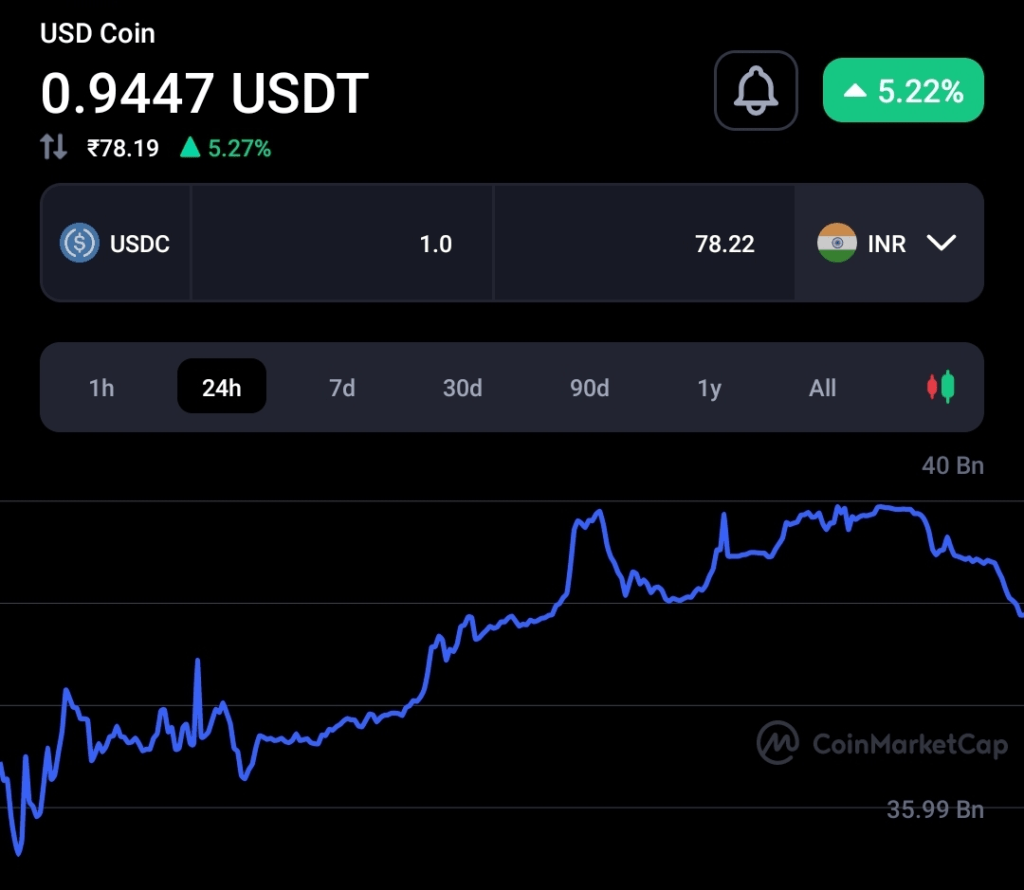

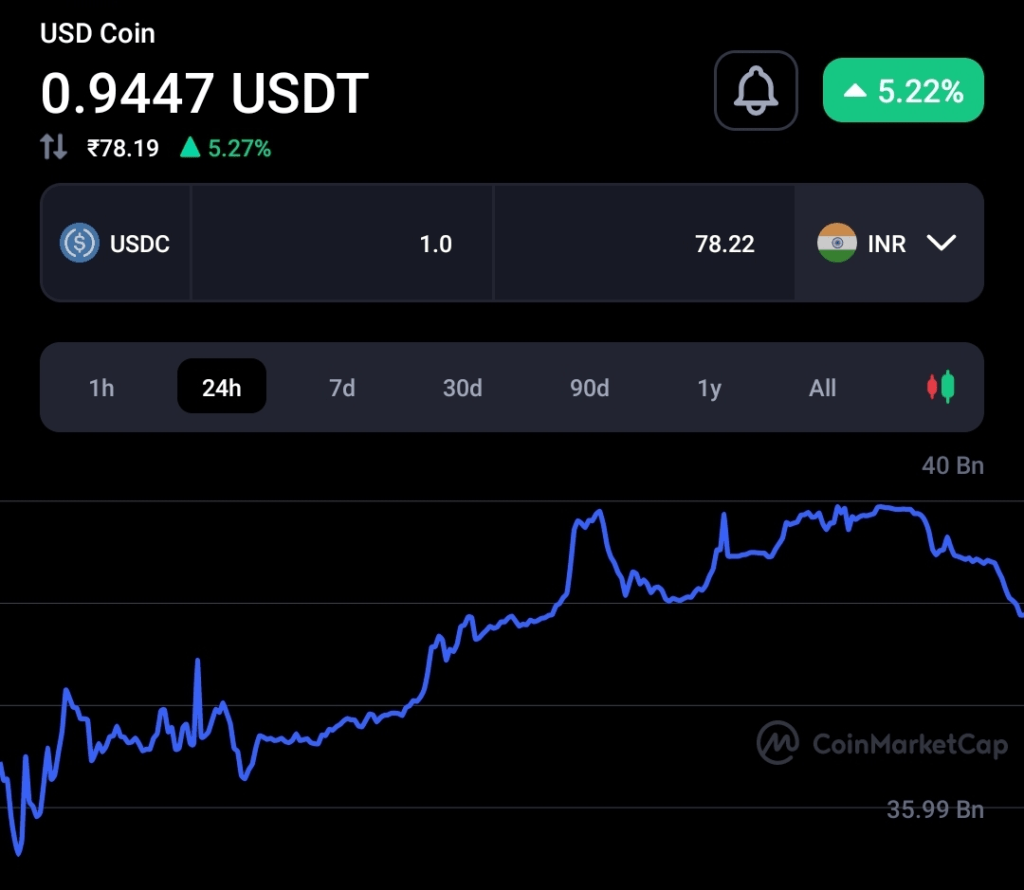

USDC stablecoin failed to reach a $1 pegged value amid the ongoing financial problem with the Silicon Valley Bank.

USDC is second ranked stablecoin in the crypto sector by 24-hour trade volume. Since May 2022, Crypto investors were trusting USDC stable with full blindness, as this stablecoin was standing strong during very high sell pressure. But in the present time, people are not able to get into trust with USDC stablecoin fully because it is trading below 5.49% over its actual pegged $1 value.

The current pegged value behind each 1 USDC is $0.9447 & this trade price is 5.49% down from the $1 value.

The sell pressure among the crypto Investors arose because of the exposure of USDC stablecoin company Circle in the Silicon Valley Bank (SVB), which is now a collapsed bank.

Initially, Circle confirmed that USDC & Circle will work smoothly without any problem and also stated that very small exposure with SVB but on 11 March 2023, Circle confirmed that Bank failed to give withdrawal which was requested by the company on Thursday of this week and also confirmed the that SVB manages 25% of the USDC reserves.

Related Posts

Now the whole situation is acting as the best enemy for USDC stablecoin holders and creating panic among the crypto investors to sell their USDC holdings.

The Circle CEO & Co-Founder Jeremy Allaire confirmed that SVB bank is facing a very bad financial situation but here USDC will remain fully safe for the crypto Investors because the Bank was regulated by Fedic and the company is confident that they will find a solution to protect the crypto Investors.

Some media reports confirmed that such situations will also bring negative pressure on the SVB rival banks and also it will create another pressure on the crypto companies because these failed banks were the top choice in the financial system which were providing 24×7 instant banking services.

Read also: Thailand SEC doesn’t seek crypto staking ban but wants regulation

