The Marijuana Mullet may not be the latest hair craze for stoners, but a business model where top line sales make eye-popping headlines but bottom line profits are scare. As they say, business on the top, party in the back, except many in the cannabis industry are still waiting for the party to start in the back. Massachusetts is great example of staggering marijuana sales numbers, yet cannabis businesses are closing up shop and licenses are being given away for pennies on the dollar.

The fourth-biggest market in the country for cannabis used for adult purposes grew somewhat in 2023. The Cannabis Control Commission (CCC) of the state of Massachusetts reports that licensed dispensaries sold over $1.79 billion worth of cannabis for medicinal and adult use combined. This is a 1.8% increase over the $1.76 billion sold in 2022.

Of this total, almost $1.57 billion, making up 87% of sales, came from the adult-use market. Meanwhile, medical sales continued their downward trend, reaching $225.6 million in 2023, reflecting a 28% decline from the peak of $312 million in 2021, marking the program's fifth full year serving adults aged 21 and older.

A noteworthy highlight was Massachusetts starting the new year with a record-breaking $140 million in adult-use sales in December 2023. For the entire year, the state's cannabis sales ranked second only to California's estimated $4.4 billion in adult-use sales, surpassing Michigan's nearly $3 billion and Illinois' $1.63 billion in adult-use sales, as per data from various state agencies.

The Cannabis Consumer Coalition (CCC) estimates that since adult-use sales began in November 2018, recreational users in Massachusetts have spent about $5.6 billion on cannabis, and medical users have spent over $1.2 billion. This makes for a total of $6.8 billion in sales in just over five years.

Massachusetts had continuous sales growth in 2023 despite the difficulties the cannabis sector experienced. But this increase was accompanied by a sharp drop in the average cost per ounce of adult-use flower, which, according to the CCC, reached an all-time low of $172, down 40% from the average of $289 per ounce in 2022. Compared to other established adult-use marketplaces throughout the nation, Massachusetts' average flower price remained comparatively higher in 2023.

Shifts in Market Dynamics: Adult-Use Dominance and Medical Sales Decline

The cannabis landscape in Massachusetts witnessed a transformative shift in market dynamics, with adult-use cannabis emerging as the dominant force. In 2023, the adult-use segment contributed a staggering $1.57 billion to the total cannabis sales, representing an impressive 87% share. This significant growth underscores the evolving preferences of consumers, as more individuals are drawn towards the recreational aspects of cannabis. The appeal of adult-use products seems to have outpaced the demand for medicinal cannabis, marking a noteworthy trend that the industry stakeholders and regulators need to closely monitor.

Conversely, medical cannabis sales in Massachusetts experienced a notable decline, continuing a trend observed over the past five years. The 28% decrease, bringing medical sales to $225.6 million in 2023, raises questions about the sustained demand for medical marijuana. It prompts a deeper examination into factors influencing this decline, including potential shifts in patient preferences, accessibility of recreational options, and the evolving medical cannabis landscape. This market dynamic emphasizes the need for a nuanced approach in catering to the diverse needs of both recreational and medicinal cannabis users within the state.

Despite the decline in medical sales, the dual market system presents a unique challenge and opportunity for Massachusetts. Striking the right balance between the burgeoning adult-use sector and the medical cannabis market will be crucial for ensuring a sustainable and inclusive cannabis industry. Regulatory adjustments and targeted efforts to address the specific needs of medical cannabis users could play a pivotal role in shaping the future trajectory of cannabis sales in the state.

Massachusetts' Impressive December Sales

The advent of 2023 marked a historic milestone for Massachusetts as the state catapulted into the national spotlight with a record-breaking December in cannabis sales. Boasting an unprecedented $140 million in adult-use cannabis sales for the month, Massachusetts showcased its prowess in the cannabis market, setting the tone for a promising year ahead. This achievement not only solidifies the state's position as a key player in the industry but also underscores the resilience and adaptability of its cannabis market, even in the face of external challenges.

