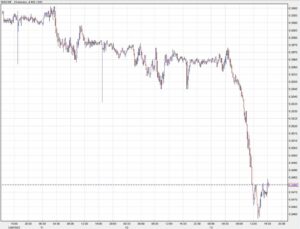

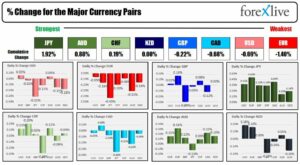

Major currencies aren’t doing a whole lot on the day after some pushing and pulling yesterday, with the dollar continuing to keep steadier mostly. The kiwi is the notable mover after the RBNZ signaled the end to its tightening cycle, and that is seeing NZD/USD drop by over 1% to 0.6170 on the day.

In Wall Street, we saw equities stumble with the S&P 500 falling by over 1% as tech stocks lead the downside move yesterday. That should keep risk sentiment on edge in European trading today, even as US futures are holding just a touch higher for now.

Besides that, we saw a modest rebound in gold and silver prices with the former moving back to $1,970 levels while the latter hangs on at the 100-day moving average upon the close – now seen at $23.45. That is certainly keeping things interesting as the bond market is also stepping back and forth with Treasury yields reversing lower after holding higher early yesterday.

Looking ahead to Europe, UK inflation data will be one to watch for the pound and the rates market today. The expectation is for headline annual inflation to fall to 8.2% in April from 10.1% in March. That comes amid base effects adjustment – similar to what we saw in the Eurozone last month.

Core annual inflation is estimated to remain sticky at 6.2%, so that should keep the pressure on the BOE as there is not much evidence of a turnaround in food price inflation yet.

0600 GMT – UK April CPI figures

0800 GMT – Germany May Ifo business climate index

1000 GMT – UK May CBI trends total orders

1100 GMT – US MBA mortgage applications w.e. 19 May

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://www.forexlive.com/news/uk-inflation-on-the-agenda-today-20230524/

- :is

- :not

- ][p

- 10

- 2%

- 500

- 8

- 970

- a

- Adjustment

- After

- agenda

- ahead

- All

- also

- Amid

- and

- annual

- applications

- April

- ARE

- AS

- At

- average

- back

- base

- BE

- BEST

- BoE

- bond

- bond market

- business

- business climate

- by

- cbi

- certainly

- Climate

- Close

- come

- comes

- continuing

- CPI

- currencies

- cycle

- data

- day

- Days

- doing

- Dollar

- downside

- Drop

- e

- Early

- Edge

- effects

- end

- Equities

- estimated

- Europe

- European

- Eurozone

- Even

- evidence

- expectation

- Fall

- Falling

- food

- For

- Former

- forth

- from

- Futures

- Germany

- GMT

- Gold

- good

- headline

- higher

- holding

- HTTPS

- i

- in

- inflation

- interesting

- ITS

- jpg

- just

- Keep

- keeping

- Last

- lead

- levels

- Lot

- luck

- March

- Market

- May..

- MBA

- modest

- Month

- Mortgage

- mostly

- move

- moving

- moving average

- much

- notable

- now

- NZD/USD

- of

- on

- ONE

- out

- over

- plato

- Plato Data Intelligence

- PlatoData

- pound

- pressure

- price

- Prices

- pulling

- Pushing

- Rates

- RBNZ

- rebound

- remain

- Risk

- s

- S&P

- S&P 500

- safe

- seeing

- seen

- sentiment

- session

- should

- Silver

- Silver Prices

- similar

- So

- some

- stay

- stepping

- sticky

- Stocks

- street

- tech

- tech stocks

- that

- The

- There.

- things

- tightening

- to

- today

- Total

- touch

- Trading

- treasury

- Treasury yields

- Trends

- Uk

- UK Inflation

- upon

- us

- us futures

- W

- Wall

- Wall Street

- Watch

- we

- What

- while

- whole

- will

- with

- yet

- yields

- you

- Your

- zephyrnet