This January marks Inman’s fifth annual Agent Appreciation Month, which culminates at Inman Connect New York in a celebration of agents at the end of January. Plus, we’re rolling out the coveted Inman Power Player Awards, as well as the New York Power Brokers and MLS Innovators awards.

This January marks Inman’s fifth annual Agent Appreciation Month, which culminates at Inman Connect New York in a celebration of agents at the end of January. Plus, we’re rolling out the coveted Inman Power Player Awards, as well as the New York Power Brokers and MLS Innovators awards.

By now, you have seen the experts predicting a “Silver Tsunami” or a massive influx of homes poised to hit the housing market as seniors downsize over the next several years. Where or when will the housing industry feel it most? The answers might surprise you.

In 2020 the U.S. Census reported that 1 in 6 people in America were age 65 and over. In 1920, this proportion was less than 1 in 20.

Talk of the wave has risen again, thanks to financial analyst Meredith Whitney’s comments to attendees at the Yahoo Finance Invest Conference in November 2023.

Whitney, who successfully predicted the 2007-2008 financial crisis , thinks that the boomer shift is about to start and could be just the solution to quench the thirst of buyers who have been sitting on the sidelines waiting for more selections to arrive on the market.

“You’ll see a supply-demand dynamic shift,” Whitney, founder and CEO of Whitney Advisory Group, told Yahoo Finance’s Invest Conference

Whitney cited data from the AARP stating that 51 percent of people over 50 — a group that owns more than 70 percent of U.S. homes — are set to downsize to smaller homes. Whitney believes this could bring 30 million units of housing onto the market.

But here is what she gets wrong: Just because they are set, predicted or expected to downsize doesn’t mean that will happen. Because here is what no one is talking about.

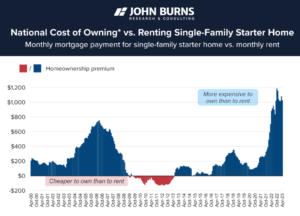

For many boomers, it’s more expensive to move than it is to stay in their current home, and many of them will ultimately stay in place whether it makes sense or not.

There is a massive shift in the culture and expectations of seniors and the reality of retirement, and all of the previous data on predicted behavior needs to be thrown out the window.

This generation is less concerned with following previous protocol and more concerned with their own personal happiness, and that happiness means:

- having all their special collections and heavy furniture

- having space to house all their complicated (and expensive) hobbies and materials to complete said hobbies

- large garages to house their cars and boats they will not stop driving

Most importantly, they have no desire to have anyone tell them what to do or to sacrifice their independence.

Boomers are going to do it their way, and they will not go quietly into a nursing home and forfeit their homes and personal freedoms as easily as generations before them. They want to have it all and are not about to slow down anytime soon. — Rachael Hite

All about the Benjamins

The business of getting old is expensive. Think about what you think it costs to retire and have care, and then keep adding zeros, and you might be close to the reality of how devastatingly expensive it is to be a senior in America.

We often read reports that seniors hold all the wealth, but what isn’t discussed is that the actual cost to receive high-quality private nursing care when you need it is now so high that this care is reserved for the wealthiest among us.

Average income?

Critical income data for 2023 from The Motley Fool tells a story many of us are not discussing. Income is either going to create barriers or gateways for this population.

- The average income for U.S. adults 65 and older is $75,254.

- The median income for U.S. adults 65 and older is $47,620.

- Average annual expenses for adults 65 and older are $48,872.

- The average monthly Social Security benefit for retired workers is $1,681 and is set to rise to $1,827 in 2023.

- The Social Security Administration reports that 12 percent of men and 15 percent of women rely on the program for 90 percent or more of their income.

Since the pandemic, seniors have become bullish on aging in place, remodeling where they live to be safer to stay in, and avoiding going into higher levels of care as they are still traumatized by the pandemic lockdowns and are worried about losing their freedoms.

We have one of the highest costs in the world to retire. In a study conducted by Net Credit, out of 125 countries studied, only 13 countries were found to be more expensive to retire in than the U.S.

It’s easy to talk about planning for a single-level home, groceries, and maybe a vacation once a year, but what about planning to pay for your care when you can no longer care for yourself? This is one cost of retirement that all generations detest thinking about or are living in denial about because they don’t think it will happen to them.

