Posted January 3, 2024 at 4:29 pm EST.

Bitcoin, the oldest cryptocurrency at age 15 years, is still demonstrating teenage volatility.

After adding more than 8% in the first two days of 2024, pushing past the critical price threshold of $45,000, BTC retreated to as low as $41,800 Wednesday morning, data from CoinGecko shows. BTC is trading around $43,000 at the time of publication, down 5.6% in the past 24 hours. The overall crypto market is similarly down 6.7% in the same period, per the CoinDesk Market Index.

Anticipation has been heightened in recent days as investors have expected that the U.S. Securities and Exchange Commission will approve spot Bitcoin exchange-traded funds (ETFs) by mid-January. Such approvals would potentially open the still-niche category of cryptocurrencies to the average investor masses. But total liquidations on crypto exchanges show that Bitcoin’s recent drop took crypto bulls by surprise.

ARVE Error: src mismatch

provider: youtube

url: https://www.youtube.com/watch?v=TQCEw_NyJTg&t=8s

src in org: https://www.youtube-nocookie.com/embed/TQCEw_NyJTg?start=8&feature=oembed

src in mod: https://www.youtube-nocookie.com/embed/TQCEw_NyJTg?start=8

src gen org: https://www.youtube-nocookie.com/embed/TQCEw_NyJTg

Within the last 24 hours, 203,973 traders experienced liquidation, amounting to a total of $687.38 million in liquidated cryptoassets, according to crypto derivative data-analysis platform CoinGlass. OKX, Binance and Huobi were the top exchanges seeing the most liquidations.

Trading platforms liquidate – or forcibly close – a trader’s position when the trader faces losses that exceed the collateral they’ve posted. Liquidations tend to occur during volatile price swings such as unexpected downturns.

What happened?

Crypto X, formerly Crypto Twitter, is awash in theories for the dip. There is likely no single answer, though many speculate that a single report predicting the SEC will reject Bitcoin spot ETFs is the culprit. More likely, the largest cryptocurrency by market capitalization slid because of several qualitative and quantitative forces. Here are some crib notes to help sort through the noise:

Pundits punditing

Matrixport, a crypto investment services provider, published an executive summary predicting the SEC would reject the dozen or so ETF applications before it.

The SEC will “reject all [ETF] proposals in January,” wrote Markus Thielen, CEO and head of research at financial research firm 10X, as “all applications fall short of a critical requirement that must be met before the SEC approves.”

Thielen argues that since Democrats dominate the five-person leadership of the commission and SEC Chair Gary Gensler has an anti-crypto stance, “from a political perspective, there is no reason to approve a Bitcoin Spot ETF that would legitimize Bitcoin as an alternative store of value.”

When Matrixport posted Thielen’s one-page executive summary of why the SEC will reject Bitcoin Spot ETFs at 5:32 a.m. EST, the price of BTC was hovering around $45,000. Roughly an hour later, BTC dropped about 8% to the $41,000 level.

🚀 The Potential Ramifications if SEC Rejects Bitcoin Spot ETFs Next Weekhttps://t.co/T9oVE6bvoW pic.twitter.com/TQkb5qpGjt

— 10x Research (@10x_Research) January 3, 2024

It’s worth noting that Thielen was until December the head of research at Matrixport, according to his LinkedIn profile. And Matrixport published Thielen’s prediction just one day after it posted its own take on its blog, “Bitcoin Spot ETF approval imminent, BTC to jump to $50,000.”

Inverse pundits inversing

More superstitious investors have pointed to an ongoing gag and meme centered on Jim Cramer, the former hedge fund manager and current host of CNBC’s Mad Money.

Dubbed “Inverse Cramer,” the joke refers to how BTC’s price moves in the opposite direction of Cramer’s commentary. When Cramer shares negative sentiments about BTC, supposedly its price jumps, but when he expresses positivity about BTC, the price slides, allegedly.

Tuesday in a live television interview around 9:30 a.m. EST, Cramer declared that “Bitcoin is a technological marvel and I think people need to start recognizing it’s here to stay.”

