AUDUSD drops with decreased risk appetite

The Australian dollar fell through a significant support zone as the market remains risk-off. The US dollar’s strength could continue to provide tailwinds despite lackluster domestic data. Australia’s retail sales saw numbers fall back into negative territory as the economy still feels the pinch. With inflation easing and the RBA expected to hold on its interest rate hikes, the Aussie could have a turnaround in fortunes. The pair is heading towards 0.6500, with a break here leading prices to last year’s Q4 lows. A recent bullish divergence could swing prices back up towards 0.6600.

USDCAD struggles in consolidation

The Canadian dollar remains stable, and a soft landing this year looks likely. Cooling inflation has led to the BoC following the Fed with as more dovish outlook. As major central banks enter the pausing phase, traders shift their focus to the actual economic impact. Both growth and employment in Canada have proven resilient despite a rapid climb in borrowing costs. If a recession does not materialise, the loonie would be better positioned to surf a new wave of risk-taking. December’s low of 1.32 is a critical floor and 1.3540 an immediate resistance.

UKOIL softens on demand uncertainty

Brent crude slipped after a rally towards 84.00 saw the black gold lose momentum. With the IMF boosting its global growth forecast for the year, the market now awaits to see how the world will respond to the uncertainties in the Middle East. Despite a pickup in Chinese economic momentum, stimulus in the country could lead to a more positive undertone. However, a drop in China’s imports due to the Lunar New Year holidays has kept traders on their toes. The commodity looks for support at 80.00, with 84.00 being a top.

