Every great empire that has come before the United States has eventually fallen. Some have fallen at least somewhat gracefully, like Great Britain. Others, like ancient Rome, well, not so much.

As I write these words, more and more ink has been spilled regarding the looming threat to the American-led world order. Words such as “de-dollarization” and a “multipolar world” are thrown out often, perhaps simultaneously or even interchangeably.

And indeed, “de-dollarization” is happening, albeit at nowhere near the speed some doomsayers describe. And we are likely already in a “multipolar world” where the United States is no longer the sole superpower. Instead, a new cold war—this time between the United States and China—seems to have dawned as East and West once again bifurcate and globalization slows down and begins to reverse.

Not surprisingly, what plays out over the next few years will have a significant impact on investors. But first, let us strip away the hyperbole and describe what exactly is happening.

A Crash Course on the History of Reserve Currencies

Before the Great Depression, the United States and most other countries had a gold-backed currency. In other words, citizens could have their dollars redeemed in gold bullion. This remained true until Franklin D. Roosevelt severed that link during the Great Depression.

While most currencies had been convertible to gold, this was rarely done. And during most of the 19th century and the first half of the 20th century, Britain’s pound sterling was the reserve currency of the world. It was World War II that changed this, as Britain put itself into such enormous debt to pay for the war (peaking at 270% of GDP) that the position of the pound was severely eroded.

So much so, in fact, that when Britain, along with France and Israel, invaded Egypt during the Suez Crisis of 1956, the United States effectively vetoed the action by pressuring the International Monetary Fund to deny Britain financial assistance. Without such assistance, Britain, which once held the reserve currency of the world, would have to humiliatingly devalue its own currency. Britain decided to withdraw from Egypt (and eventually devalued its currency in 1967, anyways).

While the Suez Crisis symbolized the changing of the guard, the shift from pounds to dollars was all but codified with the Bretton Woods Agreement of 1944. This agreement opened a “gold window,” allowing nations (but not individuals) to convert dollars to gold at a fixed rate of $35 an ounce. At the time, most of the world was devastated, and the United States controlled a whopping two-thirds of the world’s gold supply. Bretton Woods all but made it official that the dollar was now supreme.

However, such power usually leads to excess. And American exceptionalism, in this case, just meant exceptional excess. The United States very soon found its gold supplies being squeezed as the “guns and butter” of the 1960s (the Vietnam War and Great Society programs) were costing a fortune. To pay for both, the United States printed a lot of money, causing the currency to depreciate. Remember, though, the Bretton Woods system had a fixed exchange rate for gold. As dollars lost their value, gold was still priced at $35/ounce, and a run on America’s gold reserves began.

Thus, in 1971, Nixon closed the gold window, and dollars were no longer convertible to gold.

Now, the dollar was the reserve currency of the world, yet it was backed by nothing but the “full faith and credit of the U.S. government.” At the time, this left something to be desired, especially given all the money the U.S. had printed to help pay for so many guns and so much butter. The United States began to suffer from stagflation with low growth and inflation rates consistently north of 10%.

A large part of the reason for such inflation was that there were too many dollars chasing too few goods. To alleviate this pressure, the Nixon Administration made a deal with Saudi Arabia in 1974, which brought about what is now referred to as the petrodollar.

Under this and subsequent agreements, Saudi Arabia and all OPEC members would sell oil exclusively in dollars. Then, as Investopedia notes, “subsequent deals deployed Saudi oil export proceeds to pay for U.S. aid and development projects in Saudi Arabia and to finance U.S. weapons sales to the kingdom.”

The petrodollar both increased the demand for dollars and also created an important reason for other countries to store them. And so, they did. In 1975, a full 84.6% of currencies held in reserve were dollars. After oscillating for a while, it settled in at 71.1% in 2000. Then, well, things started to unravel, albeit slowly.

Things Fall Apart?

After Russia invaded Ukraine in February 2022, Russia quickly became the most sanctioned country in the world, surpassing Iran for that dubious title by a factor of three. Unfortunately, though, the sanctions didn’t work, and the Russian ruble hit its strongest level since 2015.

Perhaps this was a sign of America’s eroding economic position in the world. Since then, a smorgasbord of countries have abandoned the dollar for trade in whole or in part. Not surprisingly, Iran and Russia abandoned the dollar. But in addition, India has signed an oil deal with Russia that forgoes the dollar, as has Brazil with China. France is doing the same, bringing de-dollarization right into the heart of NATO. And so is Saudi Arabia, the progenitor of the petrodollar.

