Through possession of non-fungible tokens, NFTs, any of us can be the owner of digital works of art, books, music and video content, including iconic moments in sport or other performances and events. Their use extends to event tickets, anything collectible and digital, or even membership of organisations. Other uses are constantly being added to the list. The items become ours, are most often housed on the Ethereum blockchain distributed ledger rather than by a third-party, and accessed through a complicated and confidential code. They are bought with cryptocurrency relevant to the particular blockchain that hosts the asset, and proven ownership of digital assets through NFTs creates new marketplaces.

NFTs can thus be the ‘ownership certificate’ of items sold for a regular set price such as a book or a music album, which provides the authors and artists with direct-to-customer opportunities (D2C) free of any cut of the takings taken by a publisher or record label. Though it gets more interesting when the NFTs confer ownership of limited edition or collectible items. Buyer demand sets the selling price through an auction process. In this scenario, a purchase decision could be made on a potential return-on-investment basis rather than an appreciation of the intrinsic quality of the product itself. Add in the volatility of cryptocurrency valuations, and it can be an uncertain though highly speculative space to operate in.

In an added bonus for the original creators of the digital items, any changes of NFT ownership trigger a royalty payment, whether an NFT is sold at a higher or a lower price than the time before. Forecasts of royalty income can be recognised as an asset that creators may be able to borrow against in cryptocurrency from a decentralized finance (DeFi) platform such as Aave (whose stakeholders include Winklevoss Capital). It’s like a P2P loan platform that operates in crypto.

What prevents investing in NFTs to be regarded as closer to investing through a stock market, or in fine wine or a fine art painting, is the lack of information available to support confident trading and evaluations. Public companies trade on stock exchanges and have to file annual reports giving market performance information, and trading is regulated. There are also many experts who have professional opinions on the value of rare, though tangible (non-digital) items. This gives those respective marketplaces some transparency. What information is there about the many NFTs being launched? A low-velocity of NFT resales (they don’t change hands very often) means they are hard to price in a relatively illiquid marketplace. Crowdsourcing is able to deliver a solution.

Crowdsourcing NFT appraisals

Upshot is a platform that crowdsources appraisals of NFTs. A decentralized community of collectors interact with Upshot to deliver quick and accurate pricing of assets through what they call appraisal games. Upshot’s ultimate goal is to be a kind of comparison site to help anyone considering a trade, while also paying the expert contributors for honest evaluations: contributors who provide the most accurate forecasts are better rewarded.

So if you want some background on buying or selling a particular NFT, or to earn rewards from giving your expert opinion, head over to Upshot. It is definitely crowdsourcing NFT support. In May 2021 the company announced it had raised $7.5 million in Series A funding to expand its operations.

The first crowdsourced NFT

The prestigious art auction house Christie’s made global headlines when in March 2021 it auctioned off a digital collage by an artist using the name of Beeple for $69.3m. It made him the third-most expensive living artist in history. It was the first time the 255 years old auction house had sold a piece of digital-only artwork with a non-fungible token as a guarantee of its authenticity, as well as the first time cryptocurrency has been used to pay for an artwork at auction. The work, titled The First 5,000 Days, was a collage of 5,000 images that had been individually created on a daily basis over more than 13 years.

Perhaps inspired by this collage execution, Project 100 wants a hundred people to donate a piece of visual art in JPG or PNG format, and pay 1 ETH for doing so. The 100 pieces of art will be assembled together, and minted as a single NFT that will be offered for sale. Right now, the price of an Ethereum coin is a little over $2,500, which some would-be contributors say they find a bit steep. Even so, the project is definitely crowdsourcing NFT support.

However, the potential return is that the creators of Project 100 will share the sale proceeds with the contributors to this crowdsourced NFT, which means they can look on their involvement in the project as a financial investment. Though there has to be a question asked about how long the sale process will last for, and what happens if there are no bids above 100 ETH (over $250,000 at today’s ETH value) for the completed ‘work of art’? The project organisers say that although they can set a reserve price, the final value will be determined by the market (the bidders). They have made an assumption that if all spaces get filled, the value of the piece will start off pretty high since it would carry the backing of 100 individual artists behind it. Though it could turn out to be just wishful thinking – at this stage, who really knows?

Top NFT Marketplace Platforms

Creators of NFTs need to choose a platform where they can mint them (NFTs are ‘minted’ rather than ‘built’ or ‘issued’) and then sell them. There is also legitimate trading of pre-owned NFTs by original and subsequent owners. Let’s look at some of the top marketplace platforms, though this market is in its infancy, and turnover, transaction and customer figures are often a closely guarded secret. Each platform is effectively crowdsourcing NFT support through creating unique user communities.

