In the ever-evolving landscape of SaaS, Venture Capital, Bootstrapping, and Valuations – understanding market trends and investment patterns is critical. In this post, we’ll share the learnings from SaaStr CEO and Founder Jason Lemkin’s frontline analysis of the current state of the market in 2023, and distill down into why we’re now in the era of efficient growth in SaaS.

We’ll explain Jason’s take on the recent market fluctuations, highlighting major deals that shaped investment patterns and their effects on valuation trends. We’ll also examine how public markets currently influence the SaaS industry and unpack the elevated CIOs’ role in budgeting for SaaS products.

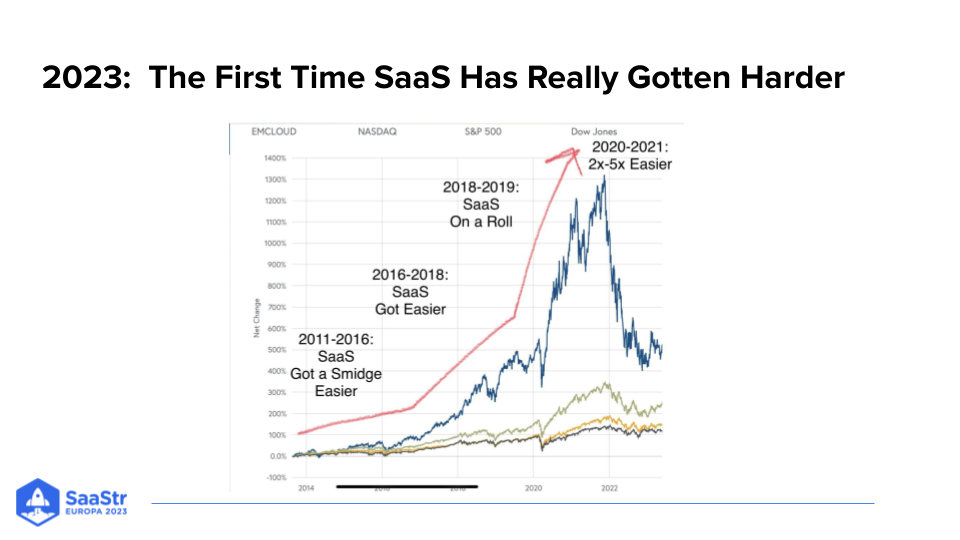

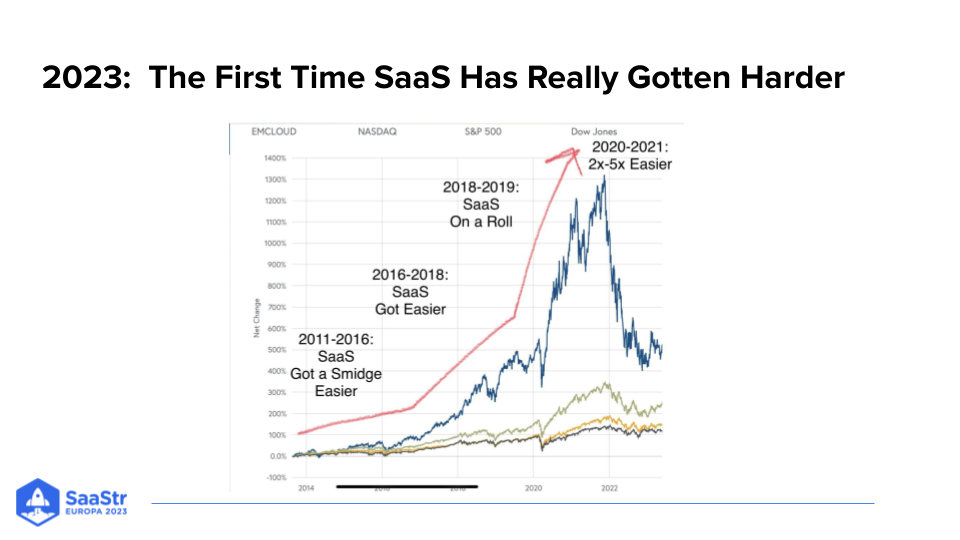

Market Fluctuations in 2023

Recent times have seen changes in the SaaS landscape, with market fluctuation being an expected outcome. These shifts can significantly impact investment patterns within the industry and influence valuation trends.

