When venture funding started to turn south after a blockbuster year in 2021, seed and early-stage funding was at first relatively unscathed. Investment into seed startups globally actually grew in Q2 2022, even as venture investment overall dropped off dramatically.

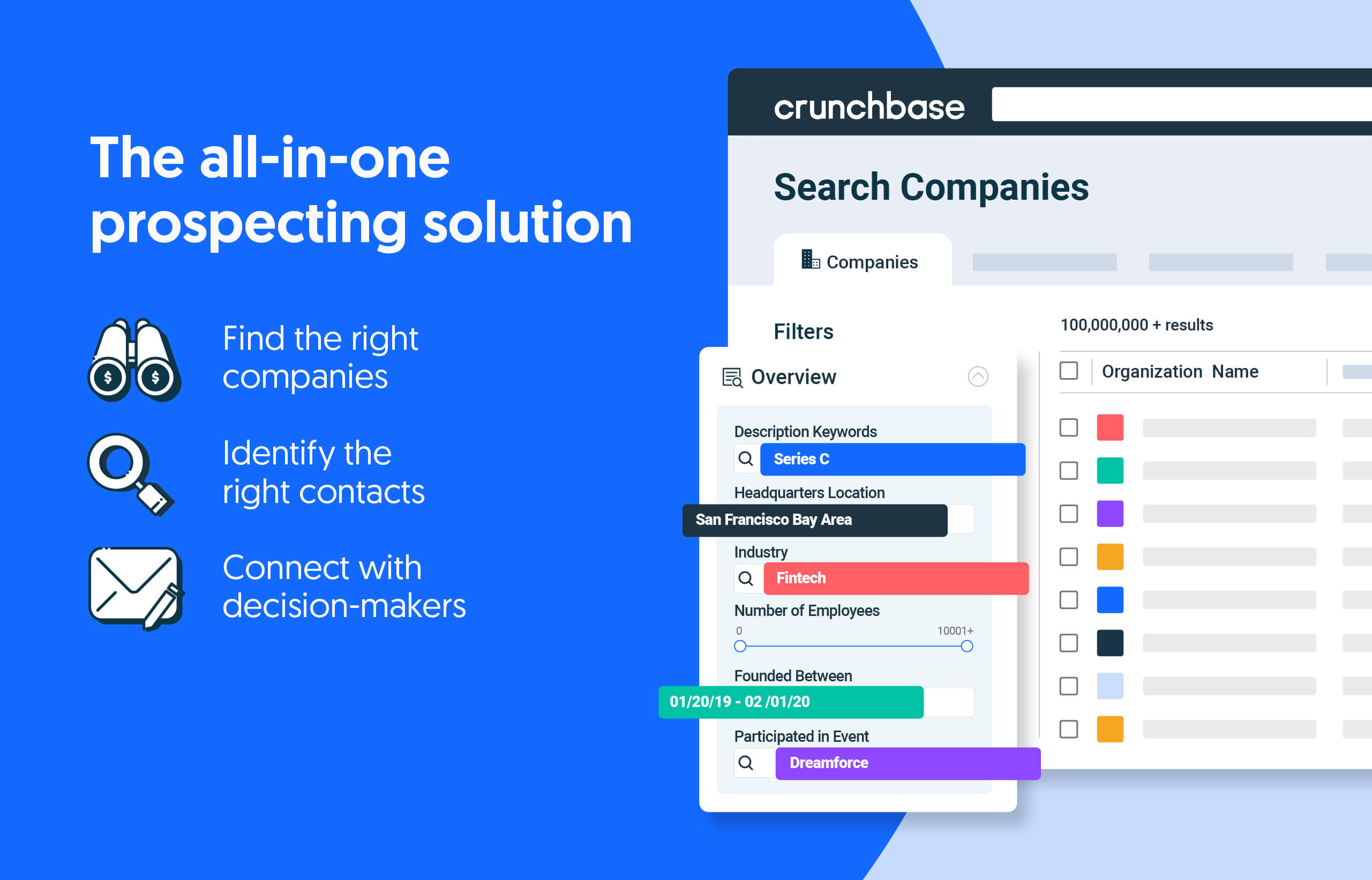

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

That’s no longer the case.

Seed funding starts to slip

Seed and angel investment to U.S. startups fell 45% year over year in the first quarter of 2023, to $3.1 billion, Crunchbase data shows. That’s the lowest quarterly amount since Q4 2020.

The size of a typical seed round also shrank, an analysis of Crunchbase data shows. After peaking in 2022 at $2.5 million, the median U.S. seed round dipped to $2.3 million in Q1 2023. The average dipped slightly from $3.7 million to $3.6 million.