The cost of care is outrageous. Gen Worth, a very well-known long-term care insurance company, provides a sliding scale cost of care calculator to help educate seniors and their loved ones about how much certain types of care cost in their zip code, state and national averages.

Hold on to your seats, kids. In 2021, according to Gen Worth, it costs an average of $54,000 for assisted living and over $100,000 a year for private skilled nursing care. The average cost per hour for in-home health aides is about $27; 24-7 care can translate to $4,536 a week.

What we can count on

So what do the experts have right? Change is coming, but I strongly feel the populations that will be affected the most will, once again, be Gen X and millennials, as they are going to be the family members and the workforce who are ultimately going to shoulder the bulk of the responsibility of downsizing tasks, becoming caregivers, and figuring out how to utilize the wealth to pay debts and invest for parents’ and grandparents’ future retirement.

What can we count on seeing?

- Increase in demand for 55+ living with luxury amenities and many expense-heavy HOA fees for maintenance-free living.

- Increase in demand for off-site storage solutions.

- Increase in boomers renting instead of being homeowners, increasing rents and reducing rental inventory for millennials and Gen Z.

- Increase in seniors competing for smaller “starter” homes by paying cash, further pushing affordable housing out of the reach of millenials and Gen Z.

- Increase in demand for “age in place” home conversions to stay in the current home.

- Increase in demand for skilled auctioneers who will obtain top dollar for any prized items seniors are willing to part with.

- Increase in demand for residential assisted living options. This newer trend is becoming a popular alternative to traditional assisted living. Essentially, a large residential home is converted to accommodate a small group of seniors Golden Girls-style, where they live, help each other and share caregivers. This is largely unregulated and very much the Wild, Wild West of senior care.

What the experts have wrong. Really wrong

The most significant thing housing analysts have wrong is that boomers will want, or can afford, to retire.

Many boomers have no desire to retire fully and take up less space. This is the first time in history that we have five generations collaborating in the workforce. The silent generation (think President Biden), boomers, and even Gen X admit they will work as long as possible because they like to work. Many are uncomfortable with their retirement savings and need the extra income.

Baby boomers aren’t totally ready to retire: 79 percent of workers between the ages of 57 and 75 want to go part-time instead, according to a new survey from Harris Poll and staffing agency Express Employment Professionals.

Also wrong? Assuming that the entire group will make a move. Many will modify their current home, and the wealthiest will opt to have multiple homes. This cohort will make moves but not like their parents.

- According to a Merill Lynch Age Wave report, 65 percent of older Americans are planning to stay at home, and they are very comfortable in their current home.

- Also, in the report, 49 percent of retirees have upsized into a larger home.

- Seniors want a completely different retirement and care experience than what they encountered caring for their own parents. They refuse to be “pigeonholed” into “tired” senior living communities of the past. They are looking to leverage their “freedom threshold” after age 61 figuring out how to maximize their life around living their “best life” and choosing where they want to live.

Estimated deaths? I think previous life expectancy data will change over the next decade. Boomers are outliving their parents, and thanks to modern medicine, many of them are living much longer than they planned.

Unfortunately, their quality of life will be challenging if they do not take measures to preserve mobility and if they have other pre-existing conditions such as obesity, diabetes, heart and pulmonary issues.

Horizons and headwinds: Accessibility is key

I’ve been working at a CCRC or continuing care community — a retirement community planning for all levels of long-term care — for over a year. I can confidently say that it has changed and challenged everything I thought I knew about seniors, housing and the future impact of this cohort of individuals on every aspect of our working economy.

My most popular housing offerings are floor plans between 1,700 to 2,000+ square feet. These homes are luxurious and maximize storage, and we aim to provide all the amenities seniors crave.

The needs and wants of this group are widespread. From maintenance to health care to entertainment, this generation employs so much of our workforce it is undeniable that we are transitioning into a society that will flex around the needs of seniors.

What agents need to understand about the future of homeownership in this country is that accessibility is the master key to offering the most value to your clients. This past fall, we tackled the central issue in our infrastructure, which is that the majority of homes are not built for individuals with disabilities.

Seniors fall into this category; thus, traditionally, the pathway is to move to a safer, more manageable home because the norm is a home that is not built for all seasons of life. However, none of this works if people cannot afford it or simply don’t want to go.

There has to be some level of cooperation. The Census Bureau reports that only 10 percent of homes are aging-ready with a step-free entryway, a bedroom and a full bathroom on the first floor, and at least one bathroom with accessible features.