Major Deals That Shaped Investment Patterns

Recent events have demonstrated the profound impact that major deals can have on investment patterns in the SaaS industry. One such deal that Jason points out was Salesloft’s $2.5 billion cash acquisition deal in December 2021. In the midst of a “down-turn” in SaaS, this deal signaled to investors that even amidst uncertainty, there was room for significant returns.

Another noteworthy transaction was Adobe’s acquisition of Marketo for $4.75 billion, one of the largest deals in martech history. These high-profile transactions illustrate how despite market fluctuations, substantial investments continue to pour into promising SaaS companies.

How Market Fluctuations Impacted Valuation Trends

Sudden changes in market conditions can cause dramatic swings in company valuations. For instance, during periods of economic downturns or increased competition, investor sentiment may sour leading to lower valuations for otherwise healthy companies.

Innovation is often born out of necessity – this couldn’t be truer than in 2023. SaaS businesses were forced to adapt quickly or risk being left behind as consumer behaviors shifted dramatically due to lockdowns and social distancing measures.

Jason emphasizes that those who embraced change rather than resisting it were able to weather the storm much better. For instance, video conferencing software Zoom saw an unprecedented surge in demand as remote work became widespread. Similarly, e-commerce platforms like Shopify benefited immensely from increased online shopping trends.

This demonstrates that while times may be tough for many businesses right now, opportunities still exist for those willing to innovate and adapt accordingly.

Embracing Efficient Growth in Business Operations

To maximize success in the SaaS industry, efficiency must be a priority for businesses. Jason Lemkin, CEO and Founder of SaaStr, uses examples from successful companies like UiPath and HubSpot to illustrate this point.

Case study analysis – UiPath & HubSpot

UiPath, a leading enterprise automation software company, managed an impressive turnaround by focusing on operational efficiency. Despite losing $400 million in 2023, they nearly broke even just one year later. This was achieved through strategic cost-cutting measures without compromising their growth trajectory.

Another example is HubSpot. Known for its inbound marketing software products, it has consistently reinvested profits back into the business to fuel sustainable growth. By doing so, they’ve maintained steady revenue streams while also enhancing product offerings and customer service capabilities.

Importance of Reinvesting Profits for Sustainable Growth

The journey towards efficient SaaS growth isn’t solely about cutting costs or boosting revenues ”it’s about strategically allocating resources where they’ll generate the most value over time. Reinvesting profits back into your business can lead to improved services or products which will attract more customers thus generating more revenue in return.”

This approach requires careful planning and execution but can result in significant long-term benefits such as increased market share, enhanced brand reputation, and ultimately higher profit margins.

Achieving these results though requires an organization-wide commitment towards continuous improvement across all aspects of operations, ” from product development to customer support, ” thus creating a culture that embraces efficiency at every level within the organization.”

