By Bart Stephens, Ryan Sproule, and Yuan Han Li

You have an amazing idea for a new cryptoeconomic network/protocol—whether an L1, oracle, bridge, data storage protocols, or something else—after building it, how would you go about bootstrapping it? Well, one of the first things you are likely to do is to try to find a robust and decentralized set of validators to stake your token and secure your protocol. However, thus far, doing this has been a challenging and expensive endeavor for builders. One reason for this is that the capital outlay required to do this is extremely expensive—put differently, the cost of capital for bootstrapping these new networks is incredibly high.

Cryptoeconomic networks use cryptography and economic incentives/penalties to motivate a decentralized set of validators and nodes to act in the interest of the network. Proper economic incentives generally require these validators and nodes to “stake,” or post collateral denominated in the network’s native token to earn token rewards. Any misbehavior by a validator or node operator, therefore, comes with the threat of economic impairment through the loss of collateral (slashing). However, given that native tokens of new networks may exhibit higher price volatility, the amount of rewards (via yield or inflation) demanded by validators and nodes to participate is commensurately high.

This is a problem that Sreeram Kannan has experienced first hand. Sreeram’s background is as a professor specializing in information theory and P2P systems—specifically focusing on maximizing throughput and minimizing latency in P2P systems. Thus, after falling down the crypto rabbit hole in 2018 when a colleague of his introduced him to Bitcoin, it was natural that Sreeram quickly had a variety of ideas on how existing cryptoeconomic networks, such as Ethereum, can be improved. However, Sreeram also quickly realized that implementing any of his many ideas would require either going through the lengthy EIP process, or building an entirely new cryptoeconomic network, just to experiment with a minor upgrade! This quickly dissuaded him from seriously pursuing any of his ideas—that is, until he dreamed up EigenLayer.

EigenLayer offers a solution to this dilemma through its core innovation of re-staking. As the term suggests, re-staking allows ETH that is already securing the Ethereum network to be reused into securing new cryptoeconomic networks. Since the validator’s collateral is denominated in Ether, the capital outlay required to incentivize, attract, and retain a decentralized set of high-quality validators is lowered in turn.

As an analogy, imagine that you invest your time and resources into a new infrastructure project in your local community. All participants in this project are required to put up collateral in either 1) CommunityBucks, a potentially volatile, speculative currency that exhibits a perfect correlation to the success of the overall project, or 2) USD. Naturally, those putting up USD as collateral will likely demand a lower yield than those electing to put up CommunityBucks, given its higher probability of capital impairment. In the world of blockchain technology and cryptocurrency, Ether is the equivalent of the lower risk option in this analogy.

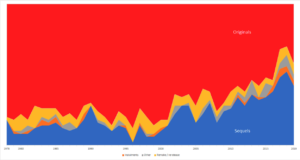

Further, these new EigenLayer-enabled cryptoeconomic networks are drawing from the Ethereum validator set, perhaps the most diverse and decentralized validator set globally. EigenLayer therefore not only drastically reduces the cost of capital for bootstrapping new cryptoeconomic networks, it also makes it easier to decentralize (and potentially propels their adoption) since Ethereum has more validators than any other network.

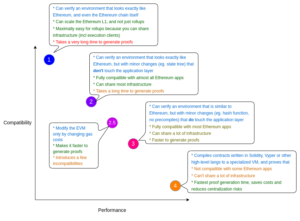

While the types of cryptoeconomic protocols that are suitable to be built on EigenLayer are extremely broad and span everything from middleware to brand new blockchains there are a few that we think are particularly suitable and would be excited to see. These include things like hyperscale data availability layers, off-chain ZKP verification protocols, protocols augmenting Ethereum’s censorship resistance, novel oracle mechanisms, cross-chain bridges/messaging protocols, decentralized sequencing protocols, as well as completely novel protocols we cannot even begin to imagine.

Innovations that lowered the cost of capital have made it easier for people to start new ventures and enterprises; we have seen this time and time again throughout history with everything from the invention of the stock market, limited liability laws, and securitization to crowdfunding. EigenLayer is no different, and represents a paradigm shift that makes it easier for visionaries to start new cryptoeconomic networks. We could not be more excited about the wave of innovation EigenLayer is sure to unleash.

