If you wonder what is the secondary market, it is a segment of the financial markets where securities, stocks, or other financial instruments are traded following their public offering (ICO/IDO) or sale. In short, it's a place where investors can buy and sell assets from each other, unlike the primary market where assets are bought directly from the issuing companies.

In the Web3 sphere, the secondary market plays a particularly crucial role as it offers a platform for trading Simple Agreements for Future Tokens (SAFT) or Simple Agreements for Future Equity (SAFE). These documents represent contracts that pre-establish rights to shares or tokens that will be issued in the future.

The secondary market hosts numerous Web3 projects looking for opportunities to trade SAFT/SAFE, including Animoca, Consensys, Fuel, Ripple, Layer Zero, Scroll, and many others, trading their SAFTs on the secondary market.

The benefits of trading SAFTs on the secondary market include:

- Protecting your startup from dump investors

When you give your early investors a way to sell their allocations via OTC, it would mean they can make a deal without price slippage and won’t be selling big amounts via CEX, thus not dumping your token.

- Insuring your token price well by sustainable

When the token unlocks happen, many investors go to the exchange to sell it. When you give them a way to resell it to the investors via OTC, it would help to keep the price sustainable

- Managing the token price of the Web3 startup

Token price of web3 startup is a hard task, usually done by one or several market makers. However, this job usually covers only exchanges and their liquidity. Giving your big investors a way to resell their allocations via OTC will help market makers to hold a price and increase it when possible, as big amounts sell wouldn’t affect the price.

So why do founders of Web3 projects come to the secondary market?

Let's delve into this 👇

The Role of the Secondary Market in Web3 Project Development: From Liquidity to Valuation

In the modern Web3 ecosystem, the secondary market is gaining ever more importance. It acts not only as a platform for buying and selling tokens but also as a tool that promotes healthy project development. Let's look in more detail at how the secondary market can benefit Web3 projects and what advantages it can offer them.

Firstly, the secondary market provides an important aspect of any project - the liquidity of tokens. This means that token holders have the ability to freely buy and sell them at their discretion, which in turn promotes a healthy token economy within the project.

Secondly, thanks to the secondary market, a project's tokens become accessible to a wider circle of participants. This increases the diversity and involvement of project participants, which in turn promotes its development and growth.

In addition, the secondary market serves as a valuation tool for projects. The price of a token on the secondary market reflects its real market value, based on the principle of supply and demand. Thus, it can serve as an important indicator of a project's success and stability.

But at the same time, it's not easy for a web3 startup founder to navigate the secondary market of token deals. There are plenty of things that will cause your headache if you enter the secondary market with early investors:

- 👎 Finding a suitable investor in place of the departing one can be challenging: It is not always easy to find an investor who perfectly matches the vision and long-term goals of your project.

- 👎 Conducting transactions and re-signing contracts can be a headache: The administrative aspects of processing transactions, re-signing contracts, and managing documentation can be quite burdensome.

- 👎 An army of unqualified OTC agents takes up time: Time is a valuable asset in any project. Dealing with a multitude of unqualified OTC agents can take up much of your time.

- 👎 Lengthy search for liquidity and poor quality of service: A lot of time can be spent in search of liquidity, and poor service quality can exacerbate this condition.

- 👎 Unqualified investors ("retail investors") and their impact on the project: Investors who do not belong to "smart money" can fragment your assets, attracting more "empty" participants to the project who may dump their position at the unlocking stage, as they are not "strong holders".

In addition to this, there are fewer benefits from such transactions, and the results of such deals cannot be brought into the public domain.

Token Price Management can also cause your headache:

- ⚠️ Early sell-off impact: Early investors selling their tokens after unlocking can cause a significant dip in the price.

- ⚠️ Community panic sell: When massive sell begin, the community might freak out and start dumping, exacerbating the situation.

- ⚠️ Maintaining liquidity across platforms: This can be a labor-intensive process, demanding significant resources and leading to high market management costs (market making becomes too expensive).

- ⚠️ Unprofessional MM actions: Market management can often be geared towards achieving personal objectives, potentially damaging the token price.

