- USD/CHF holds above the 0.9000 psychological mark in the Asian session on Monday.

- US NY Empire State Manufacturing Index for October fell to 4.6 vs. 1.9 rise prior.

- The escalating geopolitical tensions between Israel-Hamas might lift the traditional safe-haven Swiss Franc.

- Market players will monitor US Retail Sales on Tuesday and Swiss trade data on Thursday.

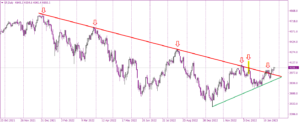

The USD/CHF pair snaps a two-day losing streak during the early Asian session on Tuesday. The recovery of US Treasury yields lends some support to the pair. At the time of writing, USD/CHF is trading near 0.9011, holding higher while adding 0.12% on the day.

Meanwhile, the US Dollar Index (DXY), a measure of the value of the USD relative to a basket of foreign currencies, attracts some buyers to 106.32. The US Treasury yield recovers its losses, with the US 10-Y yield staying at 4.746% by press time.

On Monday, the US NY Empire State Manufacturing Index for October fell to 4.6 versus a 1.9 rise prior, above the market consensus of a 7.0 decline. The upbeat low-tier US economic data failed to boost the Greenback and the dovish comments from the Federal Reserve (Fed) still exert pressure on the pair.

Chicago Fed President Austan Goolsbee maintained his dovish stance by saying that a fall in US inflation is not a bleep, while Philadelphia Fed President Patrick Harker said that in the absence of some turn in the data, the Fed should hold rates steady. Traders will take more cues from the Fed speakers on Tuesday, which include Williams, Bowman, Barkin, and Kashkari, which might offer some hints about further monetary policy paths.

Early Tuesday, the US Marine Rapid Response force is headed to the waters off the coast of Israel. A rapid response force of 2,000 Marines and sailors is being sent. It will join an increasing number of US warships en route to Israel in an effort to send a deterrent message to Iran and the Lebanese militant group Hezbollah, according to a CNN report. That said, the rising geopolitical tensions between Israel and Hamas might boost the traditional safe-haven Swiss Franc and act as a headwind for the USD/CHF pair.

About the data, the Swiss Federal Statistical Office revealed on Friday that the nation’s Producer and Import Prices fell 1.0% YoY in September from the previous reading of a 0.8% drop. On a monthly basis, the figures dropped 0.1% versus a 0.8% drop prior.

Investors will keep an eye on the Israel-Hamas conflict headline. The US Retail Sales for September will be released on Tuesday, with the figure expected to rise by 0.2%. The Swiss Trade Balance for September will be due on Thursday. These figures could give a clear direction to the USD/CHF pair.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fxstreet.com/news/usd-chf-holds-above-the-09000-area-amid-renewed-usd-demand-us-retail-sales-looms-202310170449

- :is

- :not

- 000

- 1

- 2%

- 32

- 7

- 9

- a

- About

- above

- According

- Act

- adding

- Amid

- an

- and

- AREA

- AS

- asian

- At

- Attracts

- Balance

- basis

- basket

- BE

- being

- between

- boost

- buyers

- by

- clear

- CNN

- Coast

- comments

- conflict

- Consensus

- could

- currencies

- data

- day

- Decline

- Demand

- deterrent

- direction

- Dollar

- dollar index

- Dovish

- Drop

- dropped

- due

- during

- Dxy

- Early

- Economic

- effort

- Empire

- expected

- eye

- Failed

- Fall

- Fed

- Federal

- federal reserve

- Figure

- Figures

- For

- Force

- foreign

- Franc

- Friday

- from

- further

- geopolitical

- Give

- Greenback

- Group

- headed

- headline

- higher

- hints

- his

- hold

- holding

- holds

- HTTPS

- import

- in

- include

- increasing

- index

- inflation

- Iran

- Israel

- IT

- ITS

- join

- jpg

- Keep

- Lebanese

- losing

- losses

- manufacturing

- Marine

- mark

- Market

- measure

- message

- might

- Monday

- Monitor

- monthly

- more

- Nations

- Near

- number

- NY

- october

- of

- off

- offer

- Office

- on

- pair

- patrick

- philadelphia

- plato

- Plato Data Intelligence

- PlatoData

- players

- president

- press

- pressure

- previous

- Prices

- Prior

- producer

- rapid

- Rates

- Reading

- Recovers

- recovery

- relative

- released

- renewed

- report

- Reserve

- response

- retail

- Retail Sales

- Revealed

- Rise

- rising

- Route

- Said

- sales

- saying

- send

- sent

- September

- session

- should

- some

- speakers

- stance

- State

- statistical

- staying

- steady

- Still

- support

- Swiss

- Take

- tensions

- that

- The

- the Fed

- These

- thursday

- time

- to

- trade

- Traders

- Trading

- traditional

- treasury

- Treasury yields

- Tuesday

- TURN

- upbeat

- us

- US Dollar

- US Dollar Index

- us inflation

- US Retail Sales

- US Treasury

- US treasury yields

- USD

- USD/CHF

- value

- Versus

- vs

- Waters

- which

- while

- will

- Williams

- with

- writing

- Yield

- yields

- zephyrnet