This eighteen and twenty-two year old are on track to reach financial freedom by the age of thirty. And if you think that you can’t make big money moves because you don’t have the experience, resources, or income to build wealth, think again. These two young adults are on the path to making millions in their lifetime, and if you’re in your late teens or twenties or have children or grandchildren who are, THIS is the episode to watch.

First, we talk to Gloria Stonelake, an eighteen-year-old who runs a social media marketing agency on track to bring in six figures in income a year. She’s still technically a high school student but spends almost all her time working on her business, learning leadership, and getting leads for her clients. She ditched the traditional route of getting a diploma, a degree, and THEN a job and skipped right to the money-making part. She has some incredible advice for ANYONE who wants to start their own business, no matter your age!

Next, Ben Carver joins us to talk about his high school house-flipping side hustle, how he became a real estate agent before getting his college degree, and the newest house hack he’s set to buy at just twenty-two years old! By thirty, both Ben and Gloria should be financially free, and if you want to hit FIRE in your 30s, 40s, 50s, or 60s, these wunderkinds are two to watch!

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Mindy:

Today’s episode is about the power of starting young, of exploiting the unique circumstances you have available to you specifically. It’s about taking advantage of starting with a safety net. You are going to be inspired and amazed by Gloria and Ben, two young people who are making massive progress so early in life, and it might just make you think about the way that you approach financial freedom for yourself.

Scott:

Yeah. There’s something to be said about the almost unfair advantage on the wealth-building journey that those who start at 16, 17, or 18 years old seem to have. But while it’s always best to start at 18 years old, there’s nothing stopping you from beginning or accelerating the journey to financial freedom today, and learning from the examples of these two wonderful role models.

Mindy:

As you listen to today’s episode, think about the young people in your life and who might benefit from listening to these stories. Then share this episode with them.

All right. Welcome, my dear listeners, to the BiggerPockets Money podcast where we interview Gloria Stonelake and Ben Carver from Dan Sheeks’ online community, SheeksFreaks. Dan Sheeks is the author of a book called First to a Million, and SheeksFreaks is dedicated to helping young people learn financial management skills, start investing in real estate, and pursue early financial independence. Today we talk to Gloria and Ben about how they started their individual paths to financial independence at such young ages, and what their financial futures hold.

Hello, hello, hello. My name is Mindy Jensen, and with me as always is, also started his FI journey at a young age co-host, Scott Trench.

Scott:

Thanks, Mindy. Great to be here, with my crushed her journey to financial freedom in 1,500 days co-host, Mindy.

Mindy:

Scott and I are here to make financial independence less scary, less just for somebody else, to introduce you to every money story because we truly believe financial freedom is attainable for everyone, no matter when or where you are starting.

Scott:

That’s right. Whether you want to retire early and travel the world, go on to make big-time investments and assets like real estate or start your own business, whether you’re 16 or 60, we’ll help you reach your financial goals and get money out of the way so you can launch yourself towards your dreams.

Mindy:

Scott, I am so excited to bring this episode to our listeners. So without further ado, let’s bring in Gloria. Gloria is the founder of a social media marketing agency. At just 18, she’s been able to grow her business to an annual six-figure revenue, all while still being a full-time student. Gloria, welcome to the BiggerPockets Money podcast. I am so excited to talk to you today.

Gloria:

Thank you for having me.

Mindy:

This is going to be a great story. I was chatting with Gloria right before we started recording, and I can’t wait to share it with our listeners today, Scott. Gloria, let’s jump right in. Can you give us a little bit about your background and your business?

Gloria:

Yes. So my name is Gloria Stonelake. I am from right around Minneapolis, Minnesota. I am currently still in high school. I’m a senior, technically, in high school still, but I do an online college thing on Saturdays. So I don’t attend high school so I can focus on my business. I started my social media marketing agency about over a year ago, maybe 14 months ago, and I have been scaling it and learning sales and learning marketing and learning leadership ever since.

Mindy:

And what is social media marketing?

Gloria:

Social media marketing, I mean, there’s so many different aspects to it. For me and what I do with my clients is I just run ads, whether it’s on Facebook, whether it’s on TikTok, Instagram, to generate more leads and then appointments and then clients for my clients. But I mean, I’ve tried short-form content before, but really what stuck with me and it makes more sense for me and my company is Facebook, Instagram, and TikTok ads.

Scott:

And so how did you get into this business? What’s your background that led you to start this and get going?

Gloria:

Yeah, yeah. So I was an antsy teenager. I was antsy. I’m like, “I need to start something. I need to do something with my energy.” Entrepreneur at heart, of course. So I’m like, “I need to do something.” I scrolled on YouTube for a while, found a bunch of videos about social media marketing and how I can make money as a teenager with my own business. And I’m like, “Heck yeah, this is amazing.”

So I binged videos for a while, for a couple months there, and then I finally started my agency September, October of 2022. And then that’s kind of how I got into it. I found a coaching program, a couple along the way, that’s taught me a lot about running a business and how to actually run a business, especially when it comes to social media marketing. So that’s how I got in here.

Mindy:

And who is your client base?

Gloria:

Yeah. So I help mortgage loan officers and brokers all around the United States. So, really, anyone, I help them find purchase business, primarily purchase business, sometimes refinance, depending on the market. But that’s who I help.

Scott:

You said $100,000 in revenue, or six figures in revenue, sorry. What’s the profit margin on this business? How do we understand the take-home for this?

Gloria:

Yeah. So that’s a toughie. And to clarify, I haven’t hit $100,000. It’s six-figure run rate so far. So my highest month in revenue so far was about $16K. And that’s a tough question, because my parents are like, “Gloria, you should be taking more home. You should be keeping more.” But I’m like, “Mom, I want to reinvest back in the business.” So my profit margin’s about, roughly, I would say 50 to 70%. The rest is take-home for me, but I want to reinvest that into overhead, put that in more ads for my own company to reinvest and build, because I’m 18. I just turned 18. Why do I need so much cash in the bank? Why do I need that? Why not just reinvest in my education, my business, who I am, becoming a better person in general, so I can acquire those skills to build the businesses.

Scott:

So you made $16,000 in a month, and could bring home 50 to 70% of that, is what I just heard there. Is that right?

Gloria:

Yeah, that’s right.

Scott:

And what do you invest it in? What are these investments you’re making in yourself or education? Is this education, is it more staff? What are you putting that money to?

Gloria:

That cash, a lot is going into overhead. So a lot of that is going into the Facebook ads I run for my own company, and a lot of the education. Some of the cash I allocate towards my education is going towards a coaching program I joined. It’s a coaching mentorship program for agency owners specifically. And it’s teaching me about money, it’s teaching me about how to allocate funds, it’s giving me so, so many friends. So I’m allocating that cash towards myself, growing as a person, and finding connections, especially in this lonely place of entrepreneurship, especially as a teenager.