-

OpenSea

OpenSea describes itself boldly as being the largest NFT marketplace. OpenSea’s minting service is free to use and requires no knowledge of coding. It currently features over 700 projects that are held on the Ethereum blockchain. As well as selling NFTs at a fixed price or with bid prices as at an auction, a third pricing possibility is a ‘declining price option’. This is where the seller chooses a start price, an end price, and a duration. The price will decline over time until it reaches the end, allowing the seller to charge a premium price to the most eager buyers.

Its founders launched OpenSea in 2017 with an aim to be the Amazon of the NFT world. Early in 2021 the startup raised $23 million in a round of venture capital funding led by the cryptocurrency arm of VC firm Andreessen Horowitz based in Silicon Valley.

-

Rarible

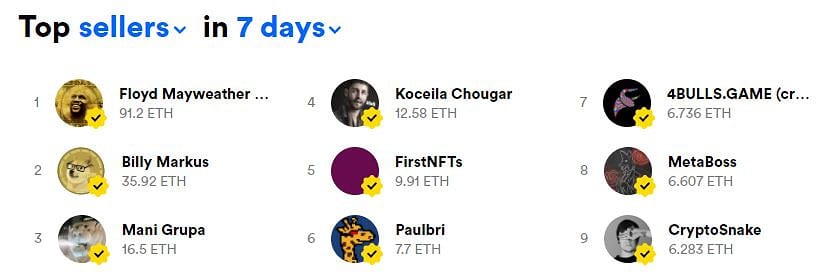

Rarible buys and sells NFTs held on the Ethereum blockchain, in ETH, in categories including art, photography, games, metaverses, music, domains and memes. Creators can use Rarible to mint new NFTs to sell their books, movies, music or art creations. It is a community-owned NFT marketplace, with its “owners” holding $RARI tokens. Rarible awards the token to active users who buy or sell on the marketplace platform. It distributes 75,000 $RARI every week, with 50% reserved for buyers, and 50% for sellers.

The top NFT seller in the previous seven days from when we took a look at the Rarible site had received 91.2 ETH, approximately $230,000.

-

SuperRare

SuperRare aims to establish a USP as a marketplace for unique, single-edition digital artworks, again based on Ethereum. Each artwork is authentically created by an artist in the network and tokenized as a crypto-collectible digital item to be owned and traded. They describe the platform as being “like Instagram meets Christie’s (auction house).”

-

Foundation

Rather than simply be a marketplace for ETH-backed NFTs, Foundation aspires to create a community of artists, creators and collectors in a culture that will be mutually supportive rather than exploitative.

-

AtomicMarket

This platform mints, and is a marketplace for, NFTs held on the EOSIO blockchain.

-

Myth Market

The Myth Market platform hosts a number of online marketplaces that trade various digital card brands. Its current featured markets are GPK.Market (where you can buy digital Garbage Pail Kids cards), GoPepe.Market (for GoPepe trading cards), Heroes.Market (for Blockchain Heroes trading cards), KOGS.Market (for KOGS trading cards), and Shatner.Market (for William Shatner memorabilia).

-

TreasureLand

Treasureland is a multi-chain NFT issuance and trading platform, empowering users to mint NFTs with a one-click-process and then buy, sell or auction NFTs. It claims long-term cooperation with some well-known companies or institutions around the world to promote the development of the NFT ecosystem.

-

Enjin Marketplace

For minting and then trading NFTs in Enjin Coin, an ERC20 token built on the Ethereum network. Since its launch in 2017, Enjin has grown into an ecosystem of integrated digital products, for trading and monetising games. Developers can use the Enjin Coin to tokenise in-game items on the Ethereum blockchain. In March 2021, Enjin Coin had the highest market cap of all NFTs.

Other platforms include BakerySwap, KnownOrigin and Portion.

Given that NFTs are still at such an early stage of development and wider adoption, we’re really calling out for input and insights from anyone operating in the space. Please share them with the rest of the Crowdsourcing Week community – and who knows where they may lead in crowdsourcing NFT support?

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://crowdsourcingweek.com/blog/the-first-crowdsourced-nft-and-crowdsourcing-nft-appraisals/

