Utkarsh Small Finance Bank IPO has opened today for subscription and analysts are out with their coverage report on the Varanasi-based banking player. The company aims to raise INR 500 crores through a fresh issue of shares. Priced at INR 23 – 25 per share, the IPO will remain active through 14 July 2023. Utkarsh SFB IPO ratings are mostly positive and analysts have highlighted multiple positive factors including strong operating performance, better cost-efficiencies and deep understanding of microfinance market.

Utkarsh SFB IPO Ratings: Brokers Upbeat About Prospects

“Utkarsh, at the Upper / Lower price band of Rs 25/ Rs 23 is valued at 1.1x/1.0x of its FY23 book on post-issue capital. While compared with its close peers on similar valuation parameters, the Bank is fairly priced. We recommend investors to subscribe the IPO for listing at CUT-OFF price,” said analysts at SBI Securities.

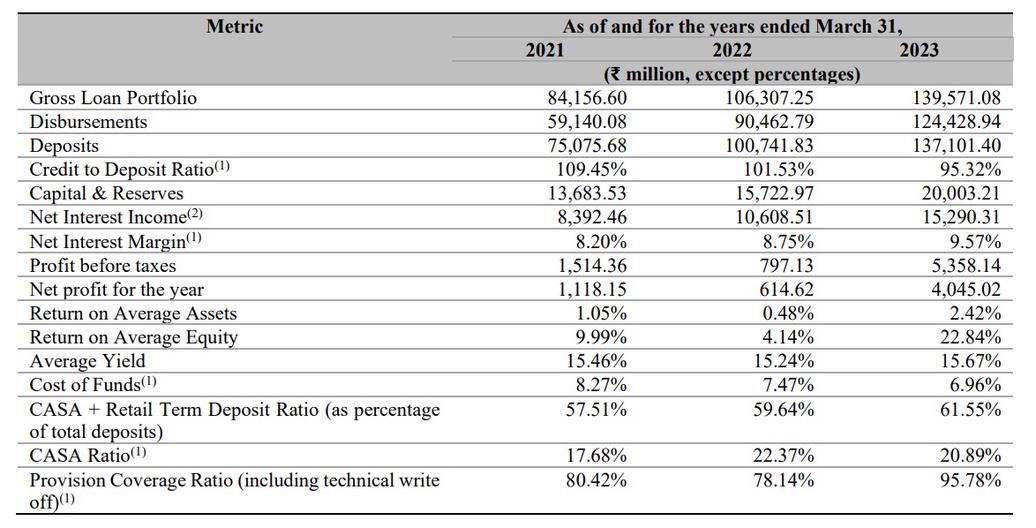

A strong vote of confidence came from BP Wealth which cited the bank’s asset quality and robust performance as primary reasons behind a subscribe rating. “It has the best cost-to-income ratio of 54.15% in FY23 which is the highest amongst other SFBs. Utkarsh SFB’s average management experience is also at par with the industry average. In FY23, Utkarsh SFB posted the second-highest RoE of 22.64% and RoA of 2.37%. On the basis of strong asset quality, consistent financial performance and the future growth story of the Indian economy, we recommend a “SUBSCRIBE” rating for the long term. On the upper end of the price band, the issue is valued at a Price to Book Value of 1.1x (as of FY23), which we believe is to be fairly priced,” opined the brokerage house’s research team in Utkarsh SFB IPO Review.

Between FY 2019 and FY 2023, the bank achieved the third-highest growth rate in Gross Loan Portfolio among SFBs with a portfolio exceeding INR 6,000 crore.

Analysts at Geojit added to positive Utkarsh SFB IPO Ratings while stating that the bank’s loan portfolio is expected to grow strong at around 22% over FY 2023 – 2025. “At the upper price band of Rs.25, USFBL is available at a P/Bv of 1.4x FY23, which appears reasonably priced compared to peers. Considering its resilient performance post COVID, consistent growth in loan book and deposits, healthy return ratios, best cost to income ratio, pan India presence and promising industry outlook, we assign a “Subscribe” rating on a short to medium term basis,” recommended its IPO note.