Crypto followers on X shortly afterward began invoking the “Inverse Cramer” meme.

FK…

I think the Inverse Cramer BLACK SWAN is taking place right now… DUMPING HARD pic.twitter.com/askcd4DUis

— Ivan on Tech – Moralis 🧙♂️ (@IvanOnTech) January 3, 2024

It’s the data

According to blockchain analytics firm CryptoQuant, the decline in BTC’s price was a foreseeable event, as it predicted the downturn in its Dec. 28 report based on several on-chain metrics.

First, Bitcoin holders are holding on to substantial unrealized gains. Data from the on-chain data firm shows that short-term Bitcoin holders are sitting on high, unrealized profit margins of more than 32% at press time, and according to the report this level of unrealized profit margin “historically has preceded price corrections.”

Hochan Chung, head of marketing at CryptoQuant, also pointed out to Unchained via Telegram that BTC inflows into spot exchanges “has been gradually increasing” and that miners have been moving their BTC to exchanges, causing “selling pressure.”

The 14-day simple moving average of the difference between bitcoins flowing into and out of exchanges has been positive for the last two days, highlighting how BTC inflows have outpaced outflows in the new year, per CryptoQuant data. Additionally, miners, in the last seven days of 2023, sent roughly 14,494 bitcoins, worth roughly $622 million at today’s prices to exchanges.

