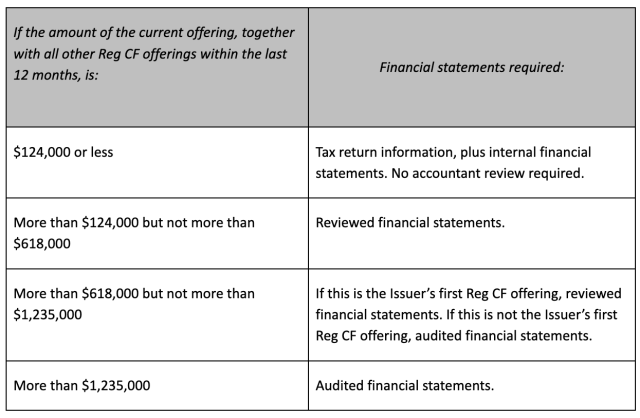

Reg CF requires financial statements. To refresh your memory:

Those thresholds are based on the maximum you’re trying to raise. So if your “target amount” is $600,000 but you’re trying to raise up to $900,000, and this is your second Reg CF offering, you need audited statements.

Now suppose you conducted your business as a sole proprietorship or an LLC until six months ago, when someone in Silicon Valley told you to convert to a C corporation. Your sole proprietorship or your LLC is a “predecessor” of your C corporation within the meaning of 17 CFR §230.405. Hence, under the Reg CF rules, your financial statements should include the results of the sole proprietorship or LLC. Which makes sense, given the purpose of the disclosure rules.

The same is true if your company intends to acquire another company. If you’re raising money to buy TargetCo Inc. then TargetCo Inc. is a “predecessor” of your company for purposes of Reg CF. Hence, you should include the financial statements of TargetCo Inc. Which also makes sense.

Especially for small companies, financial statements represent one of the biggest impediments to Reg CF. The rules around predecessors make the impediment that much higher.

Questions? Let me know.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://crowdfundingattorney.com/2023/11/17/whose-financial-statements/

- :is

- $UP

- 000

- 1

- 17

- a

- acquire

- ago

- also

- an

- and

- Another

- ARE

- around

- AS

- audited

- based

- Blog

- business

- but

- buy

- Companies

- company

- conducted

- CORPORATION

- Crowdfunding

- disclosure

- financial

- fintech

- For

- given

- hence

- higher

- HTTPS

- if

- in

- Inc.

- include

- intends

- Know

- Law

- LLC

- make

- MAKES

- max-width

- maximum

- me

- meaning

- Memory

- money

- months

- much

- Need

- of

- offering

- on

- ONE

- or

- plato

- Plato Data Intelligence

- PlatoData

- purpose

- purposes

- raise

- raising

- Reg

- represent

- requires

- Results

- rules

- same

- Second

- sense

- should

- Silicon

- Silicon Valley

- SIX

- Six months

- small

- So

- Someone

- statements

- that

- The

- then

- this

- to

- told

- true

- trying

- under

- until

- Valley

- when

- which

- whose

- within

- you

- Your

- zephyrnet