Scott:

And so can you give us an idea of what do you spend to acquire a customer? What are those customers worth to you, if you’re putting all this money into Facebook ads?

Gloria:

Yeah. So I spend about 50 to $100 a day in Facebook ads. And what those stats look like is I get maybe three to five appointments a day. So my booked appointment, on average, is about maybe 20 to $30 per booked appointment. So what that looks like more specifically … I’m working on my close rate as well. So I’m trying to learn sales better. I’m not amazing at sales right now. I’m allocating some funds towards coaching as well, private one-on-one sales coaching, to get stuff together to increase my close rate, but that’s kind of what it looks like.

Scott:

And then one last question here before we go back to your story here, on this. You’re a full-time student. So how much time are you spending?

Gloria:

With school, I do school only on Saturday. So all my school is completely online, because I enrolled in a local college to finish my high school. So it’s like a dual enrollment type of thing. So I do my school all on Saturdays when I don’t typically take sales calls, Saturdays and Sundays. And then throughout my whole week, all day, every day, I am SACA-ing, which is setting and closing appointments, purely sales and client acquisition, to scale my business. And then I like to section off a few hours at the end of the day to focus primarily just on service delivery, adjusting ads, doing all those technical things.

Mindy:

I’m going to come in here as a mom and say, on the one hand, I think this is fan-flipping-tastic that you already have a job in a career that you’re clearly excited about and knowledgeable about. And also I’m like, “Oh, you’re only doing school on Saturdays. Shouldn’t you be spending more time on your schoolwork?” But also, why? Why should you be spending more time on your schoolwork? So that you could get a job? I mean, what does high school prepare you for? It prepares you for college. Do you want to go to college, or do you need to go to college? Here’s a little hint. Social media isn’t going away, so this job is only going to get bigger. We’re in the beginning stages of social media marketing. I am so excited for your experiences.

I call Scott a kid on this show a lot, not out of disrespect, just because he’s so much younger than me and you’re even younger than Scott. So I’m looking at you and I’m listening to your story and I’m thinking, “Holy cow, she’s so smart and poised, and she’s got answers for …” Scott can be a little intense. Well, what about this? What about this? And you’re like, “Here’s an answer.”

Scott:

Mindy, she’s 15 years younger than me.

Mindy:

I’m so delighted by this whole story. And I want to know what your parents did right to raise you. What was your upbringing like, when it came to money and finances? And did your parents talk about this all the time? Because I am bombarding my kids with finances, and they’re always like, “We don’t care, Mom.”

Gloria:

Yeah, yeah. That’s a great question. Actually, no. Not at all, actually. My parents, they taught me … Growing up, they’re like, “Gloria, don’t talk about money. Don’t talk about money with your friends. We’ll not even talk about money in front of you. We just are not going to talk about money at all.” And I’m like, “Okay, interesting.” I’ve always had a spark or a drive to become successful. I knew. I knew I didn’t want to nine-to-five it for the rest of my life. I knew that. But no, I wasn’t surrounded by a lot of money. We’re middle class here. I wasn’t surrounded by a lot of money. I just have a drive, a drive to succeed, a drive to do something different, a drive to build something.

Mindy:

So then what made you want to start your own business? I mean the drive, yes, but if they’re not talking about money, do your parents have traditional jobs where they work for other people? Or are they entrepreneurs as well?

Gloria:

They work nine-to-five jobs. And I feel like that motivation came from seeing that. And that’s totally okay that you work a nine-to-five job. That’s totally okay. Just seeing that in general, I’m like, “Maybe that’s not where I want to be.” Maybe that’s not where I want to be. Respect, but I don’t want to do that. I want time, location, financial freedom, and that’s not going to get me there.

Mindy:

Where did you come up with the idea of financial freedom? Or where did you hear about this? Not come up with it. I would love to say, “Gloria invented financial freedom and we’re talking to her today,” but this isn’t something that’s really part of the vernacular in middle school and high school.

Gloria:

Yeah. No, it’s not. It’s not spoken about at all. I don’t want to call myself a conspiracy theorist, but I’d say a realist. I’m always one for figuring out what’s not being taught? What’s behind the curtains with all of this? So in eighth grade, I did my own research. I decided I’m going to read Rich Dad Poor Dad, going to do a bunch of research, figure out what is the real way, how do I get wealthy? How do I start something, how do I do something, where do I allocate this energy? So it started with Rich Dad Poor Dad, of course.

And then shortly after, I found SheeksFreaks. Shout out to Dan. He’s awesome. SheeksFreaks, as well. That community is amazing. He found me on BiggerPockets, because I posted something on BiggerPockets talking about wanting to work for a realtor, something gets experience. And that’s kind of where it all started. It all unfolded with reading a lot about personal finance from Robert Kiyosaki to Think and Grow Rich to all of these iconic books when it comes to finances and wealth. I found communities like the agency community I’m in right now, and then SheeksFreaks. And it all came together with the community, finding people that are like me, that have the drive like me.

Mindy:

I was going to ask about the mentorship and the training. And I look back to my 18-year-old self, and I would not have paid anybody to teach me anything, because I knew everything when I was 18. What led you to look into training and connecting with people to help with the business coaching?

Gloria:

The closest five people to you are a reflection of yourself. No hate to anyone that I’m close to, or close to here at home, but I wanted to be surrounded by people, whether it’s online, in person, whatever, by people that actually think like me. So it kind of reflects. Does that make sense?

Scott:

You can tell I’m just super interested in your business and the details of it with this. So with your permission, I’d love to go back to talking more about it. And I’d love to just pop out to a more fundamental question of what is the objective of your business? How do you explain it to new people that you’re talking to, new clients?

Gloria:

Yeah, of course. So I explain it as seeing a return on investment. Why invest in marketing if you’re not going to get a return on investment? So what I guarantee is loan applications, because that’s what I can control, and that’s what I can send them with my marketing. So I structure this whole thing. Yes, I tie in the Facebook ads. Yes, I tie in the advertising that I do that’s custom to them, whatever works, but I also help them see the bigger vision once you get something like this under your belt. You can save time, you can save energy, you can save money. You’re losing more money than you actually are without something like this. So that’s how I frame it, because it’s real and it’s true for most of the people I talk to.

Mindy:

Yeah. So you’ve mentioned that you have a couple of people that work with you. It’s not just you. You’ve got a team in place?

Gloria:

I do. Since two days ago, I had two people working under me, a call center associate and a cold caller that’s actually cold calling officers underneath me to get me more clients through that direction. I actually let go of the cold caller recently, and now I’m just with the call center associate, and putting more funds towards my B2B ads, paid ads, to kind of scale that direction.

