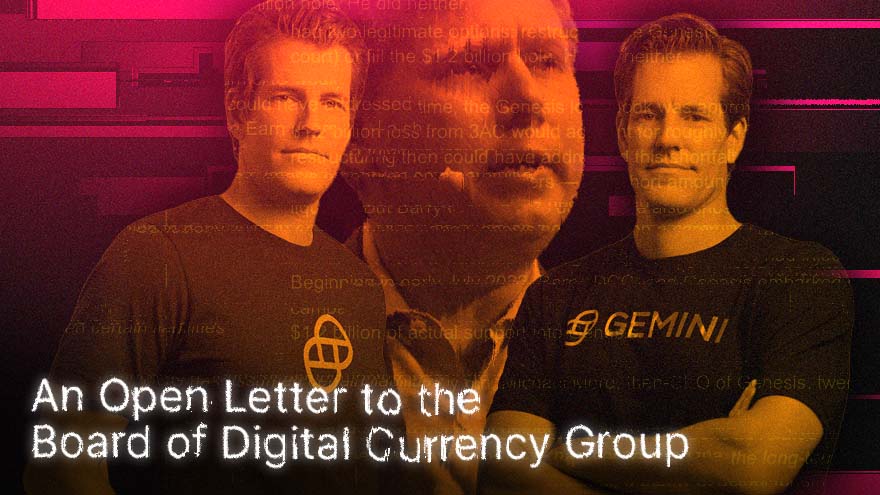

Gemini CEO Cameron Winklevoss has called for the termination of Barry Silbert, the founder and CEO of crypto conglomerate Digital Currency Group, in a scathing open letter shared on Twitter Tuesday that accuses Silbert and DCG of accounting fraud.

DCG’s many subsidiaries include Grayscale, the company behind the Grayscale Bitcoin Trust (GTBC), crypto publication CoinDesk, and Genesis, a crypto trading and lending platform that froze customer assets shortly after the bankruptcy of FTX in November.

Silbert and other key DCG executives lied about Genesis’ financial health “to mislead lenders into believing that DCG had absorbed massive losses that Genesis incurred from the Three Arrow Capital…collapse and induce lenders to continue making loans to Genesis,” Winklevoss wrote. “By lying, they hoped to dig themselves out of the hole they created.”

DCG shot back in a brief statement posted on Twitter.

“This is another desperate and unconstructive publicity stunt from [Cameron Winklevoss] to deflect blame from himself and Gemini, who are solely responsible for operating Gemini Earn and marketing the program to its customers,” DCG wrote.

“While we obviously do not agree with everything that Gemini has said, and we are disappointed that Gemini is waging a public media campaign despite ongoing productive private dialogue between the parties, we remain focused on finding a solution for our borrowing and lending intermediation business and reaching the best outcome for all affected Genesis lending and Gemini Earn clients,” Genesis spokesperson Abigail Farr said in a statement provided to The Defiant.”

Gemini Earn

Gemini, a US-based centralized crypto exchange founded by Winklevoss and his twin brother, Tyler, offered its users a product called Gemini Earn, which promised a handsome return on crypto deposits. Earn, in turn, deposited the crypto in Genesis, which made its money lending out those crypto assets.

Genesis’ decision to freeze customer assets trapped $900M deposited by Gemini Earn users. In a sign of users’ frustration, two have sued the Winklevoss twins and are reportedly seeking class-action status.

Last week, Winklevoss turned up the heat on Silbert, accusing him of imperiling the life savings of thousands of Earn customers. He accused Silbert of dragging his feet on making Gemini customers whole and demanded that Silbert publically commit to solving the problem by Jan. 8.

In Tuesday’s letter, Winklevoss pulls no punches. Subsections of his letter are titled “public lies,” “private lies,” and “accounting fraud.” According to Winklevoss, the story begins as many others this year have: with the collapse of Three Arrows, a crypto hedge fund that blew up last summer.

Three Arrows’ Implosion

As The Defiant previously reported, Genesis was Three Arrows’ largest creditor, having lent the insolvent fund more than $2.3B. The loan was secured by more than $1B in collateral in the form of shares of Grayscale Bitcoin Trust, Grayscale Ethereum Trust, and tokens for the Near and Avalanche blockchains.

Silbert has repeatedly said that DCG assumed Genesis’ $1.2B in liabilities created by Three Arrows’ collapse. In an email to Gemini employees who oversee the Earn program, Michael Ballensweig, Genesis’ then-head of trading and lending, doubled down on that message, saying losses had been “netted against the DCG balance sheet,” according to Winklevoss.

Ballensweig included a document that characterized a $1.1B DCG promissory note to Genesis, due in 2032, as a “current asset,” according to Winklevoss.