Of course, that’s still far above where those deal sizes were less than a decade ago. In 2014, the median and average were both under $1 million.

Series A tumbles

Series A is suffering too. Crunchbase data shows Series A investment into U.S.-based startups has fallen for five consecutive quarters, dwindling from $14.5 billion in Q4 2021 to $5.7 billion last quarter.

Series A round sizes also dipped. The median Series A for a U.S. startup was $12 million last quarter — down $2 million compared to the 2022 median. Average deal size dipped from $19.1 million in 2022 and 2021 to $18.7 million last quarter.

Still, last quarter’s typical Series A deals were double or triple their size in 2014.

And some massive Series A checks have gone to biotech startups and companies in the red-hot artificial intelligence space this year.

Paradigm, a clinical trials platform, raised a $203 million Series A round last quarter. Cargo Therapeutics, a biotech working on cancer treatments, raised $200 million.

In AI, ChatGPT competitor Character.ai raised $150 million in a round led by Andreessen Horowitz that landed it on The Crunchbase Unicorn Board.

Investors look for more than good ideas

But all in all, the early-stage funding environment is tougher than it once was.

“Ideas are not as fundable as they used to be,” Steve Lehman, chair of entrepreneur networking and skill-building platform CoFoundersLab, told Crunchbase News recently. “Sure, I think investors, particularly in seed to Series A, are looking for something a little more tangible where the wheels are already on the bus. It doesn’t have to necessarily be rolling down the highway yet, but it’s got to have good momentum with unique value propositions.”

Related Reading

Related Crunchbase Pro queries

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

Avestria Ventures’ Linda Greub offers insider insight on the topic.

SoftBank’s Vision Fund unit — known for its investment in startups including Uber, WeWork and DoorDash — suffered losses of $32 billion for its…

It’s tough out there. Here are some startup survival tips.

This year is on pace for the lowest amount of dealmaking in China by U.S. investors in recent years, according to Crunchbase data.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://news.crunchbase.com/venture/seed-series-a-funding-charts-2023/

- :has

- :is

- :not

- :where

- $1 million

- $3

- $UP

- 1

- 2014

- 2020

- 2021

- 2022

- 2023

- 7

- a

- above

- According

- acquisitions

- actually

- After

- ago

- AI

- All

- all-in-one

- already

- also

- amount

- an

- analysis

- and

- Angel

- ARE

- artificial

- artificial intelligence

- AS

- At

- average

- BE

- Billion

- biotech

- blockbuster

- board

- both

- bus

- but

- by

- Cancer

- case

- Chair

- Charts

- Checks

- China

- Clinical

- clinical trials

- Close

- Companies

- compared

- competitor

- consecutive

- course

- cover

- CrunchBase

- daily

- data

- Date

- deal

- Deals

- decade

- Doesn’t

- DoorDash

- double

- down

- dramatically

- dropped

- early stage

- end

- Entrepreneur

- Environment

- Even

- Fallen

- far

- First

- For

- from

- fund

- funding

- funding rounds

- Globally

- good

- Happening

- Have

- here

- Highway

- HTTPS

- i

- in

- Including

- Insider

- insight

- Intelligence

- into

- investment

- Investors

- IT

- ITS

- jpg

- known

- Last

- leader

- Led

- Lehman

- less

- little

- longer

- Look

- looking

- losses

- lowest

- massive

- million

- Momentum

- more

- necessarily

- networking

- news

- no

- of

- off

- Offers

- on

- once

- or

- out

- over

- overall

- Pace

- particularly

- platform

- plato

- Plato Data Intelligence

- PlatoData

- powered

- Pro

- Q1

- Q2

- Quarter

- raised

- recent

- Recent Funding

- recently

- relatively

- revenue

- Rolling

- round

- rounds

- s

- seed

- Seed Round

- Series

- Series A

- Series A funding

- series a round

- Shows

- since

- Size

- sizes

- Solutions

- some

- something

- South

- Space

- started

- starts

- startup

- Startups

- stay

- Steve

- Still

- suffering

- survival

- than

- that

- The

- their

- There.

- they

- think

- this

- this year

- those

- tips

- to

- too

- topic

- trials

- Triple

- TURN

- typical

- u.s.

- Uber

- under

- unicorn

- unique

- unit

- used

- value

- venture

- venture-funding

- Ventures

- vision

- VISION FUND

- was

- were

- wework

- with

- working

- year

- years

- yet

- Your

- zephyrnet