These issues can result in extra expenses, time loss, decreased profitability, and lower investment attractiveness of your web3 project.

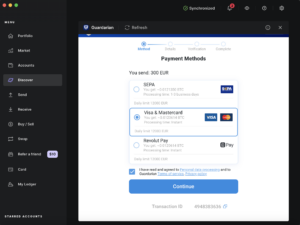

MarsBase: DeFi secondary market for all types of illiquid assets in web3 👌

Marsbase platform offers powerful tools and services that will help your web3 project effectively manage liquidity issues, investment portfolio management, and more.

Let's look more closely at the specific opportunities that open up for your project when collaborating with Marsbase:

- A full spectrum of liquidity management services for SAFT / SAFE, allowing the project to remain flexible and adapt to changing market conditions.

- The opportunity to strengthen your VC board, even if the funding round is already closed. This gives the project the ability to redistribute allocations among funds, enhancing its investment potential.

- The ability to sell team options and tokens & monetize your assets.

- Revenue from commissions from partners' deals. Thanks to our referral program.

- More flexible market-making (MM) opportunities using the OTC desk, including the ability to set up Buy/Sell walls.

- Investor management and KYC/KYB execution services, significantly reducing the workload on the project team.

- Increasing the project's VC score, as our platform reduces risks with flexible exit terms.

- Access to MarsBase partner services and products on favorable terms, helping projects conserve resources and increase their efficiency.

Marsbase is more than just a DeFi OTC desk. It's a decentralized platform designed for trading instruments such as SAFT/SAFE, and low liquidity tokens. We serve a wide range of clients, including investors, Web3 project founders, as well as stake and allocation holders.

In our world where flexibility and adaptability play a key role, Marsbase provides investors and asset owners with the opportunity to safely and gradually liquidate their assets at any stage. This adds investment attractiveness to every project and increases flexibility in investors' strategies.

Marsbase is a secondary market for every Web3 project, providing a decentralized, reliable, and flexible platform for trading digital assets.

If you are looking for the best solutions for managing liquidity, maintaining token value, and utilizing the full potential of the secondary market, contact the Marsbase team to discuss how they enhance the results of your project 👇

Telegram: @pashter | Book a call

Read also:

Web3 Startup Valuation: Key Metrics for Founders

Dive deep into the core metrics to value your Web3 startup. From DeFi to Layer 1-2s & P2E, discover how each metric impacts valuation in web3.

Top 20 Active Web3 VCs, Investing in 2023 Bear Market

The crypto winter is still there, but there are active venture capital firms that invest in early-stage crypto and web3 startups and deploy capital

Top 10 DeFi and Web3 infrastructure startups Revolutionizing the Industry in Q1 2023

Even in a bear market, DeFi and Web3 infrastructure sectors continue to attract significant VC interest, proving their resilience and potential.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://blog.innmind.com/secondary-markets-for-web3-projects/

- :is

- :not

- :where

- $UP

- 10

- 20

- 2023

- 28

- 36

- a

- ability

- accessible

- achieving

- across

- active

- acts

- adapt

- addition

- Adds

- administrative

- advantages

- affect

- After

- agents

- agreements

- All

- allocation

- allocations

- Allowing

- already

- also

- always

- among

- amounts

- an

- and

- Animoca

- any

- ARE

- Army

- AS

- aspect

- aspects

- asset

- Assets

- At

- attract

- attracting

- based

- BE

- Bear

- Bear Market

- become

- becomes

- begin

- benefit

- benefits

- BEST

- Big

- bought

- brought

- but

- buy

- Buying

- by

- CAN

- cannot

- capital

- Cause

- CEX

- challenging

- changing

- Circle

- clients

- closed

- closely

- collaborating

- come

- community

- Companies

- condition

- conditions

- ConsenSys

- contact

- continue

- contracts

- Core

- Costs

- covers

- crucial

- crypto

- Crypto Winter

- damaging

- deal

- dealing

- Deals

- decentralized

- decentralized platform

- deep

- DeFi

- Demand

- demanding

- deploy

- designed

- desk

- detail

- Development

- digital

- Digital Assets

- Dip

- directly

- discover

- discretion

- discuss

- Diversity

- do

- documentation

- documents

- domain

- done

- dump

- each

- Early

- early stage

- easy

- economy

- ecosystem

- effectively

- efficiency

- enhance

- enhancing

- Enter

- equity

- Ether (ETH)