The views expressed in each blog post may be the personal views of each author and do not necessarily reflect the views of Blockchain Capital and its affiliates. Neither Blockchain Capital nor the author guarantees the accuracy, adequacy or completeness of information provided in each blog post. No representation or warranty, express or implied, is made or given by or on behalf of Blockchain Capital, the author or any other person as to the accuracy and completeness or fairness of the information contained in any blog post and no responsibility or liability is accepted for any such information. Nothing contained in each blog post constitutes investment, regulatory, legal, compliance or tax or other advice nor is it to be relied on in making an investment decision. Blog posts should not be viewed as current or past recommendations or solicitations of an offer to buy or sell any securities or to adopt any investment strategy. The blog posts may contain projections or other forward-looking statements, which are based on beliefs, assumptions and expectations that may change as a result of many possible events or factors. If a change occurs, actual results may vary materially from those expressed in the forward-looking statements. All forward-looking statements speak only as of the date such statements are made, and neither Blockchain Capital nor each author assumes any duty to update such statements except as required by law. To the extent that any documents, presentations or other materials produced, published or otherwise distributed by Blockchain Capital are referenced in any blog post, such materials should be read with careful attention to any disclaimers provided therein.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://blockchain.capital/the-next-frontier-in-crypto-eigenlayers-vision-for-a-lower-cost-of-capital/

- :is

- $UP

- 1

- 2018

- a

- About

- accuracy

- Act

- adequacy

- adopt

- Adoption

- advice

- affiliates

- After

- All

- allows

- already

- amazing

- amount

- and

- ARE

- AS

- attention

- author

- availability

- background

- based

- BE

- begin

- Bitcoin

- blockchain

- Blockchain Capital

- blockchain technology

- blockchains

- Blog

- Blog Posts

- brand

- Brand New

- BRIDGE

- broad

- builders

- Building

- built

- buy

- by

- CAN

- cannot

- capital

- careful

- Censorship

- challenging

- change

- Collateral

- colleague

- community

- completely

- compliance

- Core

- Correlation

- Cost

- could

- Cross-Chain

- Crowdfunding

- crypto

- cryptocurrency

- cryptography

- Currency

- Current

- data

- data storage

- Date

- decentralize

- decentralized

- decision

- Demand

- demanded

- Denominated

- different

- distributed

- diverse

- documents

- doing

- down

- drastically

- drawing

- each

- earn

- easier

- Economic

- EIP

- either

- enterprises

- entirely

- Equivalent

- ETH

- Ether

- ethereum

- ethereum network

- Ethereum's

- Even

- events

- everything

- Except

- excited

- exhibit

- exhibits

- existing

- expectations

- expensive

- experienced

- experiment

- express

- expressed

- extremely

- factors

- fairness

- Falling

- few

- Find

- First

- first hand

- focusing

- For

- forward-looking

- from

- Frontier

- generally

- given

- Globally

- Go

- going

- guarantees

- hand

- Have

- High

- high-quality

- higher

- history

- Hole

- How

- However

- HTTPS

- idea

- ideas

- impairment

- implementing

- implied

- improved

- in

- Incentives

- incentivize

- include

- incredibly

- inflation

- information

- Infrastructure

- Innovation

- interest

- introduced

- Invention

- Invest

- investment

- Investment strategy

- IT

- ITS

- Latency

- Law

- Laws

- Legal

- liability

- like

- likely

- Limited

- local

- loss

- made

- MAKES

- Making

- many

- Market

- materially

- materials

- minimizing

- minor

- more

- most

- native

- Natural

- necessarily

- Neither

- network

- networks

- New

- next

- node

- Node operator

- nodes

- novel

- of

- offer

- Offers

- on

- ONE

- operator

- Option

- oracle

- Other

- otherwise

- overall

- p2p

- paradigm

- participants

- participate

- particularly

- past

- People

- perfect

- perhaps

- person

- personal

- plato

- Plato Data Intelligence

- PlatoData

- possible

- Post

- Posts

- potentially

- Presentations

- price

- probability

- Problem

- process

- Produced

- Professor

- project

- projections

- proper

- protocol

- protocols

- provided

- published

- put

- Putting

- quickly

- Rabbit

- Read

- realized

- reason

- recommendations

- reduces

- reflect

- regulatory

- representation

- represents

- require

- required

- Resources

- responsibility

- result

- Results

- retain

- Rewards

- Risk

- robust

- secure

- securing

- Securities

- securitization

- sell

- sequencing

- set

- shift

- should

- since

- slashing

- solution

- something

- span

- speak

- specializing

- stake

- start

- statements

- stock

- stock market

- storage

- Strategy

- success

- such

- Suggests

- suitable

- tax

- Technology

- that

- The

- The Capital

- the information

- the world

- their

- therefore

- therein

- These

- things

- threat

- Through

- throughout

- throughput

- time

- to

- token

- Tokens

- TURN

- types

- unleash

- Update

- USD

- use

- Validator

- validators

- variety

- Ventures

- Verification

- via

- views

- vision

- visionaries

- volatile

- Volatility

- Wave

- WELL

- which

- will

- with

- world

- would

- Yield

- Your

- youtube

- zephyrnet