Mindy:

How old are these employees of yours? I’m just coming at this from a position of … Most people aren’t going to be younger than you working for you. And some people won’t care that their boss is younger than them, but some people might have a real big problem with this. How do you assert yourself with employees that are older than you?

Gloria:

Yeah. Over Zoom, people will say I’m 25. People think I’m 30. People think I’m a millennial. I don’t correct them. I don’t say anything. Why people say that is because of how I carry myself over Zoom, and how I’m acting versus how I’m not acting. So if I am very to the point, if I am confident enough, I am confident about what I’m saying, even, and hold myself with confidence, people aren’t going to think twice. It doesn’t matter. It doesn’t matter how old you are. My employees, or my employee, never asked that question once, because I always gave her direction. I’m giving direction. So I’m a leader. I lead them. So that question has never even occurred to them, because I’m not even radiating any youthful kid energy. I’m radiating a business owner. I’m radiating someone that’s leading a team. So there’s a big difference there.

Mindy:

I love that answer. Oh my god, I love that answer. And I am asking because I happen to know how old you are. Okay. Well, on the other side, do you have any issue with clients? Or is it kind of the same thing? On Zoom, they don’t question you because you’re not saying, “Hi, I’m 18. I want to work for you.” I wouldn’t be announcing that either, frankly.

Gloria:

Age is just a number. Age is just a number, in my book. My parents are still like, “Gloria, you’re just 18. You’re just 17,” whatever they said, “calm down.” I’m like, “I don’t feel like age has anything to do with knowledge at all.” You can acquire as much knowledge as you want, how young you are. So age is nothing to me. It means nothing to me. What you’ve accomplished and what you’re accomplishing matters.

So with my clients, I’ve gotten people assuming that I’m 25, 30. I’ve gotten people saying I look like I’m 16. I don’t care, because in the end, if they find out how young I am, it’s a power. It’s a power, because Gen Z knows more about social media than any other generation out there. So I carry it as a superpower, and I’ve gotten respect. When people find out my age, it doesn’t matter to me because I get respect from that. People on these calls are telling me, “Gloria, I wish I was like you. Gloria, you remind me of myself back when I was 18.” I mean, I think that’s a superpower.

Mindy:

I think it’s a superpower too. I love that you are in such ownership of your … You’re like, “I happen to be this age. I don’t care. That doesn’t have anything to do with my qualifications.” And you’re absolutely right. If I was looking for a brain surgeon, I probably wouldn’t be looking in the 18 to 25 range. But if I’m looking for social media, I absolutely am looking in the 18 to 25 range, because that’s what you grew up with. I don’t know anything about social media, and I am totally fine with that. But if I need somebody to do that for me, I need somebody who understands it. And who understands it better than the people who literally grew up with it? What are some of the challenges that you have faced on your entrepreneurial path?

Gloria:

Taking action and getting uncomfortable. I feel like it’s hard. It’s hard at the beginning to get uncomfortable. It’s hard to pick up the phone and dial and talk to people. It’s hard. I grew up without amazing social skills. It’s hard to do things that make you uncomfortable, so the number one thing that was just a struggle to me was just talking to people, getting comfortable talking over the phone, and connecting with people. And sometimes I still have a problem with that, but I’m trying to shed that and move forward with that.

Something funny though, my old job, I used to work … Actually, before I started my agency, I worked at a restaurant, a local Chinese restaurant around where I live and I was on the phones. That was my first official job. I was on the phones at all times. So I can kind of allocate some of this communication, phone communication to that job. So kudos to that restaurant, because I probably wouldn’t be here right now if it weren’t for that, or it would take me a little bit longer.

Mindy:

I am a real estate agent, and I work with a few lenders. I have my favorite, of course. And it is very much a pick up the phone and make a phone call job. They do text, they do email. And I prefer having it written down because I want to be able to go back and see exactly what we said, as opposed to trying to remember the phone call that we had.

But in this industry, in the real estate industry, it’s all about relationships. And people want you to pick up the phone and call. So that’s awesome that you have that experience and that you’re working on flexing that muscle. I mean, honestly, what’s the worst that’s going to happen? They’re going to say, “No, I don’t want your services. Thank you so much,” and then they’re going to hang up. And that’s like … Okay, next. It’s not, oh, they hate me. No, they just don’t understand what you do.

Scott:

I imagine that the success you’ve had and the platform you’ve built is in some cases potentially isolating. This is not what other kids in high school are doing. How have you built community and managed relationships as a CEO and an entrepreneur here?

Gloria:

It’s complicated a little bit, because I’m still close with my friends that I grew up with, but I also have made so many new connections with other entrepreneurs around my age in these other different entrepreneurship groups. So I feel like I am allocating some of that energy over here to build these relationships, but also it’s still balanced. On either side, it’s still kind of the same.

There’s a little bit of distance with what I’m doing. I am at the level where I am thinking about business. I am thinking about my career and future, when maybe it’s not the case so much with people I used to hang out with so often. So I mean, there’s no disrespect at all. There’s nothing like that. Everyone grows at different paces, but it is hard. It’s still hard navigating this, but I mean, I’m coping. I’m learning with all of this, so that’s that.

Scott:

Awesome. And then last question here. I imagine in your situation, this puts some conflict into play about what should be next. Should you take a gap year between high school and college? Should you go to college at all? Just because you have this super profitable business, how are you thinking about those types of questions, and what’s your lean right now?

Gloria:

I’m not going to college. It’s not in the scope of where I’m looking to take things. No. No college for me. Sitting in a classroom is just not my forte. I like taking action. I’m actually technically in college right now for marketing. So I do college marketing on the side, and I run a marketing business over here. What they’re teaching over here with the college marketing, it’s not the same. It’s not what I’m seeing over here in the real world, the real business. So people say high school gets you ready for college, and college gets you ready for the real world. I don’t think so, because I am doing the real world right now and it’s not even similar to what I’m doing in class.

Mindy:

What is one piece of advice that you would tell someone like yourself, who’s young and wants to start off on their own financial freedom journey?

Gloria:

You have to get rid of the limited beliefs. We have to unscrew-up our mind. Once you understand how much power you actually have, what you can accomplish, it doesn’t matter how old you are. 15, 16, 17, 18, 19, 20. Doesn’t matter. Everyone has the power to take action, and taking action is learning and experiencing.

In this day and age, we have so much access to anything online, courses and everything. My question is if you want to become successful, if you’re just like, “I just want to make money, why are we going to college,” when we can find all of that information literally on YouTube University, I like to call it. I think self-belief, taking action, and acquiring those skill sets and putting that over just making a quick buck at the beginning, what’s the worst that can happen?

Mindy:

What is the worst that can happen? They’re just going to say, “No, thank you,” and hang up.