The $140 million in adult-use sales for December positioned Massachusetts as the second-highest-ranking state in the country for cannabis sales during that month, trailing only behind California's estimated $4.4 billion in adult-use sales. This remarkable feat not only speaks to the growing acceptance and popularity of cannabis among Massachusetts residents but also highlights the state's ability to compete on a national scale. The December surge in sales reflects a combination of factors, including increased consumer interest, effective marketing strategies, and a well-regulated market that caters to the diverse preferences of cannabis enthusiasts.

The record-breaking start to 2023 signifies more than just economic success; it symbolizes the normalization and mainstream acceptance of cannabis in Massachusetts. As the state continues to refine its regulatory framework and address emerging trends, the impressive December sales set a precedent for sustained growth and influence in the national cannabis landscape. It also prompts industry stakeholders and policymakers to explore how Massachusetts can leverage this momentum to further enhance its position as a leading hub for responsible and thriving cannabis commerce.

Cost Dynamics and Market Resilience: Massachusetts' Unique Position

Despite challenges faced by the broader cannabis sector in 2023, Massachusetts exhibited resilience with sustained sales growth. Notably, the average cost per ounce of adult-use flower in the state plummeted to an unprecedented low of $172, marking a substantial 40% decrease from the 2022 average of $289 per ounce. Importantly, even with this reduction, Massachusetts maintained an average flower price higher than other established adult-use markets, showcasing the state's unique position in the evolving cannabis landscape.

Insights from the Cannabis Control Commission (CCC) indicate that the drop in the average cost per ounce did not impede the state's continuous sales growth. Massachusetts demonstrated adaptability, attracting consumers with more affordable adult-use cannabis products while navigating market challenges. This dynamic adjustment in pricing underscores the maturation of the cannabis market in Massachusetts and serves as a valuable example for industry stakeholders navigating the delicate balance between fair pricing and sustaining the economic viability of cannabis businesses.

Bottom Line

Massachusetts's cannabis market has proven its resilience and dominance, surpassing $1.7 billion in sales for 2023. The significant surge in adult-use cannabis sales, reaching $1.57 billion and comprising 87% of the total, underlines shifting consumer preferences towards recreational products. Despite the decline in medical cannabis sales, the state's dual-market system presents both challenges and opportunities. Massachusetts's ability to strike a balance between the flourishing adult-use sector and the medical market will be pivotal for ensuring a sustainable and inclusive industry. The state's record-breaking December sales showcase not only economic success but also symbolize the normalization of cannabis, setting the stage for continued growth and influence in the national landscape. Additionally, the unique position of Massachusetts, maintaining higher average flower prices despite a sharp drop, reflects the state's adaptability and maturity in navigating market dynamics. As the cannabis industry evolves, Massachusetts stands as a beacon, providing valuable insights for stakeholders and policymakers aiming to navigate the delicate balance of fair pricing and economic sustainability.

MASSACHUETTS CANNABIS SALES, READ ON...

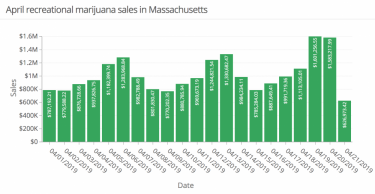

MASSACHUSETTS CANNABIS SALES BOOM AFTER 4/20 EACH YEAR!

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://cannabis.net/blog/news/the-marijuana-industry-mullet-great-on-the-top-line-no-profits-on-the-bottom-line