So, needless to say, the petrodollar’s preeminence is being tested. Now, it’s important to note that this is not de-dollarization per se. The dollar reserve standard regards the currencies world governments hold, not the currencies they trade in. Still, the latter moving away from the dollar bodes poorly for the dollar to remain the world’s hegemon.

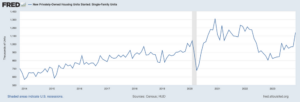

And that is what is happening, although at a very slow and steady rate. Over the first 23 years of this century, we have seen a notable decline in the dollar’s reserve currency status, falling from 71% to under 60%.

Here’s a chart from the Federal Reserve that shows how foreign exchange reserves have changed since 2000. The dollar has been slowly but steadily losing its share of foreign reserves: pic.twitter.com/1CRpMWJCPu

— Genevieve Roch-Decter, CFA (@GRDecter) March 29, 2023

At the same time, the United States is flirting with the same things that brought down the pound sterling and the Gold Window: too much debt.

The U.S. trade deficit has been negative for decades and sits at negative $948.1 billion in 2022, up over 10% from 2021. And the federal budget deficit is even worse, at $1.1 trillion during just the first half of fiscal year 2023—up 63% from 2021.

And there is no Covid nor lockdowns to explain this away.

Should We Panic?

Fiscal implosions rarely look like real-life implosions. After all, the United States bounced back from the Great Depression and Great Recession at least relatively quickly. A country’s collapse is usually due to war or revolution. Think of the Goths with Rome, the Bolsheviks in Russia, the Americans, British, and Russians with Germany, etc.

Fiscal unraveling may hollow out and leave nations vulnerable to such destruction, but it rarely destroys a country by itself. And there doesn’t appear to be anyone likely to threaten the United States militarily. We should also remember that Britain did not collapse after the pound sterling fell to second behind the dollar.

At this point, the only possible contender to the dollar is the Chinese yuan. There’s no way the dollar will fall to third, and it has a long way to go just to fall to second.

Despite many doomsayers, cooler heads on both the right and left have cautioned against delusions of the opposite of grandeur. They note that “the Chinese yuan has no adopters outside of China” and “Middle East oil-producing nations have other reasons to stick to the dollar. A crucial one is that most of their currencies are pegged to the greenback, requiring a constant influx of dollars to support the arrangement.”

Furthermore, despite fiscal recklessness spanning multiple administrations by both Republicans and Democrats, the United States still has the largest economy in the world. The GDP of the United States is $20.49 trillion, 50% larger than China’s and just a few trillion smaller than the next eight countries combined.

And it should also be pointed out, as Robb Nunn succinctly did, there are other reasons the U.S. dollar isn’t going the way of the Dodo. One is that it’s backed by the world’s most powerful military.

It’s that the US dollar also comes with the underwriting of the most powerful military on Earth. Assured by alliances with 8 of the top military powers on Earth with it. The Euro-Dollar system is where capital reserves are held etc etc

— Rob Nunn (@robfnunn) March 30, 2023

What Does This Likely Mean for the United States and Investors?

What we’re seeing is unlikely to be a calamity but is instead the slow but steady deterioration of the dollar as the sole reserve currency of the world. The future is likely that “multipolar” world with the dollar being held as the plurality of the world’s reserves but no longer the dominant position it had for so long.

What this means is that there will be more dollars returning to U.S. shores that were once occupied in some foreign country’s reserve accounts. Not a tsunami of dollars returning, but a noteworthy amount in a relatively steady stream.

At the same time, global trade and integration is slowing and likely to reduce as countries retrench with more nationalist policies and the world again divides between East and West. While this has its benefits, low costs are not among them.

Furthermore, the baby boomer generation is retiring, taking a disproportionate percentage of the labor pool out of the workforce. And this is a global phenomenon. The United States isn’t even close to the worst when it comes to upside-down demographic pyramids.

