To je prvi od treh delov serije Sterlinga Campbella o igranju iger Web3, ki preučuje njegovo preteklost, potencial in prihodnost.

Od uvedbe Ethereuma so bile igre na srečo rastoči sektor v kripto. Razvijalci so prepoznali vrednost v interoperabilnosti kriptovalut, gospodarstvu v lasti igralcev in digitalnih sredstvih, s katerimi je mogoče trgovati, vodilni močni vodstveni delavci zapustiti tradicionalne medije za izdelavo iger Web3. Konec lanskega leta je igralništvo predstavljalo več polovica dejavnosti blockchainin Vloženih je bilo 739 milijonov dolarjev samo v igrah blockchain v prvem četrtletju 1.

Skoraj jih je 3.2 milijarde gamerjev po vsem svetu, igranje iger pa je ena največjih priložnosti za vključitev v kripto. Moč tega lijaka smo že videli v NFT-jih in izbranih projektih GameFi, vendar je pred nami še dolga pot, če se bodo te sanje uresničile.

To better understand the future of Web3 gaming, it’s important to examine the past decade of on-chain games and all of the learnings therein. Only by understanding where we have fallen short can we correctly navigate the future of this industry. So let’s start at the beginning.

Začetek

Igre v verigi so se začele leta 2014, ko huntercoin je bil uveden kot način za testiranje uporabe verige blokov za več igralcev in ugotavljanje, ali verige blokov zmorejo igralna okolja. Kovanci so bili posejani po vsem virtualnem svetu, kjer so igralci tekmovali med seboj, da bi jih pobrali. Mehanika igre je bila preprosta in sčasoma (kot je bilo predvideno) so igro prehiteli boti, vendar je Huntercoin kljub temu pokazal, da se tehnologija blockchain lahko uporablja v polnih svetovih iger.

The first on-chain gaming experiment (2014)

After the launch of Ethereum, the first game to generate real traction was CryptoKitties back in 2017, which allowed users to buy, sell, and breed non-fungible digital cats. The game was a resounding success in demonstrating the potential for NFTs and, at one point, comprised over 25% of Ethereum network activity. However, it ultimately lacked compelling and sustainable mechanics. The hype train was driven by the potential of what could be, rather than what was, and the lack of innovation slowly killed the game’s momentum, causing asset values to plummet.

Look at how cute and non-fungible (2017)

Axie neskončnost iterated on the owning and breeding model, adding battling and building, and coined the term “play to earn,” which attracted over 1 million monthly active users and ustvarili več kot 328 milijonov dolarjev at its peak in August 2021 alone. Users were drawn to the ability to make real money playing the game, with some players in the Philippines claiming over $1,000 a month in earnings. Axie was also the first time most users interacted with crypto and represented the massive onboarding opportunity that a well-made game could offer.

Ultimately, the decline of Axie’s user base was caused by thin gameplay mechanics (we’re seeing a bit of a theme here) and unsustainable, inflated speculation on asset values. There wasn’t enough content to retain the majority of existing users, and the game relied heavily on new users entering the ecosystem. As the barrier to entry for the game inflated to hundreds of dollars, users realized there were many other opportunities for them to play games with less financial risk and churned out. Axie has since added much more content, launched their own chain, Ronin, and begun to build out the Axie world and ecosystem to address some of these early challenges.

At the same time, Decentraland and Sandbox began to explore the potential for decentralized content creation, selling virtual land to users with which they could build their own experiences. Given the success of Minecraft with a similar model, it was assumed that players would flock to these worlds and build out unique and fun experiences to create the metaverse everyone was talking about. Ultimately, the two games struggled to build enough scale to make UGC a viable path, and soaring land prices prevented many users from getting involved at all.

Decentraland (2020)

There is another genre of fully on-chain games that have emerged, leveraging crypto technology to create new and innovative gameplay mechanics. One such example is Temni gozd, which uses zk technology to create an on-chain fog of war. There are more ways than ever to create provably fair games, and as this technology improves, we should see crypto integrated into more of our favorite classics. Think provably fair casinos where you know the odds (even if they’re still in favor of the house) and receive automatic payouts.