Achieving Profitability through Improved Margins

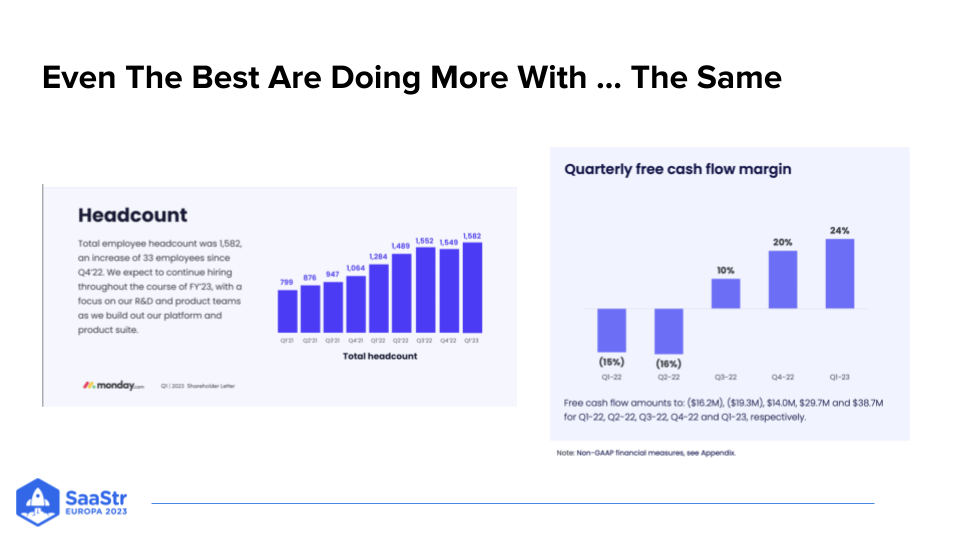

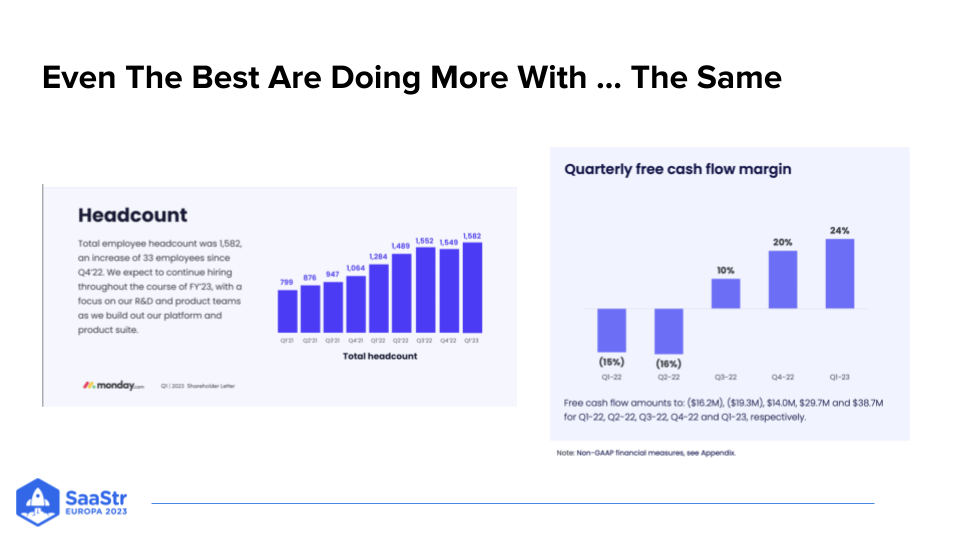

Want to transform your SaaS business? Improving margins is key. Just look at Monday.com‘s success story.

Less than a year ago, Monday.com turned negative margins into positive ones. It wasn’t luck – it was strategic planning and execution. They optimized operational efficiency, cut costs, and increased profitability.

Their approach:

- Reduced unnecessary expenses

- Invested in technology for automation and process streamlining

- Focused on customer retention strategies

- Prioritized high-margin products or services

This plan helped them thrive in challenging market conditions.

Increasing profitability through improved operational efficiency

Operational efficiency is key to profitability. Maximize output while minimizing input. Analyze operations to identify inefficiencies and leverage technology for automation. It’s tough, but with careful planning and efficient operations management, success isn’t far off.

Efficiency Among Startups Amid Challenging Times

It’s no secret that startups are facing tough times right now. With market downturns and reduced venture capital funding, some businesses struggle to stay afloat. However, others seem to remain unimpacted by these changes.

Venture Capital Funding Fallouts and Their Effects on Startups

The venture capital landscape has significantly shifted in recent years. Investors have become more cautious due to economic uncertainties, leading to decreased funding for many startups. Entrepreneurs have been compelled to adjust their approaches and search for other methods of financing their companies in light of the modifications.

Startups that were once able to secure millions in early-stage investments now find themselves struggling with cash flow issues and operational challenges as they try to navigate this new reality. The fallout from these shifts can be significant – layoffs, stalled growth plans, or even business closures are not uncommon outcomes.

