The world of corporate governance isn’t as wild as it used to be.

I was a young analyst at a corporate governance rating firm in 2001 when I was assigned to follow companies such as Worldcom and Enron. For those too young to remember, Enron was an energy-trading firm that perpetrated one of the largest accounting frauds in American history in 2001, resulting in the company’s bankruptcy. In Enron’s case, it was clear that the board members on the audit committee of the board had no idea how to police the fraudulent accounting perpetrated by company management.

Soon after the Enron scandal, Worldcom, an American telecom company, perpetrated its own accounting fraud, resulting in that company’s eventual bankruptcy.

My team at that ratings firm was tasked with judging the corporate governance and shareholder rights at public companies around the world. There were plenty of other examples of poor governance; from weak boards to abuses of shareowner rights, related party transactions between the company and board members and many others.

It was clear that Enron blew up in 2001 due to horrific board oversight. The cozy relationships between directors and company leaders made it easier for the board to overlook the glaring red flags that were raised when our team rated the company's corporate governance. It was clear that the board was in no way independent, and it did not possess the expertise to properly oversee the company’s audit.

One common feature among corporate boards during that timeframe was the practice of "interlocking directors." These interlocks happened when an executive from Company A (often the CEO) would sit on the board of Company B, and an executive of Company B (again, often the CEO) would sit on the board of Company A.

Corporate governance practices evolved after Worldcom and Enron and Congress eventually figured out interlocks were a bad idea, so protections were put in place to discourage this practice — not just in the United States, but in most markets around the world.

The modern era of board interlocks

Regardless of that change, many directors serve on multiple boards, and it’s worth taking a closer look at those relationships.

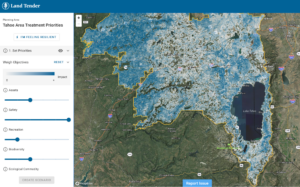

Borrowing the same algorithms social media companies use to figure out who might be in your circle of friends, you can evaluate which board members are most closely connected based on all the boards they’ve sat on, companies they worked at and affiliations they have. It is instructive to understand the communities in which a director sits, and what that means.

To take a closer look at these board communities, I used the Free Float Analytics Database, which tracks the influence and performance of more than 220,000 directors at over 10,000 publicly traded companies. This universe covers the MSCI ACWII Investable Market Index, which includes about 99 percent of the investible global equity market. The database analyzes a director’s network (their personal connections), the team dynamics of a board (how the board members interact with each other) and the influence a board member has on company decisions. For this analysis, I was interested in how the relationships between directors might have an impact on carbon emissions.

The director communities for finance and energy share close relations

One issue I considered was the relationship between directors for financial companies — such as banks that directly finance emissions-intensive projects — and those for businesses in the fossil fuel industries. It came as little surprise to me that directors connected with the most emissions are concentrated in the financial industry: The executives and directors of BlackRock were linked to the most emissions, due to the emissions in BlackRock portfolio companies.

For example, Pamela Daley, former senior vice president of corporate business development at General Electric, is on the BlackRock board. She’s also connected to the BP board and is part of a board community in which a quarter of the members are connected to energy companies and a quarter are linked to finance. There are many overlaps between the energy and finance sectors in her community.

What investors should study more closely

Most investors find this type of information about board relationships interesting, if not material, because it can give them insight into board dynamics and the relationships across boards that may influence strategy, partnerships and the success or failure of companies.

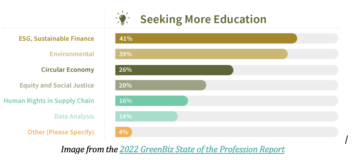

An additional thing to look for on the boards of financial firms is expertise in climate and climate finance. If no one in the boardroom understands the current and coming challenges of climate change impacts, the board may be failing its shareholders. Yes, a board has a fiduciary duty to serve the best interest of shareholders, but that "best interest" increasingly means a board must include climate-related factors in strategy and planning.

It is also important to understand why a board member may serve on the board beyond their expertise in a certain area.

Much was made recently about BlackRock’s decision to appoint Saudi Aramco CEO Amin Nasser to its board. Some saw this as a betrayal because BlackRock CEO Larry Fink has been one of the most vocal critics from the financial world about global inaction on climate change.

