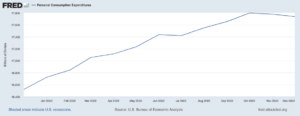

The Fed’s new “neutral interest rate” could mean pricier mortgages, less cash flow, and higher home prices for longer. After the great financial crisis, interest rates were kept in check, slowly sliding down for over a decade. But, since the pandemic, things have gone the opposite way. Mortgage rates have hit multi-decade highs, bond yields have crossed new territory, and we could be far from things returning to “normal.”

If you want to know the math behind the mortgage rates and understand what the Fed does (and doesn’t) control in a high-rate world, Redfin’s Chen Zhao can break it down for you. In this episode, Chen goes through the economic indicators tied to mortgage rates, how bond yields affect banks’ lending power, why the ten-year treasury is at a historic high, and the Fed’s newest “neutral interest rate.”

We’ll also get into the potential effect of next year’s presidential election on mortgage rates and the housing market and what to look for to gauge where we’re headed. If you want to know where interest rates will go, Chen details the roadmap in this episode.

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Dave:

Hello, everyone, and welcome to On The Market. I’m Dave Meyer. Joined today by Henry Washington. Henry, I heard a rumor about you today.

Henry:

Uh-oh. This can’t be good. Or maybe it is. I don’t know. Go for it.

Dave:

It’s good. I heard you finished your book.

Henry:

I finished the first half of my book. I’m still working on it.

Dave:

Okay.

Henry:

Still working on it.

Dave:

Show us how much attention I was paying in that meeting.

Henry:

We finished the first half of the book. We’re working on the second half of the book. We’ve got it all transcripted out, but we’ve got some more details to put in there.

Dave:

Well, the team at BiggerPockets Publishing seemed very pleased about your book and that things were coming in on time. It sounds like a great book. What’s it about?

Henry:

It is about finding and funding your real estate deals. Great book for beginners to learn how to get out there and start finding these deals. Man, with this economy, it’s crazy. You got to get good at finding deals.

Dave:

Heck. I don’t know if I’m a beginner, but I will definitely read a book if it helps me find better deals right now. I would love to know that. When’s it coming out, by the way?

Henry:

I think it’s March.

Dave:

Okay, nice. Nice. All right. Well, we’re both having Q1 books coming out.

Henry:

You have a book every Q.

Dave:

I have one book out. This is going to be the second one. I’ve just been writing this one for three years. I won’t shut up about it.

All right. Well, we have a great episode today. I think they call this one a… This is like a Dave Meyer special episode. We’re going to be getting a little bit nerdy today. We have a lot of great shows where we talk about tactical decisions in the economy/things that are going on with your business. But today, we’re going to go behind the scenes in one of the more detailed/technical economic things that does impact your business every single day. That is mortgage rates. But specifically, we’re going to talk about how mortgage rates come to be. You might know this from listening to this show a little bit, but the Fed does not set mortgage rates. It is instead set by a complex set of variables. We’re going to dive into those today with Chen Xiao from Redfin. She’s an economist. She studies just this: how mortgage rates come to be. I am so excited, if you can’t tell, to have her on the show to dive into this topic that, I think, everyone is particularly curious about.

Henry:

Yeah. I agree. I am excited as well. But not for the same nerdy reasons that you are excited. But I’m excited because everybody that you talk to has some opinion based on almost nothing about what they think interest rates are going to do. People are making decisions about their investing. They’re buying properties. They’re not buying properties based on these rando factors that they think are going to play into this. Actually, hearing from someone who is looking at this information every day and can make common sense of it for us is going to be super helpful if you are trying to figure out should you be buying property right now or should you be waiting, or how long do you think rates are going to stay where they are or go up or go down because these things are impacting the amount of money that investors are making.

Dave:

I think the thing I am so excited about this for is that we can all make projections, like you’re saying. But in this episode, we’re going to be helping everyone understand how this is actually going to play out one way or another. We don’t know which direction it’s going to go. But we can understand the ingredients that are going in. You can form your own informed opinion here and use that to make wise investing decisions.

Henry:

Dave?

Dave:

Yes.

Henry:

I’m going to have to ask you to do something. Are you going to be able to hold yourself back and not dive all the way into the deepest weeds possible? Because this is pretty much your baby here. This is what you love.

Dave:

This is my dream. I mean, three years ago/four years ago, I didn’t even know really what bonds were. Now, I spend all day talking about bonds. God! What has become of me? I will do my best to hold back and keep this at a level that is appropriate for real estate investors and not people who just like talking about financial instruments for the sake of [inaudible 00:04:24].

Henry:

We appreciate you.

Dave:

All right. Well, we’re going to take a quick break, and then we’ll be back with the show.

Chen Xiao, welcome to On the Market. Thank you so much for joining us today.

Chen:

Thanks so much for having me. I’m really happy to be here.

Dave:

Well, we’ve been very fortunate to have a bunch of different of your colleagues from Redfin joining us. You guys do such great economic research. What, in particular, are you focused on tracking and researching in your job at Redfin?

Chen:

Absolutely. Thanks for having so many of us from Redfin on. We’re all big fans of the show. In my role at Redfin, my job is to basically lead the economics team to think about how our team can help consumers and impact the housing community externally and also guide Redfin internally with our views on the housing market and economy. I’m very much involved with thought leadership on where are the topics that we should really be paying attention to and where should our research be headed towards.