Alleged Misrepresentation

“A promissory note with a principal repayment due in 10 years falls outside the definition of a ‘current asset’ by a country mile,” Winklevoss wrote, calling the alleged misrepresentation an act of accounting fraud.

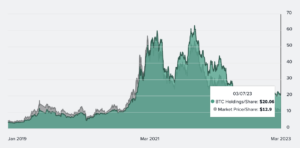

Winklevoss also alleges that Genesis had made itself vulnerable to Three Arrows’ collapse by lending the hedge fund bitcoin and accepting a DCG product, shares of GBTC, as collateral. Three Arrows would then convert the bitcoin it had borrowed to shares of GBTC.

Winklevoss called it “a recursive trade that ballooned the [assets under management] of the Grayscale Bitcoin Trust … and, as a consequence, the fees earned by [DCG subsidiary Grayscale].”

GBTC Premium

For the first several years of GBTC’s existence, shares were trading for more than the bitcoin that backed them. Analysts have attributed that premium to the fact that GBTC was, at the time, the only way for institutional investors to gain exposure to bitcoin.

Genesis never benefited from this premium, according to Winklevoss. It never closed out Three Arrows’ position, even when the GBTC premium turned into a discount in March 2021.

According to Winklevoss, Gemini should have characterized the bitcoin-for-GBTC “swaps” as risky derivatives, rather than collateralized loans.

This “original accounting fraud” made Genesis’ balance sheet “appear healthier than it actually was, fraudulently including lenders to continue making loans.”

With Silbert’s ouster, “we can all work together to achieve a positive, out-of-court solution,” Winklevoss wrote.

UPDATED on 1/10 @ 1330 with a statement from Genesis.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://thedefiant.io/winklevoss-accuses-silbert-fraud/

- 10

- 2021

- a

- About

- According

- Accounting

- accused

- Achieve

- Act

- actually

- After

- against

- All

- alleged

- alleges

- Analysts

- and

- Another

- asset

- Assets

- assumed

- Avalanche

- back

- backed

- Balance

- Balance Sheet

- Bankruptcy

- Barry Silbert

- behind

- believing

- BEST

- between

- Bitcoin

- Bitcoin Trust

- blockchains

- borrowed

- Borrowing

- business

- called

- calling

- Cameron Winklevoss

- Campaign

- centralized

- ceo

- characterized

- clients

- closed

- Coindesk

- Collapse

- Collateral

- collateralized

- collateralized loans

- commit

- company

- conglomerate

- continue

- convert

- country

- created

- creditor

- crypto

- crypto exchange

- Crypto Hedge

- crypto trading

- crypto-assets

- Currency

- customer

- Customers

- DCG

- decision

- demanded

- deposited

- deposits

- Derivatives

- Despite

- DIG

- digital

- digital currency

- digital currency group

- Discount

- document

- doubled

- down

- earn

- earned

- employees

- ethereum

- Even

- everything

- exchange

- executives

- Exposure

- Falls

- Fees

- Feet

- financial

- financial health

- finding

- First

- focused

- form

- Founded

- founder

- Founder and CEO

- fraud

- Freeze

- from

- FTX

- fund

- Gain

- GBTC

- Gemini

- Gemini Earn

- Genesis

- Genesis Lending

- Grayscale

- Grayscale Bitcoin Trust

- grayscale ethereum trust

- Group

- having

- Health

- healthier

- hedge

- hedge fund

- Hole

- HTTPS

- in

- include

- included

- Including

- insolvent

- Institutional

- institutional investors

- Investors

- IT

- itself

- Jan

- Key

- largest

- Last

- lenders

- lending

- lending platform

- letter

- liabilities

- Life

- loan

- Loans

- losses

- made

- Making

- management

- many

- March

- Marketing

- massive

- Media

- message

- Michael

- money

- more

- Near

- November

- offered

- ongoing

- operating

- Other

- Others

- outside

- parties

- platform

- plato

- Plato Data Intelligence

- PlatoData

- position

- positive

- posted

- Premium

- previously

- Principal

- private

- Problem

- Product

- Program

- promised

- provided

- public

- Publication

- publicity

- Pulls

- Recursive

- remain

- repayment

- REPEATEDLY

- responsible

- return

- Risky

- Said

- Savings

- Secured

- seeking

- several

- shared

- Shares

- Shortly

- should

- sign

- solution

- Solving

- spokesperson

- Statement

- Status

- Story

- subsidiary

- sued

- summer

- The

- The Defiant

- themselves

- this year

- thousands

- three

- Three Arrows

- time

- titled

- to

- together

- Tokens

- trade

- Trading

- Trust

- Tuesday

- TURN

- Turned

- Twins

- under

- users

- Vulnerable

- week

- which

- WHO

- Winklevoss

- Winklevoss Twins

- Work

- work together

- would

- year

- years

- zephyrnet