- 000

- 1

- 100

- 2017

- 2021

- 7

- a

- aave

- Able

- About

- above

- accessed

- accurate

- active

- added

- Adoption

- against

- aims

- Album

- All

- Allowing

- Although

- Amazon

- and

- Andreessen

- Andreessen Horowitz

- announced

- annual

- anyone

- appreciation

- approximately

- ARM

- around

- Art

- artist

- Artists

- artwork

- artworks

- assembled

- asset

- Assets

- assumption

- Auction

- authentically

- authenticity

- authors

- available

- awards

- background

- backing

- based

- basis

- become

- Beeple

- before

- behind

- being

- Better

- bid

- Bit

- blockchain

- Bonus

- book

- Books

- borrow

- bought

- brands

- built

- buy

- buyers

- Buying

- Buys

- call

- calling

- cap

- capital

- card

- Cards

- carry

- categories

- change

- Changes

- charge

- Choose

- Christie’s

- claims

- closely

- closer

- code

- Coding

- Coin

- Collectible

- collectors

- Communities

- community

- Companies

- company

- comparison

- Completed

- complicated

- confident

- considering

- constantly

- content

- contributors

- cooperation

- could

- create

- created

- creates

- Creating

- creations

- creators

- crypto

- cryptocurrency

- Culture

- Current

- customer

- Cut

- daily

- Days

- decentralized

- decision

- Decline

- DeFi

- definitely

- deliver

- Demand

- describe

- determined

- developers

- Development

- digital

- Digital Assets

- distributed

- Distributed Ledger

- doing

- domains

- donate

- Dont

- each

- Early

- early stage

- earn

- ecosystem

- edition

- effectively

- empowering

- Enjin

- Enjin Coin

- EOSIO

- ERC20

- ERC20 token

- establish

- ETH

- ethereum

- Ethereum blockchain

- ethereum network

- evaluations

- Even

- Event

- events

- Exchanges

- execution

- Expand

- expensive

- expert

- experts

- featured

- Features

- Figures

- File

- filled

- final

- financial

- Find

- fine

- Fine Art

- Firm

- First

- first time

- fixed

- format

- Foundation

- founders

- Free

- from

- funding

- Games

- Garbage Pail Kids

- get

- gives

- Giving

- Global

- goal

- GPK

- grown

- guarantee

- Hands

- happens

- Hard

- head

- Headlines

- Held

- help

- Heroes

- High

- higher

- highest

- highly

- history

- holding

- Horowitz

- House

- How

- HTTPS

- iconic

- images

- in

- in-game

- include

- Including

- Income

- individual

- Individually

- information

- input

- insights

- inspired

- institutions

- integrated

- interact

- interesting

- intrinsic

- investing

- investment

- involvement

- issuance

- IT

- items

- itself

- kids

- Kind

- knowledge

- Label

- Lack

- largest

- Last

- launch

- launched

- lead

- Led

- Ledger

- Limited

- List

- little

- living

- loan

- Long

- long-term

- Look

- made

- many

- March

- Market

- Market Cap

- marketplace

- marketplaces

- Markets

- max-width

- means

- Meets

- membership

- memes

- metaverses

- million

- mint

- minted

- minting

- Moments

- more

- most

- Movies

- multi-chain

- Music

- mutually

- name

- Need

- network

- New

- NFT

- nft marketplace

- NFTs

- non-fungible

- non-fungible token

- non-fungible tokens

- number

- offered

- Old

- online

- OpenSea

- operate

- operates

- operating

- Operations

- Opinion

- Opinions

- opportunities

- Organisations

- original

- Other

- owned

- owner

- owners

- ownership

- p2p

- particular

- past

- Pay

- paying

- payment

- People

- performance

- performances

- photography

- piece

- pieces

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- please

- possession

- possibility

- potential

- Premium

- prestigious

- pretty

- previous

- price

- Prices

- pricing

- proceeds

- process

- Product

- Products

- professional

- project

- projects

- promote

- proven

- provide

- provides

- public

- public companies

- publisher

- purchase

- quality

- question

- Quick

- raised

- RARE

- rarible

- Reaches

- received

- recognised

- record

- regular

- regulated

- relatively

- relevant

- Reports

- requires

- Reserve

- reserved

- respective

- REST

- return

- rewarded

- Rewards

- round

- royalty

- sale

- Secret

- sell

- Sellers

- Selling

- Sells

- Series

- Series A

- service

- set

- Sets

- seven

- Share

- Silicon

- Silicon Valley

- simply

- since

- single

- site

- So

- sold

- solution

- some

- Space

- spaces

- Sport

- Stage

- stakeholders

- start

- startup

- Still

- stock

- stock exchanges

- stock market

- subsequent

- such

- support

- supportive

- The

- the world

- their

- Thinking

- Third

- third-party

- Through

- tickets

- time

- titled

- to

- today’s

- together

- token

- tokenized

- Tokens

- top

- trade

- traded

- Trading

- Trading Cards

- Trading Platform

- transaction

- Transparency

- trigger

- TURN

- turnover

- ultimate

- unique

- us

- use

- User

- users

- Valley

- Valuations

- value

- various

- VC

- venture

- venture capital

- Venture Capital Funding

- Video

- visual art

- Volatility

- webp

- week

- well-known

- What

- whether

- which

- while

- WHO

- wider

- will

- WINE

- Winklevoss

- Work

- works

- world

- would

- years

- Your

- zephyrnet