Dave:

Great. Today, we’re going to dive into a little bit of a nerdy, more technical topic. We’re going to put you on the hook here. We’d like to talk about mortgage rates. This is not a very hot take. But clearly, given where things are in the market, mortgage rates and their direction are going to play a big role in the direction of the housing market next year. We’d like to unpack part of how mortgage rates are set. We all know the feds have been raising rates. But they don’t control mortgage rates. Can you tell us just a little bit more about what economic indicators are correlated to mortgage rates?

Chen:

Sure. I’m going to answer your question a little indirectly. But I promise I’ll get to what you’re asking. I think it’s helpful to take a step back and think about a framework for mortgage rates. Actually, think about a framework for interest rates more broadly because, oftentimes, we say “interest rates” in the economy, and there are various interest rates. At a very basic level, an interest rate is a price for borrowing money. It’s determined by two things: credit risk and duration risk. How risky is the person or the entity I’m lending to, and how long am I lending them this money for?

Critical to this discussion is thinking about the bond market. Bonds are just a way of lending out money to various entities for varying lengths of time. When we think about the bond market, we’re thinking about two metrics. We’re thinking about the price and the yield, which are inversely related. When there’s more demand, prices go up and then yields go down and vice versa.

Really importantly… When I’m thinking about mortgage rates, there’s two other rates that I need to be thinking about. The first is the federal funds rate. That is the rate that the Fed controls. Then, there’s the 10-year treasury rate, which I think we’ll probably spend a lot of time talking about today. Mortgage rates actually build on top of both the federal funds rate and the 10-year treasury. In that framework that I was talking about, for the federal funds rate, there is no credit risk at all. This is an overnight lending rate between banks. There’s also no duration risk.

If I’m thinking about treasuries now, the treasury market, treasuries come in a wide variety of forms. Anything from a one-month treasury bill up to a 30-year treasury bond. But the one that’s most important to mortgage rates is the 10-year treasury note. This is a reference rate in the economy. This is the most correlated on a day-to-day basis with mortgage rates.

When I’m thinking about the 10-year treasury, economists like to think about this as being decomposed into three components. The first is the real rate. That is the part that is most related to what the Fed is doing. How restrictive is the Fed trying to be with the economy, or how accommodative is the Fed trying to be? The second part is inflation expectations. This has to do with duration risk. This means if I’m thinking 10 years out, “What is inflation going to be?” Because whatever yield I am getting on the 10-year treasury inflation is going to eat into that as an investor.

Then the third is the term premium. The term premium is the squishiest. Term premium is how much excess return I’m demanding for holding this for 10 years versus a shorter duration. You asked what are the economic indicators that are most correlated with mortgage rates. Well, it’s all of these things that are going to affect the 10-year treasury note. Inflation obviously is important when we’re thinking also about economic growth. We’re looking at GDP. We’re looking at labor market conditions. All of the major economic components are going to be feeding into what the 10-year treasury yield is. Then, mortgage rates build on top of that.

I said the two are very much correlated. What that means is that mortgage rates are usually trading at a spread relative to the 10-year treasury. That spread, most of the time, is remaining pretty consistent. But one of the main stories of the past year is that that mortgage/that spread has really ballooned. We can talk about why that is and what the outlook is for that as well.

Henry:

Yeah. It’s like you know exactly what we’re going to ask ’cause I think that’s exactly where we wanted to go is to try to understand… Well, first, let me go back and say I think that was the best explanation of interest rates and how they work that we’ve ever had on the show. That was fantastic. Thank you for breaking that down. But secondly, yeah, I think we want to understand… so the 10 treasury rate yield, where it’s currently at, versus where it’s historically been, and how that’s impacting the market.

Chen:

Absolutely. Today, right now, I think the 10-year treasury is sitting just above four or five. That’s where it was yesterday at close. I think it’s actually climbing a little bit today. This is a historic high, I think, perhaps since 2007 if I have my data correct. It’s been climbing a lot. In May of this year, it was about 100 basis points lower.

The real story for mortgage markets in the past few months has really been… Why has the 10-year treasury yield gone up so much? Importantly, it’s confusing because inflation has actually fallen these last few months. I think for a lot of people who are listening to this are probably thinking, “I’ve been reading in the press, and the economists have been telling me that if inflation falls, mortgage rates won’t fall. Why hasn’t that happened?” It really has to do with this framework that I was talking about.

Like I said, since the whole debt ceiling debacle was resolved, the 10-year treasury has gone up about 100 basis points. Let’s think about why that is. About half of that is what I would call the term premium. What this is related to is mostly concerns about long-term debt for the US government and treasury issuance. As we know, the country is borrowing more and more. There’s more and more supply of treasury debt. At the same time, demand for that treasury debt has not kept up. That is causing that term premium to increase.

The other main story is the increase in real rates. This is the idea that the Fed is increasingly telling us that they are going to hold higher for longer, not necessarily they’re going higher than where they are right now, but that they’re going to hold at this high restrictive level for a longer amount of time, meaning that they’re projecting they will start cutting next year in the back half of 2024. But when they start cutting, it’s later than previously we thought, and that it’s fewer cuts. It’s slower than we thought. Oftentimes, people are debating: is the Fed going to hike again? Actually, another 25 basis points doesn’t matter so much. The real story now is how long are we going to stay in this restrictive territory.

