- Violence in the Middle East spooked markets, boosting the haven dollar.

- An exceptional US jobs report strengthened the greenback.

- Naoyuki Shinohara said that Japan was unlikely to pursue exchange-rate intervention.

The USD/JPY outlook is bullish as violence in the Middle East spooked markets, causing the safe-haven dollar to rise on Monday. Simultaneously, an exceptional US jobs report further strengthened the greenback.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Tony Sycamore, a market analyst at IG Australia, noted the prevailing uncertainty in the markets. Moreover, he suggested that while the dollar would remain strong due to risk-averse moves, the yen might gain some support, especially in currency crosses.

Notably, the dollar index was trading 0.1% higher. This gain was further bolstered by Friday’s data, revealing the most substantial increase in US employment in eight months in September. Thus, it potentially foreshadows higher-than-anticipated inflation figures later in the week.

Meanwhile, former top currency diplomat Naoyuki Shinohara told Reuters that Japan was unlikely to pursue exchange-rate intervention. He reasoned that recent yen declines were a reflection of economic fundamentals.

Moreover, he said there is no established rule or common consensus regarding the definition of “excess volatility” that would necessitate intervention. Furthermore, he explained that when referring to excess volatility, the typical context revolves around a timeframe spanning several days or weeks, as opposed to a period spanning several months.

These comments contrasted with the views expressed by the current top currency diplomat, Masato Kanda. He stated on Wednesday that continuous and gradual declines in the yen over an extended period might also warrant intervention.

USD/JPY key events today

No key economic reports are coming out from Japan or the US today. As such, the pair will likely remain mostly flat.

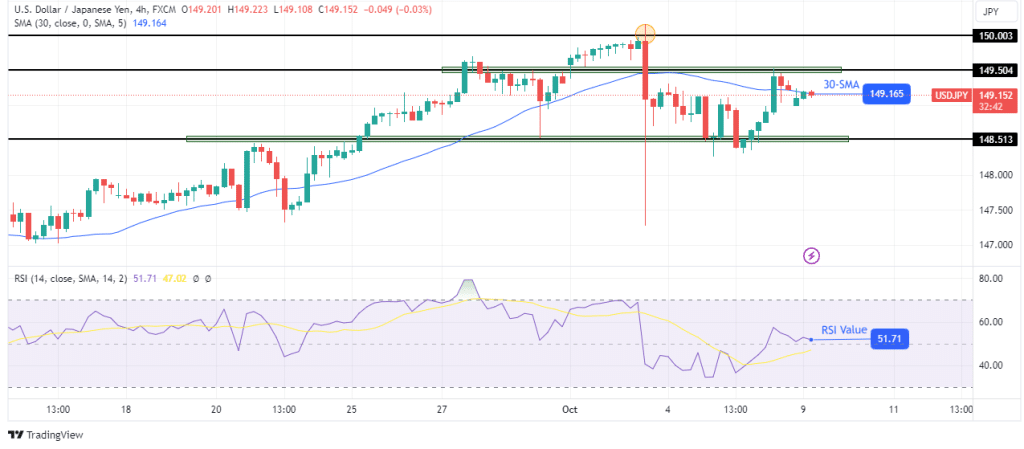

USD/JPY technical outlook: Price rests at 30-SMA following bullish momentum.

The USD/JPY price has paused near the 30-SMA after a solid bullish surge from the 148.51 support level. At the same time, the price retested the 149.50 resistance level, where it paused before dropping below the 30-SMA. The RSI points to a shift in sentiment to bullish as it trades slightly above 50.

–Are you interested to learn about forex bonuses? Check our detailed guide-

Clearly, bulls are challenging the 30-SMA resistance. If it holds, the price will likely return to the 148.51 support level. However, if they successfully break above, the price will probably take out the 149.50 resistance to retest the 150.00 key resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-outlook-dollar-gains-ground-amid-middle-east-turmoil/

- :has

- :is

- :where

- 1

- 150

- 50

- 51

- a

- About

- above

- Accounts

- After

- also

- Amid

- an

- analyst

- and

- ARE

- around

- AS

- At

- Australia

- before

- below

- boosting

- Break

- Bullish

- Bulls

- by

- CAN

- causing

- CFDs

- challenging

- check

- coming

- comments

- Common

- Consensus

- Consider

- context

- continuous

- Currency

- Current

- data

- Days

- Declines

- definition

- detailed

- Dollar

- dollar index

- Dropping

- due

- East

- Economic

- employment

- especially

- established

- events

- exceptional

- excess

- explained

- expressed

- Figures

- flat

- following

- Forecast

- forex

- Former

- from

- Fundamentals

- further

- Furthermore

- Gain

- Gains

- gradual

- Greenback

- Ground

- haven

- he

- High

- higher

- holds

- However

- HTTPS

- if

- in

- Increase

- index

- inflation

- inflation figures

- interested

- intervention

- Invest

- investor

- IT

- Japan

- Jobs

- jobs report

- Key

- key resistance

- later

- LEARN

- Level

- likely

- lose

- losing

- Market

- Markets

- Masato Kanda

- max-width

- Middle

- Middle East

- might

- Momentum

- Monday

- money

- months

- more

- Moreover

- most

- mostly

- moves

- Near

- no

- noted

- now

- of

- on

- opposed

- Options

- or

- our

- out

- Outlook

- over

- pair

- paused

- period

- plato

- Plato Data Intelligence

- PlatoData

- points

- potentially

- price

- probably

- provider

- pursue

- recent

- reflection

- regarding

- remain

- report

- Reports

- Resistance

- retail

- return

- Reuters

- revealing

- revolves

- Rise

- Risk

- rsi

- Rule

- Said

- same

- sentiment

- September

- several

- shift

- should

- simultaneously

- solid

- some

- spanning

- stated

- strong

- substantial

- Successfully

- such

- support

- support level

- surge

- Take

- Technical

- that

- The

- There.

- they

- this

- Thus

- time

- timeframe

- to

- today

- told

- top

- trade

- trades

- Trading

- typical

- Uncertainty

- unlikely

- us

- US Jobs Report

- USD/JPY

- views

- Volatility

- Warrant

- was

- Wednesday

- week

- Weeks

- were

- when

- whether

- while

- will

- with

- would

- Yahoo

- Yen

- you

- Your

- zephyrnet