No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at the immersive Virtual Inman Connect online Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the roaring future, and join us at Connect.

Several folks I’ve talked with recently, especially at Inman, said that rates were to blame for the decline of lead gen and related reduction in home sales, but I think it’s a bit more nuanced than that. For many of us in housing, the memories of the Global Financial Crisis (GFC) still linger, when 10 million families lost their homes to foreclosure. We are left wondering how the current interest rate adjustments have or might affect home sales in comparison to that tumultuous period.

While not an economist, I wanted to explore some of the intricacies of the Fed’s interest rate hikes and their potential effects on future home sales, drawing parallels and distinctions from the GFC from my data-nerd viewpoint.

TAKE INMAN’S INAUGURAL SURVEY ON AGENT COMMISSIONS

A non-linear balance

First, the basics: Interest rates play a pivotal role in determining the affordability of mortgages and subsequently influence the demand for homes. When the Federal Reserve raises interest rates, borrowing becomes more expensive, leading to higher mortgage rates. This, in turn, makes owning a home more expensive and discourages potential homebuyers from entering the market, reducing the overall demand for homes.

However, the relationship between interest rates and home sales isn’t linear; other economic factors, such as job growth, wage trends, consumer confidence and the average price per listing, contribute to the equation.

Today vs GFC

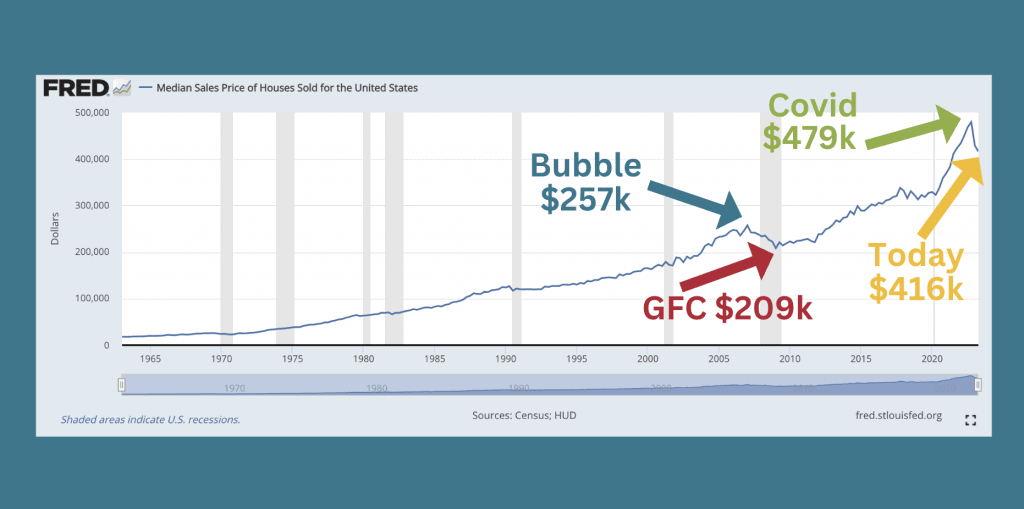

Today, the average SFR price per listing is $450,000, up $50,000 year over year. But while the list price is a good indicator, the sales price shows reality — and currently, it’s lower than the listing price (post negotiations and timing in a cooling market) at $416,000 vs. $450,000 year over year.

From the Bubble to the GFC, home prices dropped 19 percent over eight quarters from Q1 2007 to Q1 2009. From the COVID bubble to today, prices have dropped 14 percent over only two quarters. That’s based on the national average, but still: Yowza.

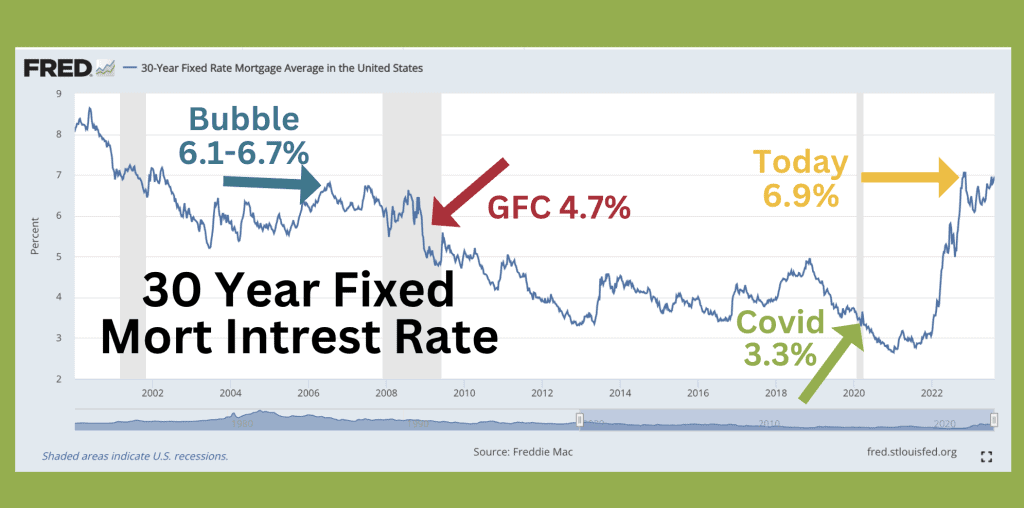

Interest rates then vs. now are also very odd. Rates were at historic lows during the bubble: a full 2 percent lower than during Y2K 6+ years prior.