Even more data

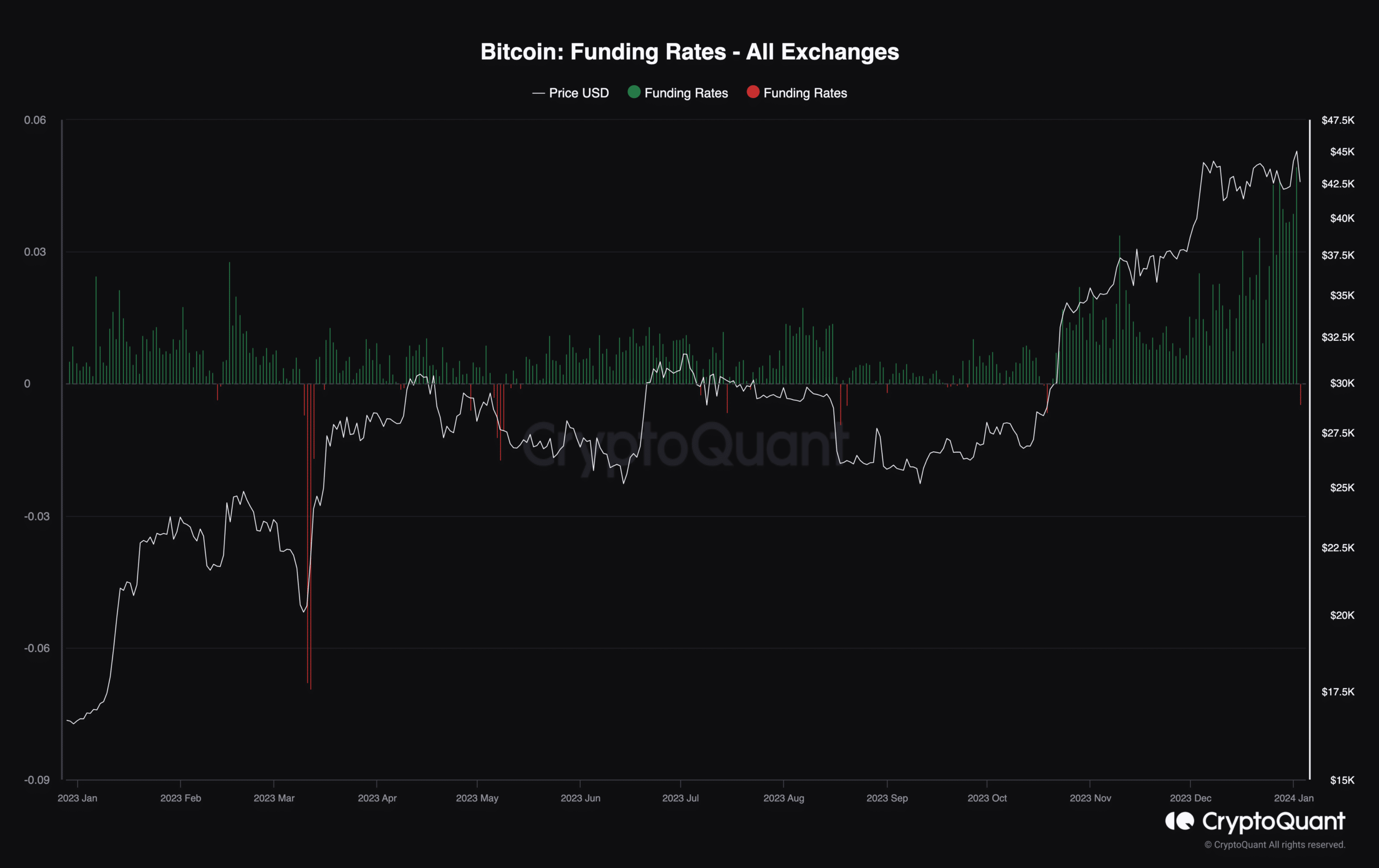

Lastly, Chung noted that “exceptionally high funding rates” in derivatives markets played a role in the BTC downswing.

“The derivative markets are showing the highest level of funding rates in more than a year for Bitcoin and Ethereum, meaning that traders are paying too much to open long positions,” said CryptoQuant’s report.

The Takeaway

Whatever the reason for the pullback – whether it be quantitative, qualitative, specious, or all of the above – investors see the pullback itself as a reason to question whether spot Bitcoin ETFs will be approved by mid-month.

“Where there’s smoke, I imagine there’s fire, meaning someone has new information,” Jim Hwang, chief operating officer at Firinne Capital, wrote in a text message to Unchained. “So for me, the odds of a Jan. 10 approval seem more like a coin flip now. The sharp pullback in the markets is reflective of the leveraged positions that speculators have built in anticipation of an approval.”

Charles Storry, head of growth at crypto index platform Phuture, doesn’t think an ETF approval will happen in January. “I think the SEC will fight it till the bitter end. We’ve seen them do this time and time again,” wrote Storry to Unchained on Telegram.

Traders on decentralized prediction platform Polymarket remain confident that the SEC will approve at least one Bitcoin ETF by Jan. 15, however. According to its website, the probability of the much-anticipated event occurring is 83%. Though that’s high, it’s a slight decrease from the day before, when the probability stood at 89%.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://unchainedcrypto.com/why-did-bitcoins-price-dip-as-etf-approval-nears/