Being knowledgeable about care, housing options, and age-in-place renovations and connecting with professionals who know storage, auctions and specialty services will be your way of connecting with seniors.

We have an ethical responsibility to help seniors choose homes with the features they will need to age in place and improve their quality of life. —Rachael Hite

Agents also need to acknowledge that the younger part of this cohort loves technology, and they will be seeking knowledgeable agents who can help them use technology and connect all their devices smoothly in their new moves.

Boomers drive electric cars; they need charging stations in garage spaces for recreational vehicles, high-speed internet, and top-of-the-line smart appliances. They associate technology with modern living. They want cutting-edge experiences. They are not afraid of new experiences, and they always want high-quality customer service.

Finally, agents who recognize the lifestyle wants of this group will come out on top. They want to travel; they want pickleball. They want theater, music, adventure and all their doctors close by. They want health and fitness offerings, golf, tennis, clubs and social experiences.

They do not want to sit in a rocking chair, and they may be insulted if you suggest that to them.

The “Silver Tsunami” is here, but it’s not just affecting housing; it’s rippling through all areas of our economy and personal lives. Instead of bracing for the impact, we need to be building a boat, a big one that can withstand these headwinds and push us into the new horizons ahead.

Rachael Hite is a former agent, a business development specialist, fair housing advocate, copy editor and is currently perfecting her long game selling homes in a retirement community in Northern Virginia. You can connect with her about life, marketing and business on Instagram.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.inman.com/2024/01/19/what-experts-have-right-and-wrong-about-the-silver-tsunami/

- :has

- :is

- :not

- :where

- $UP

- 1

- 12

- 125

- 13

- 15%

- 20

- 2020

- 2021

- 2023

- 30

- 50

- 51

- 65

- 7

- 700

- 75

- 8

- 90

- a

- About

- accessibility

- accessible

- accommodate

- According

- acknowledge

- actual

- adding

- administration

- admit

- adults

- Adventure

- advisory

- advocate

- affected

- affecting

- affordable

- affordable housing

- afraid

- After

- again

- age

- agency

- Agent

- agents

- Ages

- ahead

- aim

- All

- also

- alternative

- always

- amenities

- america

- Americans

- among

- among us

- an

- analyst

- Analysts

- and

- annual

- answers

- any

- anyone

- appliances

- appreciation

- ARE

- areas

- around

- AS

- aspect

- Associate

- At

- attendees

- Auctions

- average

- avoiding

- awards

- barriers

- BE

- because

- become

- becoming

- been

- before

- behavior

- being

- believes

- benefit

- between

- biden

- Big

- boat

- bring

- brokers

- Building

- built

- Bullish

- Bureau

- business

- business development

- but

- buyers

- by

- CAN

- cannot

- care

- cars

- Cash

- Category

- Celebration

- Census

- Census Bureau

- central

- ceo

- certain

- Chair

- challenged

- challenging

- change

- changed

- charging

- charging stations

- Choose

- choosing

- cited

- clients

- Close

- clubs

- code

- Cohort

- collaborating

- come

- comfortable

- coming

- comments

- Communities

- community

- company

- competing

- complete

- completely

- complicated

- concerned

- conditions

- conducted

- confidently

- Connect

- Connecting

- continuing

- conversions

- converted

- cooperation

- Cost

- Costs

- could

- count

- countries

- country

- coveted

- crave

- create

- Culture

- Current

- Currently

- customer

- Customer Service

- cutting-edge

- data

- deaths

- decade

- Demand

- desire

- Development

- Devices

- Diabetes

- different

- discussed

- discussing

- do

- Doctors

- Doesn’t

- Dollar

- Dont

- down

- downsizing

- drive

- dynamic

- each

- easily

- easy

- economy

- editor

- educate

- either

- Electric

- electric cars

- employment

- employs

- end

- Entire

- essentially

- Ether (ETH)

