Apesar da recente queda em todo o mercado, a capitalização de mercado global de criptografia registrou um aumento de 3.68% esta semana, para US$ 1.69 trilhão, com contribuições substanciais de ativos de grande capitalização, como Bitcoin (BTC), XRP (XRP) e Shiba Inu (SHIB).

Bitcoin Breaches $48k

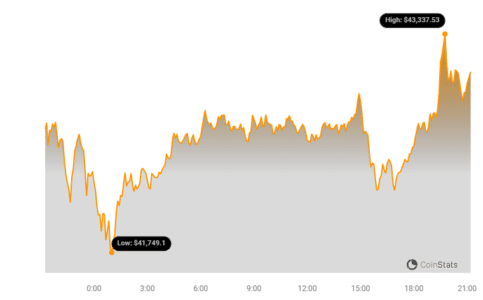

Antes do início da semana, o BTC registrou três perdas intradiárias consecutivas, caindo para um mínimo de US$ 43,929. No entanto, o criptoativo começou a semana em condições favoráveis.

Bitcoin rallied 7.5% to a 21-month high of $47,248 on Jan. 8. The asset net resistance at this new peak, leading to a slight decline.

However, despite the decline, BTC ended Jan. 8 with an impressive 6.88% increase, closing the day above the $46,000 mark, at $46,951.

Bitcoin’s bullish performance was bolstered by growing optimism surrounding the upcoming spot BTC ETF products.

With expectations of a decision this week, several industry commentators suggested a looming approval of the ETF filings, fueling bullish sentiments and increased buying pressure.

On Jan. 10, the SEC approved all 11 spot BTC ETF filings. The development led to billions in inflows in the crypto market.

The market responded with a rally across the board, with Bitcoin rallying to a 22-month high of $48,969 on Jan. 11, having breached $48,000 for the first time since March 2022.

Veja também: Bitcoin Short-Term Holders Panic-dropped $5B BTC After Price Dropped Toward $40,000

However, the market-wide rally was short-lived, as a large-scale dump ensued shortly after. BTC dropped to a low of $41,500 on Jan. 12, closing the day with a disappointing 7.67% drop.

Attempts at a comeback have been futile, as it hovers por aí the $43,000 mark. Overall, BTC traded flat this week, with an insignificant 0.02% rise.

XRP Battles For $0.6

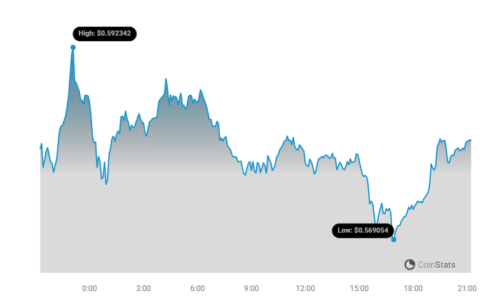

XRP leveraged the broader market uptrend this week to target the $0.63 target, but the subsequent decline resulted in a crash below multiple pivotal support levels.

The crypto token surged to a high of $0.6240 on Jan. 11, up 13% from the $0.5515 it began the week at.

However, the ensuing market drop saw it relinquish most of the gains picked up earlier in the week, as it slumped 5.32% on Jan. 12.

XRP has reclaimed some of the losses, but it still trades below the $0.58 price threshold. Regardless, the asset is still 4.87% up this week, currently trading por US $ 0.58118.

Veja também: 25.6 Billion XRP ‘Partial Payments Exploit’ On Bitfinex Thwarted

XRP needs to hold above the support at $0.5780 to make any attempt toward the next pivotal price point.

The asset’s next resistance level sits at $0.6017, currently at Fibonacci 0.5. Breaching $0.6017 would bring the next resistance level to $0.6254.

A move above $0.6254 could lift XRP toward the $0.63 price.

SHIB Looks To Defend $0.00001

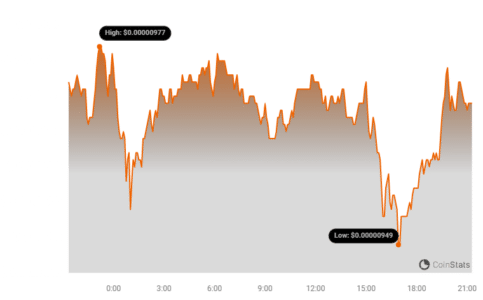

O nível de preço de US$ 0.00001 representa um dos limites psicológicos mais importantes para Shiba Inu. O ativo continuou a recuperar e abandonar o preço desde o ano passado.

SHIB recovered the $0.00001 point on Jan. 10, hitting a high of $0.00001050 the following day, as the market recorded an uptrend following the approval of the spot BTC ETF products.

Veja também: 85 milhões de recompensas SHIB para Stakers: líder de marketing Shiba Inu, Lucie

However, the asset dropped below the price territory during the Jan. 12 downturn, slumping to $0.00000964.

Attempts at recovery have seen Shiba Inu retest $0.00001 on Jan. 13 and 14. However, each retest has been followed by a subsequent rejection.

Shiba Inu atualmente trades at $0.00000969, looking to again reclaim the $0.00001 psychological threshold. The next substantial resistance point stands at $0.00001013.