Then, the other component of the 10-year yield that I’ve talked about before, inflation expectations, that actually hasn’t really changed very much. That’s not really playing a big story here. But if you are someone who’s following financial news, you have probably heard a lot of talk about this idea that the neutral rate has increased. That’s, I think, really important to touch on right now. It’s related to what I was talking about in terms of demand for treasury debt and this idea that we’re having higher interest rates for longer.

The neutral rate is something in the economy that is unobserved. We cannot measure it. My favorite way to think about it is that’s your metabolism. When you’re a teenager, you can eat a lot. You’re probably not going to gain weight. You have a high metabolism. Later on in life, your metabolism shifts. You can’t really measure. The doctor can’t tell you what it is. But you find that you can’t really eat the same things and maintain the same weight anymore.

The same thing happens in the economy, where, after the financial prices, it seemed like the neutral rate really fell. That’s why the Fed was holding rates really low. We could not really even get inflation above 2%. But then, something happened after the pandemic, where, all of a sudden, it felt like we had a lot more inflation. The rates had to be higher. What investors and increasing the Fed… Jerome Powell acknowledged this in the last press conference, is coming around to is this idea that the neutral rate has shifted up. That means that we basically just have to have higher rates for a longer amount of time. That view is also what is pushing the 10-year rate up. That’s pushing mortgage rates up.

Dave:

As you said, Chen, we’ve seen this steady rise in mortgage rates over the summer. It seems to have accelerated since this most recent press conference. It seems that what you just talked about is really what’s going on here is that we saw a few things. One, the summary of economic projections, which the Fed puts out with some of their meetings, shows that they still think that we’re going to have higher rates at the end of 2024. That’s a full year from now. But when you talk about the neutral rate, which I thought that was a great explanation of… Is that the indefinite balance/the ideal theoretical balance that the Fed wants to get to? Even after 2024, basically as far out as they are projecting, they think that the best rate that they can do is somewhere around 3% for the federal funds. Is that right?

Chen:

Yes, exactly. That is exactly what the neutral rate is. It is the rate that the Fed would hold the fed funds rate at. That would hold inflation and the unemployment rate in check. The Fed has this dual mandate, which is that we want low inflation and low unemployment rate. The neutral rate is basically a rate at which we are neither stimulating the economy nor are we trying to actively contract the economy.

When the Fed puts out its projection, it says, “Okay, for the long term,” basically past two or three years, “where do we project that neutral rate to be?” In their latest summary of economic projections, they actually kept that neutral rate at 2.5%, which was actually confusing for folks because if you looked at what their projection was for 2025/2026, it was showing a higher rate. But it was also showing the economy essentially in balance.

There was this discrepancy between… Well, what you’re saying for the long-term versus what you’re saying for the next two to three years. Reporters pointed this out. What Powell pointed to was this idea that, well, the neutral rate changes. There’s also this idea of a short-term neutral rate versus a long-term neutral rate. I think this is starting to get a little too deep into the rabbit hole. But what’s I think important as a takeaway from this whole discussion is that the Fed is telling us that they’re coming around to this idea that this neutral rate has increased. It could still change in the future. But if we’re thinking about a 10-year treasury rate or talking about a 30-year fixed mortgage rate, this is going to play a big role in setting a baseline expectation for what those rates should be.

Henry:

This information is extremely helpful to investors. I don’t want investors to hear how deep we’re getting and not think about, “What does this mean to you as you are buying property or as you are considering buying property?” What I think I’m hearing… I think one of the most important things I heard you say was that this could be a signal or that the Fed is signaling that the interest rates are going to stay in this realm of what we consider to be high for a longer period of time than what most originally anticipated.

For me, as an investor, as the investing landscape has changed over the past year due to these rates rising, a lot of strategies has changed. It’s hard to buy properties that cash flow because of the cost of money. That cost of money/that interest rate is eating into the money that I can make by renting out the property.

If you’re a long-term investor and you’re looking to buy properties at cashflow, what’s happening is people are jumping in right now and they’re willing to buy properties sometimes that break even or even lose a little bit of money every month because people have been betting on saying, “If I can buy these properties and hold them for the next six to 12 months, well, then boom. If rates come down, that means that I can refinance, and then my cash flow will absolutely be there. Then, I can go ahead and sell off some of these properties if I want to because when rates come down, people get off the sidelines. They go start buying again. There’s still an inventory issue. Now, prices start to go up.” It seems like a good bet right now to buy.

But as an investor, what I’m hearing is you really have to be careful about doing that. You have to have the reserves to be able to hold onto these properties longer ’cause we really don’t have a definite answer on when and if those rates are going to come down or how much they’re going to come down.

Chen:

Yes. I agree with what you’re saying. I think that it is definitely the case that as inflation got out of control and then the Fed started its hiking cycle last spring, that there was this rock-solid belief among many people that this was an aberration and not a paradigm shift. All we have to do is hold on and wait for this to pass, and then we’ll be back to normal, that what we were experiencing before was normal.

I think what people are increasingly thinking now is that… “Well, if you take a longer-term view of interest rates and you look back at whether it’s the 10-year treasury or you’re looking at mortgage rates, over the last few decades, it’s a story of rates just coming down. Post-financial crisis rates were very low. Like I was saying, with my metabolism analogy, that could have been the aberration. We might actually be looking at a return to maybe a more historical norm. That could definitely be the case.

