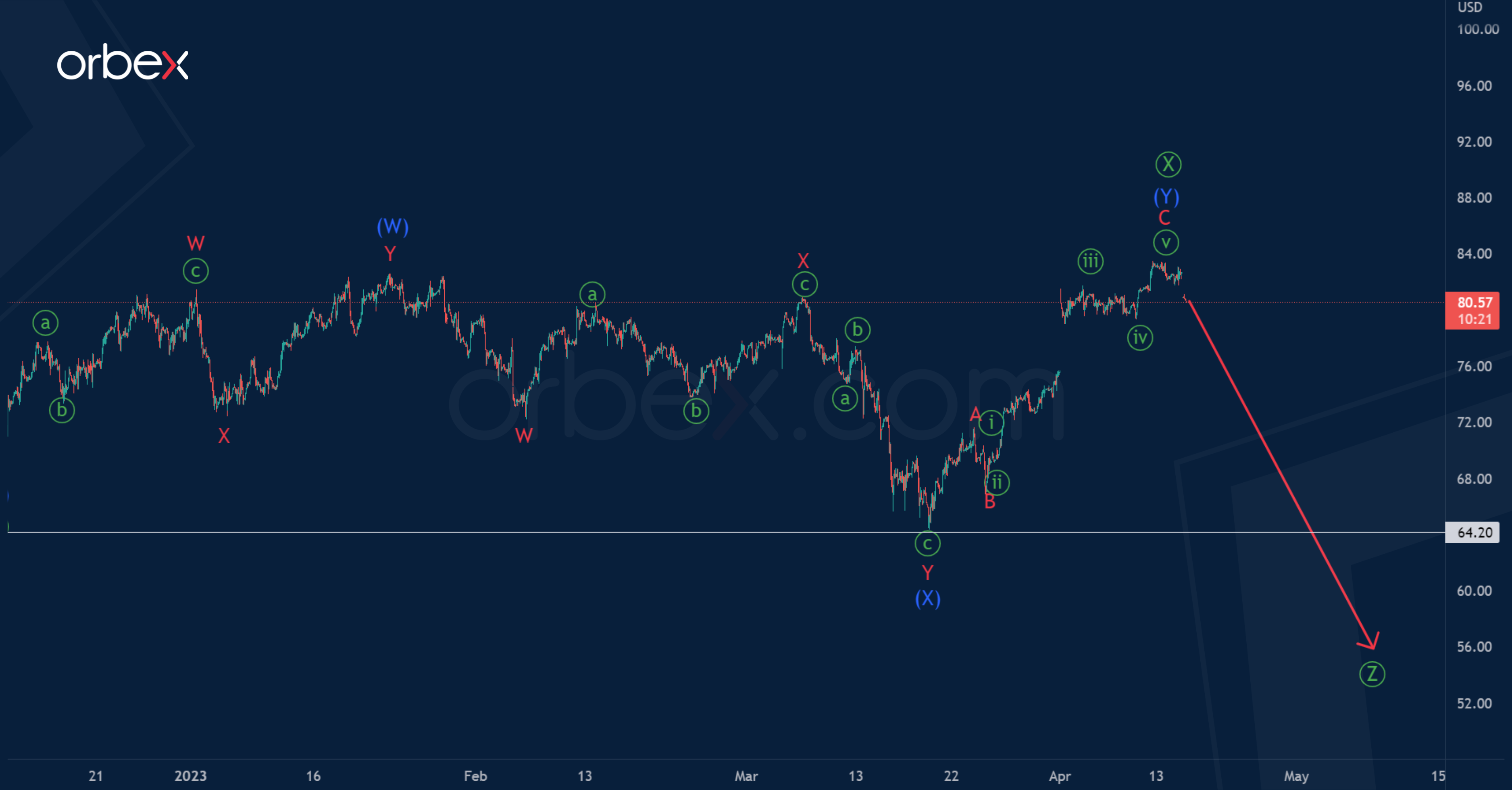

There is a high probability that a long-term corrective trend has ended for USOIL. This trend took the form of a primary triple zigzag consisting of sub-waves Ⓦ-Ⓧ-Ⓨ-Ⓧ-Ⓩ.