Isenção de responsabilidade: as informações fornecidas não constituem conselhos comerciais. Bitcoinworld.co.in não se responsabiliza por quaisquer investimentos feitos com base nas informações fornecidas nesta página. Recomendamos fortemente uma pesquisa independente e/ou consulta com um profissional qualificado antes de tomar qualquer decisão de investimento.

Análise de preços: Stacks (STX) caíram mais de 4%

Análise de preços: Celestia (TIA) subiu mais de 3%

Análise de preços: Injetivo (INJ) sobe mais de 3%

A aprovação de ETFs de Bitcoin pela SEC leva a resultados notáveis

- Conteúdo com tecnologia de SEO e distribuição de relações públicas. Seja amplificado hoje.

- PlatoData.Network Gerativa Vertical Ai. Capacite-se. Acesse aqui.

- PlatoAiStream. Inteligência Web3. Conhecimento Amplificado. Acesse aqui.

- PlatãoESG. Carbono Tecnologia Limpa, Energia, Ambiente, Solar, Gestão de resíduos. Acesse aqui.

- PlatoHealth. Inteligência em Biotecnologia e Ensaios Clínicos. Acesse aqui.

- Fonte: https://bitcoinworld.co.in/top-cryptos-to-watch-this-week-btc-xrp-shib/

- :tem

- :é

- :não

- $UP

- 000

- 10

- 11

- 12

- 13

- 14

- 15%

- 2022

- 438

- 500

- 58

- 7

- 8

- a

- acima

- em

- conselho

- Depois de

- novamente

- Todos os Produtos

- tb

- an

- análise

- e

- qualquer

- aprovação

- aprovou

- AS

- ativo

- Ativos

- At

- tentativa

- baseado

- batalhas

- sido

- antes

- começou

- abaixo

- bilhão

- bilhões

- Bitcoin

- Mundo Bitcoin

- Bitfinex

- borda

- reforçado

- violações

- trazer

- mais amplo

- BTC

- ETF BTC

- Bullish

- mas a

- Comprar

- by

- boné

- Categoria

- de cores

- encerramento

- CO

- Volta

- comentaristas

- consecutivo

- consulta

- continuou

- contribuições

- poderia

- Crash

- cripto

- ativo criptográfico

- Mercado Crypto

- limite de mercado crypto

- Criptos

- Atualmente

- dia

- decisão

- decisões

- Rejeitar

- Apesar de

- Desenvolvimento

- decepcionante

- down

- RECESSÃO

- Cair

- desistiu

- Caindo

- despejar

- durante

- cada

- Mais cedo

- terminou

- ETF

- ETFs

- expectativas

- longe

- favorável

- Fibonacci

- limalha

- Primeiro nome

- primeira vez

- plano

- seguido

- seguinte

- Escolha

- da

- alimentando

- Ganhos

- Global

- Criptografia Global

- Crescente

- Ter

- ter

- Alta

- batendo

- segurar

- titulares

- detém

- Contudo

- HTML

- HTTPS

- impressionante

- in

- Crescimento

- aumentou

- de treinadores em Entrevista Motivacional

- indústria

- influxos

- INFORMAÇÕES

- NJI

- Injetável

- Inu

- investimento

- Investimentos

- IT

- Jan

- jpg

- KAS

- Kaspa

- em grande escala

- Sobrenome

- Ano passado

- conduzir

- principal

- Leads

- levou

- Nível

- níveis

- alavancado

- responsabilidade

- procurando

- OLHARES

- iminente

- perdas

- Baixo

- moldadas

- fazer

- Fazendo

- Março

- marca

- mercado

- Capitalização de mercado

- Marketing

- max-width

- milhão

- mais

- a maioria

- mover

- múltiplo

- Cria

- líquido

- Novo

- Próximo

- não

- of

- on

- ONE

- Otimismo

- global

- página

- pagamentos

- Pico

- atuação

- escolhido

- essencial

- platão

- Inteligência de Dados Platão

- PlatãoData

- ponto

- pressão

- preço

- gráfico de preços

- Produtos

- profissional

- fornecido

- psicológico

- qualificado

- comício

- ralis

- recentemente

- recomendar

- gravado

- recuperação

- Independentemente

- representa

- pesquisa

- Resistência

- resultou

- Recompensas

- Subir

- Sobe

- ROSE

- LINHA

- serra

- SEC

- visto

- sentimentos

- vários

- SHIB

- Shiba

- Shiba Inu

- Shiba Inu (SHIB)

- assistência técnica de curto e longo prazo

- Em breve

- desde

- senta

- Queda

- alguns

- fonte

- Spot

- Pilhas

- apostadores

- fica

- começo

- começado

- Ainda

- discordaram

- STX

- subseqüente

- substancial

- tal

- ajuda

- níveis de suporte

- Surgiu

- Em torno da

- TAG

- Target

- território

- do que

- A

- as informações

- isto

- esta semana

- três

- limiar

- tia

- tempo

- para

- token

- topo

- para

- negociadas

- trades

- Trading

- Trilhão

- tutorial

- os próximos

- tendência de alta

- foi

- Assistir

- we

- semana

- de

- seria

- xrp

- XRP (XRP)

- ano

- zefirnet