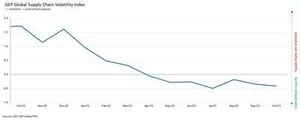

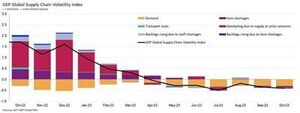

The GEP Global Supply Chain Volatility Index — the indicator tracking demand conditions, shortages, transportation costs, inventories and backlogs based on a monthly survey of 27,000 businesses — decreased again in October to -0.41, from -0.35 in September, indicating a 7th successive month of rising spare capacity across the world’s supply chains.

Additionally, the extent to which supplier capacity went underutilised was even greater than in September and August. Coupled with October’s downturn in demand for raw materials, components and commodities, this shows rising slack in global supply chains.

“While the shrinking of global suppliers’ order books is not worsening, there are no signs of improvement,” explained Jamie Ogilvie-Smals, vice president, consulting, GEP. “The notable increase in supplier capacity in Asia, which was driven by China, provides global manufacturers with greater leverage to drive down prices and inventories in 2024.”

A key finding from October’s report was the strongest rise in excess capacity across Asian supply chains since June 2020. Sustained weakness in demand, coupled with falling pressures on factories in Asia, indicates that the global manufacturing recession has further to run. With the exception of India, which continues to perform strongly, large economies in the region, such as Japan and China, are losing momentum.

Suppliers in Europe continue to report the largest level of spare capacity. In fact, the lower levels in GEP’s supply chain index for the continent have only been seen during the global financial crisis between 2008 and 2009. They highlight sustained weakness in economic conditions across the continent. Western Europe, particularly Germany’s manufacturing industry, is a key driver behind the region’s deterioration.

Um ponto relativamente positivo é a América do Norte, onde as cadeias de abastecimento têm capacidade excedentária, mas em muito menor grau do que noutros lugares, uma vez que a economia dos EUA continua a demonstrar a sua resiliência, em forte contraste com a Europa.

Outubro de 2023 Principais conclusões

Demand: Demand for raw materials, components and commodities remains depressed, although the downturn seems to have stabilised. There are still no signs of conditions improving, however, as global purchasing activity fell again in October at a pace similar to what we’ve seen since around mid-year.

Demand: Demand for raw materials, components and commodities remains depressed, although the downturn seems to have stabilised. There are still no signs of conditions improving, however, as global purchasing activity fell again in October at a pace similar to what we’ve seen since around mid-year.- Estoques: Com a queda da demanda, nossos dados mostram mais um mês de redução de estoques por parte das empresas globais, sinalizando esforços de preservação do fluxo de caixa.

- Escassez de materiais: Os relatórios de escassez de itens permanecem no nível mais baixo desde janeiro de 2020.

- Labour shortages: Shortages of workers are not impacting global manufacturers’ capacity to produce, with reports of backlogs due to inadequate labour supply running at historically typical levels.

- Transportation: Global transportation costs held steady with September’s level, although oil prices have declined in recent weeks.

Volatilidade da cadeia de abastecimento regional

-

América do Norte: O índice caiu para -0.34, de -0.30. Isto permanece muito mais suave do que a média global e continua a sugerir os EUA. a economia está preparada para uma aterragem suave.

- Europa: O índice subiu de -0.90 para -1.01, mas ainda permanece num nível que é indicativo de uma fragilidade económica considerável.

- Reino Unido: O índice subiu ligeiramente para -0.93, de -0.98. Ainda assim, os dados apontam para um aumento substancial no excesso de capacidade nos fornecedores dos mercados do Reino Unido.

- Asia: Notably, the index dropped to -0.38, from -0.20, highlighting the biggest rise in spare supplier capacity in Asia since June 2020 as the region’s resilience fades.

- Conteúdo com tecnologia de SEO e distribuição de relações públicas. Seja amplificado hoje.

- PlatoData.Network Gerativa Vertical Ai. Capacite-se. Acesse aqui.