While these titles haven’t been tremendously successful as actual games, they’ve demonstrated the asymmetric opportunity to iterate on player-owned assets. Since then, the Web3 gaming ecosystem has grown rapidly, with a wide range of games being developed for everything from trading and strategy to adventure and role-playing games. Some games like Bogovi nesojeni and Axie have been able to launch their own chains (NespremenljivX, Ronin, Com2U) to optimize UX and build powerful ecosystems, while other infrastructure companies like Stardust in Zaporedje have emerged to improve the developer experience and help bridge Web2 to Web3. There are now more opportunities and tools for game developers to create Web3 games than ever before.

Kaj smo se naučili?

While we don’t know the exact winning model, the past 9 years have given us a clearer picture of what works and what doesn’t in Web3 games.

Don’t acquire users at the expense of retention

Gamers shouldn’t be making thousands of dollars a month playing basic games, and assets required to play the game shouldn’t cost more than most traditional games. It is unfathomable to think that a game whose floor assets cost hundreds of dollars will be received positively by the broader gaming community.This mercenary dynamic has turned many gamers off from the concept for the time being.

Money is attractive to certain gamers who believe they can earn on their effort. However, if it is the main reason players are coming to your game, they will leave immediately once a better opportunity is introduced.

There is value in ownership and attachment to identity

Web3 games have turned many traditional early metrics on their head, showing improved retention, longer play times, and higher ARPU compared to traditional games. As mentioned, money is attractive to certain gamers, and some of these metrics can be attributed to incentivized playtesting, where players expect to receive a token or other benefits. Players are also typically paying a higher price to participate than in traditional games. Regardless, the shift towards ownership has an undeniable effect on gamer behavior. Many developers of Web3 games have been able to iterate much more quickly alongside their community of alpha and beta testers, who are much more aligned to provide critical early feedback.

There’s a new category of gamer emerging

Typically, there are three categories of gamers: the minnows who consume content but barely pay for anything, the dolphins that sometimes pay for content if they’re sufficiently engaged and have been playing the game long enough to derive value from it (on average about 12 days), and the whales who comprise over 50% of total revenue despite making up only 2% of the player base. The presence of whales is typically the difference between an unprofitable game and a successful one, and game developers are willing to spend exorbitant amounts to acquire these users.

Web3 has added an additional game loop for people to engage with a game’s economy and overall potential, as opposed to simply engaging with the content itself. These players, which we’ll call “octopi”, spend like whales and are just as valuable to a game developer, especially during early development. The main difference between octopi and whales is that whales are much more obsessed with consuming content (and require a lot more effort) and dominating the game, while octopi are much more concerned with maximizing the value of their owned assets. This by definition aligns them closely with the future of the game.

Additionally, there are now more ways for a minnow to become a dolphin because, for the first time, users can be given assets that have value purely by playing the game. Moreover, meta-games are created in collecting, trading, and more.

User Generated Content is becoming a bigger part of the pie

Currently, about $0.20 of every $10 is spent on UGC, and some expect that this number should increase by 400% to $1 by 2025. Web3 games should see the most significant boost in terms of UGC because they have the easiest path to reward users and can easily attribute contributions.

Decentralized development of content creates much better economics for game developers. Better content curated for users and more ownership in the game itself creates much more aligned incentives for engagement. We’re seeing many more developers design games with UGC rails early on, creating an avenue for users to build out the ecosystem.

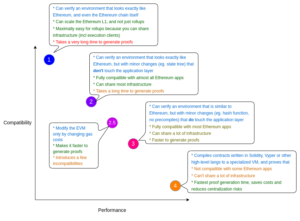

Composability is a spectrum

Many metaverse enthusiasts were drawn to this Ready Player One idea where all games existed in the same realm. Users could switch back and forth seamlessly between games, using items they earned in one world and leveraging them in another. However, in reality, it wouldn’t make sense to allow weapons in Animal Crossing or bring a sword to a gunfight. There are both technical and gameplay reasons why this concept is challenging.

