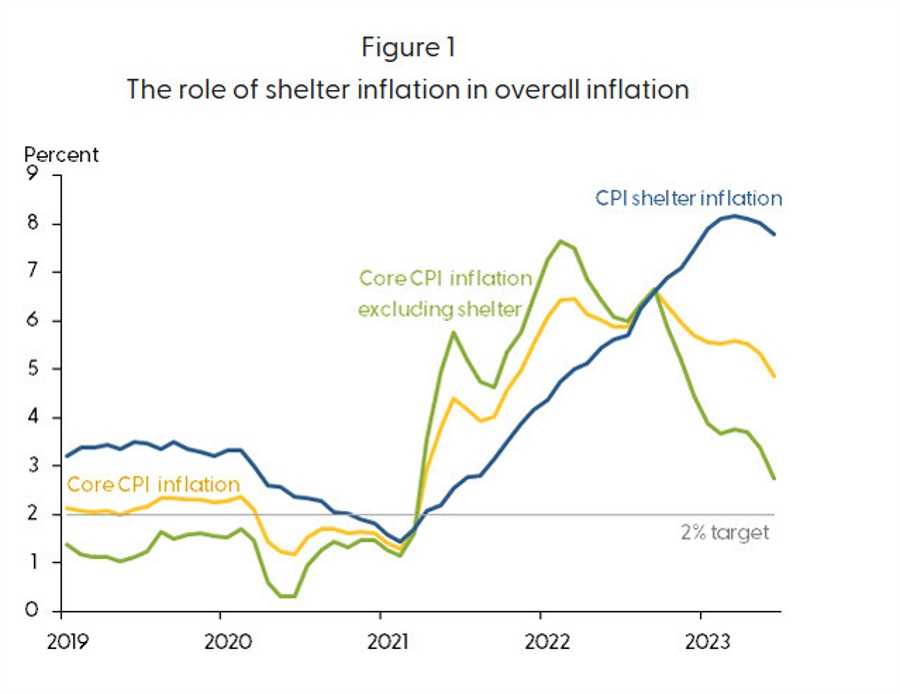

Market participants have come to recognize the profoundly laggy measurements of shelter inflation in CPI and have been trying to look through them. That’s a big reason why market-implied inflation is back on target in 2024.

Fed officials have also acknowledged the lags in shelter pricing but are reluctant to express too much confidence in a return to target given their previous failings. In a note from the San Francisco Fed today, researchers lay out the pay of shelter inflation going forward and highlight a significant slowing.

In this Economic Letter, we forecast the path of CPI shelter inflation over the next 18 months by combining data from various market indexes that measure shelter inflation and housing markets. Our results suggest that the recent slowdown in asking rents and house prices is likely to slow shelter inflation significantly in the future, although substantial uncertainty surrounds these forecasts.

The chart above already highlights how core inflation excluding shelter is closing in on the Fed target.

One indicator of future shelter price increase they looked at was ‘asking rents’. I’d be careful with the conclusions because they only use a 5-year period from 2018-2023 as the statistical backdrop and only US data to build the model. They try to justify it by using data from 18 different cities but the US housing market is relatively homogeneous so I’m skeptical that holds up.

Anyway, time will tell and this is their forecast for the next 18 months — and it highlights some intense pipeline deflation for housing that would go a long way towards Fed cuts next year.

Prices go negative around mid-year and is the largest component of the CPI index.

An alternative model adjusts to incorporate the idea that “rices tend to be less flexible in economic slowdowns and hence may not decline as rapidly as they rose” and sees shelter inflation falling to zero around the summer of 2024.

Again, I think markets are already incorporating much of this but it does add confidence that inflation will approach target next year. The x-factor for me continues to be the potential for commodity inflation and a pickup in manufacturing/construction as those emerge from recession.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexlive.com/centralbank/us-shelter-inflation-is-likely-to-slow-significantly-over-the-next-18-months-sf-fed-20230807/

- :is

- :not

- $UP

- 2024

- a

- above

- acknowledged

- add

- already

- also

- alternative

- Although

- and

- approach

- ARE

- around

- AS

- At

- back

- backdrop

- BE

- because

- been

- Big

- build

- but

- by

- careful

- Chart

- Cities

- closing

- combining

- come

- commodity

- component

- confidence

- continues

- Core

- core inflation

- CPI

- cuts

- data

- Decline

- deflation

- different

- does

- Economic

- emerge

- excluding

- express

- Falling

- Fed

- flexible

- For

- Forecast

- forecasts

- Forward

- Francisco

- from

- future

- given

- Go

- going

- Have

- hence

- Highlight

- highlights

- holds

- House

- housing

- housing market

- How

- HTTPS

- i

- idea

- in

- incorporate

- incorporating

- Increase

- index

- indexes

- Indicator

- inflation

- IT

- jpg

- largest

- lay

- less

- likely

- Long

- Look

- looked

- Market

- Markets

- May..

- me

- measure

- measurements

- model

- months

- much

- negative

- next

- of

- officials

- on

- only

- our

- out

- over

- participants

- path

- Pay

- period

- Pickup

- pipeline

- plato

- Plato Data Intelligence

- PlatoData

- potential

- previous

- price

- Price Increase

- Prices

- pricing

- rapidly

- reason

- recent

- recession

- recognize

- relatively

- researchers

- Results

- return

- ROSE

- s

- San

- San Francisco

- sees

- Shelter

- significant

- significantly

- skeptical

- slow

- Slowdown

- slowdowns

- Slowing

- So

- some

- statistical

- substantial

- suggest

- summer

- Target

- tell

- that

- The

- the Fed

- The Future

- their

- Them

- These

- they

- think

- this

- those

- Through

- time

- to

- today

- too

- towards

- try

- Uncertainty

- us

- US Housing

- US housing market

- use

- using

- various

- was

- Way..

- we

- why

- will

- with

- would

- year

- zephyrnet

- zero