- PlatoAiStream. Inteligência Web3. Conhecimento Amplificado. Acesse aqui.

- PlatãoESG. Carbono Tecnologia Limpa, Energia, Ambiente, Solar, Gestão de resíduos. Acesse aqui.

- PlatoHealth. Inteligência em Biotecnologia e Ensaios Clínicos. Acesse aqui.

- Fonte: https://www.logisticsit.com/articles/2023/11/21/supply-chains-worldwide-remain-significantly-underutilised-gep-global-supply-chain-volatility-index

- :tem

- :é

- :não

- :onde

- 000

- 01

- 121

- 20

- 2008

- 2020

- 2023

- 2024

- 27

- 30

- 300

- 35%

- 41

- sec 7

- 90

- 98

- a

- em

- atividade

- novamente

- Apesar

- América

- e

- Outro

- SOMOS

- por aí

- AS

- Ásia

- asiático

- At

- AGOSTO

- média

- baseado

- sido

- atrás

- entre

- O maior

- Livros

- Brilhante

- negócios

- mas a

- by

- Capacidade

- cadeia

- correntes

- China

- Mercadorias

- componentes

- condições

- considerável

- consultor

- continente

- continuar

- continua

- contraste

- custos

- acoplado

- crise

- dados,

- diminuiu

- Demanda

- Ecrã

- down

- RECESSÃO

- distância

- dirigido

- motorista

- desistiu

- dois

- durante

- Econômico

- Condições económicas

- economias

- economia

- esforços

- em outro lugar

- Éter (ETH)

- Europa

- Mesmo

- exceção

- excesso

- explicado

- extensão

- fato

- fábricas

- Desvanece-se

- Queda

- financeiro

- crise financeira

- descoberta

- Escolha

- fragilidade

- da

- mais distante

- Alemanha

- Global

- financeiro global

- Crise financeira global

- maior

- Ter

- Herói

- superior

- Destaques

- Destacando

- historicamente

- Contudo

- HTTPS

- impactando

- melhoria

- melhorar

- in

- Crescimento

- índice

- Índia

- indicam

- indicador

- indicativo

- Indicador

- indústria

- ESTÁ

- Jamie

- janeiro

- Japão

- jpg

- Junho

- Chave

- Trabalho

- aterrissagem

- grande

- maior

- menor

- Nível

- níveis

- Alavancagem

- perder

- diminuir

- menor

- Fabricantes

- fabrica

- indústria de transformação

- Mercados

- materiais

- Ímpeto

- Mês

- mensal

- muito

- não

- Norte

- América do Norte

- notável

- notavelmente

- Outubro

- of

- AZEITE E AZEITE EVO

- on

- só

- ordem

- livros de encomendas

- A Nossa

- Paz

- particularmente

- realizar

- platão

- Inteligência de Dados Platão

- PlatãoData

- ponto

- equilibrado

- preservação

- presidente

- Valores

- produzir

- fornece

- aquisitivo

- Cru

- recentemente

- recessão

- região

- relativo

- permanecem

- permanece

- Denunciar

- Relatórios

- resiliência

- Subir

- ascensão

- ROSE

- Execute

- corrida

- s

- parece

- visto

- Setembro

- escassez

- Shows

- de forma considerável

- Sinais

- semelhante

- desde

- folga

- Suave

- Spot

- forte

- estável

- Ainda

- mais forte

- discordaram

- substancial

- tal

- sugerir

- fornecedor

- fornecedores

- supply

- cadeia de suprimentos

- Redes de fornecimento

- Vistorias

- telhado

- do que

- que

- A

- o mundo

- deles

- Lá.

- deles

- isto

- para

- Rastreamento

- transporte

- típico

- Uk

- us

- Economia dos EUA

- Ve

- vício

- Vice-Presidente

- 👍 Volatilidade

- foi

- we

- fraqueza

- semanas

- fui

- Ocidental

- Europa Ocidental

- O Quê

- qual

- enquanto

- de

- trabalhadores

- mundo

- no mundo todo

- zefirnet