momentum.

Suppliers in Europe continue to report the largest level of spare capacity. In fact, the lower levels in GEP’s supply chain index for the continent have only been seen during the global financial crisis between 2008 and 2009. They highlight sustained weakness in economic conditions across the continent. Western Europe, particularly Germany’s manufacturing industry, is a key driver behind the region’s deterioration.

Göreceli olarak parlak bir nokta, tedarik zincirlerinin aşırı kapasiteye sahip olduğu, ancak ABD ekonomisinin Avrupa'nın tam tersine dayanıklılığını sergilemeye devam etmesi nedeniyle diğer yerlere göre çok daha az ölçüde olduğu Kuzey Amerika'dır.

Ekim 2023 Temel bulgular

Demand: Demand for raw materials, components and commodities remains depressed, although the downturn seems to have stabilised. There are still no signs of conditions improving, however, as global purchasing activity fell again in October at a pace similar to what we’ve seen since around mid-year.

Demand: Demand for raw materials, components and commodities remains depressed, although the downturn seems to have stabilised. There are still no signs of conditions improving, however, as global purchasing activity fell again in October at a pace similar to what we’ve seen since around mid-year.- Stoklar: Talebin düşmesiyle birlikte verilerimiz, küresel işletmelerin bir ay daha stoklarını erittiğini gösteriyor ve bu da nakit akışını koruma çabalarının sinyalini veriyor.

- Malzeme kıtlığı: Ürün kıtlığı raporları Ocak 2020'den bu yana en düşük seviyesinde kalıyor.

- Labour shortages: Shortages of workers are not impacting global manufacturers’ capacity to produce, with reports of backlogs due to inadequate labour supply running at historically typical levels.

- Transportation: Global transportation costs held steady with September’s level, although oil prices have declined in recent weeks.

Bölgesel tedarik zinciri değişkenliği

-

Kuzey Amerika: Endeks -0.34'dan -0.30'e düştü. Bu, küresel ortalamadan çok daha yumuşak kalıyor ve ABD'yi önermeye devam ediyor. Ekonomi yumuşak inişe hazırlanıyor.

- Avrupa: Endeks -0.90'den -1.01'a yükseldi ancak hala önemli ekonomik kırılganlığın göstergesi olan bir seviyede kalıyor.

- İngiltere: Endeks -0.93'den biraz yükselerek -0.98'e yükseldi. Yine de veriler, Birleşik Krallık pazarlarındaki tedarikçilerde aşırı kapasitede önemli bir artışa işaret ediyor.

- Asia: Notably, the index dropped to -0.38, from -0.20, highlighting the biggest rise in spare supplier capacity in Asia since June 2020 as the region’s resilience fades.

- SEO Destekli İçerik ve Halkla İlişkiler Dağıtımı. Bugün Gücünüzü Artırın.

- PlatoData.Network Dikey Üretken Yapay Zeka. Kendine güç ver. Buradan Erişin.

- PlatoAiStream. Web3 Zekası. Bilgi Genişletildi. Buradan Erişin.

- PlatoESG. karbon, temiz teknoloji, Enerji, Çevre, Güneş, Atık Yönetimi. Buradan Erişin.

- PlatoSağlık. Biyoteknoloji ve Klinik Araştırmalar Zekası. Buradan Erişin.

- Kaynak: https://www.logisticsit.com/articles/2023/11/21/supply-chains-worldwide-remain-significantly-underutilised-gep-global-supply-chain-volatility-index

- :vardır

- :dır-dir

- :olumsuzluk

- :Neresi

- 000

- 01

- 121

- 20

- 2008

- 2020

- 2023

- 2024

- 27

- 30

- 300

- %35

- 41

- 7th

- 90

- 98

- a

- karşısında

- etkinlik

- tekrar

- Rağmen

- Amerika

- ve

- Başka

- ARE

- etrafında

- AS

- Asya

- Asya

- At

- Ağustos

- ortalama

- merkezli

- olmuştur

- arkasında

- arasında

- Biggest

- Kitaplar

- Parlak

- işletmeler

- fakat

- by

- Kapasite

- zincir

- zincirler

- Çin

- Emtialar

- bileşenler

- koşullar

- önemli

- danışman

- kıta

- devam etmek

- devam ediyor

- kontrast

- maliyetler

- çiftleşmiş

- kriz

- veri

- azalmış

- Talep

- ekran

- aşağı

- DÖNÜŞ

- sürücü

- tahrik

- sürücü

- düştü

- gereken

- sırasında

- Ekonomik

- Ekonomik koşullar

- ekonomileri

- ekonomisini

- çabaları

- başka yerde

- Eter (ETH)

- AVRUPA

- Hatta

- istisna

- fazla

- açıkladı

- kapsam

- gerçek

- fabrikalar

- Belirme

- Düşen

- mali

- Finansal Kriz

- bulma

- İçin

- kırılganlık

- itibaren

- daha fazla

- Almanya

- Küresel

- küresel finans

- Küresel Finansal Kriz

- büyük

- Var

- Held

- daha yüksek

- Vurgulamak

- vurgulayarak

- tarihsel

- Ancak

- HTTPS

- etkileyen

- iyileşme

- geliştirme

- in

- Artırmak

- indeks

- Hindistan

- gösterir

- belirten

- belirten

- Gösterge

- sanayi

- ONUN

- Jamie

- Ocak

- Japonya

- jpg

- Haziran

- anahtar

- Emek

- iniş

- büyük

- büyük

- daha az

- seviye

- seviyeleri

- Kaldıraç

- kaybetme

- alt

- en düşük

- Üreticiler

- üretim

- üretim endüstrisi

- Piyasalar

- malzemeler

- Moment

- Ay

- aylık

- çok

- yok hayır

- Kuzey

- Kuzey Amerika

- dikkate değer

- özellikle

- Ekim

- of

- Sıvı yağ

- on

- bir tek

- sipariş

- sipariş kitapları

- bizim

- Barış

- özellikle

- yapmak

- Platon

- Plato Veri Zekası

- PlatoVeri

- Nokta

- hazırlanıyor

- koruma

- başkan

- Fiyatlar

- üretmek

- sağlar

- Satın alma

- Çiğ

- son

- durgunluk

- bölge

- bağıl

- kalmak

- kalıntılar

- rapor

- Raporlar

- esneklik

- Yükselmek

- yükselen

- ROSE

- koşmak

- koşu

- s

- görünüyor

- görüldü

- Eylül

- sıkıntısı

- Gösteriler

- önemli ölçüde

- İşaretler

- benzer

- beri

- gevşek

- Yumuşak

- Spot

- sade

- istikrarlı

- Yine

- güçlü

- şiddetle

- önemli

- böyle

- önermek

- satıcı

- tedarikçileri

- arz

- tedarik zinciri

- Tedarik zinciri

- Anket

- sürekli

- göre

- o

- The

- Dünya

- ve bazı Asya

- Orada.

- onlar

- Re-Tweet

- için

- Takip

- taşımacılık

- tipik

- Uk

- us

- ABD ekonomisi

- Ve

- mengene

- Başkan Yardımcısı

- Uçuculuk

- oldu

- we

- zayıflık

- Haftalar

- Kimler

- batı

- Doğu Avrupa

- Ne

- hangi

- süre

- ile

- işçiler

- Dünya

- Dünya çapında

- zefirnet