Scott:

I also want to call out one other thing here. You are basically skipping senior year of high school, essentially, with the part-time classes here, in order to start your business. What a great concept for aspiring entrepreneurs to at least think about in the back of their minds. This year for you is a free spin, right? You have rent and probably food paid for, because I think you’re living at home, is that right?

Gloria:

Yep. Yep. I am.

Scott:

So you get a free spin. If this hadn’t worked out, you go to college and continue along with your education and get a job like everybody else. Because it did work out, you have now a business that is worth probably multiples of the revenue that you have currently on the trajectory. You have a great income stream and a super promising trajectory here.

I think that’s a really powerful thing for parents and students that are thinking about entrepreneurship to consider. And you can even start it potentially in the summers and part-time at first, towards the end of sophomore, junior year if you’re really starting to plan around it, and think, “Hey, is there a way to de-risk this?” Even there, and actually make sure that there’s a momentum building before you decide to drop out of the traditional schooling system.

Gloria:

And to add to that, if you don’t mind, I feel like anyone can just start now. You can just start now. You don’t need to wait. You don’t need to wait, just start now. Take that first step. 99% of people don’t take that first step. So once you take that first step, you’re good to go and just sail. Cope.

Scott:

Well, Gloria, you are absolutely amazing. Thank you for sharing this story. I will wish you a lot of success. You don’t need it. The wish is there, because you are well on your way. You have got incredible command of your business here. Congratulations on what you built, and I can’t wait to see the enormous business that you build over the next couple of years here. Love the way you think about approaching business and life here, really have high respect for the total competency and command you have over it, and the learner attitude. So thank you so much for joining us today.

Gloria:

Yeah, thanks so much.

Mindy:

Before you go, Gloria, where can people find this lovely business?

Gloria:

Yeah. So they can email me at . And then they can find my website, fill out a survey to see if I can help them, loan officers, at glowmedia.us. And then if you’re interested in what I’m doing, I’m also building my personal brand. So my Instagram is Gloria Entrepreneur, and then my YouTube is also Gloria Entrepreneur, if you’re interested.

Mindy:

Awesome, Gloria. This has been so much fun. I had a great time talking to you. Thank you so much, and we will talk to you soon.

Gloria:

All right. Thanks so much.

Mindy:

Holy cats, Scott. I feel a little bit lazy after talking to Gloria. What an impressive young woman.

Scott:

I love the … Yeah, I’m not going to college. I would have been a little surprised if she was, in that situation. I mean, that was just absolutely amazing and impressive.

Mindy:

I am so excited for her future because it is … She might not know this song, Scott, but her future’s so bright, she’s got to wear shades. Do you know that song?

Scott:

Another pop culture reference goes way over my head. So please give me feedback as you always do, dear listeners, in the YouTube comments on a missed pop culture reference.

Mindy:

1987, Timbuk 3. The future’s so bright, I got to wear shades. Just looking at her, I need to put shades on. Her future is absolutely so bright, and I am so delighted to have her on the show today, and I am so delighted to be able to share her story with our listeners.

Scott:

All right. Now let’s talk to Ben.

Mindy:

Ben is a real estate agent and investor who got his start in the industry while still in high school. At age 22, Ben has been able to build robust savings and investment funds while slowly and strategically building out his real estate portfolio. Ben, welcome to the BiggerPockets Money podcast. I am so excited to talk to you today.

Benjamin:

Hi, thank you so much. I’m really honored to be here today.

Mindy:

Okay, Ben. I just said that you got started in high school. How did you get started in real estate in high school? What were you doing?

Benjamin:

During high school, my dad started doing investing in all sorts of stuff, stock market. He decided to do a flip with me one day, and so we went and flipped a property together. So real estate’s always kind of been a part of my life, but I started taking an active approach with it in high school.

Mindy:

Awesome. So let’s talk about your money history. Growing up, did your parents talk about money with you or did they kind of just ignore it?

Benjamin:

Money was never taboo, like it is in a lot of families, but I’ve definitely experienced both sides of the coin. So my parents, when they got married, before I was born, they were dirt poor. Dirt poor. By the time they had me, money was very, very tight for us, but it was something we talked about. They were never scared of it, they just didn’t have a lot of it.

And I watched as my family went from being definitely lower mid-class, not going out to eat, that kind of stuff, to eventually my dad starting his own business during the first part of high school. And eventually, money wasn’t really a problem for my family. We were able to travel and do all these fun things. So I had a time in my life where I held onto every dollar, and then I had another time in my life where I, alongside my family, learned that it’s okay to let go of money and not be cheap, and invest and all that kind of stuff.

Scott:

Has that informed, first of all, your relationship with money now? And then I’d love to hear about this first flip in high school.

Benjamin:

Yep. So I’m at a point with money right now where I’ve learned a lot about, like I said, letting go of money. I put most of it towards investments, and I’m just really focused on spending my time in the best possible way, whether that’s using money to free up time to spend time with my wife, or sacrificing a little bit of money to start and propel my business.

Scott:

Oh, I wanted to hear about that flip. So I love that mentality. Yeah. I want to hear about this … You flipped a house in high school. What was that like? Did you do it over the summer? Did you do it during the school year? What was your role? How did that come to pass, and what did that teach you?

Benjamin:

Yeah, it taught me a lot. We did it over the summer. We went through a wholesaler. It was a really great experience. We tried to rent it afterwards. We ended up just turning it into a flip because the renting part of it didn’t go well. We didn’t get a good property manager. It wasn’t just this amazing, perfect situation, but I learned a lot about the physical side of flipping. We worked with contractors and everything, but we also put in a lot of sweat equity, and that was some of the best memories that I have with my dad.

Mindy:

Why did your dad involve you in this flip? Had he done flips before, and you were interested and he wanted to bring you into it? Or was he just like, “Hey, you want to try this out?”

Benjamin:

That’s my dad. He’s the, hey, you want to try this out guy. So I didn’t grow up in a family where he just was affluent and knew all these things. I learned alongside him, and he was a good dad for teaching me what he knew, and learning along with me. So I remember when I was in middle school, we did this stock market game together, like a simulator. And that’s something we did together. And then once he started investing in syndications and stuff like that, he was teaching me what he was doing and letting me sit in on the Zoom calls and all that kind of stuff.

Mindy:

Okay. So you started investing in high school, and now that you’ve been out of high school for five minutes, what does your portfolio look like now?

Benjamin:

Yep. So my wife and I, we close on our house hack in two weeks now. So we’re really excited about that, here in the Raleigh area. But other than that, I’ve purely done stocks and REITs, stuff like that.

Mindy:

Okay. So this house hack is your first dive into real estate. What does it look like? Let’s run those numbers.

