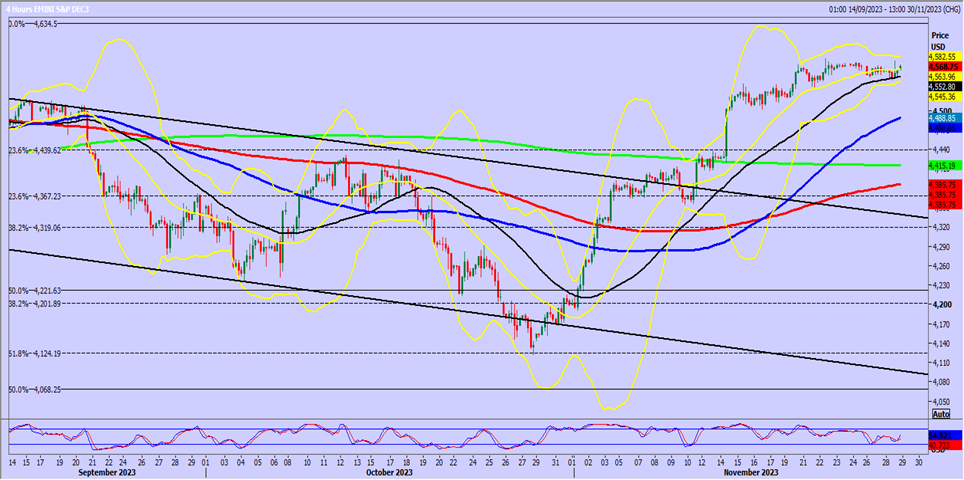

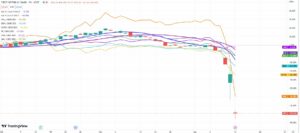

Emini S&P December futures still just drifting aimlessly after the long holiday weekend. We are still holding just above minor support at 4542/38 to keep bulls in control & perhaps on the next leg higher we can reach my next target of 4591/94, perhaps as far as 4615/19 eventually.

Strong support again at 4542/38. Longs need stops below 4533.

A break lower risks a slide to 4505/00 & even 4480/75 is possible.

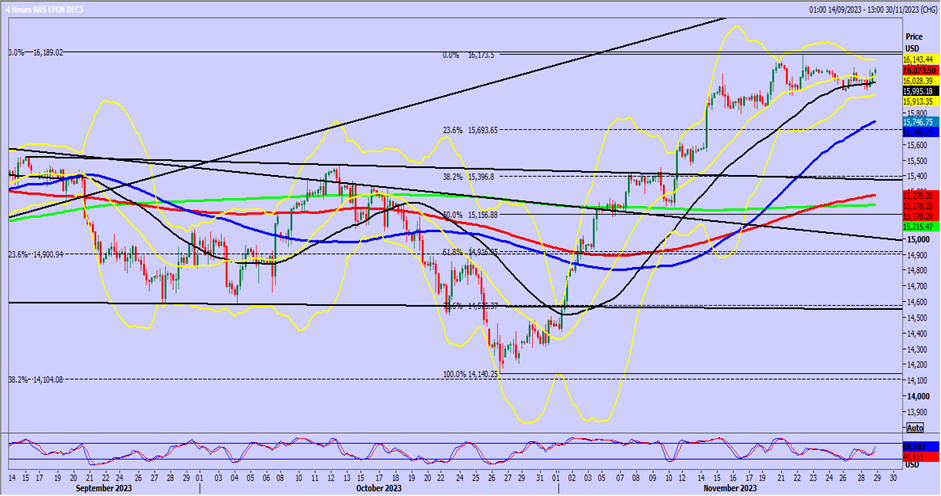

Nasdaq December futures edged higher to 16173 last week as we look for 16300 next target. Further gains can target 16390/410.

We have held a very tight range from around 15940/920 up to 16090/16120 for a week.

The best buying opportunity should be at 15850/830 & longs need stops below 15770. We should also have strong support at 15700/660.

Emini Dow Jones December continues higher through 35080/35100 to my next targets of 35170/190 & 35230 & now we are edging above 35400/450, so we look for 35570/590. Further gains this week can target 35650/670.

Support again at 35390/360. Longs need stops below 35250.

Global stock index and Dollar movement

-

Global stock indexes advanced on Tuesday.

-

The U.S. dollar fell to a 3-1/2 month low, marking its biggest monthly drop in a year.

-

Federal Reserve official signals that the central bank may consider rate cuts if inflation continues to ease.

Fed Governor Christopher Waller's comments

-

Waller suggested the possibility of lowering the Fed policy rate in the coming months if inflation continues to decrease.

-

He expressed increasing confidence that the current interest rate setting would be sufficient to lower inflation to the Fed's 2% target.

Fed Governor Michelle Bowman's remarks

Market Response and Rate Cut Expectations

-

Traders increased bets for the first rate cut, with March being a possibility.