Now, with that being said, the other thing I would caution is that there is a huge amount of uncertainty regarding the economy right now. If you had had me on last year, what I would’ve told you was there’s a lot of uncertainty about the economy right now. But I will say that this year, there is even more uncertainty. The reason is because, last year, we knew what the basic story was. We knew inflation was out of control. The Fed had this fight on its hands. It was going to hike interest rates really, really fast. We were going to watch that play out in 2023. That is what we watched play out in 2023.

Now, the Fed has done this. We’re in this position where they hiked more quickly than they have ever done so in history. We’re sitting here, and the question is, well, what happens now? There is still recession risk that’s significant. I think a lot of people have adopted this view that we got the soft landing. Recession risk is over. The economy is so resilient. I think that we still can’t forget that recession risk.

Then, on the other hand, inflation could still get out of control. Rates could still go higher. There’s actually risk on both sides. When I used to go skiing, there was this trail where you would ski. There was a cliff on both sides. This is how I think about this, in some sense, where there’s this risk on both sides. That creates a huge amount of uncertainty.

If you look at futures markets right now for what the futures markets are predicting about the 10-year treasury one year from today, they’re basically predicting that yields will be the same as they are today. That’s this idea that interest rates are basically going to stay here. That is assuming, for mortgage rates, that mortgage spreads also stay pretty consistent to where they are right now, which is not necessarily going to be the case.

Dave:

Let’s dig into spreads there because we talk about that a bit on this show. Just as a reminder to everyone, there is a historic correlation between 10-year treasuries and mortgage rates. I think it’s like 170/190 basis points, something like that. Now, it’s what? 300 basis points. Significantly higher than it used to be. You talked about the spread. Maybe we should just jump back a little bit. Can you explain why the spread is usually so consistent/how it has changed over the course of the last few years?

Chen:

Sure. Absolutely. Like I was saying, mortgage rates are, on a day-to-day basis, very much tightly correlated with 10-year treasuries. If the 10-year treasury is going up today, mortgage rates are probably going to go up today. Over a longer period of time, that relationship is less certain. Like you said, historically, just depending on how you measure… It’s about 170-ish basis points.

But, conceptually, why would that spread change? I think there’s two important things to think about. One is rate volatility and expected prepayment risk. The thing that really differentiates mortgage bonds or government bonds like treasuries is that mortgage bonds have this built-in prepayment risk, so someone who has a 30-year fixed mortgage and refinance or pay off their mortgage with no cost at any point. Investors can have their income stream cut off at any point. They have to think about that when they’re investing in the security.

When interest rates are very volatile or when interest rates are really high, and investors expect that that is an aberration and then interest rates will come down in the future, all this talk of, “Oh, buy now, refinance later,” then they’re going to demand a much higher premium for buying mortgage bonds. That is a big part of the story about why mortgage spreads have ballooned over this past year.

The other part of the story is just simply demand for MBS. There’s two parts of this. One is the Fed. The Fed owns about 25% of outstanding MBS. During the pandemic, they bought something like $3 trillion of MBS. Because in order to stimulate the economy during that very deep recession, the Fed brought out the QE playbook again and said, “We will commit to buying an unlimited amount of MBS in order to hold this ship together.” They kept buying, even when it seemed like actually the housing market was doing fine. But then they stopped. When they stopped, that was a big buyer, all of a sudden, just exited that market.

Then, the second part of the demand story is banks. Banks have a lot of MBS already on their balance sheet. Because of what’s going on with interest rates, there’s a lot of unrealized losses because of that. They can mark that as something that’s to be held to maturity. Therefore, they don’t have to mark to market the losses on that. But that also means that they have less appetite to buy more MBS now.

Ever since SVB happened in March, I think the view on deposits for banks has changed. That means that if banks feel like deposits are less sticky, meaning that there’s a greater chance that deposits could leave, they have less demand for long-duration assets like MBS. That will also lead to less demand for banks for MBS. If you want to talk about, “Well, what does that mean in a forward-looking way? Is this a new normal for spreads now, or could they come back down?” I think that just depends on a few things.

Going back to the two main reasons why they have gotten bigger to begin with, if great volatility comes down and prepayment risk is coming down, then, yes, you could see that spread come down. That higher for longer idea, that rates are going to be higher for longer, does mean that I think prepayment risk does come down a little bit. Therefore, there is a little room for spreads to come down.

Then, if you think about demand for MBS… The Fed is out. Banks are out. But there’s still money managers. There’s hedge funds. At some point, there’s a ceiling on how big these spreads can get because some investors will start to say, “Well, actually, if I can get this huge payoff for investing in MBS, I should do that relative to other fixed-income securities.” There’s a ceiling to how big the spreads can get as well.

Dave:

Just to clarify for everyone listening, MBS is mortgage-backed securities. It’s basically when investors or banks or originators basically pool together mortgages and sell them as securities on the market, too. All of the different parties that Chen just listed… For a while now, the Fed has been buying them. Normally, it’s banks or pension funds or different people who can basically invest in them.