The Role of CIOs in Budgeting for SaaS Products

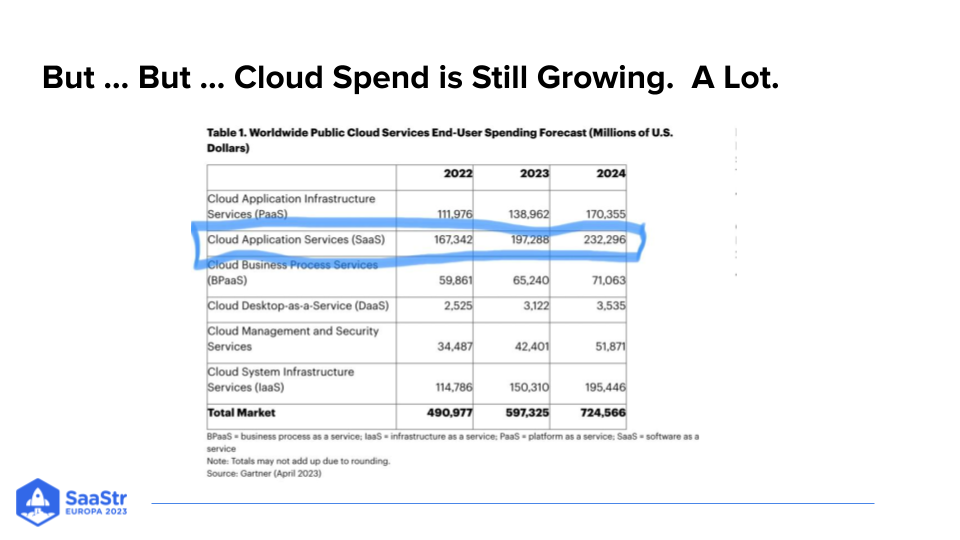

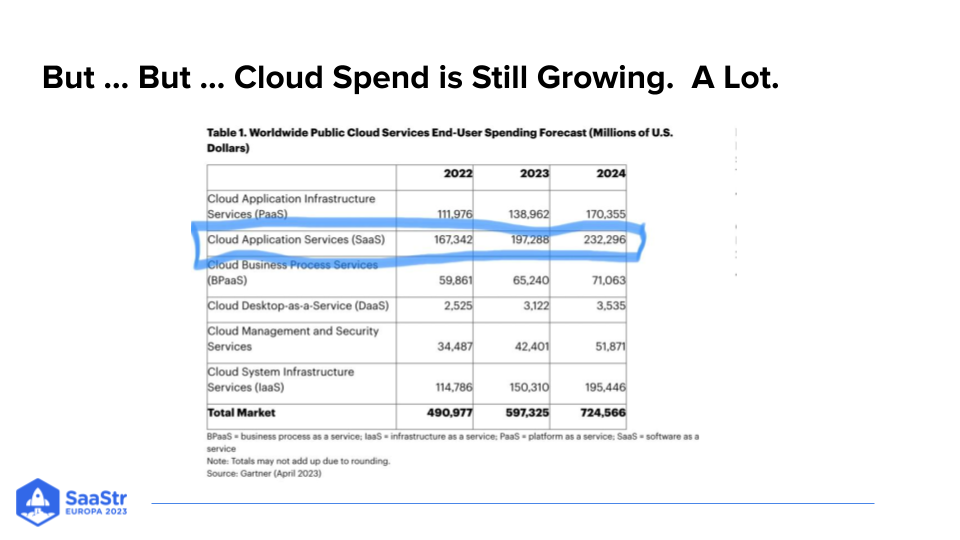

CIOs have recently emerged as primary players in determining how much money is allocated for SaaS products. As technology becomes more integrated into business operations, CIOs are tasked with identifying cost-effective solutions that offer high returns on investment. Gartner’s research predicts a notable rise in IT expenditures in the upcoming years, which could signify an optimistic outlook for the SaaS market.

The Importance of Efficient Growth in Today’s Climate

In response to these challenges, there is an increasing emphasis on efficiency among startups today. While rapid growth was once the ultimate goal for most young companies (and still remains important), achieving sustainable growth through efficient operations is becoming equally critical.