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://bitcoinik.com/usdc-depeg-is-not-a-failure-of-circle-report/

- :is

- 1

- 10

- 11

- 2022

- 2023

- 7

- 8

- a

- Able

- Amid

- among

- and

- Another

- ARE

- AS

- await

- Bad

- Ban

- Bank

- Bank run

- Banking

- Banks

- because

- behind

- below

- BEST

- Blindness

- blockchain

- bring

- by

- Cash

- ceo

- choice

- Circle

- Circle CEO

- clarity

- classic

- Co-founder

- collapsed

- Companies

- company

- confident

- CONFIRMED

- continue

- create

- Creating

- crisis

- crypto

- crypto companies

- Crypto investors

- crypto sector

- Crypto staking

- Current

- depeg

- depositors

- Doesn’t

- down

- during

- each

- economy

- Ether (ETH)

- Exposure

- facing

- Failed

- Failure

- fdic

- financial

- financial crisis

- financial system

- Find

- For

- from

- full

- fully

- get

- Give

- happened

- Have

- Held

- here

- High

- holders

- Holdings

- How

- HTTPS

- Impact

- in

- Innovation

- instant

- Investors

- IT

- ITS

- Jeremy Allaire

- jpg

- like

- Liquidity

- manages

- managing

- March

- max-width

- Media

- negative

- normally

- of

- on

- ONE

- ongoing

- operate

- Panic

- partner

- partners

- People

- plato

- Plato Data Intelligence

- PlatoData

- Post

- present

- pressure

- price

- Problem

- protect

- providing

- ranked

- reach

- regulated

- remain

- report

- Reports

- requested

- reserves

- Rival

- Run

- safe

- SEC

- Second

- sector

- Seek

- sell

- Services

- Silicon

- Silicon Valley

- silicon valley bank

- since

- situation

- situations

- SIX

- small

- smoothly

- solution

- stable

- stablecoin

- Staking

- stated

- strong

- such

- sufficient

- system

- that

- The

- their

- These

- this week

- time

- to

- top

- trade

- Trading

- traditional

- true

- Trust

- trusted

- trusted partner

- updated

- us

- USDC

- USDC reserves

- Valley

- value

- volume

- week

- which

- while

- will

- with

- withdrawal

- without

- Work

- zephyrnet