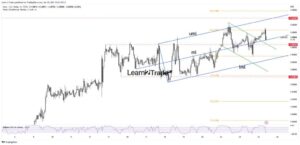

- The bias remains bullish as long as it stays above the median line (ml).

- The ADP Non-Farm Employment Change could be decisive today.

- A new higher high activates a larger growth.

The USD/JPY price retreated within the broader bullish trend. After its amazing rise, a short-term correction is probable.

-Are you looking for the best CFD broker? Check our detailed guide-

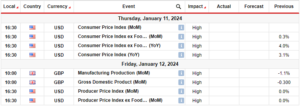

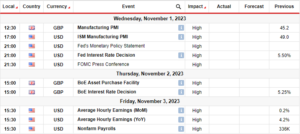

The pair is located at 142.63 and is fighting hard to return higher. Fundamentally, the Japanese Final Manufacturing PMI came in at 49.6 points versus 49.4 points expected, while the Unemployment Rate dropped unexpectedly to 2.5% in the last trading session.

On the other hand, the greenback was punished by the US economic figures. JOLTS Job Openings, ISM Manufacturing PMI, Final manufacturing PMI, ISM Manufacturing Prices, and Construction Spending came in worse than expected.

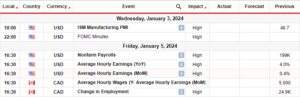

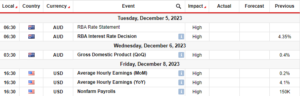

Today, the Japanese Monetary Base came in worse than expected. Later, the ADP Non-Farm Employment Change is seen as a high-impact event and is expected at 191K in July versus 497K in the previous reporting period.

Tomorrow, the BOE and the US Unemployment Claims and ISM Services PMI should shake the markets.

Also, the NFP, Average Hourly Earnings, and Unemployment Rate data should be decisive on Friday. Poor US economic figures should force the currency pair down.

USD/JPY Price Technical Analysis: Bullish Bias

Technically, the price came back below the weekly R1 (142.61), and it almost hit the median line (ml). The bias remains bullish as long as it stays above this dynamic support. Testing or failing to reach it should result in new bullish momentum. The current retreat could represent a bullish formation.

-If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

Only dropping and stabilizing below the median line (ml) invalidates the upside scenario and opens the door for a larger drop. On the other hand, staying above the median line (ml) and jumping above yesterday’s high of 143.54 activates further growth.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-price-retreats-below-143-ahead-of-us-adp/

- :is

- 167

- 30

- 49

- a

- above

- Accounts

- adp

- After

- ahead

- amazing

- analysis

- and

- ARE

- AS

- At

- average

- back

- base

- BE

- below

- BEST

- bias

- BoE

- broader

- brokers

- Bullish

- by

- came

- CAN

- CFDs

- change

- check

- claims

- Consider

- construction

- Container

- could

- Currency

- Current

- data

- decisive

- detailed

- Door

- down

- Drop

- dropped

- Dropping

- dynamic

- Earnings

- Economic

- employment

- Event

- expected

- failing

- fighting

- Figures

- final

- For

- Force

- forex

- Forex Brokers

- formation

- Friday

- fundamentally

- further

- Greenback

- Growth

- hand

- Hard

- High

- higher

- Hit

- HTTPS

- in

- interested

- Invest

- investor

- IT

- ITS

- Japanese

- Job

- JOLTS Job Openings

- July

- larger

- Last

- later

- Line

- located

- Long

- looking

- lose

- losing

- manufacturing

- Markets

- max-width

- ML

- Momentum

- Monetary

- money

- New

- nfp

- now

- of

- on

- openings

- opens

- or

- Other

- our

- pair

- period

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- points

- poor

- previous

- price

- Prices

- provider

- Rate

- reach

- remains

- Reporting

- represent

- result

- retail

- Retreat

- return

- Rise

- Risk

- ROW

- scenario

- seen

- Services

- session

- short-term

- should

- Spending

- support

- SVG

- Take

- Technical

- Technical Analysis

- Testing

- than

- The

- The Weekly

- this

- to

- today

- trade

- Trading

- Trend

- unemployment

- unemployment rate

- Upside

- us

- US Unemployment Claims

- USD/JPY

- Versus

- was

- weekly

- when

- whether

- while

- with

- within

- worse

- you

- Your

- zephyrnet