Yes, the move may be an admission by BlackRock that while it sees the world moving away from oil and gas, that won’t happen tomorrow. It might also just be what BlackRock said about the appointment — that adding Nassar to the board is part of the firm’s Middle East strategy.

Try finding a CEO-level board member with an extensive "community" in the Middle East that doesn’t have oil and gas connections.

I looked in the database. You can’t.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.greenbiz.com/article/tracking-influence-boards-carbon-emissions-its-complicated

- :has

- :is

- :not

- $UP

- 000

- 10

- 2001

- 220

- 8

- a

- About

- abuses

- Accounting

- across

- adding

- Additional

- affiliations

- After

- again

- algorithms

- All

- also

- American

- among

- an

- analysis

- analyst

- analytics

- analyzes

- and

- appointment

- ARE

- AREA

- around

- article

- AS

- assigned

- At

- audit

- away

- b

- Bad

- Bankruptcy

- Banks

- based

- BE

- because

- been

- BEST

- between

- Beyond

- BlackRock

- board

- board member

- BP

- business

- business development

- businesses

- but

- by

- came

- CAN

- carbon

- carbon emissions

- case

- ceo

- certain

- challenges

- change

- Circle

- clear

- Climate

- Climate change

- Close

- closely

- closer

- coming

- committee

- Common

- Communities

- community

- Companies

- company

- Company’s

- complicated

- Concentrated

- connected

- Connections

- considered

- cornell

- Corporate

- corporate governance

- covers

- Critics

- Current

- Database

- decision

- decisions

- Development

- DID

- directly

- Director

- Directors

- do

- Doesn’t

- due

- during

- dynamics

- each

- easier

- East

- economy

- Electric

- Emissions

- energy

- equity

- Era

- Ether (ETH)

- evaluate

- eventual

- eventually

- evolved

- example

- examples

- executive

- executives

- expertise

- expressed

- extensive

- factors

- failing

- Failure

- Feature

- Figure

- figured

- finance

- financial

- Find

- finding

- Firm

- firms

- flags

- Float

- follow

- For

- Former

- fossil

- Fossil fuel

- fraudulent

- friends

- from

- Fuel

- GAS

- General

- General Electric

- Give

- Global

- governance

- had

- happen

- happened

- harvard

- Have

- her

- How

- How To

- HTTPS

- i

- idea

- if

- Impact

- Impacts

- important

- in

- inaction

- include

- includes

- increasingly

- independent

- index

- industries

- industry

- influence

- information

- insight

- interact

- interest

- interested

- interesting

- into

- Investopedia

- Investors

- issue

- IT

- ITS

- jpg

- just

- Larry Fink

- Law

- leaders

- linked

- little

- Look

- looked

- made

- management

- many

- Market

- Markets

- material

- May..

- me

- means

- Media

- member

- Members

- Middle

- Middle East

- might

- Modern

- more

- most

- move

- moving

- MSCI

- multiple

- must

- necessarily

- network

- no

- node

- of

- often

- Oil

- Oil and Gas

- on

- ONE

- or

- Other

- Others

- our

- out

- over

- oversee

- own

- part

- partnerships

- party

- percent

- performance

- personal

- perspectives

- Place

- planning

- plato

- Plato Data Intelligence

- PlatoData

- Plenty

- Police

- poor

- portfolio

- position

- possess

- practice

- practices

- president

- projects

- properly

- public

- public companies

- publicly

- Publishes

- put

- Quarter

- raised

- range

- rated

- rating

- ratings

- recently

- Red

- Red Flags

- reflect

- related

- relationship

- Relationships

- remember

- resulting

- rights

- s

- Said

- same

- Saudi

- Saudi Aramco

- saw

- Scandal

- Sectors

- sees

- senior

- serve

- Share

- shareholder

- Shareholders

- should

- sit

- sits

- So

- Social

- social media

- some

- States

- Strategy

- Study

- success

- such

- surprise

- Take

- taking

- team

- telecom

- than

- that

- The

- the world

- their

- Them

- There.

- These

- they

- thing

- this

- those

- timeframe

- to

- tomorrow

- too

- Tracking

- traded

- Transactions

- transition

- type

- understand

- understands

- United

- United States

- Universe

- use

- used

- vice

- Vice President

- views

- was

- Way..

- were

- What

- when

- which

- while

- WHO

- why

- Wild

- with

- worked

- world

- worth

- would

- yes

- you

- young

- Your

- zephyrnet