- Even

- EVER

- Every

- exchange

- Exchanges

- execution

- Exit

- expenses

- expensive

- extra

- favorable

- fewer

- financial

- Financial Instruments

- Find

- firms

- Flexibility

- flexible

- following

- For

- founder

- founders

- from

- Fuel

- full

- full spectrum

- funding

- Funding Round

- funds

- future

- gaining

- geared

- Give

- gives

- Giving

- Go

- Goals

- gradually

- Growth

- happen

- Hard

- Have

- healthy

- help

- helping

- High

- hold

- holders

- hosts

- How

- However

- HTTPS

- if

- Impact

- Impacts

- importance

- important

- important aspect

- in

- include

- Including

- Increase

- Increases

- Indicator

- industry

- Infrastructure

- instruments

- interest

- into

- Invest

- investing

- investment

- investment portfolio

- investor

- Investors

- involvement

- Issued

- issues

- issuing

- IT

- ITS

- Job

- just

- Keep

- Key

- layer

- leading

- liquidate

- Liquidity

- long-term

- Look

- looking

- loss

- Lot

- Low

- lower

- maintaining

- make

- Makers

- Making

- manage

- management

- managing

- many

- Market

- market conditions

- market makers

- market value

- market-making

- Markets

- massive

- May..

- mean

- means

- metric

- Metrics

- might

- Modern

- monetize

- money

- more

- much

- multitude

- Navigate

- numerous

- objectives

- of

- offer

- offering

- Offers

- often

- on

- ONE

- only

- open

- opportunities

- Opportunity

- Options

- or

- OTC

- Other

- Others

- our

- out

- owners

- P2E

- Panic

- participants

- particularly

- partners

- perfectly

- personal

- Place

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Play

- plays

- Plenty

- poor

- portfolio

- portfolio management

- position

- possible

- potential

- potentially

- powerful

- price

- primary

- principle

- process

- processing

- profitability

- Program

- project

- projects

- promotes

- protecting

- provides

- providing

- public

- public offering

- Q1

- quality

- range

- real

- reduces

- reducing

- Referral

- referral program

- reflects

- reliable

- remain

- represent

- resell

- resilience

- Resources

- result

- Results

- retail

- Retail Investors

- Revolutionizing

- rights

- Ripple

- risks

- Role

- round

- s

- safe

- safely

- SAFTs

- sale

- same

- scroll

- Search

- secondary

- Secondary Market

- Secondary Markets

- Sectors

- Securities

- segment

- sell

- sell-off

- Selling

- serve

- serves

- service

- Services

- set

- several

- Shares

- Short

- significant

- significantly

- Simple

- situation

- slippage

- smart

- Solutions

- specific

- Spectrum

- spent

- Stability

- Stage

- stake

- start

- startup

- Startups

- Still

- Stocks

- strategies

- strong

- success

- such

- suitable

- supply

- Supply and Demand

- Take

- takes

- Task

- team

- terms

- than

- thanks

- that

- The

- The Future

- their

- Them

- There.

- These

- they

- things

- this

- Thus

- time

- to

- token

- Token Economy

- token holders

- Token Value

- Tokens

- too

- tool

- tools

- towards

- trade

- traded

- Trading

- Transactions

- TURN

- types

- unlike

- unlocking

- unlocks

- unqualified

- using

- usually

- Utilizing

- Valuable

- Valuation

- value

- VC

- VCs

- venture

- venture capital

- venture capital Firms

- via

- vision

- Way..

- we

- Web3

- Web3 Ecosystem

- web3 project

- WELL

- What

- What is

- when

- which

- WHO

- why

- wide

- Wide range

- wider

- will

- Winter

- with

- within

- without

- world

- would

- you

- Your

- zephyrnet

- zero