The bank has a deep understanding of microfinance segment and is accordingly expanding deposits base with focus on retail deposits. The bank has opened more than 270 branches during last two financial years, FY22-FY23 and out of its 830 banking outlets, 522 are located in rural and semi-urban areas.

Anand Rathi also has a positive view on the bank’s prospects. “The bank’s ability to provide their products and services in a cost-efficient manner is among their core strengths and their cost-to-income ratio was the lowest among SFBs with Gross Loan Portfolio of more than ₹ 60 billion. At the upper price band company is valuing at P/B of 1.39x with a market cap of ₹ 27,400 million post issue of equity shares and return on net worth of 20.22%. We believe that company is fairly priced and recommend a “Subscribe- Long term” rating to the IPO,” said Kuber Chauhan in his Utkarsh SFB IPO Recommendation.

The above recommendations are just a sample of pretty unanimous view in Utkarsh SFB IPO Ratings. The only weak review came from SMC Global Securities which accorded a ‘2/5’ rating to the IPO.

Nevertheless, it is quite clear that most brokerage houses have sounded positive notes in Utkarsh SFB IPO Ratings. According to the data collected by IPO Central from the grey market, the offer is not only actively traded but is also commanding a healthy premium indicating to a positive listing.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://ipocentral.in/utkarsh-sfb-ipo-ratings-brokers-upbeat-prospects/

- :has

- :is

- :not

- 000

- 0x

- 1

- 14

- 15%

- 20

- 2019

- 2023

- 2025

- 22

- 23

- 25

- 27

- 500

- 60

- a

- ability

- About

- above

- According

- accordingly

- achieved

- active

- actively

- added

- aims

- also

- among

- amongst

- Analysts

- and

- ARE

- areas

- around

- AS

- asset

- At

- available

- average

- BAND

- Bank

- Banking

- base

- basis

- BE

- behind

- believe

- BEST

- Better

- Billion

- book

- branches

- brokerage

- brokers

- but

- by

- came

- cap

- capital

- central

- cited

- clear

- Close

- company

- compared

- confidence

- considering

- consistent

- Core

- Cost

- coverage

- Covid

- data

- deep

- deposits

- during

- eager

- economy

- end

- equity

- expanding

- expected

- experience

- factors

- fairly

- finance

- financial

- financial performance

- Focus

- For

- fresh

- from

- future

- future growth

- Global

- gross

- Grow

- Growth

- Have

- healthy

- High

- highest

- Highlighted

- his

- houses

- HTTPS

- in

- Including

- Income

- india

- Indian

- indicating

- industry

- Investors

- IPO

- issue

- IT

- ITS

- jpg

- July

- just

- Key

- Last

- listing

- loan

- located

- Long

- lower

- lowest

- management

- manner

- Market

- Market Cap

- medium

- Microfinance

- million

- more

- most

- mostly

- multiple

- net

- Notes

- of

- offer

- on

- only

- opened

- operating

- Other

- out

- Outlets

- Outlook

- over

- PAN

- parameters

- per

- performance

- plato

- Plato Data Intelligence

- PlatoData

- player

- portfolio

- positive

- Post

- posted

- Premium

- presence

- pretty

- price

- primary

- Products

- Products and Services

- promising

- prospects

- provide

- quality

- raise

- Rate

- rating

- ratings

- ratio

- reasons

- recommend

- Recommendation

- recommendations

- recommended

- remain

- report

- research

- resilient

- retail

- return

- review

- robust

- Rural

- Said

- Securities

- segment

- Services

- Share

- Shares

- Short

- similar

- sizes

- small

- sounded

- stating

- Story

- strengths

- strong

- subscribe

- subscription

- team

- term

- than

- that

- The

- The Future

- their

- Through

- to

- today

- traded

- two

- understanding

- Valuation

- value

- valued

- valuing

- View

- Vote

- Vote of confidence

- was

- we

- which

- while

- will

- with

- worth

- years

- zephyrnet