Chen, this demand side of MBS thing is something that I’ve been trying to learn a little bit more about. The other thing that I was curious about… And this is going to be maybe a little too nerdy, so we shouldn’t go too deep into it. But how do bond rates and yields across the world in other countries impact demand? Because I’ve seen that investors are maybe fleeing to… or at least hedging their bats and putting their money in either securities or stock markets in other countries. That is also impacting the 10-year yield. Is that right?

Chen:

Oh, yes. Absolutely. I think the way an economist would think about this is just the opportunity cost of your money. If you are an investor, you can invest in stocks. You can invest in fixed-income securities. You can invest in foreign exchange currencies. There’s all these different vehicles that you can put your money in. If you’re thinking about fixed-income securities. You can invest in these asset-backed securities like MBS, or you can invest in government bonds. If you’re thinking about government bonds, you can think about US government bonds versus government bonds for other countries as well as all these other things that I’m not talking about.

Yes, as the rate of return on these other assets are changing, that is also going to influence the demand for both US government bonds and also MBS. That, in turn, is going to influence the price and, therefore, the interest rates that are associated with these bonds.

Henry:

I want to shift a little bit and get some… There’ll be some speculation and opinion here. But there’s one factor that we haven’t hit on yet that could have an impact or that some people feel may have an impact on mortgage rates in the future. That’s the next presidential election. Can you talk to us a little bit about how a political change in power might positively or negatively affect mortgage rates? Or has that happened historically, so speaking, specifically, if the Republican Party wins the election, then we have a shift from a Democratic Party to a Republican, and how that might impact rates?

Chen:

Absolutely. I think the most direct path that economists would think about when they’re thinking about something like an election is similar to other geopolitical events, which is thinking about it through the lens of what is the threat to economic growth. What does this mean for the strength of the economy? That would be similar to how we would think about all the ongoing strikes that are happening, the resumption of student loans, the government shutdown that seems like it’s looming. All of these things are… We can use a similar framework.

Historically, if you think about, well, are the Democrats going to be in power, or will it be the Republicans? There’s this perception that Republicans are more friendly to economic growth and maybe to the business community. Maybe that would be good. On the other hand, it depends on specific candidates. Is there just tail risk associated with any specific candidates who might be in power? I think people would take that into consideration in thinking about, “Is that more likely to lead to a recession?”

Then, you might also think about having these candidates in power mean for who is nominated to lead the Fed, for example, and what policies their administration is going to pursue. All of these things will come into play, which all goes to say that I don’t think there’s a really simple cut and dry, “If this person comes into power, that means stock markets and bond markets will do this and vice versa.” But that’s the framework that I would use.

Dave:

I don’t want to put you in the hot seat and ask you what rates will be next year. But if you had to pick two or three indicators to watch going into next year to get a sense of where mortgage rates start to go, what would you recommend people look at?

Chen:

Absolutely. I’m glad you’re not asking me to make a forecast because-

Dave:

That’s coming later. Don’t worry.

Chen:

I think a lot of economists are feeling like maybe we need to change the batteries on our crystal ball or something. But I think if you are trying to think in a forward way about where the economy is headed/where rates are headed, looking at a consensus expectation is going to be your best bet. That’s what the futures markets and that thing imply. That’s what really that is.

That being said, we are living at a time of, I think, unprecedented uncertainty. We have to really take that with a grain of salt. What are we looking at when we’re trying to take a forward-looking view? I think it’s all the standard stuff that we have been looking at, which is really just the main economic data releases. Even though I said, “Inflation’s gone down,” why did rates go up? Well, inflation is still an important part of the story. If inflation goes back up again… Right now, just in this past month or two, oil prices have shot back up again. That could have really profound implications for interest rates again. Continuing to keep an eye on inflation is very, very important.

Then, the most important economic indicator for the economy in general is not actually GDP. It’s actually the labor market. It is the jobs report. It’s thinking about the unemployment rate/looking at how many jobs are being added every month to the economy. Then, there’s also associated labor market reports such as JOLTS. The Job Openings and Labor Turnover Survey has been getting a lot of attention this past year. Then, also the private sector numbers like ADP and all of that. It’s really all of the same standard economic data.

What’s really different about economics today versus when I started my career is that there is so much more private sector data now. On the housing side, obviously, Redfin, we provide a lot of private sector data about the housing market that we think is more forward-looking than what you get from public data sources.

Similarly, I think it’s important to pay attention to data, for example, that the JP Morgan Chase Institute and the Bank of America Institute puts out about the state of the US consumer in terms of how much more savings is there left. We know that there was a ton of savings. People had a lot of excess savings after the pandemic. Has that really dried up? If it has dried up, for whom? Who still has savings? That’s important for when we’re thinking about issues. People are going to start paying student loans again in just a few days. Who is on the hook to make those student loan payments? Who has the money to make those payments? What will it imply for their spending going forward? There’s a lot of private sector data sources that I think are also really important to pay attention to.

Dave:

Great. Thank you so much, Jen. This has been incredibly helpful. Obviously, people can find you at Redfin. Is there anywhere in particular that you put out your work or where people should follow you?

Chen:

Yeah. The Redfin news site is where we publish all of our reports. We also just recently added from our economist corner of that to that website where you can see quick takes about events that happen or economic developments. That’s a really great place to find all of our thoughts.

Dave:

All right. Great. Well, thank you so much, Chen. We appreciate you joining us.

