UPCOMING EVENTS:

- Monday: PBoC LPR.

- Wednesday: NZ Retail Sales, AU/JP/EZ/GB/US PMIs, Canada Retail Sales.

- Thursday: US Jobless Claims.

- Friday: Fed Chair Powell speaks at the Jackson Hole Symposium (24-26 August).

Monday

The PBoC is expected to cut the LPR

rates by 15 bps as it did the last week with the MLF. The rate cuts follow

the promise of Chinese authorities to deliver more on the stimulus side to

propel its ailing economy. The markets didn’t react positively to rate cuts as

they probably want to see a stronger action.

PBoC

Wednesday

New Zealand Retails Sales Q/Q is expected

at -2.6% vs. -1.4% prior, while Core Retail Sales Q/Q is seen at -2.5% vs.

-1.1% prior. Unless we see huge surprises, this data point is likely to be

disregarded by the RBNZ as it made clear that they are comfortable with the

current level of interest rate, and they are “ready to work through noisy data

in the near term”.

New Zealand Retail Sales YoY

We will also see the Preliminary PMIs for

many advanced economies that are likely to lead the sentiment for the rest of

the day:

- Australia Manufacturing

PMI 49.6 expected vs. 49.6 prior. - Australia Services PMI

47.9 expected vs. 47.9 prior. - Japan Manufacturing PMI

49.5 expected vs. 49.6 prior. - Japan Services PMI no

forecast vs. 53.8 prior. - France Manufacturing PMI

45.2 expected vs. 45.1 prior. - France Services PMI 47.3 expected

vs. 47.1 prior. - Germany Manufacturing PMI

38.6 expected vs. 38.8 prior. - Germany Services PMI 51.5

expected vs. 52.3 prior. - Eurozone Manufacturing

PMI 42.4 expected vs. 42.7 prior. - Eurozone Services PMI 50.4 expected vs. 50.9 prior.

- UK Manufacturing PMI 45.0

expected vs. 45.3 prior. - UK Services PMI 50.8

expected vs. 51.5 prior. - US Manufacturing PMI 49.4

expected vs. 49.0 prior. - US Services PMI 52.3

expected vs. 52.3 prior.

PMI

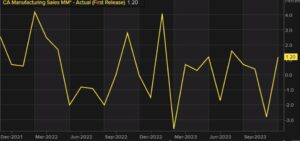

The Canadian Retail Sales M/M is expected

at 0.0% vs. 0.2% prior, while the Core Retail Sales M/M is seen at 0.3% vs.

0.0% prior. Although another BoC rate hike in September is seen as a close

call, the recent surge in wage growth and higher than expected core

inflation data might be enough for them to proceed with another hike.

Canada Retail Sales YoY

Thursday

Every Thursday is important because of one

key data point: the US Jobless Claims. The Fed and the Market are

particularly focused on the labour market data due to the fear that

continued tightness might lead to a wage price spiral (as it’s likely happening

in the UK) and it will be harder to bring inflation back to target sustainably.

Initial Claims are expected at 244K vs. 239K prior, while Continuing Claims are

seen at 1700K vs. 1716K.

US Initial Claims

Friday

Fed Chair Powell is scheduled to speak at

the Jackson Hole Symposium at 14:05 GMT. Given that the Fed will have

another month of key data points before the next meeting, it’s unlikely to see

Powell deviate from the recent comments and he should reaffirm once again their

data dependency and keep all the options on the table. Some say that Powell

is likely to be dovish because of the recent selloff in the stock and bond

markets, but he’s been trying for a year to see higher yields and lower equity

prices and now that the market might be finally doing the job for them, it

would be a bad strategy to say something.

Fed Chair Powell

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexlive.com/news/weekly-market-outlook-21-25-august-20230820/

- :is

- 1

- 14

- 15%

- 2%

- 26

- 49

- 50

- 51

- 52

- 53

- 7

- 8

- 9

- a

- Action

- advanced

- again

- All

- also

- Although

- and

- Another

- ARE

- AS

- At

- AUGUST

- Authorities

- back

- Bad

- BE

- because

- been

- before

- bond

- bring

- but

- by

- Canada

- Canada retail Sales

- Canadian

- Canadian Retail Sales

- Chair

- chinese

- claims

- clear

- Close

- comfortable

- comments

- continued

- continuing

- Core

- Current

- Cut

- cuts

- data

- data points

- day

- deliver

- Dependency

- DID

- doing

- Dovish

- due

- economies

- economy

- enough

- equity

- expected

- fear

- Fed

- Finally

- focused

- follow

- For

- Forecast

- from

- GMT

- Growth

- Happening

- harder

- Have

- he

- higher

- Hike

- Hole

- HTTPS

- huge

- important

- in

- inflation

- initial

- interest

- INTEREST RATE

- IT

- ITS

- Jackson

- jackson hole

- Jackson Hole Symposium

- Job

- jobless claims

- jpg

- Keep

- Key

- Labour

- Last

- lead

- Level

- likely

- lower

- LPR

- made

- manufacturing

- many

- Market

- market outlook

- Markets

- meeting

- might

- MLF

- Month

- more

- Near

- next

- no

- now

- of

- on

- once

- ONE

- Options

- Outlook

- particularly

- PBOC

- PBOC LPR

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- Point

- points

- Powell

- price

- Prices

- Prior

- probably

- proceed

- promise

- Propel

- Rate

- Rate Hike

- Rates

- RBNZ

- React

- recent

- REST

- retail

- Retail Sales

- sales

- say

- scheduled

- see

- seen

- SellOff

- sentiment

- September

- Services

- should

- side

- some

- something

- speak

- Speaks

- stimulus

- stock

- Strategy

- stronger

- surge

- surprises

- sustainably

- Symposium

- Target

- than

- that

- The

- the Fed

- the UK

- their

- Them

- they

- this

- Through

- thursday

- to

- Uk

- unlikely

- us

- US Jobless Claims

- vs

- wage

- want

- we

- week

- weekly

- while

- will

- with

- Work

- would

- year

- yields

- Zealand

- zephyrnet