- Better resource management: Efficiency means doing more with less – maximizing resources while minimizing waste. This approach can lead not only to cost savings but also to improved productivity and better customer service.

- Sustainable scaling: An efficient startup scales its operations sustainably without sacrificing quality or customer satisfaction levels along the way. Sustainable scaling, therefore, becomes key in maintaining long-term success amidst uncertain times. [source]

- Risk mitigation: By focusing on efficiency rather than unchecked expansion at all costs, startups can mitigate potential risks associated with overextension such as financial instability or reputational damage.

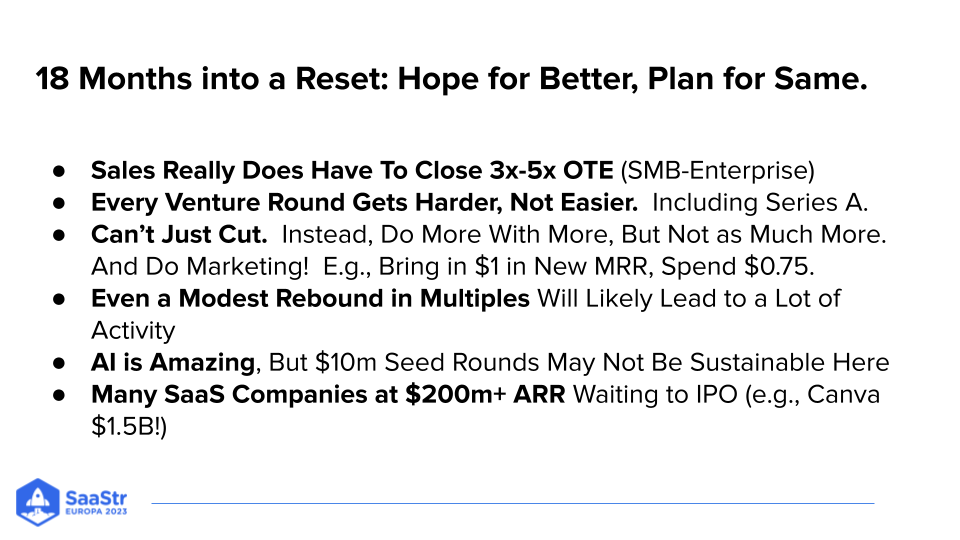

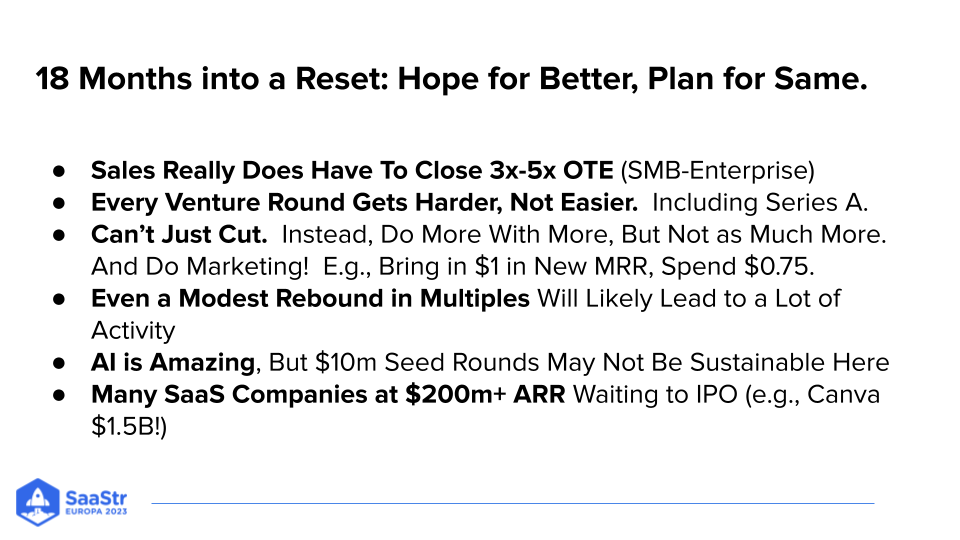

Venture Capital Markets: Toughest in 5+ Years

The current economic climate has resulted in slower growth periods for many startups. Investors are now exercising increased caution when considering investing in new ventures due to the current economic climate. Forbes details how market size, product uniqueness, team capability, and financial performance play into investor decisions during slow growth periods.

