How is Gross MRR Churn Rate calculated?

Gross MRR Churn Rate = [(Downgrade MRR + Cancellation MRR) / (Total MRR at the beginning of the period)] * 100

How should your business interpret Gross MRR Churn?

The overall contraction in the MRR can be due to downgrades or cancellations. If this is high, a business should try to understand the reason for the cancellations taking place. It could be voluntary churn wherein dissatisfied customers cancel their subscription due to lack of perceived value, or, it could be involuntary churn wherein the customer’s credit card expires and hence the subscription gets canceled.

To handle involuntary churn it’s good hygiene to track credit card expiry dates and notify customers ahead of time. Good billing management systems offer this capability out of the box. Another way to battle involuntary churn is by setting up an effective dunning process – gentle, timely reminders for payment.

Churn can be good sometimes— A drop in the MRR coming from customers moving to an annual plan shows higher value and retention.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

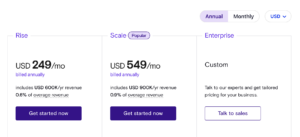

- Source: https://www.chargebee.com/resources/glossaries/what-is-gross-mrr-churn-rate/

- :is

- $UP

- a

- ahead

- an

- and

- annual

- annual plan

- Another

- At

- Battle

- BE

- Beginning

- billing

- Box

- business

- by

- calculated

- CAN

- canceled

- card

- Chargebee

- coming

- contraction

- could

- credit

- credit card

- customer

- Customers

- Dates

- Downgrade

- Drop

- due

- Effective

- expiry

- For

- from

- gentle

- good

- gross

- handle

- hence

- High

- higher

- HTTPS

- if

- in

- IT

- Lack

- management

- moving

- of

- offer

- or

- out

- overall

- payment

- perceived

- period

- Place

- plan

- plato

- Plato Data Intelligence

- PlatoData

- process

- Rate

- reason

- retention

- s

- setting

- should

- Shows

- subscription

- Systems

- taking

- The

- their

- this

- time

- to

- Total

- track

- try

- understand

- value

- voluntary

- Way..

- What

- What is

- Your

- zephyrnet