These new retirees are and will be switching from savings mode to spending mode. As geopolitical strategist Peter Zeihan notes,

“In the world of 1990 through 2020… all the richest and most upwardly mobile countries of the world were in the capital-rich stage of the aging process more or less at the same time. Throughout that three-decade period there have been a lot of countries with a lot of late-forty-through-early-sixty-somethings, the age group that generates the most capital… Collectively, their savings has pushed the supply of capital up while pushing the cost of capital down…”

But once those Baby Boomers start retiring (as they already are), the math switches,

“Not only is there nothing new to be invested, but what investments they do have tend to be reapportioned from high-earning stocks, corporate bonds, and foreign assets to investments that are inflation-proof, stock market crash-proof, and currency crash-proof.” (The End of the World is Just the Beginning, pg. 200-202)

In short, the eroding of dollar hegemony, the fiscal deficits, the pivot away from globalization, and the reduction in savings from retiring baby boomers is all going to be putting significant upward pressure on interest rates.

Inflation in the United States has cooled significantly since the highs of 2022. But long term, the “good ole days” of interest rates in the 3s and 4s are likely a thing of the past. There’s simply too much upward pressure on prices and interest rates.

Already, there has been talk of moving the Fed’s inflation goalpost of 2% up to 3 or 4%. While Fed chairman Jerome Powell has rejected such ideas so far, it will likely become inevitable in the relatively near future.

Given the long-term trends, it would make me hesitant to refinance old mortgages in the 3s and 4s, even if rates drop back into the 5s. (Unless, of course, you have a really good place to put the money you refinance out.) Fixed rates are also better than adjustable, at least once rates come back down from their current high.

While no one has a crystal ball, rates appear to be coming down in the short term, but all signs point toward persistently higher interest rates in the long term.

Close MORE deals in LESS time for LESS money

Wealth without Cash will fully prepare you to find off-market leads, uncover sellers’ motivations, negotiate with confidence, close more deals, build a team, and much more. This book by Pace Morby has everything you need to become a millionaire investor without utilizing your own capital.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://www.biggerpockets.com/blog/will-a-struggling-us-dollar-impact-real-estate-investors