-

Probability for a 25 basis-point cut rose to nearly 33% from 21.5% on Monday, according to CME Group's Fedwatch tool.

-

Majority expected a cut, at least one notch, in May.

Wall Street indexes performance

-

Wall Street indexes closed higher.

-

Dow Jones rose 0.24%, S&P 500 gained 0.10%, and Nasdaq Composite added 0.29%.

US consumer confidence survey

-

A survey showed U.S. consumer confidence rose in November after three months of declines.

-

However, households still anticipated a recession over the next year.

Upcoming economic data

-

The spotlight will be on the U.S. October personal consumption expenditures report (PCE), including core PCE (Fed's preferred inflation measure).

-

Euro zone consumer inflation figures are expected to provide clarity on price and monetary policy directions.

US treasury yields and Dollar Index

-

After the Fed commentary, U.S. Treasury yields dipped, with benchmark 10-year notes down 6 basis points.

-

Dollar index fell 0.368%, with the euro up 0.32% to $1.0988.

Currency movements

-

Japanese yen strengthened 0.82% against the greenback.

-

Sterling was last trading at $1.2694, up 0.55% on the day.

Gold prices

Oil prices

-

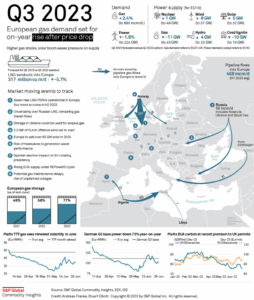

Oil prices settled higher on the possibility of OPEC+ extending or deepening supply cuts, a storm-related drop in Kazakh oil output, and the weaker U.S. dollar.

-

U.S. crude settled up 2.07% at $76.41 per barrel, and Brent settled at $81.68, up 2.13% on the day.

Australian and New Zealand Dollars

-

Australian dollar held near a four-month peak.

-

New Zealand dollar scaled a roughly four-month top of $0.61495.

-

Australian inflation data and a rate decision from the Reserve Bank of New Zealand are awaited.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fxstreet.com/news/wall-street-indexes-closed-higher-dow-jones-rose-024-sp-500-gained-010-202311290712

- :is

- ][p

- $UP

- 1

- 2%

- 25

- 41

- 500

- a

- above

- According

- added

- advanced

- After

- again

- against

- also

- and

- Anticipated

- ARE

- around

- AS

- At

- awaited

- Bank

- basis

- BE

- being

- below

- Benchmark

- BEST

- Bets

- Biggest

- Break

- brent

- Bulls

- Buying

- CAN

- central

- Central Bank

- Chart

- clarity

- closed

- CME

- CME Group

- coming

- Commentary

- confidence

- Consider

- consumer

- consumption

- continues

- control

- Core

- crude

- Current

- Cut

- cuts

- data

- day

- December

- decision

- Declines

- decrease

- directions

- Dollar

- dow

- Dow Jones

- down

- Drop

- ease

- Economic

- Ether (ETH)

- Euro

- Even

- eventually

- expected

- expressed

- extending

- far

- Fed

- Figures

- First

- For

- from

- further

- Futures

- gained

- Gains

- Governor

- Greenback

- Group

- Have

- Held

- higher

- holding

- Holiday

- households

- HTTPS

- if

- in

- Including

- increased

- increasing

- index

- indexes

- inflation

- inflation figures

- interest

- INTEREST RATE

- ITS

- jones

- just

- kazakh

- Keep

- Last

- least

- Long

- Look

- Low

- lower

- lowering

- March

- marking

- May..

- measure

- michelle

- minor

- Monday

- Monetary

- Monetary Policy

- Month

- monthly

- months

- my

- Nasdaq

- Near

- nearly

- Need

- New

- New Zealand

- next

- Notes

- November

- now

- october

- of

- official

- Oil

- on

- ONE

- Opportunity

- or

- output

- over

- pce

- Peak

- per

- perhaps

- personal

- plato

- Plato Data Intelligence

- PlatoData

- points

- policy

- possibility

- possible

- preferred

- price

- Prices

- provide

- range

- Rate

- reach

- recession

- report

- Reserve

- reserve bank

- Reserve Bank of New Zealand

- risks

- ROSE

- roughly

- s

- S&P

- S&P 500

- setting

- Settled

- should

- showed

- signals

- Slide

- So

- Spotlight

- Still

- stock

- stock indexes

- Stops

- street

- strengthened

- strong

- sufficient

- supply

- support

- Survey

- Target

- targets

- that

- The

- the Fed

- this

- this week

- three

- Through

- to

- tool

- top

- Trading

- treasury

- Treasury yields

- Tuesday

- u.s.

- u.s. dollar

- U.S. Treasury

- very

- Wall

- Wall Street

- was

- we

- week

- weekend

- will

- with

- would

- year

- Yen

- yields

- Zealand

- zephyrnet