- The rebound could be only temporary.

- Coming back below the pivot point indicates more declines.

- The ECB and the US figures should move the rate today.

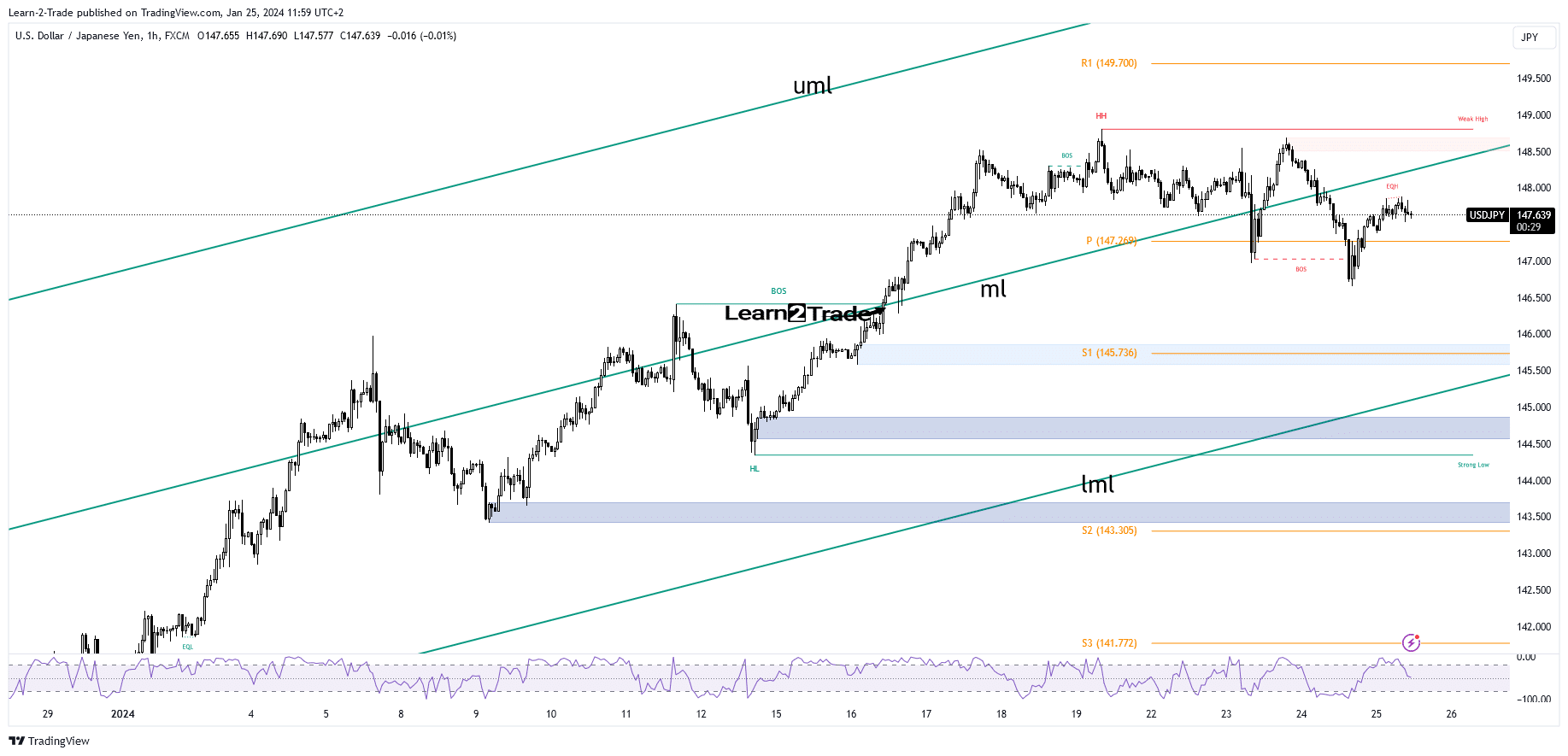

The USD/JPY price turned upside after reaching yesterday’s low of 146.65. The pair has climbed as high as 147.87 today, failing to test the 148.00 psychological level.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Yesterday, the greenback received a helping hand from the upbeat US economic data. The price recovered as the United States Flash Manufacturing PMI reached 50.3 points versus the expected 47.6 points, confirming expansion. Meanwhile, the Flash Services PMI jumped from 51.4 points to 52.9 points, announcing further expansion.

Today, the European Central Bank should drive the markets. The Main Refinancing Rate should remain at 4.50%, but the Monetary Policy Statement and the ECB Press Conference could change the sentiment.

Furthermore, the US will release key economic data, so the fundamentals could be decisive. The Advance GDP may announce a 2.0% growth, less compared to the 4.9% growth in the previous reporting period. Furthermore, the Unemployment Claims, Advance GDP Price Index, Durable Goods Orders, Core Durable Goods Orders, and New Home Sales data will also be released. Tomorrow, the Japanese Tokyo Core CPI, Monetary Policy Meeting Minutes, and the US Core PCE Price Index should move the price.

USD/JPY Price Technical Analysis: New Selling Wave

Technically, the USD/JPY price failed to stay below the 147.00 psychological level. The pair has tried to retest the 148.00 psychological level and the median line (ml). After the last sell-off, the rebound is widely anticipated.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

The rate could only retest the key level before going down again. Coming back and stabilizing below the weekly pivot point of 147.26 indicates more declines towards the S1 (145.73).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/25/usd-jpy-price-exhausted-below-148-00-eyes-on-us-gdp/

- :has

- :is

- 26

- 50

- 51

- 52

- 65

- 73

- 87

- 9

- a

- About

- Accounts

- advance

- After

- again

- also

- analysis

- and

- Announce

- Announcing

- Anticipated

- ARE

- AS

- At

- back

- Bank

- BE

- before

- below

- but

- CAN

- central

- Central Bank

- CFDs

- change

- check

- claims

- Climbed

- coming

- compared

- Conference

- Consider

- Core

- could

- CPI

- data

- decisive

- Declines

- detailed

- down

- drive

- ECB

- Economic

- European

- European Central Bank

- expansion

- expected

- Eyes

- Failed

- failing

- Figures

- Flash

- forex

- from

- Fundamentals

- further

- Furthermore

- GDP

- get

- going

- goods

- Greenback

- Growth

- guidelines

- hand

- helping

- High

- Home

- HTTPS

- in

- index

- indicates

- interested

- Invest

- investor

- Japanese

- Key

- Knowing

- Last

- LEARN

- less

- Level

- Line

- lose

- losing

- Low

- Main

- manufacturing

- Markets

- max-width

- May..

- Meanwhile

- meeting

- minutes

- ML

- Monetary

- Monetary Policy

- money

- more

- move

- New

- now

- of

- on

- only

- Options

- orders

- our

- pair

- pce

- period

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- Point

- points

- policy

- press

- previous

- price

- provider

- psychological

- Rate

- reached

- reaching

- Read

- rebound

- received

- release

- released

- remain

- Reporting

- retail

- Risk

- sales

- sell-off

- Selling

- sentiment

- Services

- should

- So

- Statement

- States

- stay

- Take

- Technical

- Technical Analysis

- temporary

- test

- The

- The Weekly

- then

- this

- to

- today

- tokyo

- Tokyo Core CPI

- tomorrow

- towards

- trade

- Trading

- tried

- Turned

- unemployment

- United

- United States

- upbeat

- Upside

- us

- US Core PCE

- US Core PCE Price Index

- US GDP

- USD/JPY

- Versus

- weekly

- when

- whether

- widely

- will

- with

- you

- Your

- zephyrnet