- :has

- :is

- 000

- 10

- 14

- 15%

- 2023

- 2024

- 203

- 24

- 28

- 29

- 30

- 32

- 500

- 7

- 9

- a

- About

- above

- According

- adding

- Additionally

- advanced

- After

- again

- All

- allegedly

- also

- alternative

- an

- analytics

- and

- answer

- anti-crypto

- anticipation

- applications

- approval

- approvals

- approve

- approved

- ARE

- Argues

- around

- AS

- At

- average

- based

- BE

- because

- been

- before

- began

- between

- binance

- Bitcoin

- bitcoin and ethereum

- Bitcoin ETF

- Bitcoin Holders

- Bitcoin spot etf

- bitcoin's price

- Bitcoins

- Black

- blockchain

- BLOCKCHAIN ANALYTICS

- Blog

- BTC

- built

- Bulls

- but

- by

- capital

- capitalization

- Category

- causing

- centered

- ceo

- Chair

- chief

- Chief Operating Officer

- Close

- Coin

- Coindesk

- CoinGecko

- Collateral

- Commentary

- commission

- confident

- Corrections

- critical

- crypto

- Crypto Exchanges

- CRYPTO INDEX

- Crypto Investment

- Crypto Market

- cryptoassets

- cryptocurrencies

- cryptocurrency

- cryptoquant

- Current

- data

- day

- Days

- dec

- December

- decentralized

- Decline

- decrease

- Democrats

- demonstrating

- derivative

- Derivatives

- derivatives markets

- DID

- difference

- Dip

- direction

- do

- Doesn’t

- dominate

- down

- DOWNTURN

- downturns

- dozen

- Drop

- dropped

- during

- end

- error

- ETF

- ETFs

- ethereum

- Event

- exceed

- exchange

- Exchange Commission

- exchange-traded

- Exchanges

- executive

- expected

- experienced

- expresses

- faces

- Fall

- fight

- financial

- Fire

- Firm

- First

- Flip

- Flowing

- followers

- For

- Forces

- foreseeable

- Former

- formerly

- from

- fund

- fund manager

- funding

- funding rates

- funds

- Gains

- Gary

- Gary Gensler

- Gen

- Gensler

- gradually

- Growth

- happen

- happened

- Hard

- Have

- he

- head

- hedge

- hedge fund

- heightened

- help

- here

- High

- highest

- highlighting

- his

- holders

- holding

- host

- hour

- HOURS

- How

- However

- HTTPS

- Huobi

- i

- if

- imagine

- in

- index

- inflows

- information

- Interview

- into

- investment

- investor

- Investors

- IT

- ITS

- itself

- ivan

- Jan

- January

- Jim

- Jim Cramer

- jump

- jumps

- just

- just one

- largest

- Last

- later

- Leadership

- least

- Level

- leveraged

- Leveraged Positions

- like

- likely

- LinkedIn profile

- liquidate

- LIQUIDATED

- Liquidation

- liquidations

- live

- Long

- losses

- Low

- mad money

- manager

- many

- Margin

- margins

- Market

- Market Capitalization

- Marketing

- Markets

- marvel

- masses

- Matrixport

- max-width

- me

- meaning

- meme

- message

- met

- Metrics

- million

- Miners

- money

- more

- morning

- most

- moves

- moving

- moving average

- much

- much-anticipated

- must

- Need

- negative

- New

- new year

- next

- no

- Noise

- noted

- Notes

- noting

- now

- occur

- occurring

- Odds

- of

- Officer

- OKX

- oldest

- on

- On-Chain

- on-chain data

- ONE

- ongoing

- open

- operating

- opposite

- or

- out

- outflows

- overall

- own

- past

- paying

- People

- per

- period

- perspective

- Place

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- played

- pm

- political

- position

- positions

- positive

- Positivity

- posted

- potential

- potentially

- predicted

- predicting

- prediction

- press

- pressure

- price

- Prices

- probability

- Profile

- Profit

- Proposals

- provider

- Publication

- published

- pullback

- Pushing

- qualitative

- quantitative

- question

- ramifications

- Rates

- reason

- recent

- recognizing

- refers

- remain

- report

- requirement

- research

- responsive

- right

- Role

- roughly

- s

- Said

- same

- SEC

- sec chair

- Securities

- Securities and Exchange Commission

- see

- seeing

- seem

- seen

- sent

- sentiments

- Services

- seven

- several

- Shares

- sharp

- Short

- short-term

- Shortly

- show

- showing

- Shows

- Similarly

- Simple

- since

- single

- Sitting

- Slides

- Smoke

- So

- some

- Someone

- Source

- Spot

- spot etf

- stance

- start

- stay

- Still

- stood

- store

- store of value

- substantial

- such

- SUMMARY

- surprise

- swan

- Swings

- Take

- taking

- tech

- technological

- Telegram

- television

- tend

- text

- than

- that

- The

- their

- Them

- There.

- think

- this

- though?

- threshold

- Through

- till

- time

- to

- today’s

- too

- took

- top

- Total

- trader

- Traders

- Trading

- true

- two

- u.s.

- U.S. Securities

- U.S. Securities and Exchange Commission

- Unchained

- Unexpected

- until

- value

- via

- Video

- volatile

- Volatility

- was

- Wednesday

- were

- when

- whether

- why

- will

- worth

- would

- wrote

- X

- year

- youtube

- zephyrnet