McKinsey & Company Report | Oct 30, 2023

McKinsey & Company on the WealthTech Revolution in Asia-Pacific, A Trillion-Dollar Opportunity

- The Asia-Pacific wealth management market is brimming with potential, estimated to reach $81 trillion in onshore personal financial assets (PFA) by 2027, propelled by technological innovations and shifts in customer behavior.

- This translates to a staggering $1 trillion in revenue pools across the wealth continuum.

- The affluent segment is highlighted for its growth potential, with a projected CAGR of 8% from 2022 to 2027, and a wealth management penetration rate expected to increase from 15-20% to 22-27% during the same period.

See: The future of Asia: Asian flows and networks are defining the next phase of globalization

- The WealthTech sector is rapidly gaining traction with 40-45% of PFA in the region held in cash and deposits.

- Broadening access to wealth management services, especially for the untapped and underserved segments.

- The industry is moving towards providing “advice for all,” enabling a wider range of customers to benefit from financial advice and investment opportunities.

- The future of wealth management in the region is expected to be dominated by digital-hybrid platforms, providing flexible and on-demand advisory services, driving a shift away from the traditional high-touch, relationship manager models.

- The report highlights the need for personalization at scale and emphasizes the importance of investor education to empower individuals to make informed financial decisions.

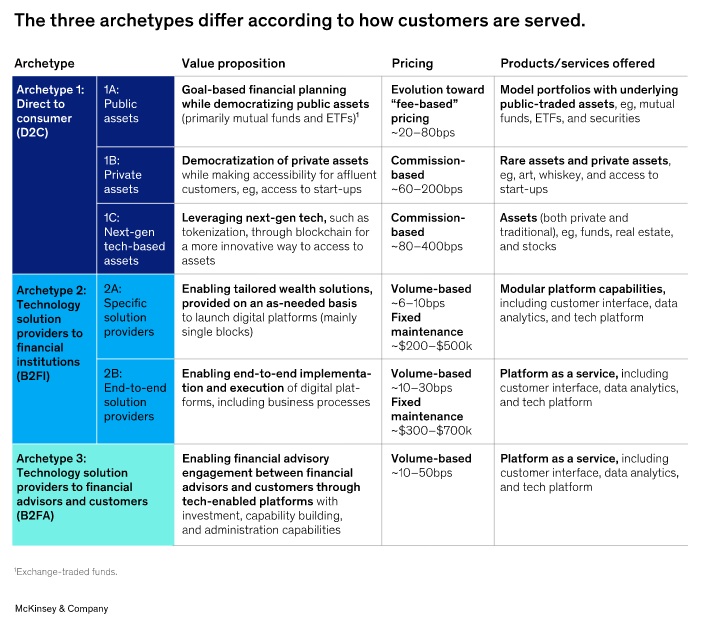

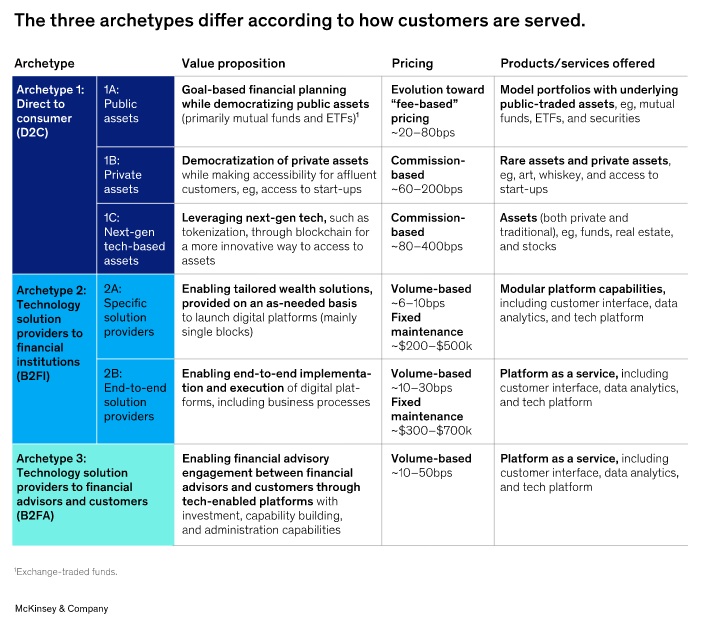

3 Primary Ways To Serve Customers

1. User-Friendly WealthTech Platforms (Direct-to-Consumer)

These digital platforms are easy to use and offer a variety of assets for trading, both public and private. Customers can get financial advice through online channels, either completely digital or a mix of online and in-person services. This type of WealthTech makes financial advice accessible to a wider range of customers, from everyday people to the wealthy, and provides more online interaction options for high-net-worth individuals.

- Wealthsimple: Based in Toronto, Wealthsimple is a popular digital investment platform that offers a variety of financial products and services, including robo-advisory, commission-free trading, and savings accounts. The platform is designed to be user-friendly, catering to both novice and experienced investors.

See: McKinsey Global Payments On Cusp of ‘Decoupled Era’

2. Tech Solutions for Financial Firms (Business-to-Financial Institutions)

These WealthTech companies provide technology solutions to help financial firms or other WealthTechs improve their online wealth management services. They might specialize in certain parts of the service, like sales or portfolio management, or offer complete solutions to upgrade a firm’s entire digital wealth management system, making it more functional and integrated.

