Ko se leto 2023 nadaljuje, umik bitcoina pod ključno mejo 30,000 $ sproža vprašanja o splošni moči in stabilnosti trga kriptovalut.

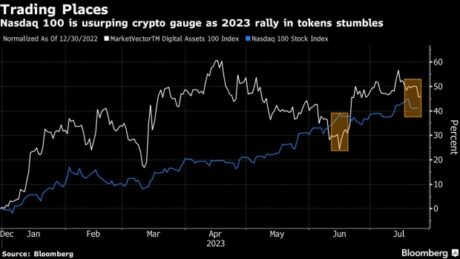

Once, the crypto market potekala a significant lead over traditional stocks, according to Bloomberg. However, this advantage seems to be dwindling as Bitcoin – a leading market indicator – exhibits signs of struggle. The year-to-date rise of the top 100 digital tokens now stands at 46%, narrowing the gap with the 41% increase of the tech-driven Nasdaq 100 Index.

Delnice tehnološkega sektorja, zlasti tiste, na katere vpliva navdušenje nad umetno inteligenco, hitro pridobivajo veljavo. Ta porast je povzročil, da je indeks Nasdaq 100 junija za kratek čas presegel indeks MVIS CryptoCompare Digital Assets 100.

Vpliv regulativnih sprememb in odločitev Feda

Previously, the crypto market received a positive push from both regulatory efforts on digital assets that face a stumbling block in US court on digital assets and the hope that spot Bitcoin skladi, s katerimi se trguje na borzi (ETF) would be authorized in the US. However, these boosting factors have waned.

Vlagatelji zdaj previdno razmišljajo o tem, kako bi lahko pričakovani dvig obrestnih mer s strani Federal Reserve vplival na tradicionalne in digitalne trge.

Po besedah Caroline Mauron, soustanoviteljice ponudnika likvidnosti izvedenih finančnih instrumentov za digitalna sredstva OrBit Markets, je dvig izgubil zagon od začetnega navdušenja, ki ga je sprožila novica o ETF. "Na obzorju ni nobenih drugih vidnih katalizatorjev," je opozorila.

Prav tako je namignila na potencialno dobro podlogo in poudarila, da bi moralo biti "tveganje padca omejeno, saj je Fed blizu konca trenutnega cikla dvigovanja obrestnih mer, kar bi moralo podpirati tvegana sredstva, vključno s kripto."

Vzorci grafikonov Bitcoin signalizirajo opozorilne znake

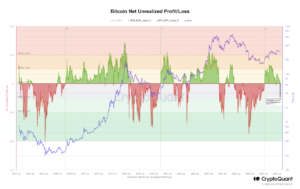

Further cause for concern is seen in the various chart patterns that track Bitcoin’s performance. A key indicator, Bitcoin’s 20-week Bollinger bandwidth, has contracted to its narrowest in seven years. This tightening suggests that moves in the value of Bitcoin could intensify, according to Bloomberg.

Če se ključni pragovi ne bodo vzdrževali, bomo verjetno opazili padajoči trend. Bollingerjeva študija zagotavlja tudi neprecenljivo metodo za analizo nestanovitnosti tega digitalnega sredstva.

Tržni analitik pri IG Australia Pty, Tony Sycamore, je opozoril na možnost, da se bo padec Bitcoina nadaljeval, "Bitcoin bi se moral razširiti proti 26,000 $/25,000 $, preden najde podporo," je napovedal.

Medtem, Bitcoin cena has continued to swim in red over the past week following its fall below the $30,000 mark. Particularly, in the past 24 hours, the asset has traded slightly above $29,000 down by 1.3%. This price action has resulted in more than 45,000 traders caught in the crypto market total liquidation of over $130 million v preteklem dnevu.

Furthermore, Bitcoin currently has a 24-hour high of $29,762 and a 24-hour low of $29,983, at the time of writing. The asset’s market cap has plunged from a high of $583 billion seen last Tuesday to $567 billion, as of today. Additionally, BTC trading volume has also declined in the past week indicating less trading activity.

Predstavljena slika iStock, grafikon iz TradingView

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Avtomobili/EV, Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- BlockOffsets. Posodobitev okoljskega offset lastništva. Dostopite tukaj.

