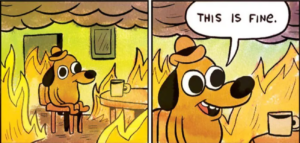

After the sheer, record-breaking insanity of early 2021, crypto is currently doing, well, nothing. And that’s not the worst thing.

Undeniably, one of cryptocurrency’s biggest draw cards is the sheer, take-no-prisoners volatility of it all. Coins doubling in a day? We call that Tuesday. Losing half their value two days later? Eh, whatcha gonna do?

This is, needless to say, not how markets usually operate. A sensible price target for a top-tier stock might be 20%, with a multi-month window. If something moves more than 5% in a day it’s a Big Deal. The long-term capital gains discount kicks in after you hold a stock for more than a year and that’s usually what you’re aiming for.

But crypto? Crypto is thrilling. It condenses years of traditional market movement into weeks and it exaggerates those movements by a factor of 10. Even if you don’t know what’s going to happen, at least you know it’s going to be unexpected and a little bit ludicrous. It’s a financial market for the internet age, where meaning is measured in minutes and things move or they die.

So, what happens when things stop moving?

Like Pong but worse

In the aftermath of the May collapse, people were instantly calling for a V-shaped recovery to US$55k or a continuation down to US$20k. A couple of weeks later, the targets became US$45k and US$24k. A couple of weeks after that, US$40k and US$28k. Now everyone’s yelling at each other about whether Bitcoin is going to hit US$36k or US$30k first.

Make no mistake, these sorts of markets are almost impossible to trade. In the absence of any true directional momentum, it’s a mess of switchbacks, fakeouts and wholly irrational movements designed to steal the money of the impatient. As crypto enthusiasts, our trigger fingers are constantly itchy. Putting the gun down altogether is a real challenge.

The storm is coming

While there are plenty of hypotheses as to why this is happening and what’s going to happen next, the truth of the matter is pretty simple: nobody knows until it actually happens. But when it does, trade my pretties, trade!

However, as is often the case, price action (or lack thereof) draws all the attention, while the actually important stuff keeps ticking along in the background. Stuff like Ethereum’s forthcoming ‘triple halving’ sequence of upgrades, or Fidelity expanding its staff by 70% due to excess interest from institutional investors, or Paraguay introducing its own Bitcoin bill. Stuff like the Bitcoin mining hash rate recovering as miners find new homes. And DeFi continues expanding at an ever increasing rate, market collapse or not. Remember, bear markets are where bull markets are built.

So, what should you do in the interim? Put down the charts, read a book, take up a hobby. Talk to your loved ones again, apologise for ignoring them from January to May. And set up Dollar Cost Averaging in your CoinJar, so that you keep on buying more crypto week-on-week, irrespective of price.

A year ago the price of 1 Bitcoin was less than US$10k. It’s now more than triple that. All you’ve ever needed to do with crypto is ignore the noise. But that can be the biggest challenge of all.

Like many investments, cryptoassets carry risk. Given the potential price volatility which can be extreme, the value of your cryptoassets may fall rapidly or over time. Cryptoassets are also currently unregulated by the FCA and you are unable to access the Financial Services Compensation Scheme or the Financial Ombudsman Service.

- access

- Action

- Aiming

- All

- Biggest

- Bit

- Bitcoin

- Buying

- call

- capital

- challenge

- Charts

- Coins

- Compensation

- continues

- Couple

- crypto

- day

- deal

- DeFi

- Discount

- Dollar

- Early

- expanding

- eye

- FCA

- fidelity

- financial

- financial services

- First

- hash

- hash rate

- hold

- How

- HTTPS

- Institutional

- interest

- Internet

- Investments

- IT

- Market

- Markets

- Miners

- Mining

- Momentum

- money

- move

- Noise

- Other

- Paraguay

- People

- Plenty

- price

- recovery

- Risk

- Services

- set

- Simple

- So

- stock

- Storm

- Target

- time

- trade

- value

- Volatility

- year

- years