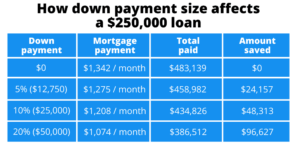

Benjamin:

Yep. So it’s a split-level here in the North Raleigh area. I got it for $362,000, once you adjust for seller paid closing costs. So definitely under our market average, for sure. It’s a single owner, 1982 or 1984. They’ve owned it the entire time. Old, sweet couple, just looking to move somewhere else to retire with family. So they definitely let us get it at a discount. It’s in complete original condition.

Scott:

You did your first flip in high school. You got married at 19, I understand. And you just had a generally earlier start than most people, I think, your age. I’d love to hear about those years in between the graduation of high school and today. What were you doing? Did you go to college? Did you try your hand at various business activities? What did that look like?

Benjamin:

Yeah. So I’m the real estate agent who didn’t need to go to college, but did anyways. About halfway into college, I realized I wanted to be a real estate agent, and by then it was like, all right, well, I might as well finish this thing up. So I got my degree in marketing. I learned a lot, honestly. And that’s where I found out that I like content and social media and I could actually use that to propel my real estate business, which is what I’m working on right now. I was married all throughout college. I worked all throughout college. I tested different side hustles, which is how I found out that I love being a real estate agent. That’s what I was doing.

Mindy:

So you just purchased your first house hack. Let’s talk a little bit more about this property. You bought it for $362. How many beds and bathrooms are in it? You said it was in original condition. But you bought it from the original owner, so I’m guessing that it’s well-kept, just well-kept 1984 condition.

Benjamin:

So I was walking a lot of properties. As an agent, I’m able to get in fast. And I knew from the moment I saw it that they loved the house, they took care of it. It was outdated as heck, but it was maintained. And that was really the important part. The one big thing that needed replaced was the HVAC. They had already replaced the roof, but we ran all those numbers before making the offer, and they listed it at $375. So we definitely got them to come down a bit, in a market where most people are still getting asking when they’re listing their properties. So it has three bedrooms, two bath. It is a split-level, but there is an easy opportunity to add a fourth bedroom, which is what we will be doing to the basement.

Mindy:

Nice. And you can rent out all three additional bedrooms once you add this fourth bedroom?

Benjamin:

So we have that option. We’re going to start off by renting the upstairs two bedrooms. And then once we move out, we’ll rent it basically like a duplex, an up-down duplex. But being married, we want our own space and everything. But if the numbers aren’t looking as good as we want them to be and we feel like we want to or need to, we can always rent that third bedroom, for sure.

Mindy:

Nice. And do you have any plans to rehab it?

Benjamin:

Yep. So the moment we close on this thing, we are going to send contractors in. We ourselves are going to be putting in sweat equity again. We’re going to be doing the LVP flooring, which is something I’ve done on a lot of homes. We’re going to be painting the thing. We’re actually going to be putting a kitchenette in the basement. We’re going to be tearing down some walls. But then we’re going to hire people to scrape off popcorn, put in the HVAC, that kind of stuff.

Scott:

You’re obviously living in a house hack here, and that’s going to help control your biggest expense. But what’s your mindset around the rest of your spending? Are you very frugal? You walked us through a journey that your family went under. Where are you at, personally, with regards to your mentality around spending?

Benjamin:

Yeah. I’m very frugal, and I’ve always been that way. When I was younger, I knew the importance of every dollar, and I just naturally saved up. I was able to save up a lot during high school and college because of that. But now that we’ve gotten to a certain point in our finances, we can relax a little bit. We spend money on dates and experiences, travel. But outside of that, both my wife and I thankfully are in agreement that it’s just not worth spending money to spend money. And so we’ve been able to save up quite a bit.

Scott:

And what does she do?

Benjamin:

So she coordinates a physical therapy office here in Raleigh.

Mindy:

You mentioned, “When we move out of the house hack.” What are your plans for when you move out? Are you actively looking for another property now? Do you have a timeline for that?

Benjamin:

Yep. My goal is to do one per year. So I think at the nine-month mark is when I would start actively looking for the next one. But of course, Mindy, I’m looking at properties all the time. So chances are I’ll see the house hack because I’m already on the MLS looking at it for other people.

Mindy:

I do the same thing. I’m also an agent. And every morning, I wake up, I have my coffee, and I go through all of the listings that came up for all of my clients every single morning, because they sent it to me and to my clients. And I’m like, “Oh, that could work. That could work.”

Benjamin:

That’s exactly how it happens.

Mindy:

So we met you through Dan Sheeks’ community, SheeksFreaks. How has the SheeksFreaks community helped you with your real estate investing?

Benjamin:

Yeah, so I was on their first phone call or their Zoom call four years ago. It’s hard to believe it’s been that long. And he found me through BiggerPockets. And Dan’s an amazing guy. If you guys haven’t read his book that they published through BiggerPockets, definitely go read that. First to a Million, great book. Little shameless plug there.

But this group is great. It’s a bunch of people like me. And when you’re our age, you don’t think that exists, to be honest. So back in high school, I didn’t have any friends that were interested in this kind of stuff, would understand this kind of stuff. And so this group opened up people, anywhere from ages 14 to 27 who have similar interests in business, entrepreneurship. Some are real estate agents, some make content, but everyone has that shared passion of reaching early financial freedom.

Scott:

Awesome. What’s the best piece of advice, or most useful connection you’ve made through that group?

Benjamin:

Two answers to that question. First of all, I’d say that being able to be on this podcast was a pretty great connection. But I’d also say that we get guest speakers a lot. We’ll usually have two guest speakers a month. And so, Scott, you’ve spoken on there. I think Mindy’s spoken on there too. Oh my goodness. Yeah. And we’ve heard from Brandon Turner as well. So we get a lot of really great, smart people on there, just sharing wisdom with young people, which is so cool.

Scott:

And so how would someone who wants to replicate the success you’ve had, and starting your career with such promise, having this first awesome investment almost under your belt and almost being closed on it, what advice would you give to somebody who wants to follow in your footsteps and also go on that journey?

Benjamin:

Biggest piece of advice is to take small daily steps. Before I started investing or started this business or anything like that, I mean, I took my first job at 14. I was scooping ice cream. That was the state minimum age. The moment I turned 14, I applied to the only place in town that would even hire a 14-year-old kid, because I looked like I was 10. And I was serving people ice cream. But I worked all throughout the end of middle school and high school and college. I put in all that work before I even started putting money into stocks or started going for a house hack.

So if you’re just starting out and you don’t have anything saved up, just take the small daily steps. Figure out how to live that frugal lifestyle or how to get your income up, and start learning and talking to people who have done what you want to do every single day. The connections alone will help get you to where you want to go, because I didn’t know anything when I joined SheeksFreaks four years ago, and same with BiggerPockets. Over those four years, I’ve been around people who have literally become millionaires, who have started businesses and gotten all sorts of properties.

