Vietnam’s startup sector has grown tremendously over the past years, driven by increased venture capital (VC) activity, favorable government policies and a youthful and motivated community of entrepreneurs looking to bring the domestic startup sector to the next level.

But despite an ecosystem that might be perceived as conducive, local startups are facing a number of challenges that are hampering their growth, including human resources challenges with a limited local talent pool, as well as a regulatory framework that’s lagging behind innovation, a new report by Dezan Shira & Associates, a pan-Asia professional services firm, says.

The report, which looks at the evolution of Vietnam’s startup industry, the drivers of investment as well as the hurdles faced by tech startups in the market, notes that Vietnam currently lacks a strong policy and regulatory structure that actively promotes innovation.

Even in large and high-priority sectors such as fintech, the government has so far remained very cautious and introduced little to no industry-specific regulation.

Instead, fintech regulation is largely covered by existing laws, the report says, mentioning as an example Decree 101/2012/ND-CP, which covers non-cash payments provided by both traditional banks and payment services providers.

Another example is consumer lending, which is currently regulated by several laws and circulars that require both commercial banks and Vietnam-based finance companies to obtain the proper operating licenses and registration certificates, and which mandate a total loan limit of VND 100 million (except for car loans with security) on providers.

The report notes, however, that the government is currently working on the establishment of a fintech sandbox regime that would allow credit organizations and financial institutions to develop new technologies and test these solutions. For regulators, the framework will allow them to better assess the risks and benefits of new fintech solutions, and formulate appropriate rulings.

While a draft decree has been circulated, the report says that it may still be some time before the sandbox regime is approved and becomes operational.

