Home prices stayed roughly the same, but rents climbed higher. Researchers say the Dutch experiment undercut supply, though it’s unclear exactly how it would play out in the U.S.

In these times, double down — on your skills, on your knowledge, on you. Join us Aug. 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

Independent landlords may have a positive impact on the people who live in neighborhoods and may not drive up the cost of housing, according to a new study that’s being lauded by housing experts as proof that supply and demand apply to housing.

The new research looked at what happened after The Netherlands allowed cities to ban investors from buying homes to rent them out. All major cities put some kind of ban in effect.

More than a year after the policy went into effect, researchers found an increase in first-time homebuyers. But the bans didn’t help to lower the price of rent. In fact, the policy may have had the opposite effect and led to gentrification in neighborhoods, the researchers said.

“The ban did increase rental prices, consistent with reduced rental housing supply,” the researchers said.

But that’s not all. The study found that the neighborhoods themselves began changing as a result of the ban.

“The policy caused a change in neighborhood composition as tenants of investor-purchased properties tend to be younger, have lower incomes, and are more likely to have a migration background,” they said.

Investors and landlords provide housing that’s attainable for residents with “substantially lower incomes” compared to residents who have the means to buy a home.

“This shows that investor activity can have significant consequences on neighborhood composition, particularly over the long run, even when their direct price impact appears limited in the short run,” the researchers said.

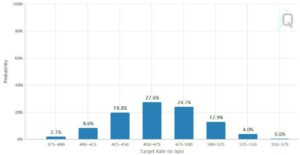

The bans led to a 4 percent increase in the price of rent, which Korevaar called “significant.” The change on home sales prices was “effectively zero,” one of the researchers, Matthijs Korevaar, said.

The city of Rotterdam, with a population of over 650,000 people, will use the findings to reassess its policy later this year, Korevaar said.

Still, it’s not clear how closely the findings would mirror the more ownership-oriented U.S.

Does it apply to the U.S.?

Like the U.S., policymakers were responding to pressure from residents who were concerned by high home prices and low vacancy rates that combined to squeeze renters. There have been growing calls in the U.S. for policies that target investors, though the focus has recently been on rent control.

The Netherlands put the ban in place in January 2022 after a surge in investor activity that largely mirrors what’s occurred in the U.S.

Jay Parsons, chief economist of rental data firm RealPage, said it was “fair” to question whether the study applies to the U.S. But he said the findings broadly match other research in the U.S.

Freddie Mac released a report last year that suggested investor purchases, which have grown in recent years, weren’t the reason for the unprecedented rise of home prices during the COVID-19 housing market. Freddie Mac found record low mortgage rates, limited supply, increased migration and an increase in first-time homebuyers were the primary drivers of home price increases.

“What may surprise you is that investors don’t make our list of top drivers,” Freddie Mac said at the time.

Dejan Eskic is a senior research fellow and scholar at the Kem C. Gardner Policy Institute at the University of Utah. Eskic said it was interesting that the Dutch researchers found renters faced more risk of displacement under a ban on landlords.

“It didn’t gentrify under the investors,” Eskic said. “For me the biggest takeaway is the punchline: Investors didn’t cause a massive spike in prices.”

Still, it’s not clear what a similar study across the U.S. might find.

“It’s awesome that they drilled down so much,” Eskic said. “But if you repeated this on more cities across the [U.S.] you’d get varying results by city.”

Ultimately, though, Parsons said rental housing in the U.S. is affected by supply and demand. Restricting supply, he said, will lead to higher prices.

“This is common sense,” Parsons said. “Renters in the U.S., too, are indeed younger and less affluent. Allowing rental homes helps diversify neighborhoods everywhere.”

What’s more, Parsons added, the issue is one of simple economics.

“The laws of supply and demand apply everywhere,” Parsons said, “not just in Europe.”

Get Inman’s Property Portfolio Newsletter delivered right to your inbox. A weekly roundup of news that real estate investors need to stay on top, delivered every Tuesday. Click here to subscribe.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.inman.com/2023/06/20/the-netherlands-let-cities-ban-landlords-heres-what-happened/

- :has

- :is

- :not

- $UP

- 000

- 10

- 2022

- 32

- a

- According

- across

- activity

- added

- After

- All

- Allowing

- an

- and

- Apply

- ARE

- AS

- At

- Attainable

- Aug

- background

- Ban

- Bans

- BE

- been

- began

- being

- BEST

- Biggest

- broadly

- but

- buy

- Buying

- by

- called

- Calls

- CAN

- Cause

- caused

- CFM

- change

- changing

- chief

- Cities

- City

- clear

- Climbed

- closely

- COM

- combined

- Common

- compared

- concerned

- Connect

- Consequences

- consistent

- control

- Cost

- data

- delivered

- Demand

- DID

- direct

- diversify

- Dont

- double

- down

- drive

- drivers

- during

- Dutch

- Economics

- Economist

- effect

- estate

- Europe

- Even

- Every

- exactly

- experiment

- experts

- faced

- fact

- fellow

- Find

- findings

- Firm

- Focus

- For

- found

- from

- get

- Growing

- grown

- had

- happened

- Have

- he

- help

- helps

- here

- High

- higher

- Home

- Homes

- housing

- housing market

- How

- HTTPS

- if

- Impact

- in

- Increase

- increased

- Increases

- Institute

- interesting

- into

- investor

- Investors

- issue

- IT

- ITS

- January

- join

- Join us

- jpg

- just

- Kind

- knowledge

- largely

- LAS

- Las Vegas

- Last

- later

- Laws

- lead

- LEARN

- Led

- less

- likely

- Limited

- List

- live

- Long

- looked

- Low

- lower

- mac

- major

- make

- Market

- massive

- Match

- max-width

- May..

- me

- means

- might

- migration

- mirror

- more

- Mortgage

- much

- Need

- Netherlands

- New

- news

- Newsletter

- now

- occurred

- of

- on

- ONE

- opposite

- Other

- our

- out

- over

- particularly

- People

- percent

- Place

- plato

- Plato Data Intelligence

- PlatoData

- Play

- policies

- policy

- policymakers

- population

- positive

- pressure

- price

- Prices

- primary

- proof

- properties

- provide

- purchases

- put

- question

- Rates

- real

- real estate

- reason

- recent

- recently

- record

- Reduced

- released

- Rent

- renters

- repeated

- report

- research

- researchers

- residents

- responding

- restricting

- result

- Results

- right

- Rise

- Risk

- roughly

- roundup

- Run

- s

- Said

- sales

- same

- say

- senior

- sense

- shift

- Short

- Shows

- significant

- similar

- Simple

- skills

- So

- some

- spike

- Squeeze

- stay

- stayed

- Study

- supply

- Supply and Demand

- surge

- surprise

- Target

- than

- that

- The

- the Netherlands

- their

- Them

- themselves

- These

- they

- this

- this year

- though?

- ticket

- time

- times

- to

- too

- top

- Tuesday

- u.s.

- under

- university

- unprecedented

- us

- use

- utah

- VEGAS

- was

- weekly

- went

- were

- What

- when

- whether

- which

- WHO

- will

- with

- would

- year

- years

- you

- Younger

- Your

- zephyrnet

- zero