Composability does not mean that all games and their assets should be interoperable. Instead, it means that new games should be able to leverage the time players have spent acquiring assets in previous games to enhance their engagement with new users. This might seem far-fetched, but it’s already happening, albeit in a permissioned way. In Web2, United status members automatically get status at Marriotts. In Web3, Bored Ape holders have received various benefits from other projects, and Punks have seen collaborations with Tiffany and other brands. These benefits can range from live experiences and tickets to tokens.

We’re a ways away from traditional gaming parity

It’s evident that Web3 games today just simply aren’t fun. Most of them are thin, repetitive DeFi protocols that rely on new user acquisition to remain profitable. For many players, the most enjoyable aspect of these games is trading assets, which doesn’t suit all genres. Furthermore, most developers have used NFTs as gating technology or as a means to tax gameplay, creating friction with most game loops.

We have only begun to scratch the surface of unlocking the potential of emergent user behavior. It will likely be over a year before we start seeing Web3 games that are on par with traditional games. With legendary studios like CCP committing to building games and exploring the space, it is reasonable to expect that games built with the core tenets of player-first ownership and valuing users’ time will see the maximal benefits of community-led growth and retention.

Kaj torej sledi?

In short, we’ve seen the powerful customer acquisition and retention engines possible when players can own game assets. However, the games themselves have largely failed to deliver an experience where owning the assets matters or provide opportunities for for new users to enjoy the game loops due to misaligned incentives

We cannot let history dictate our future, or we may miss out on one of the most critical onboarding funnels that crypto has ever seen. If we continue to use Web3 to tax users or inhibit their ability to enjoy games, we will fail to realize our true potential.

At Blockchain Capital, gaming is in our DNA, and we’re committed to supporting a decentralized gaming future. We’re excited about all areas of Web3 gaming, whether it’s community building like Acadarena, ecosystems like Igranje Galaxy, or infrastructure like Stardust. If you’re actively building something in the space, don’t hesitate to reach out to us.

Part II on the evolution of player-owned economies is coming soon!

Razkritja: Blockchain Capital je vlagatelj v več zgoraj omenjenih protokolov.

Stališča, izražena v vsaki objavi v spletnem dnevniku, so lahko osebna stališča vsakega avtorja in ne odražajo nujno stališč Blockchain Capitala in njegovih podružnic. Niti Blockchain Capital niti avtor ne jamčita za točnost, ustreznost ali popolnost informacij, navedenih v vsaki objavi v spletnem dnevniku. Blockchain Capital, avtor ali katera koli druga oseba ne dajejo ali dajejo nobene izjave ali jamstva, izrecnega ali implicitnega, ali v njegovem imenu glede točnosti in popolnosti ali poštenosti informacij, vsebovanih v kateri koli objavi v spletnem dnevniku, in ne prevzema nobene odgovornosti za kakršne koli take informacije. Nič, kar vsebuje vsaka objava v spletnem dnevniku, ne predstavlja naložbenega, regulativnega, pravnega, davčnega ali drugega svetovanja, prav tako se nanj ni mogoče zanašati pri odločanju o naložbi. Objav v spletnem dnevniku ne smete obravnavati kot trenutna ali pretekla priporočila ali nagovarjanje k ponudbi za nakup ali prodajo kakršnih koli vrednostnih papirjev ali za sprejetje kakršne koli naložbene strategije. Objave v spletnem dnevniku lahko vsebujejo napovedi ali druge izjave o prihodnosti, ki temeljijo na prepričanjih, predpostavkah in pričakovanjih, ki se lahko spremenijo zaradi številnih možnih dogodkov ali dejavnikov. Če pride do spremembe, se lahko dejanski rezultati bistveno razlikujejo od tistih, izraženih v izjavah o prihodnosti. Vse izjave, ki se nanašajo na prihodnost, veljajo samo za datum, ko so take izjave podane, in niti Blockchain Capital niti vsak avtor ne prevzemata nobene dolžnosti, da bi posodabljal takšne izjave, razen če to zahteva zakon. Če se kateri koli dokument, predstavitev ali drugo gradivo, ki ga je ustvaril, objavil ali kako drugače distribuira Blockchain Capital, sklicuje na katero koli objavo v spletnem dnevniku, je treba takšno gradivo prebrati s posebno pozornostjo na morebitne zavrnitve odgovornosti, navedene v njem.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoAiStream. Podatkovna inteligenca Web3. Razširjeno znanje. Dostopite tukaj.

