The ethos of living frugally and investing wisely only gets better when applied to a bitcoin standard.

Kaj je OGNJ?

Finančna neodvisnost, zgodnja upokojitev (FIRE) je gibanje, ki se osredotoča na ekstremne prihranke in naložbe, da bi ljudem omogočili, da se upokojijo veliko prej, kot ciljajo običajne strategije.

Izjemna varčnost je jedro OGNJA. Zagovorniki želijo prihraniti znatne zneske svojega dohodka – v mnogih primerih tudi več kot 50 %. To se običajno doseže z disciplinirano osredotočenostjo na zmanjševanje stroškov. Povečanje dohodka se spodbuja, vendar je priznano, da je manj nadzorovano kot neusmiljeno zmanjševanje porabe.

Ko je cilj varčevanja dosežen, upokojenci živijo od majhnih občasnih dvigov. Večina bi uporabila “4% rule” ali kaj podobnega, da bi izračunali svoj cilj varčevanja in varne zneske dvigov. Prihranki se običajno skoraj v celoti naložijo v delniške indeksne sklade.

O FIRE je na voljo ogromno informacij, ki jih tukaj ni vredno ponavljati. Lahko opravite lastno raziskavo, morda začnete z enim izmed najbolj priljubljenih blogerjev FIRE – Gospod denarni brki.

Dobro: ogenj in svoboda

The FIRE movement has a lot going for it. Its biggest strengths stem from the low time preference behavior it encourages, much like bitcoin. FIRE proponents are willing to sacrifice immediate expenditure and make lifestyle compromises for the potential of increased future returns (by compounding savings) that will later enable a lifestyle of freedom. FIRE’s extreme frugality pairs well with minimalizem and there is a degree of overlap between these movements. A common thread is the desire for freedom in its many forms — again something familiar to many bitcoiners. A minimalist lifestyle and mentality can provide a psychological sense of freedom well before retirement is achieved. Your possessions stop owning you and you can focus on the things you value most, even if you haven’t yet won complete control over your time.

The FIRE community is also ruthless at reducing management fees on their investments, almost always seeking out the lowest-cost options. They’ll be pleased to learn that bitcoin can be stored virtually for free in a fully self-sovereign manner in perpetuity. Even the lowest cost Vanguard or BlackRock equities ETF will be more expensive than holding the equivalent dollar value in bitcoin.

Slabo: morda ne bo delovalo dlje časa

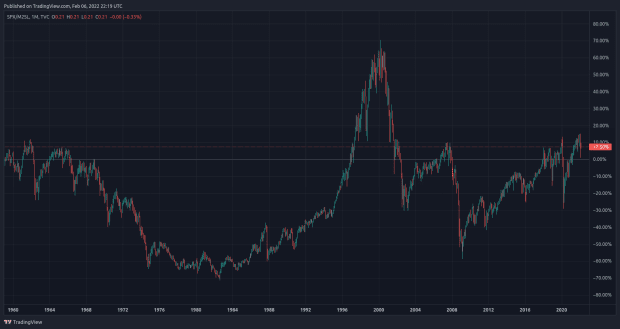

Zagovorniki FIRE običajno vložijo skoraj vse svoje prihranke v delniške indeksne sklade. To je potencialna težava, če centralne banke izklopijo tiskalnik denarja, kot je razvidno iz grafikona S&P 500, denominiranega v denarni ponudbi USD M2, ki kaže v bistvu enakomerno delovanje v več desetletjih:

FIRE proponents’ calculations could stop working if the fiat currency system fails and hyperbitcoinization arrives. As most bitcoiners know already, vse je bil trend na nič, ko priced in bitcoin, Vključno z S&P 500.

The Best Of Both Worlds: Bitcoin On FIRE

“I don’t think there is a single person with a negative opinion on bitcoin who has spent 100 hours studying it.” – Michael saylor

Like all asset owners, the FIRE movement has been a beneficiary of the fiat standard. If it ain’t broke, don’t fix it …

But perhaps if FIRE proponents did their 100 hours they may find an incredible alignment between bitcoin and their personal values, as well as discovering investment fundamentals that are nearly bulletproof and make bitcoin the ideal savings vehicle.

Common critiques of bitcoin by the FIRE community are no different from those dished up by traditional finance circles over the past decade: bitcoin has no intrinsic value, it produces no cash flows, it is too volatile. Even if you accept these arguments as being deal-breakers to implementing a FIRE strategy (I don’t and I doubt most will after their 100 hours), they are all blown out of the water simply by bitcoin’s superior skupni donos.

It’s often said to be sacrosanct to sell bitcoin and I generally accept holding for as long as possible and supporting your lifestyle through productive work is likely to be the safest strategy for most people. However, retiring early and drawing down on your bitcoin holdings periodically into perpetuity will be mathematically possible for many, both sooner than they might imagine and before hyperbitcoinization. It simply requires bitcoin’s growth rate to exceed that of your withdrawals and inflation. As Greg Foss pravi: "To je samo matematika."

Spodbujam vas, da izvedete svoje številke (pri vseh je situacija drugačna in to ni finančni nasvet). Če potrebujete pomoč pri zelo osnovni predlogi preglednice, se obrnite via Twitter.