Scott:

I was going to say, you started working at 14 and have had a number of jobs, experiences like the flip, those kinds of things. Can you give us an idea of the magnitude of what you were able to accumulate after graduating college?

Benjamin:

When I finished high school, I had $19,000. And yeah. I just saved every dollar I made, to be honest. I just didn’t have a desire to spend it, and I didn’t even know where to put it. And so once I entered college, it was 2020, the stock market crashed. And per the advice of my dad, who didn’t have any experience with investing in stocks, but all of a sudden he was interested in it, said, “Why not just throw your money in there?” And so I did. And you can call it dumb, you can call it luck, you can call it dumb luck, but I was able to grow that money substantially throughout college. And that definitely helped our financial position.

Scott:

Awesome. So hard work and good timing from an investment standpoint probably means you have ample for the down payment on this property, plus plenty of reserves, plus you’ve been accumulating after college. So you got an incredible start here in terms of your financial position, just less than a year after graduating college.

Benjamin:

Yeah. I never thought that I’d have this much at this age. I remember it was getting really, really close to being my 21st birthday. And then a week or two before I turned 21, we hit $100K. And I thought, “$100K by 20. That’s pretty awesome.” I didn’t even know that was possible. It is just crazy. It just happened really fast.

Mindy:

What is your 10-year plan, and your 10-year investing plan?

Benjamin:

I definitely want to accumulate at least eight house hacks. Running the numbers the way I have, I think eight house hacks would be more than enough to take care of our major living expenses and then some. And in that same amount of time, I don’t have a number, but I want to grow my real estate agent business. In 10 years, honestly, I’d love to be running a team myself and getting most of my leads through social media and other platforms like that.

Scott:

Have you made any mistakes so far? I mean, you’ve actually got four or five years of experience at this point, investing and working. Despite your young age, you’re relatively experienced in a lot of things. Any lessons learned or things you’d take back?

Benjamin:

Yeah. When my dad and I were investing in many different things, we were trying to diversify. And so we at one point, for fun, put our money into a robo-investing website that went to zero, and played around a little too much with Bitcoin. There was one point in 2021 where that $19,000 turned into $60,000, and I thought I’d made it. And I remember thinking, “This can’t last forever. I need to sell.”

And I think at that time, the market had even turned a little bit. And at that point I was watching it every day, which is dumb. You shouldn’t do that. You shouldn’t get emotionally attached to your investments, which I definitely did because my gosh, I have $60,000 and I’m 19. So I sold everything and then things kept going up, and then I ended up buying later at a higher price. Not that I need it, but I’d be even further ahead if I hadn’t acted emotionally. And that’s one thing that I definitely learned.

Scott:

Some people learn that lesson 30 years from your point, with a much larger dollar amount. So I think it’s great. What a great lesson there. And I think, yeah, that’s not going to hold you back very much at all, but thanks for sharing it. Where can people find out more about you if they want to follow your journey or potentially work with you as an agent?

Benjamin:

Sure. Yeah. So if you’re on any social media platform, it’ll be @itsbenjamincarver. On YouTube, the name of the channel is Living in Raleigh – Benjamin Carver.

Scott:

Thank you so much for coming on today and sharing your journey. Amazing what you’ve accomplished less than, what, eight months following graduation from college. A six-figure net worth at 21 years old, a house hack under your belt, a career that looks like it’s poised to take off. I can’t wait to see where things are going to go in the next couple of years for you, Ben.

Benjamin:

I really appreciate it. Thank you, Scott and Mindy.

Mindy:

Thank you, Ben, and we will talk to you soon.

Benjamin:

Awesome.

Scott:

All right. That was Ben. Mindy, what’d you think?

Mindy:

I thought that Ben had a very impressive story. I mean, you don’t just flip houses in high school without having drive behind you. You don’t become a real estate agent at age 22 without drive behind you. And that’s the underlying story behind Ben.

Scott:

I love Ben’s story in here. And look, Ben’s an example of … You don’t have to build a crazy business at 18. You can just do the very basics right. Study hard, get good grades, save your pennies, work a good job, be financially responsible, buy the house hack at 22. This guy’s got a six-figure net worth right now. No way, I’m calling it right now, is he not a millionaire by 30 if he continues on this trajectory, because of the compounding nature of his career trajectory and the investment decisions he’s making right now. So absolutely love to see it, and cannot wait to see where his career and investments go.

All right, Mindy. I got a question for you. What’s one piece of advice you’d give yourself in your teens or early 20s?

Mindy:

If I could go back in time a couple of years to my teens and 20s, I would have gotten my real estate license. I have had a license for 10 years, and I wish I would have had it for … Let’s see. I was a teenager 40 years ago, or 35 years ago. So I wish I would’ve gotten my license 35 years ago. How about you, Scott?

Scott:

I’m going to go with a complete opposite tact to everything we just talked about in today’s show. And I would’ve said in my early 20s, I would’ve lightened up a little bit, and I would’ve spent a little bit more. There were times when I was so focused on building wealth that … I still went, but I almost resented certain trips that cost a lot of money, for example, with them instead of just fully enjoying them as experiences that, now at 33, I’m not going to go back and have that same type of trip with friends and be that rambunctious, for example. So that’s what I would’ve done, is I would’ve said, “Look, I didn’t need quite the amount of wealth I have now at 33, and I would’ve traded some of that for a couple more of those adventures.” Still would’ve house hacked, still would’ve done all the basics right, but that would’ve been mine.

Mindy:

No, I completely relate to what you’re saying. And there are a lot of things that I gave up. I didn’t want to spend the money. And if you only have $100, you don’t spend 99 of it on a vacation. But there are things that I could have done that would not have had a negative impact on my financial future that I just said no to, simply because of the cost, I’d never even considered because of the cost. So I think that’s a good one too.

Scott:

We would love to hear the advice you would give yourself in your 20s. I think that’s a great way to frame it, because you’re not giving advice to other 20-year-olds who don’t want to hear your advice, frankly, but you’re giving advice to your own 20-year-old self. I would love to see it, and maybe we’ll inspire some folks to go and read that, and take it to heart if we post it into the BiggerPockets Money Facebook group. So let’s hear it. Let’s give some advice to your former 20-year-old self. And I would love to see what other people think.

Mindy:

That is facebook.com/groups/BPmoney. If you have not joined, please join. We would love to have you, and have you join the conversation. All right, Scott. That wraps up this episode of the BiggerPockets Money podcast. He, of course, is Scott Trench. I am Mindy Jensen, saying goodbye, moon eye.

Scott:

If you enjoyed today’s episode, please give us a five-star review on Spotify or Apple. And if you’re looking for even more money content, feel free to visit our YouTube channel at youtube.com/biggerpocketsmoney.

Mindy:

BiggerPockets Money was created by Mindy Jensen and Scott Trench, produced by Kailyn Bennett, editing by Exodus Media, copywriting by Nate Weintraub. Lastly, a big thank you to the BiggerPockets team for making this show possible.