- Kovanje prihodnosti z Adryenn Ashley. Dostopite tukaj.

- vir: https://blockchain.capital/a-brief-history-of-web3-gaming-what-weve-learned-so-far/

- :ima

- : je

- :ne

- :kje

- $GOR

- 000

- 1

- 12

- 20

- 2014

- 2017

- 2020

- 2021

- 2023

- 9

- a

- sposobnost

- Sposobna

- O meni

- nad

- sprejeta

- natančnost

- pridobiti

- pridobitev

- pridobitev

- aktivna

- aktivno

- dejavnost

- dodano

- dodajanje

- Dodatne

- Naslov

- ustreznost

- sprejme

- Adventure

- nasveti

- podružnice

- proti

- poravnano

- Poravnava

- vsi

- omogočajo

- sam

- skupaj

- Alpha

- že

- Prav tako

- zneski

- an

- in

- živali

- Še ena

- kaj

- karkoli

- APE

- SE

- območja

- AS

- vidik

- sredstvo

- Sredstva

- domnevajo

- At

- pozornosti

- privlači

- privlačen

- Avgust

- Avtor

- Samodejno

- samodejno

- Avenue

- povprečno

- stran

- axie

- nazaj

- ovira

- baza

- temeljijo

- Osnovni

- boj

- BE

- ker

- postanejo

- postajajo

- bilo

- pred

- začel

- Začetek

- začel

- počutje

- Verjemite

- Prednosti

- beta

- Boljše

- med

- večji

- Billion

- Bit

- blockchain

- Blockchain Capital

- Blockchain igre

- Blokchain tehnologija

- verige blokov

- Blog

- Blog Prispevkov

- povečanje

- Dolgčas

- DOLGOČASNA OPICA

- tako

- bote

- blagovne znamke

- BREED

- MOST

- prinašajo

- širši

- izgradnjo

- Building

- zgrajena

- vendar

- nakup

- by

- klic

- CAN

- ne more

- Kapital

- previdni

- igralnice

- kategorije

- Kategorija

- Mačke

- povzročilo

- povzroča

- CCP

- nekatere

- verige

- verige

- izzivi

- izziv

- spremenite

- trdijo,

- klasika

- bolj jasno

- tesno

- Coindesk

- skoval

- Kovanci

- sodelovanj

- zbiranje

- Zbiranje

- Com2U

- prihajajo

- storjeno

- storiti

- skupnost

- stavba skupnosti

- pod vodstvom skupnosti

- Podjetja

- v primerjavi z letom

- prepričljiv

- tekmovali

- skladnost

- Sestavljeno

- Koncept

- zaskrbljen

- porabijo

- vsebina

- ustvarjanje vsebine

- naprej

- prispevkov

- Core

- strošek

- bi

- ustvarjajo

- ustvaril

- ustvari

- Ustvarjanje

- Oblikovanje

- kritično

- kripto

- Kriptovalute

- kurirano

- Trenutna

- stranka

- Datum

- Dnevi

- desetletje

- Decentralno

- Decentralizirano

- Odločitev

- Zavrni

- Defi

- DeFi protokoli

- poda

- Dokazano

- dokazuje

- Oblikovanje

- Kljub