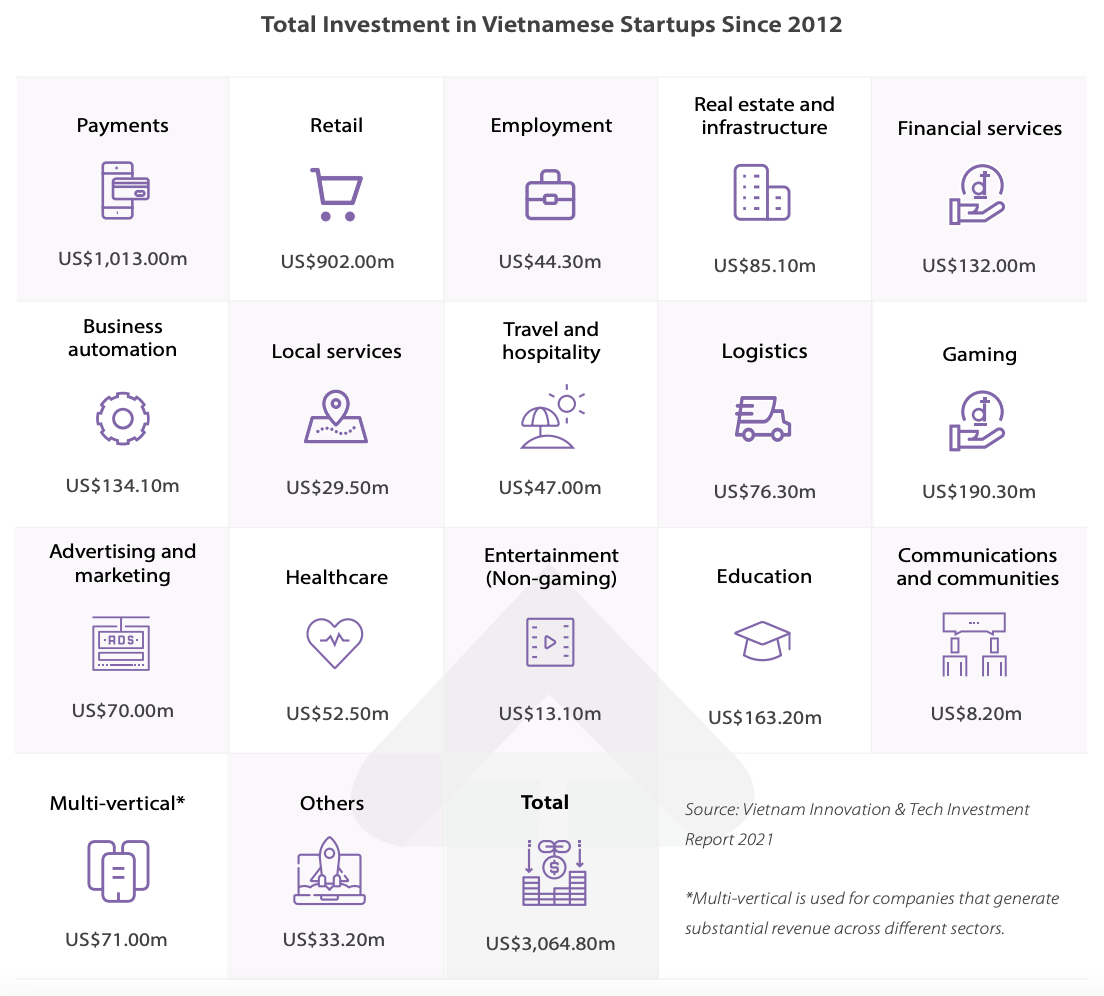

Fintech is the largest startup vertical in Vietnam, having attracted more than US$1 billion worth of investment between 2013 and 2021, the report says. The sector counts more than 150 companies, according to Nguyen Dang Hung, head of the Fintech Club Vietnam under the Vietnam Banks Association, among which fintech unicorns VNLife, a paytech company, and M_Service, the operator of Vietnam’s largest mobile wallet MoMo.

Tech talent shortage

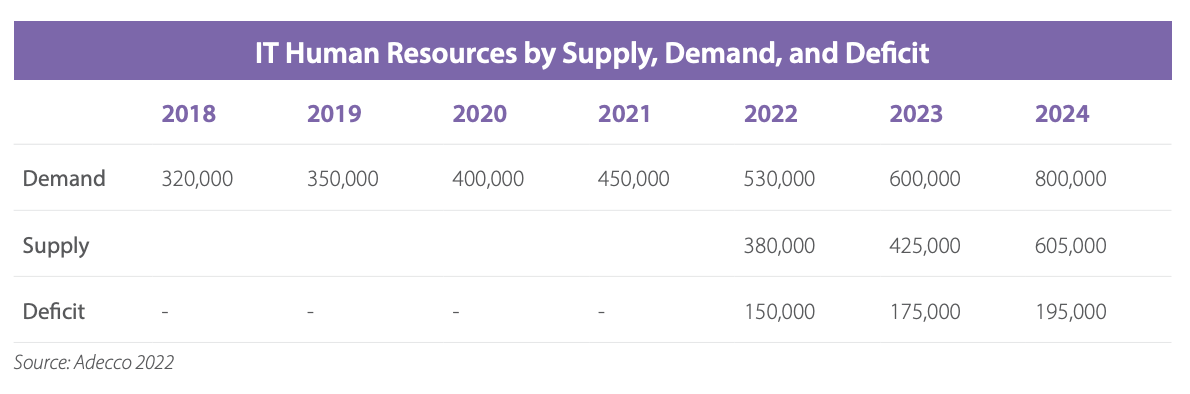

Another hurdle Vietnamese tech startups are facing is talent shortage. The report cites a 2022 analysis by human resources provider and temporary staffing firm Adecco, which estimates that Vietnam’s IT sector was short of around 150,000 workers last year. It projects the figure to grow to around 175,000 by 2023.

IT human resources in Vietnam by supply, demand and deficit, Source: Investing in Vietnam’s Startup Sector, Dezan Shira and Associates, March 2023

One main reason for this imbalance is that most local talents are flighting overseas to access higher pay and better job opportunities, the report says. In addition, the rise of remote working is providing IT and IT-enabled service professionals based in Vietnam with the opportunity to work in the comfort of their home for organizations located overseas and earn foreign currencies, typically US dollars.

This puts pressure on domestic as they struggle to compete with better financed international organizations for the local talent pool, the report says.

Against this backdrop, many entrepreneurs are looking at foreign human resources.

Though Vietnam do not have any restrictions on recruiting overseas workers, the report notes that current regulations have shortcomings. For example, the current law limits foreign workers to work permits that last for a maximum of two years with no option for indefinite contracts. Additionally, Vietnam does not have a visa scheme for foreign startups to enter Vietnam. These schemes are often used by professionals to enter a particular market and as a stepping off point for a new business.

Vietnam is home to a fast-growing startup sector which today counts an estimated 3,400 ventures. These companies secured a total of US$3 billion in funding between 2012 and 2021, with payments and financial services (US$1.132 million) taking the lion’s share, followed by retail (US$902 million), gaming (US$190 million) and education (US$163 million).

Total investment in Vietnamese startups since 2012, Source: Investing in Vietnam’s Startup Sector, Dezan Shira and Associates, March 2023

The Vietnamese government, which has committed to creating a more conducive environment for fledgling businesses and startups, is reportedly working on easing some regulations.