- PureFacts Financial Solutions: Located in Toronto, PureFacts provides wealth management solutions for financial advisors and institutions. Their services include fee billing, performance reporting, and client portals, aiming to enhance the digital capabilities of wealth management firms.

3. Digital Tools for Financial Advisors (Business-to-Financial Advisors)

This group focuses on creating digital tools specifically for financial advisors, making their jobs more efficient and allowing them to spend more time helping customers. They also provide a platform for customers to track their investments online. Some leading platforms in this category are challenging the traditional commission-based model by offering their services to customers for free.

- Croesus: Based in Montreal, Croesus offers portfolio management and CRM solutions tailored for financial advisors. Their platform aims to streamline advisors’ workflows, enhance client engagement, and provide insightful analytics.

See: Tips on Establishing Your Small Business in the Asian Market

Steffen Pauls, chief executive office, Moonfare:

We also notice that the emerging, digitally native generation no longer looks for advice from classic intermediaries, but is taking advice from peer groups. People want better access to knowledge, not only the institutional type. Banks have to do something because they do not have sustainable business models.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/wealthtech-in-asia-pacific-a-trillion-dollar-opportunity/

- :is

- :not

- 150

- 2018

- 2022

- 30

- 7

- a

- access

- accessible

- Accounts

- across

- advice

- advisors

- advisory

- advisory services

- affiliates

- Aiming

- aims

- Allowing

- also

- alternative

- alternative finance

- analytics

- and

- ARE

- artificial

- artificial intelligence

- asia

- asia pacific

- asian

- Assets

- At

- away

- Banks

- based

- BE

- because

- become

- behavior

- benefit

- Better

- billing

- blockchain

- both

- brimming

- business

- but

- by

- cache

- CAGR

- CAN

- Can Get

- Canada

- capabilities

- Cash

- Category

- certain

- challenging

- chief

- Chief Executive

- classic

- client

- closely

- community

- Companies

- company

- complete

- completely

- Continuum

- create

- Creating

- CRM

- Crowdfunding

- cryptocurrency

- Cusp

- customer

- customer behavior

- Customers

- decentralized

- decisions

- defining

- deposits

- designed

- digital

- Digital Assets

- digital platforms

- digitally

- distributed

- do

- driving

- during

- easy

- ecosystem

- Education

- efficient

- either

- emerging

- emphasizes

- empower

- enabling

- engaged

- engagement

- enhance

- Entire

- especially

- establishing

- estimated

- Ether (ETH)

- everyday

- executive

- expected

- experienced

- fee

- finance

- financial

- financial advice

- financial innovation

- financial products

- fintech

- firms

- flexible

- Flows

- focuses

- For

- Free

- from

- functional

- funding

- funding opportunities

- future

- generation

- get

- Global

- Global Payments

- globalization

- Government

- Group

- Group’s

- Growth

- growth potential

- Have

- Held

- helping

- helps

- High

- Highlighted

- highlights

- http

- HTTPS

- importance

- in

- include

- Including

- Increase

- industry

- information

- informed

- Innovation

- innovations

- innovative

- insightful

- Institutional

- institutions

- Insurtech

- integrated

- Intelligence

- interaction

- intermediaries

- investment

- investment opportunities

- Investments

- Investors

- IT

- ITS

- Jan

- Jobs

- jpg

- knowledge

- leading

- like

- located

- longer

- LOOKS

- make

- MAKES

- Making

- management

- management system

- manager

- Market

- max-width

- McKinsey

- member

- Members

- might

- mix

- model

- models

- Montreal

- more

- more efficient

- moving

- native

- networking

- networks

- next

- no

- Notice..

- novice

- Oct

- of

- offer

- offering

- Offers

- Office

- on

- On-Demand

- online

- only

- opportunities

- Opportunity

- Options

- or

- Other

- Pacific

- partners

- parts

- payments

- peer

- peer to peer

- penetration

- People

- performance

- period

- perks

- personal

- personalization

- phase

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- please

- Popular

- portfolio

- portfolio management

- potential

- primary

- private

- Products

- Products and Services

- projected

- projects

- propelled

- provide

- provides

- providing

- public

- range

- rapidly

- Rate

- reach

- region

- Regtech

- relationship

- report

- Reporting

- revenue

- Revolution

- s

- sales

- same

- Savings

- sector

- Sectors

- serve

- service

- Services

- shift

- Shifts

- small

- small business

- Solutions

- some

- something

- specialize

- specifically

- spend

- staggering

- stakeholders

- Stewardship

- streamline

- sustainable

- system

- tailored

- taking

- tech

- technological

- Technology

- that

- The

- The Future

- their

- Them

- they

- this

- thousands

- Through

- time

- tips

- to

- today

- Tokens

- tools

- toronto

- towards

- track

- Trading

- traditional

- Trillion

- type

- underserved

- upgrade

- use

- user-friendly

- variety

- vibrant

- Visit

- want

- ways

- Wealth

- wealth management

- wealthtech

- wealthy

- wider

- with

- workflows

- works

- Your

- zephyrnet