- ethical

- Even

- Every

- everything

- expectations

- expected

- expenses

- expensive

- experience

- Experiences

- experts

- express

- extra

- fair

- Fall

- family

- family members

- Features

- feel

- Fees

- Feet

- fifth

- finance

- financial

- First

- first time

- fitness

- Floor

- following

- For

- Former

- found

- founder

- Founder and CEO

- freedoms

- from

- FT

- full

- fully

- further

- future

- game

- garage

- Gen

- Gen Z

- generation

- generations

- getting

- Go

- going

- golf

- groceries

- Group

- happen

- Have

- headwinds

- Health

- Health Care

- Heart

- heavy

- help

- her

- here

- High

- high-quality

- higher

- highest

- history

- Hit

- Hobbies

- hold

- Home

- Homes

- Horizons

- hour

- House

- housing

- How

- How To

- However

- HTML

- HTTPS

- i

- if

- Impact

- importantly

- improve

- in

- Income

- increasing

- independence

- individuals

- industry

- influx

- Infrastructure

- innovators

- instead

- insurance

- Internet

- into

- inventory

- Invest

- issue

- issues

- IT

- items

- January

- just

- Keep

- Key

- kids

- Know

- large

- largely

- larger

- least

- less

- Level

- levels

- Leverage

- Life

- lifestyle

- like

- live

- Lives

- living

- lockdowns

- Long

- Long Game

- long-term

- longer

- looking

- loved

- luxurious

- Luxury

- lynch

- maintenance

- Majority

- make

- MAKES

- many

- Market

- Marketing

- massive

- massive influx

- master

- materials

- Maximize

- May..

- maybe

- mean

- means

- measures

- medicine

- Members

- Men

- might

- millenials

- Millennials

- million

- MLS

- mobility

- Modern

- modify

- monthly

- more

- most

- Most Popular

- move

- moves

- much

- multiple

- Music

- National

- Need

- needs

- New

- new horizons

- New York

- newer

- next

- NIH

- no

- None

- November

- now

- Nursing

- Obesity

- obtain

- of

- offering

- Offerings

- often

- Old

- older

- on

- once

- ONE

- ones

- only

- Options

- or

- Other

- our

- out

- over

- own

- owns

- pandemic

- parents

- part

- past

- pathway

- Pay

- paying

- People

- per

- percent

- perfecting

- personal

- Place

- planned

- planning

- plans

- plato

- Plato Data Intelligence

- PlatoData

- player

- plus

- poised

- poll

- Popular

- population

- populations

- possible

- power

- predicted

- predicting

- president

- president biden

- previous

- private

- prized

- professionals

- Program

- proportion

- protocol

- provide

- provides

- Push

- Pushing

- quality

- quietly

- reach

- Read

- ready

- Reality

- really

- receive

- recognize

- Recreational

- reducing

- rely

- report

- Reported

- Reports

- reserved

- residential

- responsibility

- retirees

- retirement

- right

- rippling

- Rise

- Risen

- Rolling

- s

- sacrifice

- safer

- Said

- Savings

- say

- Scale

- seasons

- security

- see

- seeing

- seeking

- seen

- Selling

- senior

- seniors

- sense

- service

- Services

- set

- several

- Share

- she

- shift

- significant

- Silver

- simply

- sit

- Sitting

- skilled

- sliding

- slow

- small

- smaller

- smart

- smoothly

- So

- Social

- Society

- solution

- Solutions

- some

- Soon

- Space

- spaces

- special

- specialist

- Specialty

- square

- staffing

- start

- State

- stating

- Stations

- stay

- Still

- Stop

- storage

- Story

- strongly

- studied

- Study

- Successfully

- such

- suggest

- surprise

- Take

- Talk

- talking

- tasks

- Technology

- tell

- tells

- tennis

- than

- thanks

- that

- The

- The Future

- the world

- Theater

- their

- Them

- then

- These

- they

- thing

- think

- Thinking

- Thinks

- this

- thought

- Through

- Thus

- time

- to

- told

- top

- TOTALLY

- traditional

- traditionally

- transitioning

- translate

- travel

- Trend

- Tsunami

- types

- u.s.

- Ultimately

- undeniable

- understand

- units

- us

- use

- utilize

- value

- Vehicles

- very

- virginia

- Waiting

- want

- wants

- was

- Wave

- Way..

- we

- Wealth

- week

- WELL

- well-known

- were

- West

- What

- when

- whether

- which

- WHO

- widespread

- Wild

- wild west

- will

- willing

- window

- with

- Women

- Work

- workers

- Workforce

- working

- works

- world

- worried

- worth

- Wrong

- X

- Yahoo

- year

- years

- york

- you

- Younger

- Your

- yourself

- zephyrnet

- Zip