With a comprehensive guide, one can easily grasp the concept of futures trading and the differences between them and other financial derivatives.

Understanding the ins and outs of trading futures can be a daunting task. However, with a comprehensive guide, one can easily grasp the concept of futures trading and the differences between them and other financial derivatives, such as Options vs Futures. These financial instruments can be a valuable addition to an investor's portfolio, providing opportunities for diversification and hedging. This article will delve into trading US futures on popular assets such as Bitcoin, S&P500, and Oil.

Understanding Futures Trading

Futures trading involves buying and selling contracts that obligate the buyer to purchase and the seller to sell an asset at a predetermined price and date in the future. The assets involved in these contracts can range from commodities like oil to financial instruments such as Bitcoin and the S&P500 index. These contracts are standardized in terms of quantity, quality, and delivery time to facilitate trading on a futures exchange. Understanding the mechanics of futures contracts is essential to successfully navigate the futures market and capitalize on its opportunities.

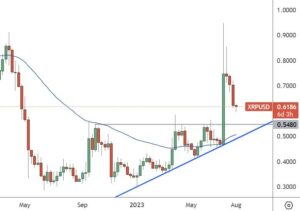

Trading Bitcoin Futures

Bitcoin futures allow investors to speculate on the future price of Bitcoin without actually owning the cryptocurrency. This means that traders can profit from price movements in either direction, which can be particularly useful in volatile markets. Bitcoin futures also provide a way for investors to hedge their digital asset portfolios against potential price swings. With the growing interest in cryptocurrencies, Bitcoin futures offer an accessible way for investors to gain exposure to this new asset class.

Trading S&P500 Futures

The S&P500 index is a benchmark that reflects the stock performance of 500 large companies listed on US stock exchanges. Trading S&P500 futures allows investors to speculate on the future price of this index. By doing so, traders can hedge their portfolios against potential losses if the market moves against them. They can also take advantage of leverage to potentially increase their returns. S&P500 futures are a popular tool among investors due to their liquidity and the wide market exposure they provide.

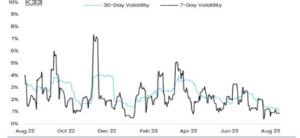

Trading Oil Futures

Oil futures are contracts that obligate the buyer to purchase and the seller to sell a specified amount of oil at a predetermined price on a future date. Trading oil futures allows investors to speculate on the future price of oil. This can be a valuable strategy for hedging against price fluctuations in the oil market, especially given the commodity's historical volatility. With global economies heavily reliant on oil, understanding oil futures can provide significant trading opportunities.

Options vs Futures

While both options and futures are financial derivatives used for hedging and speculation, they have some key differences. An options contract gives the holder the right, but not the obligation, to buy or sell an asset at a specific price before a certain date. On the other hand, a futures contract obligates the holder to buy or sell the asset at a predetermined price on a specific future date. Therefore, futures carry a higher level of risk as they require the holder to fulfill the contract regardless of how the market moves. Understanding these differences is crucial in making informed trading decisions.

The Role of Plus500 in Trading US Futures

Plus500 is a global leader in online trading platforms, offering a robust platform for trading US futures on Bitcoin, S&P500, Oil, and more. With 24/7 customer support at your disposal, Plus500 makes futures trading accessible and manageable. The platform provides a wide range of trading tools and resources to help traders make informed decisions and manage their risks effectively. Whether you're a seasoned trader or a beginner, Plus500 offers a comprehensive trading experience that caters to your needs.

Conclusion

Trading US futures can be a profitable endeavor, especially when dealing with popular assets like Bitcoin, S&P500, and Oil. However, it's crucial to understand the mechanics of futures trading and the specific characteristics of each asset. It's also important to note the differences between futures and other derivatives, like options, to make informed trading decisions. With the right knowledge and tools, such as those provided by Plus500, trading US futures can be a rewarding investment strategy.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.bitrates.com/news/p/trading-us-futures-a-comprehensive-guide-to-futures-trading

- :is

- :not

- 500

- 60

- a

- accessible

- actually

- addition

- address

- ADvantage

- advice

- against

- allow

- allows

- already

- also

- among

- amount

- an

- and

- any

- ARE

- article

- AS

- asset

- asset class

- Assets

- At

- BE

- before

- Beginner

- Benchmark

- BEST

- between

- Bitcoin

- Bitcoin Futures

- blockchain

- both

- but

- buy

- BUYER..

- Buying

- by

- CAN

- capitalize

- carry

- caters

- certain

- characteristics

- circumstances

- class

- Commodities

- commodity

- Companies

- comprehensive

- concept

- considering

- contained

- contract

- contracts

- crucial

- cryptocurrencies

- cryptocurrency

- customer

- Customer Support

- Date

- dealing

- decisions

- delivered

- delivery

- delve

- Derivatives

- differences

- digital

- Digital Asset

- direction

- directly

- disposal

- diversification

- doing

- due

- each

- easily

- economies

- effectively

- either

- endeavor

- especially

- essential

- exchange

- Exchanges

- experience

- Exposure

- facilitate

- financial

- financial advice

- Financial Derivatives

- Financial Instruments

- First

- fluctuations

- For

- For Investors

- Free

- from

- Fulfill

- future

- Future Price

- Futures

- futures exchange

- Futures Trading

- Gain

- getting

- given

- gives

- Global

- grasp

- Growing

- growing interest

- guide

- hand

- Have

- heavily

- hedge

- hedging

- help

- herein

- higher

- historical

- holder

- hottest

- How

- However

- HTTPS

- if

- important

- in

- Increase

- index

- information

- informed

- instruments

- interest

- into

- investment

- Investment strategy

- investor

- Investors

- involved

- involves

- IT

- ITS

- Key

- knowledge

- large

- leader

- Level

- Leverage

- like

- Liquidity

- Listed

- losses

- make

- MAKES

- Making

- manage

- Market

- market moves

- Markets

- means

- mechanics

- more

- movements

- moves

- Navigate

- needs

- New

- news

- Newsletter

- note

- obligation

- of

- offer

- offering

- Offers

- Oil

- on

- once

- ONE

- online

- opportunities

- Options

- or

- Other

- our

- particularly

- performance

- personal

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Popular

- portfolio

- portfolios

- potential

- potentially

- price

- Price Fluctuations

- privacy

- Profit

- profitable

- provide

- provided

- provides

- providing

- purchase

- quality

- quantity

- range

- RE

- Recommendation

- reflects

- Regardless

- require

- Resources

- returns

- rewarding

- right

- Risk

- risks

- robust

- Role

- s

- S&P500

- safe

- seasoned

- Section

- sell

- Selling

- should

- significant

- So

- solicitation

- some

- specific

- specified

- speculation

- standardized

- stock

- stock exchanges

- Stories

- Strategy

- subscribe

- subscribers

- Successfully

- such

- support

- Swings

- Take

- Task

- terms

- that

- The

- The Future

- their

- Them

- therefore

- These

- they

- this

- those

- time

- Title

- to

- tool

- tools

- trader

- Traders

- Trading

- Trading Platforms

- Transactions

- understand

- understanding

- us

- us futures

- used

- Valuable

- value

- volatile

- Volatility

- vs

- Way..

- when

- whether

- which

- wide

- Wide range

- will

- with

- without

- writers

- you

- Your

- zephyrnet