Falling below the required growth line can have severe consequences on a startup’s chances of securing further investment or reaching profitability. Investors may be concerned if a startup fails to reach the necessary growth line, potentially inquiring as to whether its business model is able to scale or if there are problems with its go-to-market approach that need course-correcting.

However, achieving $100 million ARR is still achievable since Cloud Spend is still growing… by A LOT.

It’s a delicate balancing act, but with proper planning, strategic execution, and careful monitoring of key metrics, your SaaS startup can successfully navigate its way towards achieving this milestone.

Key Takeaways:

Yes, startups are facing tougher times due to reduced venture capital funding, leading to cash flow issues and operational challenges. To navigate this new reality, startups must focus on efficiency through better resource management, sustainable scaling, and risk mitigation. Achieving sustainable growth through efficient operations is becoming equally critical as rapid growth for long-term success amidst uncertain times.

In the end, however, you can’t just cut your way to growth. It requires a full, organization-wide mindset of efficiency: from sales closing more deals to doing more with your marketing dollars – efficient growth will not only help your SaaS startup through the tougher times of 2023, but if you can use it to become profitable, it can be the key to sustained, long-term company growth, valuation, and ultimate success.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.saastr.com/why-the-era-of-efficient-growth-is-now-the-2023-vc-state-of-the-market-with-saastr-ceo-and-founder-jason-lemkin-podcast-video/

- :has

- :is

- :not

- :where

- $100 million

- $2.5 billion

- $400 Million

- 1

- 2019

- 2021

- 2023

- 75

- a

- Able

- About

- accordingly

- achieved

- achieving

- acquisition

- across

- Act

- adapt

- ago

- All

- allocated

- along

- also

- Amid

- amidst

- among

- an

- analysis

- analyze

- and

- approach

- approaches

- ARE

- AS

- aspects

- associated

- At

- attract

- Automation

- back

- balancing

- BE

- became

- become

- becomes

- becoming

- been

- behind

- being

- below

- benefits

- Better

- Billion

- boosting

- born

- brand

- Broke

- budgeting

- business

- business model

- business operations

- businesses

- but

- by

- Campaign

- CAN

- capabilities

- capital

- Capital Markets

- careful

- Cash

- cash flow

- Cause

- caution

- cautious

- ceo

- CEO and Founder

- challenges

- challenging

- chances

- change

- Changes

- Chapter

- Climate

- closing

- Cloud

- COM

- commitment

- Companies

- company

- compelled

- competition

- compromising

- concerned

- conditions

- conferencing

- Consequences

- considering

- consumer

- content

- continue

- continuous

- converting

- Cost

- cost savings

- cost-effective

- Costs

- could

- Creating

- critical

- Culture

- Current

- Current state

- Currently

- customer

- Customer Retention

- Customer satisfaction

- Customer Service

- Customer Support

- Customers

- Cut

- cut costs

- cutting

- damage

- data

- deal

- Deals

- December

- december 2021

- decisions

- Demand

- demonstrated

- demonstrates

- Despite

- details

- determining

- Development

- doing

- dollars

- down

- downturns

- dramatic

- dramatically

- due

- during

- e-commerce

- e-commerce platforms

- early stage

- Economic

- effects

- efficiency

- efficient

- elevated

- embed

- embedded

- embraced

- Embraces

- emerged

- emphasis

- emphasizes

- end

- enhanced

- enhancing

- Enterprise

- Entrepreneur

- entrepreneurs

- equally

- Era

- Ether (ETH)