Bitcoin’s historical total return performance has been incredible. Its 10-letna skupna letna stopnja rasti (CAGR) je 200 %. Vendar pa bi lahko njegova naraščajoča zrelost na koncu povzročila daljše cikle z nižjimi donosi (pravično je reči, da žirija še vedno ne razmišlja o tem!). Ne glede na to, 200 % zagotavlja a Veliko prostora za zvijanje, če upoštevate S&P 500 10 year CAGR is ~13%. When running your numbers it would be prudent to build in your own buffers (for example, assume lower bitcoin returns in the future and/or higher rates of inflation into your expenses).

Za tiste, ki so pogumni in zaupajo v matematiko, boste ugotovili, da potrebujete bistveno nižje začetno ravnotežje, če se ovrednotite v fiatu v primerjavi z uporabo tradicionalnih tehnik FIRE.

Bitcoin’s total return potential is also the best defense against volatility when retiring on a bitcoin standard in a fiat world. However, it may also be prudent to ensure withdrawals are regular (for example weekly or monthly) as you naturally wouldn’t want lumpier sales to coincide with periods of increased downside volatility in the bitcoin price. Psychologically this can be a difficult process to manage. A disciplined and consistent approach to sales – regardless of short-term price action – could help alleviate this tension. It’s essentially the opposite to buying bitcoin using dollar-cost-averaging (DCA) strategies (without the help of automated services).

For retired Bitcoiners from the Michael Saylor school who agree bitcoin will increase in value “… forever Laura” (my view too), delaying sales as much as possible will likely perform better over longer time frames. It just comes with more potential for anxiety and human error.

In conclusion, the typical FIRE template is not necessarily broken, but I contend there could be a better way for that movement. Simply replacing equity index funds with bitcoin (even in part) has the potential to significantly accelerate their path to freedom.

For existing Bitcoiners, running some basic numbers on retirement is always worth doing, even if you never intend to sell your bitcoin and would love to work forever. At the very least, afterwards you might feel like you aren’t short bitcoin … for a day or two!

To je gostujoča objava Johna Tulda. Izražena mnenja so povsem njihova in ne odražajo nujno mnenj BTC Inc oz Bitcoin Magazine.

- 10

- 100

- pospeši

- doseže

- Ukrep

- nasveti

- vsi

- Dovoli

- že

- znesek

- zneski

- letno

- Anksioznost

- pristop

- Argumenti

- sredstvo

- Avtomatizirano

- Na voljo

- Banke

- počutje

- BEST

- največji

- Bitcoin

- Bitcoin Cena

- bitcoinerji

- Blackrock

- pogumni

- BTC

- BTC Inc.

- izgradnjo

- Nakup

- primeri

- Denar

- Centralne banke

- Skupno

- skupnost

- v primerjavi z letom

- Sestavljeni

- nadzor

- Core

- bi

- valuta

- dan

- desetletje

- Defense

- Dokazano

- DID

- drugačen

- Dollar

- navzdol

- Zgodnje

- spodbujanje

- spodbuja

- pravičnost

- ETF

- Ethos

- Primer

- Stroški

- ekstremna

- sejem

- pristojbine

- Fiat

- Valuta Fiat

- financiranje

- finančna

- narava

- fiksna

- Osredotočite

- osredotočena

- za vedno

- Obrazci

- brezplačno

- Svoboda

- Osnove

- Skladi

- Prihodnost

- Cilj

- dogaja

- dobro

- Rast

- Gost

- Gost Prispevek

- pomoč

- tukaj

- več

- zgodovinski

- HTTPS

- velika

- človeškega

- Takojšen

- Vključno

- prihodki

- Povečajte

- povečal

- narašča

- Indeks

- inflacija

- Podatki

- vlaganjem

- naložbe

- naložbe

- IT

- UČITE

- način življenja

- Long

- ljubezen

- upravljanje

- math

- Denar

- več

- Najbolj

- Najbolj popularni

- Gibanje

- številke

- Mnenje

- Komentarji

- možnosti

- Da

- Lastniki

- ljudje

- performance

- mogoče

- obdobja

- Osebni

- Popular

- mogoče

- potencial

- Cena

- problem

- Postopek

- zagotavljajo

- zagotavlja

- Cene

- dosežejo

- zmanjšanje

- odražajo

- redni

- zahteva

- Raziskave

- vrne

- Run

- tek

- S&P 500

- varna

- Je dejal

- prodaja

- <span style="color: #f7f7f7;">Šola</span>

- iskanju

- prodaja

- prodati bitcoin

- Občutek

- Storitve

- Kratke Hlače

- pomemben

- Podoben

- majhna

- Nekaj

- Poraba

- Stem

- strategije

- Strategija

- superior

- dobavi

- Podpora

- sistem

- ciljna

- tehnike

- skozi

- čas

- tradicionalna

- tradicionalne finance

- trending

- Zaupajte

- tipično

- ameriški dolar

- vrednost

- vrednoti

- vozilo

- Poglej

- Volatilnost

- Voda

- Tedenski

- WHO

- umik

- brez

- delo

- deluje

- svet

- svetu

- vredno

- leto

- nič