This article is sponsored by Sphera.

When considering climate ambition, many companies focus more on the costs of carbon abatement initiatives and technologies than they will pay for failing to act. One common method for determining the price of carbon for an organization is using a carbon abatement cost curve. Companies arrive at a marginal abatement cost of after factoring in the cost of a carbon reduction measure compared to the amount of carbon emissions saved over a given period.

It is common for these discussions only consider the direct economic costs of carbon reduction, and do not cover the costs of climate change for companies, or the costs for the business-as-usual scenario. Often it is already seen as an achievement when a carbon price is used in some business areas as a control mechanism at all. The related cost of carbon abatement projects tend to define an organization’s decision-making process on what kind of decarbonization initiatives a company will undertake.

But adding the costs of climate change to the carbon abatement cost discussion helps to trigger management commitment and steer finances toward emission reduction plans, as well as create a more comprehensive and transparent corporate climate strategy.

To achieve this, companies must alter their approach when determining costs of carbon abatement in a way which combines feasibility studies on decarbonization levers and their related marginal carbon abatement costs — while also considering the climate-related financial impact on an organization. This approach brings new substance to corporate climate strategy discussions and strengthens the business case for implementing decarbonization.

Climate change has a price tag

Growing evidence reveals that decarbonization policies and the cost of transition to a low carbon future are leaving out the social cost of climate change. While this social cost is commonly discussed in policy circles, it has yet to take hold in many corporate climate conversations.

Climate change has a cost, whether we like it or not. The long-term macroeconomic effects of climate change show that 7 percent of global GDP per capita will disappear by 2100 as a result of business-as-usual carbon emissions. Over 10 percent of incomes in both Canada and the United States will vanish.

The business-as-usual carbon emissions scenario is the worst-case scenario for businesses. Despite climate change creating severe costs for business, many organizations continue to ignore it in corporate cost considerations to their own peril.

Why climate costs go ignored

Framing climate action as costly is incorrect because the cost of decarbonization often does not include the negative impacts from climate change itself, or the associated economic benefits of avoided impacts, according to an article in Nature Climate Change.

To be fair, estimating the aggregate economic effects of the physical impacts of climate change remains difficult. A lack of data, high uncertainties in regional climate change and the controversy of assigning costs to human lives, biodiversity or cultural heritage are among the challenges. But looking only at the costs of climate change mitigation action relies on a limited perspective of an idealized reference economy that does not consider already adopted climate policies or the benefits of past mitigation action.

Another reason why the costs of climate inaction haven’t been part of the calculus is because the Intergovernmental Panel of Climate Change has typically treated this as a separate issue. The IPCC’s working groups focused on the impacts of climate change and the costs of mitigation — which is why the cost of inaction (impact) is not well reflected in the costs of abatement (mitigation).

The 2022 IPCC’s AR6 Working Group III report highlights that most studies have used a cost-effectiveness analysis to develop mitigation pathways. This aims at comparing the costs of different mitigation strategies designed to meet a given climate change mitigation goal (an emission reduction target or a temperature-stabilization target). However, they do not incorporate economic impacts from climate change, nor the associated economic benefits of avoided impacts.

Omitting the economic impacts from climate change leaves out the cost of inaction. Omitting the economic benefits of avoided impacts leaves out part of the benefits of action. Climate policy helps to reduce massive adverse impacts which, if avoided or reduced, not only saves costs, but may also have economic co-benefits, such as increased standards of living, avoided conflicts over scarce resources and economic stability.

A new approach in corporate climate governance

On a scientific basis, the economic and social costs of climate change amount to roughly $180 per ton of CO₂ equivalent (CO₂e), a value 3.6 times higher than the value assigned by the U.S. government — $51 per ton of CO2e. The German Environmental Agency (German) sees the cost of climate change at $257 per t CO2e. When accounting for intergenerational justice, the price should be set much higher, at $878 per t CO2e.

To counterbalance traditional carbon abatement cost curves, companies may want to include the impact of climate change and co-benefits such as business opportunities related to innovation and access to new markets. This would build a business case for implementing decarbonization policies to overcome the pledge vs. implementation gap in corporate climate decisions.

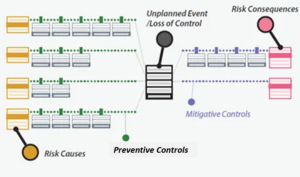

It is a good idea to include the economic and social impacts of climate change in traditional marginal carbon abatement cost curves. This requires a new carbon abatement cost approach for corporations. In line with a double materiality approach, this harmonizes corporate climate risk assessments with carbon abatement curves by incorporating financial implications in the decision-making process. Giving climate risks a financial value must be combined with assessing the cost of climate action and mitigation strategies.