Rates would continue to drop, bottoming out at nearly 2.5 percent in January of 2021, before the Fed took action to slow the rapid inflation (ironically also likely caused by the government printing free money), with rates topping out over 7 percent at the end of last year.

Inventory status

Today we have an inventory shortage, with 11 percent fewer properties for sale this August than last year, and historically, we are right about at the peak of yearly inventory. Unemployment climbed to 10 percent during the GFC (it’s currently 3.5 percent), yet still, affordability due to inflation and consumer distrust weakens the housing market — as people are not listing their homes because they can’t afford to buy “better” after they sell.

The GFC was marked by a significant collapse in the housing market, primarily triggered by a proliferation of subprime mortgages and a subsequent wave of foreclosures. The Fed’s response included a series of interest rate cuts to stimulate economic recovery.

In the aftermath of the crisis, home sales plummeted due to a lack of consumer confidence, tightening credit standards and an overabundance of distressed properties flooding the market.

In contrast, the current economic landscape has been relatively stable, with improved lending practices and stricter regulations in the mortgage industry. The Fed’s recent interest rate hikes are driven by the need to prevent runaway inflation and maintain economic equilibrium.

While rising interest rates might hinder some potential buyers, the overall housing market isn’t grappling with the same systemic issues that precipitated the GFC.

Home sales: Then and now

During the GFC, the housing market was a mess as plummeting property values left homeowners underwater on their mortgages. Foreclosures and short sales were rampant, leading to a glut of distressed properties that created a buyer’s market. Home sales dropped significantly, and many potential buyers were wary of purchasing properties due to the economy’s uncertainty.

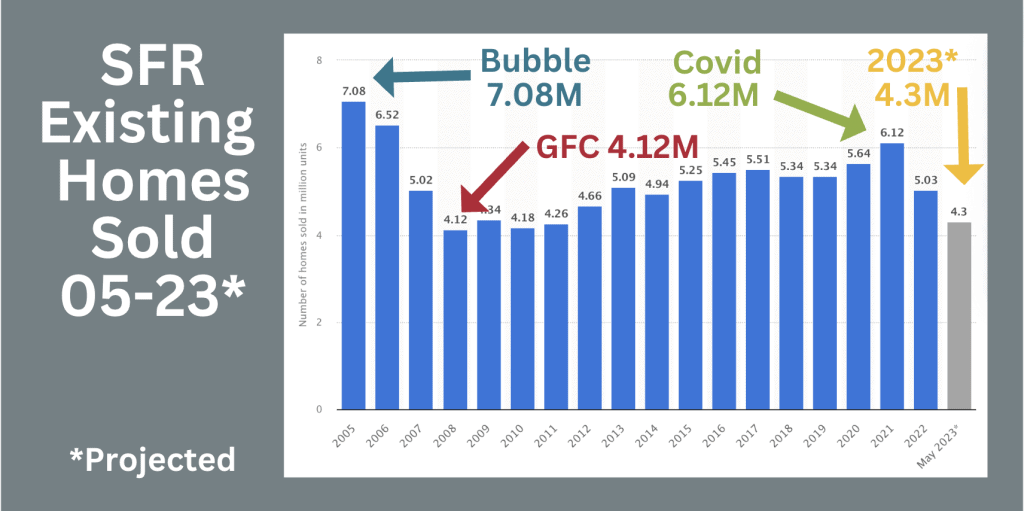

In the GFC, despite the harsh times, there were still 4.12 million homes sold in the worst year, 2008. This year looks to be about 4.3 million homes sold, a large drop from 6.12 during COVID but a far cry from the 7.08 million during the pre-GFC bubble.

In the present context, rising interest rates and higher prices have led to a slowdown in home sales, especially for those on the edge of affordability. However, the foundation of the current housing market is much stronger, with robust demand fueled by demographic trends, low housing inventory and a healthier job market.

While rising rates might dampen some enthusiasm, the overall impact on home sales will likely be more measured than the GFC.

The end?

The Global Financial Crisis was brutal on housing. While higher interest rates can lead to a decrease in home sales, the housing market today is far more resilient and better equipped to weather such fluctuations that lead to the bottom dropping out on real estate values.

The lessons learned from the GFC have prompted more cautious lending practices and stricter regulations, contributing to the current market’s stability. However, while people are not being foreclosed on and upside down in a mortgage, the opposite is now true. Homeowners still have equity, and moving is too expensive.