- razvili

- Razvojni

- Razvijalci

- Razvoj

- Razlika

- digitalni

- Digitalna sredstva

- porazdeljena

- DNK

- do

- Dokumenti

- ne

- Ne

- dolarjev

- Dolphin

- dont

- sestavljene

- sanje

- vozi

- 2

- med

- dinamično

- vsak

- Zgodnje

- zaslužiti

- zaslužili

- Plače

- najlažje

- enostavno

- Economics

- gospodarstev

- Gospodarstvo

- ekosistem

- Ekosistemi

- učinek

- prizadevanje

- pojavile

- sodelovati

- , ki se ukvarjajo

- sodelovanje

- angažiran

- Motorji

- okrepi

- uživajte

- prijetna

- dovolj

- Ljubitelji

- Vpis

- okolja

- zlasti

- Eter (ETH)

- ethereum

- omrežje ethereum

- Tudi

- dogodki

- sčasoma

- VEDNO

- Tudi vsak

- vsi

- vse

- evolucija

- preučiti

- Preučevanje

- Primer

- Razen

- razburjen

- vodstvo

- obstoječih

- pričakovati

- pričakovanja

- izkušnje

- Doživetja

- poskus

- raziskuje

- Raziskovati

- express

- izražena

- dejavniki

- FAIL

- ni uspelo

- sejem

- pravičnost

- Fallen

- daleč

- prednost

- Priljubljeni

- povratne informacije

- finančna

- prva

- prvič

- Nadstropje

- Megla

- za

- Naprej

- v prihodnost

- trenja

- iz

- v celoti

- zabava

- Poleg tega

- Prihodnost

- igra

- igra fi

- igranja

- Gamers

- Games

- igre na srečo

- ustvarjajo

- ustvarila

- zvrsti

- dobili

- pridobivanje

- dana

- Go

- dogaja

- goji

- Rast

- jamstva

- ročaj

- Zgodi se

- Imajo

- Glava

- močno

- pomoč

- tukaj

- več

- zgodovina

- imetniki

- Hiša

- Kako

- Vendar

- http

- HTTPS

- Stotine

- hype

- Ideja

- if

- ii

- takoj

- nespremenljiv

- implicirano

- Pomembno

- izboljšanje

- izboljšalo

- izboljšuje

- in

- spodbude

- spodbuden

- Industrija

- Podatki

- Infrastruktura

- Inovacije

- inovativne

- Namesto

- integrirana

- Interoperabilnost

- interoperabilno

- v

- Uvedeno

- naložbe

- Naložbena strategija

- Investitor

- vključeni

- IT

- Izdelkov

- ITS

- sam

- samo

- Vedite

- Pomanjkanje

- Država

- v veliki meri

- Največji

- Zadnja

- Lansko leto

- Pozen

- kosilo

- začela

- zakon

- vodi

- naučili

- pustite

- Pravne informacije

- legendarni

- manj

- Vzvod

- vzvod

- odgovornosti

- kot

- Verjeten

- v živo

- Long

- več

- Sklop

- je

- Glavne

- Večina

- Znamka

- Izdelava

- več

- ogromen

- materialno

- materiali

- Zadeve

- max širine

- maksimiranje

- Maj ..