Nguyen Duc Long, acting director of the country’s National Innovation Center (NIC), told Nikkei in an interview earlier this month that Vietnam will be revising Decree 38, which legally defines startups and venture capital (VC) and lets the government invest in startups.

Suggestions included raising the cap on investors in a VC fund, letting them invest in more industries, and allowing for more borrowing options.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://fintechnews.sg/72289/vietnam/startup-challenges-vietnam/

- :has

- :is

- :not

- 000

- 100

- 2012

- 2013

- 2021

- 2022

- 2023

- a

- access

- actively

- activity

- addition

- Additionally

- allow

- Allowing

- among

- an

- analysis

- and

- any

- appropriate

- approved

- ARE

- around

- AS

- Association

- At

- attracted

- backdrop

- Banks

- based

- BE

- becomes

- been

- before

- behind

- benefits

- Better

- between

- Biggest

- Billion

- Borrowing

- both

- bring

- business

- businesses

- by

- cap

- capital

- caps

- car

- cautious

- Center

- certificates

- challenges

- club

- comfort

- commercial

- community

- Companies

- company

- compete

- consumer

- contracts

- country’s

- covered

- covers

- Creating

- credit

- currencies

- Current

- Currently

- DEFICIT

- Defines

- Demand

- Despite

- develop

- Director

- do

- does

- dollars

- Domestic

- draft

- driven

- drivers

- Earlier

- earn

- easing

- ecosystem

- Education

- Enter

- entrepreneurs

- Environment

- establishment

- estimated

- estimates

- Ether (ETH)

- evolution

- example

- Except

- existing

- faced

- facing

- false

- far

- Figure

- finance

- financed

- financial

- Financial institutions

- financial services

- fintech

- fintech regulation

- Firm

- followed

- For

- foreign

- Framework

- friendly

- fund

- funding

- gaming

- Government

- Grow

- grown

- Growth

- Have

- having

- head

- higher

- Home

- However

- HTML

- http

- HTTPS

- human

- Human Resources

- Hurdles

- imbalance

- in

- included

- Including

- increased

- industries

- industry

- industry-specific

- Innovation

- institutions

- International

- Interview

- introduced

- Invest

- investing

- investment

- Investors

- IT

- IT sector

- Job

- Job Opportunities

- lagging

- large

- largely

- largest

- Last

- Last Year

- Law

- Laws

- lending

- Lets

- letting

- Level

- licenses

- LIMIT

- Limited

- limits

- little

- loan

- Loans

- local

- located

- Long

- looking

- Main

- mandate

- many

- March

- Market

- max-width

- maximum

- May..

- might

- million

- Mobile

- Mobile Wallet

- Month

- more

- most

- motivated

- National

- New

- New technologies

- next

- Nguyen

- no

- Notes

- number

- obtain

- of

- off

- often

- on

- operating

- operational

- operator

- opportunities

- Opportunity

- Option

- Options

- organizations

- over

- overseas

- particular

- past

- Pay

- payment

- Payment Services

- payments

- paytech

- perceived

- plato

- Plato Data Intelligence

- PlatoData

- Point

- policies

- policy

- pool

- pressure

- professional

- professionals

- projects

- promotes

- proper

- provided

- provider

- providers

- providing

- Puts

- raising

- reason

- recruiting

- regime

- Registration

- Regulation

- regulations

- Regulators

- regulatory

- remained

- remote

- remote working

- report

- require

- Resources

- restrictions

- retail

- return

- Rise

- risks

- s

- sandbox

- says

- scheme

- schemes

- sector

- Sectors

- Secured

- security

- service

- Services

- several

- Share

- Short

- shortage

- shortcomings

- since

- Singapore

- So

- so Far

- Solutions

- some

- Source

- staffing

- startup

- startup ecosystem

- Startups

- stepping

- Still

- strong

- structure

- Struggle

- such

- supply

- taking

- Talent

- talents

- tech

- tech startups

- Technologies

- temporary

- test

- than

- that

- The

- The Sandbox

- their

- Them

- These

- they

- this

- time

- to

- today

- Total

- traditional

- tremendously

- two

- typically

- under

- unicorns

- us

- US Dollars

- used

- VC

- vc fund

- venture

- venture capital

- venture capital (VC)

- Ventures

- vertical

- very

- Vietnam

- vietnamese

- visa

- Wallet

- was

- WELL

- What

- which

- will

- with

- Work

- workers

- working

- worth

- would

- year

- years

- youthful

- zephyrnet