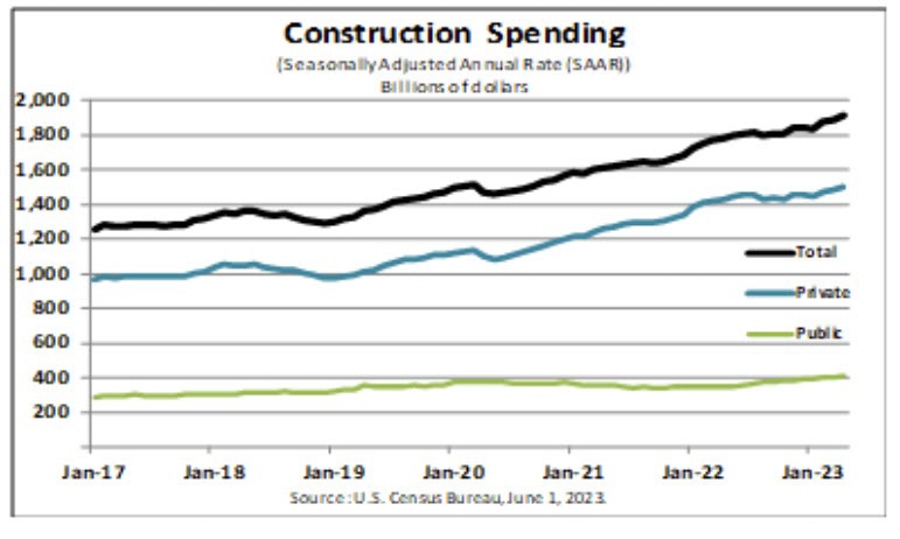

Construction spending rises strongly in April

- Prior month 0.3%

- Total construction spending in April 2023 was estimated at a seasonally adjusted annual rate of $1,908.4 billion, marking an increase of 1.2 percent from the revised March estimate of $1,885.0 billion.

- The spending figure for April 2023 was up by 7.2 percent from the estimate of April 2022, which stood at $1,780.9 billion.

- The total construction spending for the first four months of 2023 amounted to $566.7 billion, an increase of 6.1 percent from $533.9 billion during the same period in 2022.

Details on Private and Public Construction Spending

- Private construction spending was at a seasonally adjusted annual rate of $1,500.7 billion, an increase of 1.3 percent from the revised March estimate of $1,481.6 billion.

- Within private construction, residential construction stood at an annual rate of $845.4 billion in April, marking a slight increase of 0.5 percent from the revised March estimate of $841.6 billion.

- Nonresidential construction spending within the private sector was at an annual rate of $655.3 billion in April, an increase of 2.4 percent from the revised March estimate of $640.0 billion.

- Public construction spending was estimated at a seasonally adjusted annual rate of $407.7 billion in April, up by 1.1 percent from the revised March estimate of $403.4 billion.

- Within public construction, educational construction saw a minor decrease of 0.1 percent to an annual rate of $88.3 billion, compared to the revised March estimate of $88.4 billion.

- Highway construction, also within the public sector, was at an annual rate of $124.7 billion in April, marking an increase of 1.3 percent from the revised March estimate of $123.1 billion.

There has been a lot of chatter about the lack of supply in the private housing market. With many homeowners locked in at much lower rates than the current near 7% level, the amount of existing homes on the market is still well below normal levels. New construction is more risky and takes time. Nevertheless, it is needed to get inventory levels back to more normal levels.

For the full report CLICK HERE

/inflation

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://www.forexlive.com/news/us-construction-spending-for-april-12-versus-a-02-expected-20230601/

- :has

- :is

- $UP

- 1

- 1.3

- 2%

- 2022

- 2023

- 26

- 500

- 7

- 9

- a

- About

- Adjusted

- also

- amount

- an

- and

- annual

- April

- At

- back

- been

- below

- Billion

- by

- Census

- compared

- construction

- Current

- decrease

- during

- educational

- estimate

- estimated

- existing

- expected

- Figure

- First

- follow

- For

- four

- from

- full

- Full Report

- get

- Homes

- housing

- housing market

- HTML

- HTTPS

- in

- Increase

- inventory

- IT

- jpg

- Lack

- Level

- levels

- locked

- Lot

- many

- March

- Market

- marking

- minor

- months

- more

- much

- Near

- needed

- Nevertheless

- New

- New Construction

- normal

- of

- on

- percent

- period

- plato

- Plato Data Intelligence

- PlatoData

- private

- private sector

- public

- Rate

- Rates

- report

- residential

- Rises

- Risky

- same

- sector

- Spending

- Still

- strongly

- supply

- takes

- than

- The

- time

- to

- Total

- us

- Versus

- was

- WELL

- which

- with

- within

- zephyrnet