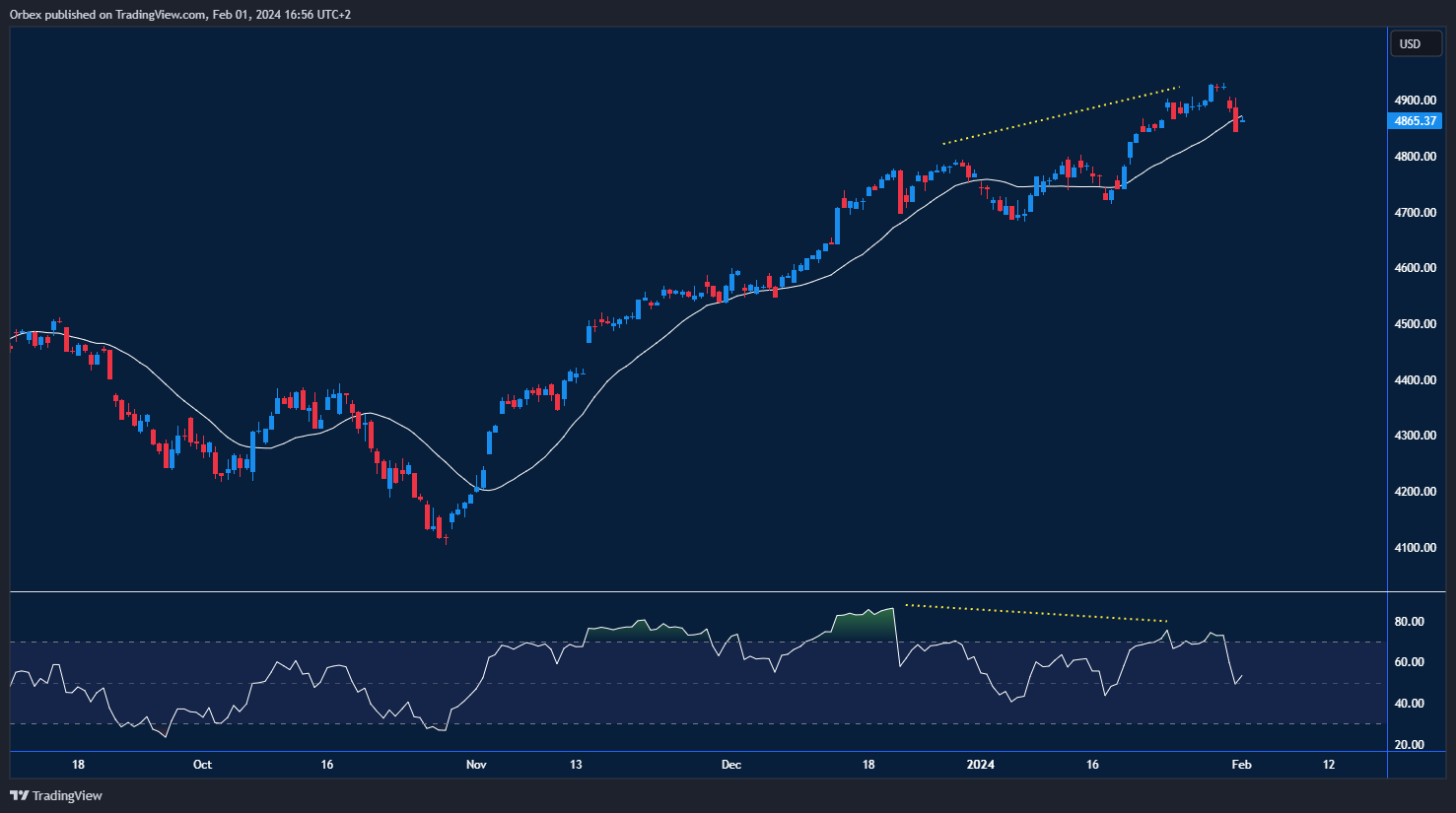

SPX 500 takes a step back after rallying

The S&P 500 extended gains after the Fed signalled there would eventually begin cutting rates. Earnings seasons continue to impress as the index continues to close at record highs. With the latest Fed meeting showing a positive outlook for the economy, NFP figures are also boosting the theory that a rate cut will happen sooner rather than later. Sentiment could carry higher equities if the CPI stays in a downtrend. The index has seen a recent dip since a bearish divergence emerged, with 4800 being a solid support.

Test your forex and CFD trading strategy with Orbex

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.orbex.com/blog/en/2024/02/the-week-ahead-time-for-a-rebound

- :has

- :is

- :not

- ][p

- $UP

- 00

- 1

- 32

- 500

- 80

- 84

- a

- actual

- After

- ahead

- also

- an

- and

- app

- ARE

- AS

- At

- aussie

- Australian

- Australian dollar

- back

- Banks

- BE

- bearish

- bearish divergence

- begin

- being

- Better

- Black

- Blog

- BoC

- boosting

- Borrowing

- both

- Break

- brent

- Brent Crude

- Bullish

- bullish divergence

- Canada

- Canadian

- Canadian Dollar

- carry

- central

- Central Banks

- CFD

- Chinas

- chinese

- climb

- Close

- commodity

- continue

- continues

- Costs

- could

- country

- CPI

- critical

- crude

- Crude oil

- Currency

- Cut

- cutting

- data

- decreased

- Demand

- depicting

- Despite

- Dip

- displaying

- Divergence

- does

- Dollar

- Domestic

- Dovish

- Drop

- Drops

- due

- Earnings

- easing

- East

- Economic

- Economic Impact

- economy

- emerged

- employment

- Enter

- Equities

- Ether (ETH)

- eventually

- expected

- extended

- Fall

- Fed

- fed meeting

- feels

- Figures

- Floor

- Focus

- following

- For

- Forecast

- forex

- Forex Trading

- fortunes

- Gains

- Global

- Gold

- graph

- Growth

- happen

- Have

- Heading

- here

- High

- higher

- Highs

- Hikes

- hold

- holidays

- How

- However

- HTTPS

- if

- illustrating

- image

- IMF

- immediate

- Impact

- imports

- in

- index

- inflation

- interest

- INTEREST RATE

- INTEREST RATE HIKES

- into

- ITS

- kept

- Lackluster

- landing

- Last

- later

- latest

- lead

- leading

- Led

- likely

- live

- LOOKS

- lose

- Low

- Lows

- Lunar

- major

- Market

- max-width

- meeting

- Middle

- Middle East

- Mobile

- Mobile app

- Momentum

- more

- movement

- negative

- negative territory

- New

- new year

- nfp

- now

- numbers

- of

- Oil

- on

- Outlook

- pair

- pausing

- phase

- Pickup

- plato

- Plato Data Intelligence

- PlatoData

- positioned

- positive

- potential

- Prices

- proven

- provide

- rally

- rapid

- Rate

- rate hikes

- Rates

- rather

- RBA

- rebound

- recent

- recession

- record

- remains

- resilient

- Resistance

- Respond

- retail

- Retail Sales

- Risk

- S&P

- S&P 500

- sales

- saw

- seasons

- see

- seen

- sentiment

- shift

- showing

- significant

- since

- Soft

- solid

- spx

- stable

- Step

- Still

- stimulus

- Strategy

- strength

- Struggles

- support

- surf

- Swing

- takes

- territory

- than

- that

- The

- the Fed

- the world

- their

- theory

- There.

- this

- this year

- Through

- time

- to

- top

- towards

- Traders

- Trading

- trading strategy

- uncertainties

- URL

- us

- Wave

- week

- Week ahead

- will

- with

- world

- would

- year

- Your

- zephyrnet

- zone