Chen:

Thanks so much for having me.

Dave:

What did you think?

Henry:

Well, first and foremost, that was an incredible job at taking a super complex topic and making it understandable even for people who don’t have an economics background or understand how all of these factors play into each other because I don’t. I was able to follow that better than any other economic conversation that we’ve had. I think that’s hugely valuable to our audience. There’s just a ton of speculation out there. Everybody’s like a street economist. They’re all like, “Yeah, interest rates will come down in six months. Then, it’ll be crazy out there.” No one really knows. It’s good to hear somebody that is actively looking at these numbers consistently and looking at these indicators consistently say that… “Well, my crystal ball still needs some battery.” Just a good word of caution that you got to be careful with your strategy out there.

Dave:

Totally. The more I learn about economics, the less, I think, I try to make predictions, and the more I just try to understand the variables and the things that go into what’s going to happen. No one knows what’s going to happen with mortgage rates. But if I can understand how the spread works, if I can understand why tenure treasuries move in the way that they do, then you’ll at least be able to monitor things in real-time and make an informed guess instead of just making these reactions based on fear, which is what I think all these armchair economists are doing.

Henry:

Give me a scale of one to 10. How hard was it for you not to just completely nerd out and go all the way into the weeds on everything she was talking about?

Dave:

I wanted to ask about how the Bank of Japan’s recent decision… This is not a joke. I literally was like, “Should I ask about Bank of Japan policy and what they’re doing with their buying yields?” I just knew no one would give a (beep) about what I was talking about. But I wanted to ask.

Henry:

I could see it on your face that you were just wanting to. You were like, “This is my people.”

Dave:

I know. I was like, “I need to keep Chen around after, so we could just have a side conversation about just totally in the weeds nonsense.” But hopefully, Henry was here to keep us in the realm of what normal investors and normal people want to talk about.

But all in all, I thought it was great. It was plenty wonky for me. There was tons of good information. Again, she made it super digestible. Hopefully, everyone walks away knowing a little bit more about why things go the way they do. I think, honestly, the most surprised people are is when you explain to them that mortgage rates aren’t dictated by the Fed. We talk about that all the time. I feel like people who listen to the show have gotten to that. But I didn’t know that five or six years ago. I didn’t really understand it. I think the more you can understand how these abstract things influence your business… Literally, your everyday existence are influenced by tenure treasuries. Who knew? I think it’s just very interesting and super important to pay attention to.

Henry:

How she explained it in a framework made it so much easier to understand. I just kept envisioning her. I’m like, “Man, I wish we had her in front of a whiteboard writing all this out.”

Dave:

That would be cool. Don’t give me ideas. We’re going to have a Mad Money, Jim Cramer joke, where we’re running around slapping buttons and throwing things around. Caleb will kill us. All right. Well, thanks, man. This was a lot of fun. Hope you also learned a lot. Let’s just do a social check-in for you. If people want to follow Henry, where should they do that?

Henry:

Instagram’s the best place. I’m @thehenrywashington on Instagram. Or you can check me out at my website at seeyouattheclosingtable.com.

Dave:

All right. I am @thedatadeli on Instagram. You can find me there as well. Thank you all so much for listening. We will see you next time for On The Market. On The Market was created by me, Dave Meyer, and Kaylin Bennett. The show is produced by Kaylin Bennett, with editing by Exodus Media. Copywriting is by Calico Content. We want to extend a big thank you to everyone at BiggerPockets for making this show possible.

Watch the Episode Here

Help Us Out!

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

In This Episode We Cover:

- The math behind mortgage rates and what causes them to rise and fall

- The Fed’s new “neutral interest rate” and why mortgage rates could stay where they are for a LONG time

- Bond spreads, how they affect mortgage rates, and why they’ve taken a massive leap

- Reaching economic equilibrium and how the Fed plans to keep unemployment and inflation down

- The 2024 presidential election and whether Democrats or Republicans could help/hurt the housing market

- And So Much More!

Links from the Show

Connect with Chen:

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.biggerpockets.com/blog/on-the-market-151

- :has

- :is

- :not

- :where

- $3

- $UP

- 1

- 10

- 100

- 12

- 12 months

- 2%

- 2023

- 2024

- 24

- 25

- 30

- 300

- a

- Able

- About

- about IT

- above

- absolutely

- ABSTRACT

- accelerated

- acknowledged

- across

- actively

- actually

- added

- administration

- adopted

- adp

- affect

- After

- again

- ago

- ahead

- All

- almost

- already

- also

- am

- america

- among

- amount

- an

- and

- Another

- answer

- Anticipated

- any

- anymore

- anything

- anywhere

- appetite

- Apple

- appreciate

- appropriate

- ARE

- around

- AS

- ask

- asking

- Assets

- associated

- At

- attention

- audience

- author

- away

- Baby

- back

- background

- Balance

- Balance Sheet

- ball

- Bank

- Bank of America

- bank of japan

- Banks

- based

- Baseline

- basic

- Basically

- basis

- bats

- batteries

- battery

- BE

- because

- become

- becoming

- been

- before

- begin

- Beginner

- Beginners

- behind

- behind the scenes

- being

- belief

- BEST

- Bet

- Better

- Betting

- between

- Big

- bigger

- Bill

- Bit

- bond

- bond market

- Bond Markets

- Bond yields

- Bonds

- book

- Books

- boom

- border

- Borrowing

- both

- Both Sides

- bought

- Break

- Breaking

- broadly

- brought

- build

- built-in

- Bunch

- business

- but

- buttons

- buy

- BUYER..