- :has

- :is

- :not

- :where

- $UP

- 1

- 2%

- 2021

- 2022

- 23

- 24

- 30

- 49

- 8

- a

- About

- Accounts

- Action

- addition

- adjustable

- administration

- Administrations

- adopters

- After

- against

- Aging

- Agreement

- agreements

- Aid

- All

- alleviate

- Allowing

- along

- already

- also

- Although

- Amazon

- American

- Americans

- among

- amount

- an

- Ancient

- and

- anyone

- apart

- appear

- ARE

- arrangement

- AS

- Assets

- Assistance

- assured

- At

- author

- away

- Baby

- back

- backed

- ball

- BE

- become

- been

- before

- began

- behind

- being

- benefits

- Better

- between

- Billion

- Block

- Bonds

- book

- border

- both

- Bretton

- Bretton Woods

- Bringing

- britain

- British

- brought

- budget

- build

- bullion

- but

- by

- capital

- case

- causing

- Century

- chairman

- changing

- Chart

- China

- Chinas

- chinese

- Chinese Yuan

- Citizens

- Close

- closed

- CNBC

- codified

- cold

- Collapse

- collectively

- combined

- come

- comes

- coming

- confidence

- constant

- controlled

- convert

- Corporate

- Cost

- Costs

- could

- countries

- country

- country’s

- course

- cover

- Covid

- Crash

- created

- credit

- crisis

- crucial

- Crystal

- currencies

- Currency

- Current

- deal

- Deals

- Debt

- decades

- decided

- DEFICIT

- Demand

- Democrats

- deployed

- depreciate

- depression

- describe

- desired

- Despite

- Development

- DID

- do

- DODO

- does

- Doesn’t

- doing

- Dollar

- Dollar Hegemony

- dollars

- dominant

- done

- down

- Drop

- due

- during

- earth

- East

- Economic

- Economist

- economy

- effectively

- Egypt

- Empire

- end

- enormous

- especially

- estate

- etc

- Even

- eventually

- everything

- exactly

- exceptional

- exchange

- Exchange rate

- Exchange Reserves

- exclusively

- Explain

- export

- faith

- Fall

- Fallen

- Falling

- February

- Fed

- Fed Chairman

- Federal

- federal reserve

- few

- finance

- financial

- Find

- First

- Fiscal

- fixed

- flat

- For

- foreign

- foreign exchange

- Fortune

- found

- France

- from

- from 2021

- fully

- fund

- future

- GDP

- generates

- generation

- geopolitical

- Germany

- given

- Global

- global trade

- globalization

- Go

- going

- Gold

- gold bullion

- good

- goods

- Government

- Governments

- grandeur

- great

- Great Britain

- Great Depression

- Greenback

- Group

- Growth

- Guard

- GUNS

- had

- Half

- Happening

- Have

- heads

- Heart

- hegemony

- Held

- help

- Hesitant

- Hidden

- High

- higher

- Highs

- history

- hold

- How

- HTML

- HTTPS

- i

- ideas

- if

- Impact

- important

- in

- In other

- increased

- individuals

- inevitable

- inflation

- Inflation Rates

- influx

- instead

- interest

- Interest Rates

- International

- international monetary fund

- into

- invested

- Investments

- Investopedia

- investor

- Investors

- Iran

- Israel

- IT

- ITS

- itself

- jerome powell

- jpg

- just

- Kingdom

- labor

- large

- larger

- largest

- Leads

- Leave

- Level

- LG

- like

- likely

- LINK

- lockdowns

- Long

- long-term

- Long-Term Trends

- longer

- Look

- look like

- looming

- losing

- lost

- Lot

- Low

- made

- make

- many

- Market

- math

- May..

- mean

- means

- Members

- Military

- Millionaire

- Mobile

- Mode

- Monetary

- money

- more

- Mortgages

- most

- motivations

- moving

- much

- multiple

- Nations

- Near

- necessarily

- Need

- Needless

- negative

- New

- next

- Nixon

- no

- North

- notable

- noteworthy

- nothing

- now

- of

- official

- often

- Oil

- Old

- on

- once

- ONE

- only

- opec

- opened

- Opinions

- opposite

- or

- order

- Other

- Others

- out

- outside

- over

- own

- Pace

- Panic

- part

- past

- Pay

- percentage

- perhaps

- period

- persistently

- Peter

- phenomenon

- Pivot

- Place

- plato

- Plato Data Intelligence

- PlatoData

- Point

- policies

- policy

- pool

- position

- possible

- pound

- pound sterling

- pounds

- Powell

- power

- powerful

- powers

- Prepare

- pressure

- Prices

- proceeds

- process

- progenitor

- Programs

- projects

- pushed

- Pushing

- put

- Putting

- quickly

- Rate

- Rates

- real

- real estate

- really

- reason

- reasons

- recession

- recklessness

- referred

- regarding

- regards

- relatively

- remain

- remained

- remember

- represent

- Republicans

- Reserve

- Reserve Currency

- reserves

- retirees

- returning

- Reuters

- reverse

- Revolution

- rob

- round

- ruble

- Run

- Russia

- russian

- russian ruble

- Russians

- s

- sales

- same

- Sanctioned

- Sanctions

- Saudi

- Saudi Arabia

- Savings

- Second

- seeing

- sell

- Settled

- Share

- shift

- Short

- should

- Shows

- sign

- signed

- significant

- Signs

- simply

- simultaneously

- since

- sits

- slow

- Slowing

- Slowly

- slows

- smaller

- So

- so Far

- Society

- some

- something

- somewhat

- Soon

- speed

- Spending

- Stage

- standard

- start

- started

- States

- Status

- steady

- sterling

- Stick

- Still

- stock

- stock market

- Stocks

- store

- Strategist

- stream

- Strip

- Struggling

- subsequent

- such

- superpower

- supply

- support

- Supreme

- system

- taking

- Talk

- team

- than

- that

- The

- The Future

- the world

- their

- Them

- then

- There.

- These

- they

- thing

- things

- think

- Third

- this

- those

- threat

- threaten

- three

- Through

- throughout

- time

- Title

- to

- too

- top

- toward

- trade

- Trends

- Trillion

- true

- Tsunami

- two-thirds

- u.s.

- u.s. dollar

- U.S. government

- Ukraine

- uncover

- under

- underwriting

- unfortunately

- United

- United States

- unravel

- upward

- us

- US Dollar

- usually

- Utilizing

- value

- very

- Vetoed

- Vietnam

- Vulnerable

- war

- was

- Way..

- we

- Weapons

- webp

- WELL

- were

- West

- What

- What is

- when

- which

- while

- Wikipedia

- will

- with

- withdraw

- without

- Woods

- words

- Work

- Workforce

- world

- world’s

- worse

- Worst

- would

- write

- written

- WSJ

- year

- years

- yet

- you

- Your

- Yuan

- zephyrnet