The Japanese yen continues to have a quiet week. In the European session, USD/JPY is trading at 146.34, down 0.18%.

Household spending rebounds

Japan’s household spending bounced back in September, with its first gain in three months. Household spending rose 1.8% MoM, despite higher inflation. This reading follows a strong retail sales report for September, with a gain of 1.1%. The sharp drop in Covid cases in September contributed to the strong numbers.

The question is whether the uptick in household and consumer spending will last. Inflation hit 3% in September for the first time in over 30 years, and inflation above the 3% level starts to squeeze spending in real terms. The government is hoping that the finance package that was announced today will reduce inflation and boost growth. The Japanese yen has improved lately and joined the bandwagon on Friday, as the US dollar retreated after a mixed nonfarm payrolls report.

Still, the outlook for the yen, which has plummeted about 20% this year against the dollar, does not look good. The Bank of Japan hasn’t budged from its ultra-loose policy, despite the declining yen and rising inflation. The Federal Reserve is far from winding up its aggressive rate policy, with inflation still running high. With the BoJ maintaining a cap on JGB yields, the US/Japan rate differential continues to widen, which is pushing the yen lower.

At the BoJ’s meeting in late October, the BOJ maintained all policy settings as well as its dovish guidance. Essentially, it was more of the same from the BoJ, with a strong likelihood that the BoJ will not make any changes before Governor Kuroda ends his term in April 2023.

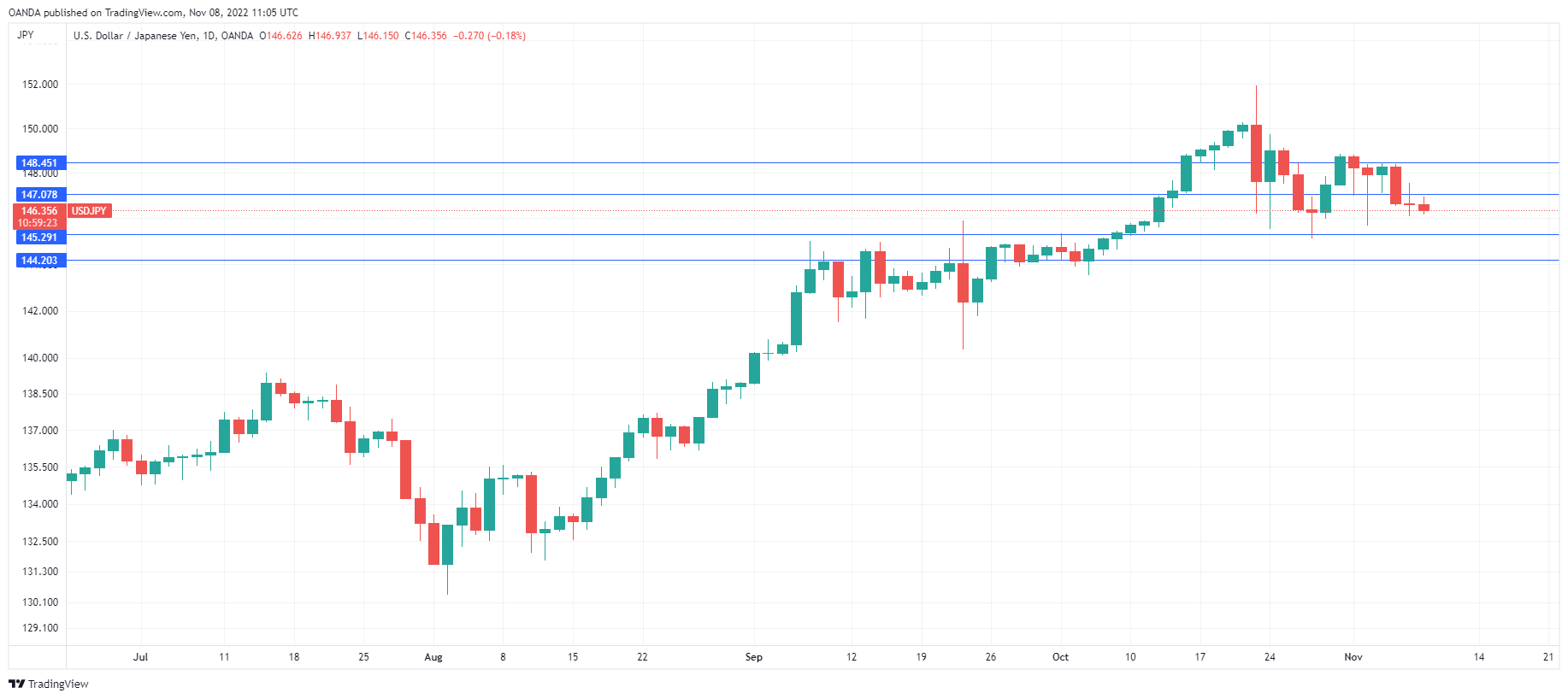

USD/JPY Technical

- There is resistance at 147.07 and 148.45

- 145.28 and 144.20 are providing support

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

- bank of japan

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- Central Banks

- coinbase

- coingenius

- Consensus

- COVID-19

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- FX

- Japan Household Spending

- japan inflation

- Japan Retail Sales

- JPY

- machine learning

- MarketPulse

- News events

- Newsfeed

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Technical Analysis

- US/Japan rate differential

- USD

- USD/JPY

- W3

- zephyrnet