Watch the Episode Here

[embedded content]

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds. Thanks! We really appreciate it!

In This Episode We Cover

- How to build a six-figure business, no matter your age or experience level

- Why ditching the college degree may be a smart move for entrepreneurial teens and twenty-year-olds

- Why your financial background does NOT determine whether or not you’ll hit FIRE

- Entrepreneurial tips to take and challenges you must prepare for to succeed

- How to live for free and start building a real estate portfolio EARLY in life

- The one piece of advice Mindy and Scott wish they could give their younger selves

- And So Much More!

Links from the Show

Books Mentioned in This Episode

Connect with Gloria

Connect with Ben

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Check out our sponsor page!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.biggerpockets.com/blog/money-480

- :has

- :is

- :not

- :where

- $UP

- 000

- 1

- 10

- 14

- 14-year-old

- 15 years

- 15%

- 16

- 17

- 19

- 20

- 2020

- 2021

- 2022

- 21st

- 22

- 24

- 25

- 27

- 30

- 33

- 35%

- 40

- 50

- 500

- 60

- a

- Able

- About

- about IT

- absolutely

- accelerating

- access

- accomplish

- accomplished

- accomplishing

- Accumulate

- acquire

- acquiring

- acquisition

- acting

- Action

- active

- actively

- activities

- actually

- add

- Additional

- adjust

- adjusting

- Ads

- adults

- ADvantage

- adventures

- Advertising

- advice

- After

- afterwards

- again

- age

- agency

- Agent

- agents

- Ages

- ago

- Agreement

- ahead

- All

- allocate

- almost

- alone

- along

- alongside

- already

- also

- always

- am

- amazed

- amazing

- amount

- an

- and

- Announcing

- annual

- Another

- answer

- answers

- any

- anyone

- anything

- anywhere

- Apple

- applications

- applied

- appointment

- appointments

- appreciate

- approach

- approaching

- ARE

- AREA

- around

- AS

- ask

- asking

- aspects

- aspiring

- Assets

- Associate

- At

- Attainable

- attend

- attitude

- author

- available

- average

- away

- B2B

- back

- background

- Balanced

- Bank

- base

- Basically

- Basics

- BE

- because

- become

- becoming

- been

- before

- Beginning

- behind

- being

- beliefs

- believe

- ben

- benefit

- Benjamin

- BEST

- Better

- between

- Big

- bigger

- Biggest

- Bit

- Bitcoin

- book

- Books

- border

- born

- BOSS

- both

- Both Sides

- bought

- Brain

- brand

- Brandon

- Bright

- bring

- brokers

- build

- Building

- built

- Bunch

- business

- business owner

- businesses

- but

- buy

- Buying

- by

- call

- call center

- called

- Caller

- calling

- Calls

- came

- CAN

- cannot

- care

- Career

- carry

- case

- cases

- Cash

- Cats

- Center

- ceo

- certain

- challenges

- chances

- Channel

- chatting

- cheap

- check

- Children

- chinese

- circumstances

- class

- classes

- classroom

- clearly

- client

- clients

- Close

- closed

- closing

- Co-Host

- coaching

- Coffee

- Coin

- cold

- College

- come

- comes

- comfortable

- coming

- comments

- Communication

- Communities

- community

- company

- complete

- completely

- complicated

- concept

- condition

- confidence

- confident

- conflict

- Connecting

- connection

- Connections

- Consider

- considered

- Conspiracy

- content

- continue

- continues

- contractors

- control

- Conversation

- Cool

- copywriting

- correct

- Cost

- Costs

- could

- Couple

- course

- courses

- Crashed

- crazy

- Cream

- created

- Culture

- Currently

- custom

- customer

- Customers

- Dad

- daily

- Dates

- day

- Days

- dear

- decide

- decided

- decisions

- dedicated

- definitely

- Degree

- delighted

- delivery

- Depending

- desire

- Despite

- details

- DID

- difference

- different

- direction

- dirt

- Discount

- distance

- dive

- diversify

- do

- does

- Doesn’t

- doing

- Dollar

- done

- Dont

- down

- dreams

- drive

- Drop

- dumb

- during

- Earlier

- Early

- easy

- eat

- editing

- Education

- Eighth

- either

- else

- embedded

- Employee

- employees

- end

- ended

- energy

- enjoying

- enormous

- enough

- enrolled

- enrollment

- entered

- Entire

- Entrepreneur

- entrepreneurial

- entrepreneurs

- entrepreneurship

- episode

- equity

- especially

- essentially

- estate

- Even

- eventually

- EVER

- Every

- every day

- everybody

- everyone

- everything

- exactly

- example

- examples

- excited

- exists

- Exodus

- expenses

- experience

- experienced

- Experiences

- experiencing

- Explain

- eye

- Facebook ads

- faced

- families

- family

- far

- FAST

- Favorite

- feedback

- feel

- few

- Figure

- Figures

- fill

- Finally

- finance

- Finances

- financial

- financial freedom

- financial goals

- Financial independence

- financial management

- financially

- Find

- finding

- fine

- finish

- First

- five

- Flip

- Flips

- Focus

- focused

- follow

- following

- food

- For

- forever

- Former

- Forte

- Forward

- found

- founder

- four

- Fourth

- FRAME

- Free

- Freedom

- friends

- from

- front

- fully

- fun

- fundamental

- funds

- funny

- further

- future

- Futures

- game

- gap

- gave

- Gen

- Gen Z

- General

- generally

- generate

- generation

- get

- getting

- Give

- Giving

- Go

- goal

- Goals

- God

- Goes

- going

- good

- good job

- gosh

- got

- grade

- great

- grew

- Group

- Group’s

- Grow

- Growing

- Grows

- guarantee

- Guest

- Guy

- hack

- hacked

- hacks

- had

- halfway

- hand

- Hang

- happen

- happened

- happens

- Hard

- hard work

- hate

- Have

- having

- he

- head

- hear

- heard

- Heart

- Held

- help

- helped

- helping

- her

- here

- Hidden

- High

- higher

- highest

- him

- hire

- his

- history

- Hit

- hold

- Home

- Homes

- honest

- Honestly

- honored

- HOURS

- House

- houses

- How

- How To

- HTTPS

- hvac

- i

- I’LL

- ICE

- ice cream

- iconic

- idea

- if

- ignore

- imagine

- Impact

- importance

- important

- impressive

- in

- Income

- Increase

- incredible

- independence

- individual

- industry

- information

- informed

- inspire

- inspired

- instead

- interested

- interesting

- interests

- Interview

- into

- introduce

- Invented

- Invest

- investing

- investment

- investment funds

- Investments

- investor

- involve

- issue

- IT