- Buying

- by

- call

- CAN

- Can Get

- candidates

- cannot

- Career

- careful

- case

- Cash

- cash flow

- causes

- causing

- caution

- ceiling

- certain

- Chance

- change

- changed

- Changes

- changing

- chase

- check

- chen

- clearly

- Climbing

- Close

- colleagues

- COM

- come

- comes

- coming

- commit

- Common

- Common Sense

- community

- completely

- complex

- component

- components

- Conceptually

- Concerns

- conditions

- Conference

- confusing

- Consensus

- Consider

- consideration

- considering

- consistent

- consistently

- consumer

- Consumers

- content

- continuing

- contract

- control

- controls

- Conversation

- Cool

- copywriting

- Corner

- correct

- correlated

- Correlation

- Cost

- could

- countries

- country

- course

- cover

- crazy

- created

- creates

- credit

- crisis

- Crossed

- Crystal

- curious

- currencies

- Currently

- Cut

- cuts

- cutting

- cycle

- data

- Dave

- day

- day-to-day

- Days

- Deals

- debating

- Debt

- decade

- decades

- decisions

- deep

- deepest

- definitely

- Demand

- demanding

- democratic

- democratic party

- Democrats

- Depending

- depends

- deposits

- details

- determined

- developments

- dictated

- DID

- different

- DIG

- digestible

- direct

- direction

- discrepancy

- discussion

- Display

- dive

- do

- Doctor

- does

- Doesn’t

- doing

- done

- Dont

- down

- dream

- dry

- due

- duration

- during

- each

- easier

- eat

- Economic

- Economic growth

- economic indicators

- Economics

- Economist

- economists

- economy

- editing

- effect

- either

- Election

- end

- entities

- entity

- episode

- Equilibrium

- essentially

- estate

- Ether (ETH)

- Even

- events

- EVER

- Every

- every day

- everybody

- everyday

- everyone

- everything

- exactly

- example

- excess

- exchange

- excited

- Exodus

- expect

- expectation

- expectations

- expected

- experiencing

- Explain

- explained

- explanation

- extend

- externally

- extremely

- eye

- Face

- factor

- factors

- Fall

- Fallen

- Falls

- fans

- fantastic

- far

- FAST

- Favorite

- fear

- Fed

- fed funds rate

- Federal

- Federal Funds Rate

- Feds

- feeding

- feel

- felt

- few

- fewer

- fight

- Figure

- financial

- financial crisis

- Financial Instruments

- financial news

- Find

- finding

- fine

- First

- five

- fixed

- flow

- focused

- follow

- following

- For

- Forecast

- foreign

- foreign exchange

- foremost

- form

- forms

- fortunate

- Forward

- forward-looking

- found

- four

- Framework

- friendly

- from

- front

- full

- fun

- funding

- funds

- future

- Futures

- futures markets

- Gain

- gauge

- GDP

- General

- geopolitical

- get

- getting

- Give

- given

- Go

- Goes

- going

- gone

- good

- got

- Government

- government bonds

- great

- greater

- Growth

- guide

- had

- Half

- hand

- Hands

- happen

- happened

- Happening

- happens

- happy

- Hard

- Have

- having

- headed

- hear

- heard

- hearing

- hedge

- Hedge Funds

- hedging

- Held

- help

- helpful

- helping

- helps

- henry

- her

- here

- Hidden

- High

- higher

- Hike

- hiking

- historic

- historical

- historically

- history

- Hit

- hold

- holding

- Hole

- Home

- Honestly

- hope

- Hopefully

- HOT

- housing

- housing market

- How

- How To

- HTTPS

- huge

- Hugely

- i

- I’LL

- idea

- ideal

- ideas

- if

- Impact

- impacting

- implications

- important

- importantly

- in

- In other

- Income

- Increase

- increased

- increasing

- increasingly

- incredible

- incredibly

- Indicator

- Indicators

- indirectly

- inflation

- Inflation expectations

- influence

- influenced

- information

- informed

- ingredients

- instead

- Institute

- instructions

- instruments

- interest

- INTEREST RATE

- Interest Rates

- interesting

- internally

- into

- inventory

- Invest

- investing

- investor

- Investors

- involved

- issuance

- issue

- issues

- IT

- ITS

- iTunes

- Japan

- Japan’s

- jen

- jerome

- jerome powell

- Jim

- Jim Cramer

- Job

- Jobs

- jobs report

- joined

- joining

- joining us

- jp morgan

- JP Morgan Chase

- jpg

- jump

- just

- Keep

- kept

- Kill

- Know

- Knowing

- knows

- labor

- labor market

- landing

- landscape

- Last

- Last Year

- later

- latest

- lead

- Leadership

- LEARN

- learned

- learning

- least

- Leave

- leaving

- left

- lending

- Lens

- less

- let

- Level

- LG

- Life

- like

- likely

- Listening

- little

- living

- loan

- Loans

- Long

- long-term

- longer

- Look

- looked

- looking

- looming

- lose

- losses

- Lot

- love

- Low

- lower

- mad money

- made

- Main

- maintain

- major

- make

- Making

- man

- Managers

- mandate

- many

- many people

- March

- mark

- Market

- market conditions

- Markets

- massive

- math

- Matter

- maturity

- May..