Today, the only people who move are those who have to move. Life events like a new job, divorce, marriage or death — the life events that require a move despite the cost — drive the majority of movers in today’s market. People are still moving, just at a reduced rate (-18.9 percent nationally) year over year per NAR.

Today there are more agents than ever. During the GFC, the successful agents shifted to working with lenders to sell properties, and they worked with corporations like Blackstone to help buy properties. Adaptation is key.

Chris Drayer is co-founder of Revaluate which segments consumers for marketers by propensity to move.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.inman.com/2023/08/23/the-fed-the-market-and-memories-of-the-global-financial-crisis/

- :has

- :is

- :not

- :where

- $10 million

- $UP

- 000

- 10

- 11

- 12

- 14

- 2008

- 2021

- 2023

- 2024

- 7

- 9

- a

- About

- Action

- adaptation

- adjustments

- affect

- After

- aftermath

- Agent

- agents

- AI

- also

- an

- and

- ARE

- AS

- At

- AUGUST

- average

- based

- Basics

- BE

- because

- becomes

- been

- before

- being

- Bet

- Better

- between

- Big

- Bit

- bold

- Borrowing

- Bottom

- bubble

- but

- buy

- buyers

- by

- CAN

- capital

- caused

- cautious

- Center

- center stage

- Co-founder

- Collapse

- comparison

- confidence

- Connect

- consumer

- Consumers

- context

- continue

- contrast

- contribute

- contributing

- Corporations

- Cost

- Covid

- created

- credit

- crisis

- Current

- Currently

- cuts

- Death

- Decline

- decrease

- Demand

- demographic

- Despite

- determining

- distressed

- distrust

- Dont

- down

- drawing

- drive

- Drop

- dropped

- Dropping

- due

- during

- Economic

- economic recovery

- Economist

- economy’s

- Edge

- effects

- end

- entering

- enthusiasm

- Equilibrium

- equipped

- equity

- especially

- estate

- events

- EVER

- expensive

- explore

- factors

- families

- far

- Far Cry

- Fed

- Federal

- federal reserve

- fewer

- financial

- financial crisis

- Find

- fluctuations

- For

- Foundation

- Free

- from

- fueled

- full

- future

- Gen

- GFC

- Global

- global financial

- Global Financial Crisis

- good

- Government

- Growth

- Have

- healthier

- help

- higher

- Hikes

- hinder

- historically

- Home

- Homes

- housing

- housing market

- How

- However

- http

- HTTPS

- i

- Impact

- improved

- in

- Inaugural

- included

- Indicator

- industry

- inflation

- influence

- interest

- INTEREST RATE

- INTEREST RATE HIKES

- Interest Rates

- intricacies

- inventory

- Ironically

- issues

- Jan

- January

- Job

- join

- Join us

- just

- Key

- Lack

- landscape

- large

- Last

- Last Year

- lead

- leading

- learned

- Led

- left

- lenders

- lending

- Lessons

- Lessons Learned

- Life

- like

- likely

- listing

- LOOKS

- lost

- Low

- lower

- Lows

- maintain

- Majority

- MAKES

- many

- marked

- Market

- marketers

- max-width

- measured

- Memories

- might

- million

- money

- more

- Mortgage

- Mortgages

- move

- Movers

- moving

- much

- my

- National

- nationally

- nearly

- Need

- negotiations

- New

- now

- of

- on

- ONE

- online

- only

- opposite

- or

- Other

- out

- over

- overall

- Parallels

- Peak

- People

- per

- percent

- period

- pick

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- Play

- Post

- potential

- practices

- predict

- Prepare

- present

- prevent

- price

- Prices

- primarily

- printing

- Prior

- properties

- property

- purchasing

- Q1

- quote

- raises

- rapid

- Rate

- rate hikes

- Rates

- real

- real estate

- Reality

- recent

- recently

- recovery

- Reduced

- reducing

- reduction

- regulations

- related

- relatively

- require

- Reserve

- resilient

- response

- right

- rising

- robust

- Role

- Said

- sale

- sales

- same

- segments

- sell

- Series

- shifted

- Short

- shortage

- Shows

- significant

- significantly

- slow

- Slowdown

- sold

- some

- Stability

- stable

- Stage

- standards

- Still

- stricter

- stronger

- subsequent

- Subsequently

- such

- Survey

- SurveyMonkey

- systemic

- than

- that

- The

- The Basics

- the Fed

- The Future

- their

- then

- There.

- they

- think

- this

- this year

- those

- tightening

- times

- timing

- to

- today

- today’s

- too

- took

- tools

- Trends

- triggered

- true

- TURN

- two

- Uncertainty

- underwater

- Upside

- us

- Values

- very

- vs

- wage

- wanted

- was

- Wave

- we

- Weather

- were

- What

- when

- which

- while

- WHO

- will

- with

- wondering

- worked

- working

- Worst

- would

- year

- yearly

- years

- yet

- you

- zephyrnet