- Job

- Jobs

- join

- joined

- joining

- joining us

- Joins

- journey

- jpg

- jump

- just

- keeping

- kept

- Kid

- kids

- Kind

- Kiyosaki

- Know

- knowledge

- knows

- KUDOS

- larger

- Last

- lastly

- Late

- later

- launch

- lead

- leader

- Leadership

- leading

- Leads

- LEARN

- learned

- learner

- learning

- least

- leaving

- Led

- lenders

- less

- lesson

- Lessons

- Lessons Learned

- let

- letting

- Level

- LG

- License

- Life

- lifestyle

- like

- Limited

- Listed

- Listening

- listing

- Listings

- little

- live

- living

- loan

- local

- location

- Long

- longer

- Look

- look like

- looked

- looking

- LOOKS

- losing

- Lot

- love

- loved

- lower

- luck

- made

- major

- make

- make money

- MAKES

- Making

- managed

- management

- manager

- many

- Margin

- mark

- Market

- Marketing

- marketing agency

- massive

- Matter

- Matters

- maybe

- me

- mean

- means

- Media

- Memories

- mentioned

- Mentorship

- met

- Middle

- might

- Millennial

- million

- Millionaire

- millionaires

- millions

- mind

- minds

- Mindset

- mine

- minimum

- minnesota

- minutes

- missed

- mistakes

- MLS

- models

- mom

- moment

- Momentum

- money

- money-making

- Month

- months

- Moon

- more

- morning

- Mortgage

- most

- Motivation

- move

- move forward

- moves

- much

- muscle

- must

- my

- myself

- name

- Nature

- navigating

- necessarily

- Need

- needed

- negative

- net

- never

- New

- Newest

- next

- no

- None

- North

- nothing

- now

- number

- numbers

- objective

- occurred

- october

- of

- off

- offer

- Office

- officers

- official

- often

- oh

- Okay

- Old

- older

- on

- once

- ONE

- online

- only

- open

- opened

- Opinions

- Opportunity

- opposed

- opposite

- Option

- or

- order

- original

- Other

- our

- ourselves

- out

- outside

- over

- own

- owned

- owner

- owners

- ownership

- paid

- painting

- parents

- part

- partner

- pass

- passion

- path

- paths

- payment

- People

- per

- perfect

- permission

- person

- personal

- Personal Finance

- Personally

- phone

- Phone call

- phones

- physical

- pick

- piece

- Place

- plan

- plans

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- played

- player

- please

- Plenty

- plug

- plus

- podcast

- Point

- poised

- poor

- pop

- Pop Culture

- portfolio

- position

- possible

- Post

- posted

- potentially

- power

- powerful

- prefer

- Prepare

- Prepares

- pretty

- price

- primarily

- private

- probably

- Problem

- Produced

- Profit

- profitable

- Program

- Progress

- promise

- promising

- Propel

- properties

- property

- protected

- published

- purchase

- purchased

- purely

- pursue

- put

- Puts

- Putting

- qualifications

- question

- Questions

- Quick

- quite

- raise

- raleigh

- range

- Rate

- rating

- reach

- reaching

- Read

- Reading

- ready

- real

- real estate

- real world

- realized

- really

- realtor

- recently

- recording

- reference

- reflection

- reflects

- regards

- rehab

- reinvest

- relationship

- Relationships

- relative

- relatively

- Relax

- remember

- Rent

- replaced

- represent

- research

- reserves

- Resources

- respect

- responsible

- REST

- restaurant

- return

- revenue

- review

- Rich

- Rich Dad Poor Dad

- Rid

- right

- ROBERT

- robert kiyosaki

- robust

- Role

- roof

- roughly

- round

- Route

- Run

- running

- runs

- sacrificing

- Safety

- Said

- sales

- same

- saturday

- Save

- saved

- Savings

- saw

- say

- saying

- Scale

- scaling

- scared

- School

- scope

- scott

- seconds

- Section

- see

- seeing

- seem

- SELF

- self-belief

- sell

- send

- senior

- sense

- sent

- September

- service

- Services

- serving

- set

- Sets

- setting

- Share

- shared

- sharing

- she

- shed

- Shortly

- should

- show

- side

- Sides

- similar

- simply

- simulator

- since

- single

- sit

- Sitting

- situation

- SIX

- skill

- skills

- Slowly

- small

- smart

- So

- so Far

- Social

- social media

- Social Skills

- sold

- some

- Someone

- something

- sometimes

- somewhere

- song

- Soon

- Space

- Spark

- speakers

- specifically

- spend

- Spending

- spending money

- spent

- Spin

- spoken

- Sponsors

- Spotify

- Staff

- stages

- standpoint

- start

- started

- Starting

- State

- States

- stats

- Step

- Steps

- Still

- stock

- stock market

- Stocks

- stopping

- Stories

- Story

- Strategically

- stream

- structure

- Struggle

- Student

- Students

- Study

- substantially

- succeed

- success

- successful

- such

- sudden

- summer

- Super

- superpower

- sure

- surgeon

- surprised

- surrounded

- Survey

- SWEAT

- sweet

- system

- Take

- takes

- taking

- Talk

- talking

- taught

- Teaching

- team

- Technical

- technically

- teenager

- Teens

- tell

- telling

- terms

- tested

- text

- than

- thank

- thanks

- that

- The

- The Basics

- The State

- the world

- their

- Them

- then

- therapy

- There.

- These

- they

- thing

- things

- think

- Thinking

- Third

- thirty

- this

- this year

- those

- though?

- thought

- three

- Through

- throughout

- TIE

- tiktok

- time

- timeline

- times

- timing

- tips

- to

- today

- today’s

- together

- too

- took

- Total

- TOTALLY

- tough

- towards

- town

- track

- traded

- traditional

- Training

- trajectory

- Transcript

- travel

- tried

- trip

- true

- truly

- try

- trying

- Turned

- Turning

- Twice

- two

- type

- types

- typically

- under

- underlying

- underneath

- understand

- understands

- unfair

- unique

- United

- United States

- university

- upstairs

- us

- use

- used

- using

- usually

- vacation

- various

- Versus

- very

- Video

- Videos

- vision

- Visit

- wait

- Wake

- Wake Up

- walked

- walking

- want

- wanted

- wanting

- wants

- was

- Watch

- watching

- Way..

- we

- Wealth

- wealthy

- Website

- week

- Weeks

- welcome

- WELL

- went

- were

- What

- What is

- whatever

- when

- whether

- which

- while

- WHO

- whole

- why

- wife

- will

- wisdom

- with

- without

- woman

- wonderful

- Work

- work out

- worked

- working

- works

- world

- Worst

- worth

- would

- would give

- written

- year

- years

- yes

- you

- young

- Younger

- Your

- yourself

- youthful

- youtube

- zephyrnet

- zero

- zoom