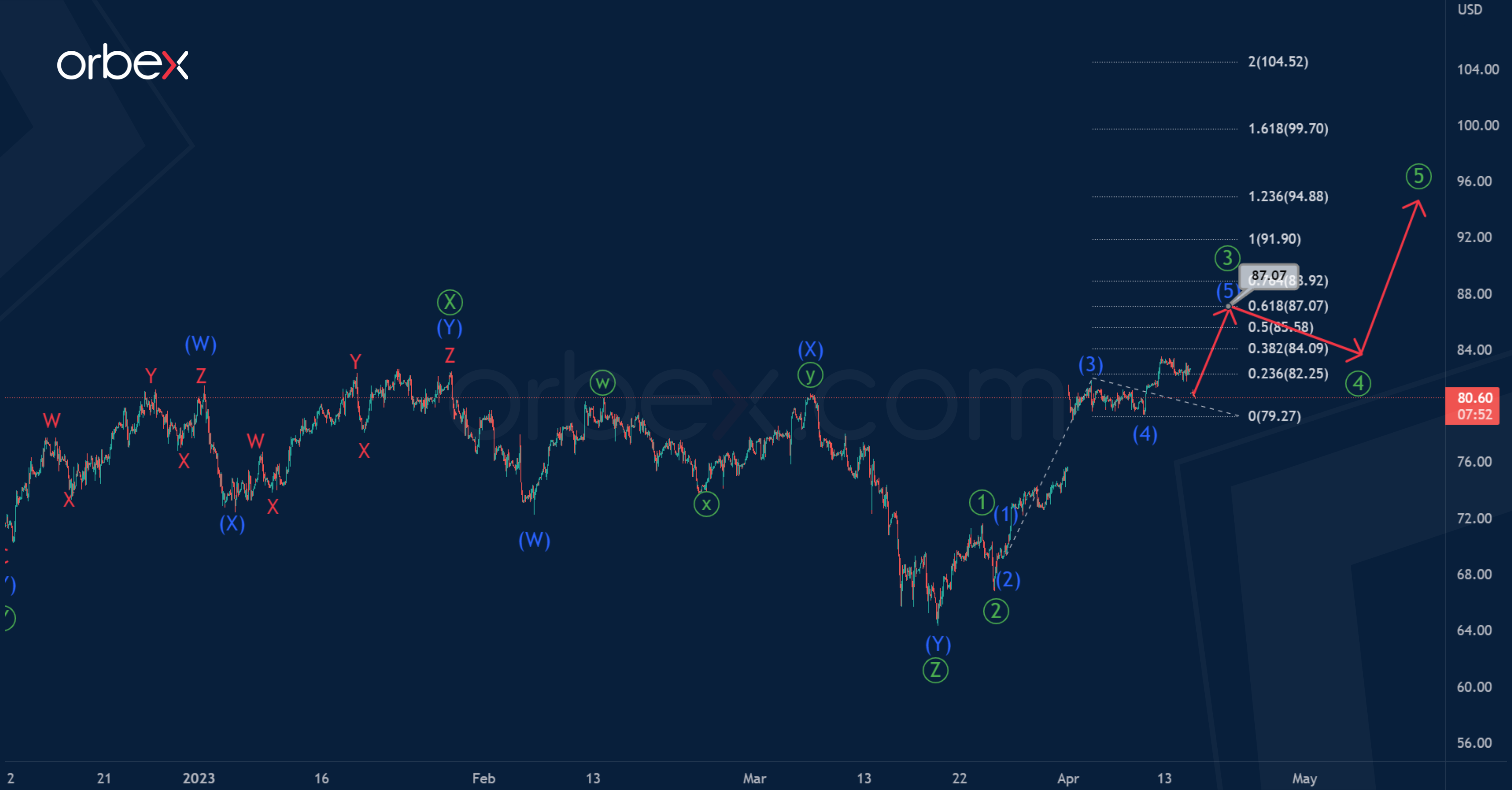

In the last section of the chart, we can see a market reversal and the beginning of a new bullish trend. Perhaps there is a construction of the primary impulse wave ①-②-③-④-⑤.

The end of the third sub-wave ③ will likely reach the price level of 87.07. This is where the intermediate sub-wave (5), which is currently being built, will be at 61.8% of impulse (3).

Alternatively, a continuation of the bearish trend is possible. Only the second intervening wave Ⓧ could be completed, it has the form of a double three (W)-(X)-(Y).

The scenario will be confirmed if the bears take the initiative and lead the market down, building a final wave Ⓩ.

The first goal, as far as the bears can reach, is a minimum of 64.20. At that level the actionary intermediate wave (Y) was completed.

Test your strategy on how the USOIL will fare with Orbex

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://www.orbex.com/blog/en/2023/04/usoil-triple-zigzag-or-double-three

- :has

- :is

- a

- and

- AS

- At

- BE

- bearish

- Bears

- Beginning

- being

- Building

- built

- Bullish

- CAN

- Chart

- Completed

- CONFIRMED

- Consisting

- construction

- continuation

- could

- Currently

- double

- down

- Ether (ETH)

- final

- First

- For

- form

- goal

- High

- How

- HTTPS

- image

- Initiative

- Intermediate

- intervening

- IT

- Last

- lead

- Level

- likely

- live

- long-term

- Market

- max-width

- minimum

- New

- of

- on

- perhaps

- plato

- Plato Data Intelligence

- PlatoData

- possible

- price

- primary

- probability

- reach

- Reversal

- scenario

- Second

- Section

- Strategy

- Take

- that

- The

- The Initiative

- Third

- three

- Trend

- Triple

- URL

- W

- Wave

- which

- will

- with

- X

- Your

- zephyrnet