- Even

- events

- Every

- examine

- example

- examples

- execution

- exist

- expansion

- expected

- Explain

- facing

- fails

- fallout

- far

- financial

- financial performance

- financing

- Find

- flow

- fluctuation

- fluctuations

- Focus

- focusing

- For

- Forbes

- founder

- from

- Fuel

- full

- funding

- further

- generate

- generating

- Go-To-Market

- goal

- Growth

- Have

- healthy

- help

- helped

- here

- High

- high-profile

- higher

- highlighting

- history

- How

- However

- HTTPS

- HubSpot

- identify

- identifying

- if

- immensely

- Impact

- impacted

- importance

- important

- impressive

- improved

- improvement

- improving

- in

- increased

- increasing

- industry

- influence

- innovate

- input

- instability

- instance

- integrated

- into

- investing

- investment

- Investments

- investor

- investor sentiment

- Investors

- issues

- IT

- ITS

- journey

- just

- just one

- Key

- known

- landscape

- largest

- later

- layoffs

- lead

- leading

- left

- less

- Level

- levels

- Leverage

- light

- like

- Line

- lockdowns

- long-term

- long-term benefits

- Look

- losing

- Lot

- lower

- luck

- maintaining

- major

- managed

- management

- many

- margins

- Market

- market conditions

- Market Trends

- Marketing

- Marketo

- Markets

- MarTech

- max-width

- Maximize

- maximizing

- May..

- means

- measures

- methods

- Metrics

- milestone

- million

- millions

- Mindset

- minimizing

- Mitigate

- mitigation

- model

- Modifications

- Monday

- money

- monitoring

- more

- most

- much

- must

- Navigate

- nearly

- necessary

- Need

- negative

- New

- no

- notable

- noteworthy

- now

- of

- off

- offer

- Offerings

- often

- on

- once

- ONE

- ones

- online

- online shopping

- only

- operational

- Operations

- Optimistic

- optimized

- or

- organization

- Other

- Others

- otherwise

- out

- Outcome

- outcomes

- Outlook

- output

- over

- patterns

- performance

- periods

- plan

- planning

- plans

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- players

- Point

- points

- positive

- Post

- potential

- potentially

- Predicts

- primary

- priority

- problems

- process

- Product

- product development

- productivity

- Products

- Profit

- profitability

- profitable

- profits

- profound

- promising

- proper

- public

- quality

- quickly

- rapid

- rather

- reach

- reaching

- Reality

- recent

- recently

- Reduced

- remain

- remains

- remote

- remote work

- reputation

- required

- requires

- research

- resource

- Resources

- response

- result

- resulted

- Results

- retention

- return

- returns

- Returns on Investment

- revenue

- revenues

- right

- Rise

- Risk

- Risk Mitigation

- risks

- Role

- Room

- s

- SaaS

- sacrificing

- sales

- satisfaction

- Savings

- saw

- Scale

- scales

- scaling

- Search

- Secret

- secure

- securing

- seem

- seen

- sentiment

- service

- Services

- severe

- shaped

- Share

- shifted

- Shifts

- Shopping

- significant

- significantly

- signify

- Similarly

- since

- site

- Size

- slow

- So

- Social

- social distancing

- Software

- solely

- Solutions

- some

- Source

- spend

- startup

- Startups

- State

- stay

- steady

- Still

- Storm

- Story

- Strategic

- Strategically

- streams

- Struggle

- Struggling

- Study

- subscribers

- substantial

- success

- success story

- successful

- Successfully

- such

- support

- surge

- sustainable

- Sustainable Growth

- sustained

- Swings

- Take

- Takeaways

- team

- Technology

- than

- that

- The

- their

- Them

- themselves

- There.

- therefore

- These

- they

- this

- those

- though?

- Thrive

- Through

- time

- times

- Title

- to

- today

- today’s

- tough

- towards

- trajectory

- transaction

- Transactions

- Transform

- Trends

- true

- try

- Turned

- UiPath

- ultimate

- Ultimately

- Uncertain

- uncertainties

- Uncertainty

- Uncommon

- understanding

- uniqueness

- unprecedented

- upcoming

- use

- uses

- Valuation

- Valuations

- value

- venture

- venture capital

- Venture Capital Funding

- Ventures

- Video

- video conferencing

- visitors

- was

- Waste

- Way..

- Weather

- were

- when

- whether

- which

- while

- WHO

- why

- widespread

- will

- willing

- with

- within

- without

- Work

- year

- years

- you

- young

- Your

- youtube

- zephyrnet