- :has

- :is

- :not

- :where

- $3

- $UP

- 1

- 2018

- 2021

- 2022

- 2023

- 7

- 8

- a

- ability

- About

- acceptance

- accessibility

- accompanied

- According

- achievement

- Additionally

- address

- Adjustment

- adjustments

- Adult

- adults

- advent

- affordable

- After

- aged

- agencies

- ahead

- Aiming

- all-time low

- almost

- also

- among

- an

- and

- appeal

- approach

- ARE

- AS

- aspects

- attracting

- average

- away

- back

- Balance

- BE

- beacon

- began

- behind

- being

- between

- Billion

- boasting

- boom

- both

- Bottom

- Bringing

- broader

- burgeoning

- business

- business model

- businesses

- but

- by

- california

- came

- CAN

- cannabis

- Cannabis Industry

- cannabis products

- catering

- caters

- ccc

- challenge

- challenges

- closely

- closing

- coalition

- combination

- combined

- Commerce

- commission

- comparatively

- compared

- compete

- comprising

- consumer

- Consumers

- continued

- continues

- continuous

- contributed

- control

- Cost

- could

- country

- crucial

- data

- December

- Decline

- decrease

- deeper

- Demand

- demonstrated

- Despite

- DID

- difficulties

- dispensaries

- diverse

- Dollar

- Dominance

- dominant

- down

- downward

- drawn

- Drop

- dual

- during

- dynamic

- dynamics

- each

- Economic

- Effective

- efforts

- emerging

- emphasizes

- enhance

- ensuring

- enthusiasts

- Entire

- established

- estimated

- estimates

- Even

- evolves

- evolving

- examination

- example

- Except

- exhibited

- experienced

- explore

- external

- Face

- faced

- factors

- fair

- feat

- fifth

- five

- flourishing

- flower

- For

- Force

- Framework

- from

- full

- further

- future

- given

- great

- grew

- Growing

- Growth

- had

- Hair

- Have

- Headlines

- higher

- Highlight

- highlights

- historic

- How

- HTTPS

- Hub

- illinois

- importantly

- impressive

- in

- Including

- Inclusive

- Increase

- increased

- indicate

- individuals

- industry

- influence

- influencing

- insights

- interest

- into

- IT

- ITS

- jpg

- just

- Key

- key player

- landscape

- latest

- leading

- Leverage

- Licensed

- licenses

- Line

- Low

- Mainstream

- maintained

- maintaining

- make

- MAKES

- Making

- many

- marijuana

- marked

- Market

- Marketing

- Marketing Strategies

- marketplaces

- Markets

- marking

- massachusetts

- maturity

- May..

- Meanwhile

- medical

- medical cannabis

- Medical Marijuana

- medicinal

- Michigan

- milestone

- million

- model

- Momentum

- Monitor

- Month

- more

- nation

- National

- Navigate

- navigating

- nearly

- Need

- needs

- New

- new year

- no

- notable

- notably

- noteworthy

- November

- nuanced

- numbers

- observed

- of

- older

- on

- only

- opportunities

- Opportunity

- Options

- Other

- over

- party

- past

- patient

- Peak

- per

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- Play

- player

- policymakers

- popularity

- position

- positioned

- potential

- Precedent

- preferences

- presents

- price

- Prices

- pricing

- Products

- profits

- Program

- promising

- prompts

- proven

- providing

- prowess

- purposes

- Questions

- raises

- ranked

- reached

- reaching

- Read

- Recreational

- reduction

- refine

- reflecting

- reflects

- Regulators

- regulatory

- remained

- remarkable

- Reports

- representing

- residents

- resilience

- responsible

- right

- Role

- s

- sales

- say

- Scale

- Second

- sector

- seems

- segment

- serves

- serving

- set

- setting

- shaping

- Share

- sharp

- shift

- SHIFTING

- Shifts

- Shop

- showcase

- showcased

- showcasing

- significant

- signifies

- since

- sold

- solidifies

- somewhat

- Speaks

- specific

- spent

- Spotlight

- Stage

- staggering

- stakeholders

- stands

- start

- Starting

- State

- Still

- strategies

- strike

- substantial

- success

- surge

- surpassing

- Sustainability

- sustainable

- sustained

- symbolizes

- system

- targeted

- than

- that

- The

- The Future

- The State

- their

- they

- this

- thriving

- throughout

- to

- TONE

- top

- Total

- towards

- trajectory

- transformative

- Trend

- Trends

- underlines

- underscores

- unique

- unprecedented

- use

- used

- users

- Valuable

- various

- viability

- Waiting

- was

- well-regulated

- which

- while

- will

- with

- within

- witnessed

- worth

- year

- years

- zephyrnet