Companies should consider a modified approach when determining corporate costs of carbon abatement. This involves:

- The traditional approach: identifying, assessing and quantifying decarbonization options for organizations and developing a marginal carbon abatement cost curve for the reduction levers.

- In parallel, counterbalancing these costs with the cost of climate impacts for corporations in both macroeconomic (stated policies) as well as company-specific scenarios (business as usual / no reduction levers applied).

- Understanding the co-benefits of both macroeconomic policies (further cost reduction over time of abatement technology), as well as co-benefits of reduction activities (driving innovation, further cost reduction over time of abatement technology, accessing new markets, etc.).

In the end, this exercise combines feasibility studies on decarbonization levers and their related marginal carbon abatement costs, while also considering the financial assessment of climate-related risks and opportunities. This approach brings new substance to corporate climate strategy discussions and strengthens the business case for decarbonization.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.greenbiz.com/article/hidden-cost-corporate-climate-inaction

- :has

- :is

- :not

- 10

- 2022

- 7

- a

- access

- accessing

- According

- Accounting

- Achieve

- achievement

- Act

- Action

- activities

- adding

- adopted

- adverse

- After

- aggregate

- aims

- All

- already

- also

- ambition

- among

- amount

- an

- analysis

- and

- applied

- approach

- ARE

- areas

- article

- AS

- Assessing

- assessment

- assessments

- assigned

- associated

- At

- avoided

- basis

- BE

- because

- been

- benefits

- both

- Brings

- build

- business

- businesses

- but

- by

- Canada

- Capita

- carbon

- carbon emissions

- Carbon Reduction

- case

- challenges

- change

- circles

- Climate

- climate action

- Climate change

- combined

- combines

- commitment

- Common

- commonly

- Companies

- company

- compared

- comparing

- comprehensive

- conflicts

- Consider

- considerations

- considering

- continue

- control

- controversy

- conversations

- Corporate

- Corporations

- Cost

- cost reduction

- costly

- Costs

- cover

- create

- Creating

- cultural

- curve

- data

- decarbonization

- Decision Making

- decisions

- define

- designed

- Despite

- determining

- develop

- developing

- different

- difficult

- direct

- disappear

- discussed

- discussion

- discussions

- do

- does

- driving

- Economic

- economic impacts

- economy

- effects

- emission

- Emissions

- end

- environmental

- Equivalent

- etc

- evidence

- Exercise

- failing

- fair

- Finances

- financial

- Focus

- focused

- For

- from

- further

- future

- gap

- GDP

- German

- given

- Giving

- Global

- Go

- goal

- good

- Government

- Group

- Group’s

- Have

- helps

- heritage

- Hidden

- High

- higher

- highlights

- hold

- However

- HTTPS

- human

- idea

- identifying

- if

- iii

- Impact

- Impacts

- implementation

- implementing

- implications

- in

- inaction

- include

- incorporate

- incorporating

- increased

- initiatives

- Innovation

- involves

- issue

- IT

- itself

- jpg

- Justice

- Kind

- Lack

- leaving

- like

- Limited

- Line

- Lives

- living

- long-term

- looking

- Low

- Macroeconomic

- management

- many

- Markets

- massive

- May..

- measure

- mechanism

- Meet

- method

- mitigation

- modified

- more

- most

- much

- must

- Nature

- negative

- New

- no

- nor

- of

- often

- on

- ONE

- only

- opportunities

- Options

- or

- organization

- organizations

- out

- over

- Overcome

- own

- panel

- Parallel

- part

- past

- Pay

- per

- percent

- period

- perspective

- physical

- plans

- plato

- Plato Data Intelligence

- PlatoData

- Pledge

- policies

- policy

- policy helps

- price

- process

- projects

- reason

- reduce

- Reduced

- reduction

- reflected

- regional

- related

- remains

- requires

- Resources

- result

- Reveals

- Risk

- risks

- roughly

- s

- Scarce

- scenario

- scenarios

- scientific

- seen

- sees

- separate

- set

- severe

- should

- show

- Social

- some

- Sponsored

- Stability

- standards

- stated

- States

- strategies

- Strategy

- Strengthens

- studies

- substance

- such

- T

- Take

- Target

- Technologies

- Technology

- than

- that

- The

- their

- These

- they

- this

- time

- times

- to

- Ton

- toward

- traditional

- transition

- treated

- trigger

- typically

- u.s.

- U.S. government

- uncertainties

- undertake

- United

- United States

- used

- using

- value

- vs

- want

- Way..

- we

- WELL

- What

- when

- whether

- which

- while

- why

- will

- with

- working

- Working Group

- Working Groups

- would

- yet

- zephyrnet