- pomeni

- pomeni

- mehanika

- srednje

- člani

- omenjeno

- Metaverse

- Meritve

- morda

- milijonov

- Minecraft

- Model

- Momentum

- Denar

- mesec

- mesečno

- več

- Poleg tega

- Najbolj

- veliko

- multiplayer

- Krmarjenje

- skoraj

- nujno

- Niti

- mreža

- Novo

- nove igre

- novih uporabnikov

- Naslednja

- NFT

- št

- ne gnojivo

- nič

- zdaj

- Številka

- Kvota

- of

- off

- ponudba

- on

- Na verigi

- Na vkrcanje

- enkrat

- ONE

- samo

- Priložnosti

- Priložnost

- nasprotuje

- Optimizirajte

- or

- Ostalo

- drugače

- naši

- ven

- več

- Splošni

- lastne

- v lasti

- lastništvo

- del

- sodelovanje

- preteklosti

- pot

- Plačajte

- plačilna

- izplačil

- Peak

- ljudje

- po naročilu

- oseba

- Osebni

- Filipini

- slika

- platon

- Platonova podatkovna inteligenca

- PlatoData

- Predvajaj

- predvajalnik

- V lasti igralca

- igralci

- igranje

- Plummet

- Točka

- mogoče

- Prispevek

- Prispevkov

- potencial

- moč

- močan

- napovedano

- Prisotnost

- Predstavitve

- prejšnja

- Cena

- Cene

- Proizvedeno

- donosno

- Napovedi

- projekti

- protokoli

- dokazljivo

- zagotavljajo

- če

- objavljeno

- pankerji

- izključno

- Q1

- hitro

- tirnice

- območje

- Nabor iger

- hitro

- precej

- dosežejo

- Preberi

- pripravljen

- pripravljen igralec eden

- pravo

- Real denar

- Reality

- uresničitev

- realizirano

- kraljestvo

- Razlog

- razumno

- Razlogi

- prejeti

- prejetih

- priznana

- Priporočila

- odražajo

- Ne glede na to

- regulatorni

- zanašajo

- ostajajo

- ponavljajoč

- zastopanje

- zastopan

- zahteva

- obvezna

- odmeven

- Odgovornost

- povzroči

- Rezultati

- ohranijo

- zadrževanje

- prihodki

- Nagrada

- Tveganje

- Igranje vlog

- Enako

- peskovnik

- Lestvica

- brez težav

- sektor

- Vrednostni papirji

- glej

- videnje

- zdi se

- videl

- prodaja

- Prodaja

- Občutek

- Serija

- več

- premik

- Kratke Hlače

- shouldnt

- pomemben

- Podoben

- Enostavno

- preprosto

- saj

- Počasi

- So

- doslej

- naraščajoče

- nekaj

- Nekaj

- Vesolje

- govorijo

- špekulacije

- preživeti

- porabljen

- Stardust

- Začetek

- Izjave

- Status

- funt

- Še vedno

- Strategija

- studii

- uspeh

- uspešno

- taka

- Suit

- Podpora

- Površina

- trajnostno

- Preklop

- pogovor

- davek

- tehnični

- Tehnologija

- načela

- Pogoji

- Test

- testerji

- kot

- da

- O

- Prihodnost

- informacije

- Metaverse

- Filipini

- njihove

- Njih

- tema

- sami

- POTEM

- Tukaj.

- v njem

- te

- jih

- mislim

- ta

- tisti,

- tisoče

- 3

- vsej

- vstopnice

- Tiffany

- čas

- krat

- naslove

- do

- danes

- žeton

- Boni

- orodja

- Skupaj za plačilo

- proti

- vleko

- Trgovanje

- tradicionalna

- tradicionalne igre

- Vlak

- izjemno

- Res

- Obrnjen

- dva

- tipično

- Konec koncev

- razumeli

- razumevanje

- edinstven

- Velika

- odklepanje

- nevzdržno

- Nadgradnja

- us

- Uporaba

- uporaba

- Rabljeni

- uporabnik

- Uporabniki

- uporabo

- ux

- dragocene

- vrednost

- Vrednote

- vrednotenje

- različnih

- preživetja

- ogledov

- Virtual

- virtualna dežela

- virtualni svet

- je

- način..

- načini

- we

- Orožje

- Web2

- Web3

- igre web3

- web3 igre

- so bili

- kiti

- Kaj

- kdaj

- ali

- ki

- medtem

- WHO

- zakaj

- široka

- Širok spekter

- bo

- pripravljeni

- zmago

- z

- deluje

- svet

- svetu

- po vsem svetu

- bi

- leto

- let

- jo

- Vaša rutina za

- zefirnet

- ZK