US stocks tumbled as investors struggle to go long risk as the Russia-Ukraine crisis intensifies and as surging oil prices threaten economic growth prospects. Wall Street is hitting the ‘sell button’ on everything except for energy stocks. Traders are trying to reduce their exposure to anything that has exposure to Russia and some are getting concerned that a prolonged economic slowdown is here. Stagflation risks have never been greater and that should continue to fuel the many commodity super cycles that are running hot. Oil, natural gas, wheat, and palladium are rallying strongly today.

ISM

The ISM manufacturing picked up in February as supply disruptions persist. The headline manufacturing index rose from 57.6 to 58.6, which was better than the 58.0 consensus estimate. New orders remained in strong growth territory, reaching the highest level since September. The employment index weakened but still remains in expansion territory. The ISM report suggests manufacturing activity remains strong but consumption could be leveling off as supply chain and logistic issues become more troublesome.

Yields

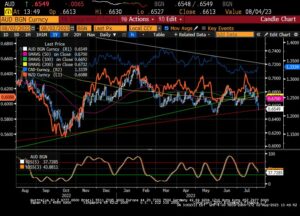

Risk aversion is running wild and Treasury yields are freefalling. The 10-year Treasury yield fell 12.1 basis points to 1.702%. Wall Street is fleeing to safe-havens as oil prices surge to seven-year highs. The flight-to-safety has the Japanese yen as the top currency, with the dollar in second place.

- Coinsmart. Europe’s Best Bitcoin and Crypto Exchange.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. FREE ACCESS.

- CryptoHawk. Altcoin Radar. Free Trial.

- Source: https://www.marketpulse.com/20220301/us-close-surging-oil-prices-drive-growth-concerns-sink-stocks-ism-impresses-yields-drop-yen-stronger/

- activity

- basis

- commodity

- Consensus

- consumption

- continue

- could

- crisis

- Currency

- Dollar

- Drop

- Economic

- Economic growth

- employment

- energy

- estimate

- everything

- Except

- expansion

- Fuel

- GAS

- getting

- Growth

- here

- HTTPS

- index

- Investors

- issues

- Level

- Long

- manufacturing

- Natural

- Natural Gas

- Oil

- orders

- prospects

- reduce

- remained

- report

- Risk

- risks

- running

- Russia

- Stocks

- street

- strong

- supply

- supply chain

- surge

- today

- top

- Traders

- us

- Wall Street

- Yen

- Yield