- vir: https://www.bitcoinnewsminer.com/bitcoin-retreat-below-30000-a-threat-to-cryptos-2023-dominance-over-stocks/

- :ima

- : je

- 000

- 1

- 100

- 2023

- 24

- a

- O meni

- nad

- Po

- Ukrep

- dejavnost

- Poleg tega

- Prednost

- Prav tako

- an

- Analitik

- analiziranje

- in

- Predvideno

- SE

- umetni

- Umetna inteligenca

- AS

- sredstvo

- Sredstva

- At

- Avstralija

- pooblaščeni

- pasovna širina

- BE

- bilo

- pred

- spodaj

- Billion

- Bitcoin

- Block

- Bloomberg

- povečanje

- tako

- Na kratko

- BTC

- trgovanje z btc

- by

- cap

- katalizatorji

- ujete

- Vzrok

- previdno

- Spremembe

- Graf

- So-ustanovitelj

- Skrb

- upoštevamo

- naprej

- naprej

- se nadaljuje

- bi

- Sodišče

- ključnega pomena

- kripto

- Kripto tržnica

- CryptoCompare

- cryptocurrency

- trg kripto valute

- Trenutna

- Trenutno

- cikel

- dan

- Izvedeni finančni instrumenti

- digitalni

- Digitalno sredstvo

- Digitalna sredstva

- digitalni žetoni

- Prevlada

- navzdol

- navzdol

- Drop

- prizadevanja

- konec

- ETF

- ETF

- Eter (ETH)

- s katerimi se trguje na borzi

- Vznemirjenje

- eksponati

- razširiti

- Obraz

- dejavniki

- Padec

- Fed

- Zvezna

- zvezne rezerve

- iskanje

- po

- za

- iz

- Skladi

- pridobivanje

- vrzel

- Igrišče

- Imajo

- he

- visoka

- Pohod

- pohodništvo

- upam,

- obzorje

- URE

- Kako

- Vendar

- HTTPS

- hype

- ponazarja

- slika

- vpliv

- in

- Vključno

- Povečajte

- Indeks

- označuje

- Kazalec

- vplivali

- začetna

- Intelligence

- neprecenljivo

- ITS

- junij

- Ključne

- Zadnja

- vodi

- vodi

- manj

- Verjeten

- Limited

- podloga

- Likvidacija

- likvidnostno

- izvajalec likvidnosti

- izgubil

- nizka

- znamka

- Tržna

- Market Cap

- Prisotnost

- max širine

- Metoda

- Momentum

- več

- premika

- Nasdaq

- Nasdaq 100

- Blizu

- novice

- NoviceBTC

- št

- opozoriti

- zdaj

- of

- on

- Orbit

- Ostalo

- ven

- več

- Splošni

- zlasti

- preteklosti

- vzorci

- performance

- ključno

- platon

- Platonova podatkovna inteligenca

- PlatoData

- pozitiven

- potencial

- napovedano

- Cena

- CENA AKCIJA

- tabela cen

- Ponudnik

- zagotavlja

- Push

- vprašanja

- povečuje

- rally

- hitro

- Oceniti

- prejetih

- Rdeča

- regulatorni

- Reserve

- rezultat

- Umik

- Rise

- Tveganje

- tveganih sredstev

- glej

- Zdi se,

- videl

- sedem

- je

- shouldnt

- Signal

- pomemben

- Znaki

- Silver

- srebrna podloga

- saj

- iskala

- Stabilnost

- stojala

- Zaloge

- moč

- Boj

- študija

- kamen

- Predlaga

- podpora

- prenapetost

- kot

- da

- O

- Fed

- te

- ta

- tisti,

- Grožnja

- zategovanje

- čas

- do

- danes

- Boni

- Tony

- vrh

- proti

- sledenje

- trgovci

- Trgovanje

- obseg trgovanja

- TradingView

- tradicionalna

- Trend

- Torek

- us

- vrednost

- različnih

- vidna

- Volatilnost

- Obseg

- opozorilo

- we

- teden

- ki

- z

- bi

- pisanje

- leto

- let

- zefirnet