- maybe

- me

- mean

- meaning

- means

- measure

- Media

- meeting

- meetings

- Metrics

- Meyer

- might

- money

- Monitor

- Month

- months

- more

- Morgan

- Mortgage

- Mortgages

- most

- mostly

- move

- much

- my

- necessarily

- Need

- needs

- negatively

- Neither

- Neutral

- New

- Newest

- news

- next

- nice

- no

- None

- nor

- normal

- normally

- note

- nothing

- now

- numbers

- of

- off

- oftentimes

- Oil

- on

- ONE

- one-month

- ongoing

- open

- openings

- Opinion

- Opinions

- Opportunity

- opposite

- or

- order

- originally

- originators

- Other

- our

- out

- Outlook

- outstanding

- over

- overnight

- own

- owns

- pandemic

- paradigm

- part

- particular

- particularly

- parties

- partner

- parts

- party

- pass

- past

- path

- Pay

- paying

- payments

- pension

- People

- perception

- perhaps

- period

- person

- pick

- Place

- plans

- plato

- Plato Data Intelligence

- PlatoData

- Play

- player

- playing

- pleased

- Plenty

- podcast

- Podcasts

- Point

- points

- policies

- policy

- political

- pool

- position

- possible

- potential

- Powell

- power

- predicting

- Predictions

- Premium

- presidential

- presidential election

- press

- pretty

- previously

- price

- Prices

- private

- private sector

- probably

- Produced

- profound

- project

- Projection

- projections

- promise

- properties

- property

- protected

- provide

- public

- publish

- Publishing

- pursue

- Pushing

- put

- Puts

- Putting

- Q1

- QE

- question

- Quick

- quickly

- Rabbit

- raising

- Rate

- Rates

- rating

- RE

- reach

- reactions

- Read

- Reading

- real

- real estate

- real-time

- really

- realm

- reason

- reasons

- recent

- recently

- recession

- recommend

- Redfin

- reference

- regarding

- related

- relationship

- relative

- Releases

- remaining

- reminder

- report

- Reports

- represent

- Republican

- Republicans

- research

- reserves

- resilient

- resolved

- Restrictive

- return

- returning

- right

- Rise

- rising

- Risk

- Risky

- roadmap

- Role

- Room

- round

- running

- Said

- sake

- salt

- same

- Savings

- saw

- say

- saying

- says

- Scale

- scenes

- Second

- seconds

- sector

- Securities

- security

- see

- seemed

- seems

- seen

- sell

- sense

- set

- setting

- she

- sheet

- shift

- shifted

- Shifts

- short-term

- shot

- should

- show

- showing

- Shows

- shutdown

- side

- Sides

- Signal

- significant

- significantly

- similar

- Simple

- simply

- since

- single

- site

- Sitting

- SIX

- Six months

- sliding

- Slowly

- So

- Social

- Soft

- some

- Someone

- something

- sometimes

- somewhere

- Sources

- speaking

- special

- specific

- specifically

- speculation

- spend

- Spending

- Sponsors

- spread

- Spreads

- spring

- standard

- start

- started

- Starting

- State

- stay

- staying

- steady

- Step

- sticky

- Still

- stock

- Stock markets

- Stocks

- stopped

- Stories

- Story

- strategies

- Strategy

- stream

- street

- strength

- Strikes

- Student

- studies

- such

- sudden

- SUMMARY

- summer

- Super

- supply

- surprised

- Survey

- SVB

- tactical

- Take

- taken

- takes

- taking

- Talk

- talking

- team

- Technical

- teenager

- tell

- telling

- term

- terms

- territory

- than

- thank

- thanks

- that

- The

- the Fed

- The Future

- The State

- the world

- their

- Them

- then

- theoretical

- There.

- therefore

- These

- they

- thing

- things

- think

- Thinking

- Third

- this

- this year

- those

- though?

- thought

- thought leadership

- threat

- three

- Through

- Throwing

- Tied

- tightly

- time

- to

- today

- today’s

- together

- told

- Ton

- tons

- too

- top

- topic

- Topics

- TOTALLY

- touch

- towards

- Tracking

- Trading

- trail

- Transcript

- Treasuries

- treasury

- Trillion

- try

- trying

- TURN

- turnover

- two

- Uncertainty

- understand

- understandable

- unemployment

- unemployment rate

- unlimited

- unprecedented

- unrealized losses

- us

- us government

- use

- used

- usually

- Valuable

- variety

- various

- varying

- Vehicles

- Versus

- very

- vice

- Video

- View

- views

- volatile

- Volatility

- wait

- Waiting

- walks

- want

- wanted

- wanting

- wants

- was

- washington

- Watch

- Way..

- we

- Website

- weight

- welcome

- WELL

- were

- What

- What is

- whatever

- when

- whether

- which

- while

- WHO

- whole

- whom

- why

- wide

- will

- willing

- Wins

- WISE

- with

- Word

- Work

- working

- works

- world

- worry

- would

- would give

- writing

- written

- xiao

- year

- years

- yes

- yesterday

- yet

- Yield

- yields

- you

- Your

- yourself

- youtube

- zephyrnet