On the same day Tesla announced its latest round of price cuts, the company reported its first-quarter earnings results, falling short of analysts’ targets.

The repeated price drops ate into the EV maker’s profit margins, which were expected to come in at 22.4%, according to a Refinitiv poll of 14 analysts; however, the Texas-based automaker’s gross margin only came in at 19.3% — a number other automakers would celebrate.

“We expect that our product pricing will continue to evolve, upwards or downwards, depending on a number of factors,” the company said in a letter to shareholders.

Tesla’s CFO Zachary Kirkhorn promised in January, according to Reuters, that Tesla would not go below automotive gross margins of 20% and an average selling price of $47,000 across models. However, Tesla’s gross margins are usually several percentage points higher than any other automaker.

“We continue to believe that our operating margin will remain the highest among volume OEMs,” the company said in the letter.

Hard numbers

The company did exceed analysts estimates in some areas, including first-quarter revenue where it reported $23.3 billion, compared with consensus estimate of $23.2 billion, according to Refinitiv’s analysts poll.

The company reported net profit of $2.5 billion, down 24% from the year ago results. The company’s earnings per share was 73 cents, down 23%. The company’s adjusted EBITDA was $4.3 billion, a decline of 15%.

Tesla pointed to higher costs for raw materials, commodities, logistics and warranties as well as costs of ramping up production of its new 4680 battery cells as one of the factors impacting its Q1 results. While it acknowledge the prices cuts did negatively impact its results this quarter, officials believe there is a bigger picture to see.

“Our near-term pricing strategy considers a long-term view on per vehicle profitability given the potential lifetime value of a Tesla vehicle through autonomy, supercharging, connectivity and service,” the company said in its shareholder letter.

“We expect that our product pricing will continue to evolve, upwards or downwards, depending on a number of factors.

“Although we implemented price reductions on many vehicle models across regions in the first quarter, our operating margins reduced at a manageable rate. We expect ongoing cost reduction of our vehicles, including improved production efficiency at our newest factories and lower logistics costs, and remain focused on operating leverage as we scale.

Good news

The company did take note of several positives during the quarter, noting tooling for the Cybertruck factory nearly Austin, Texas was on track and it was producing “alpha” versions of the long-awaited full-sized pickup.

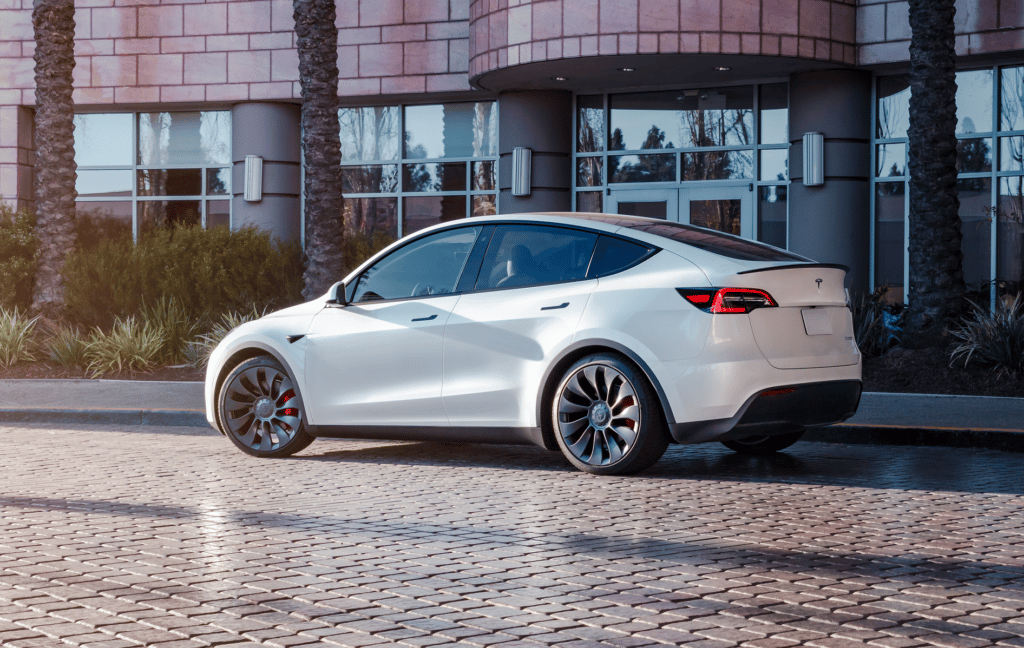

It also noted the Model Y was the best-selling vehicle in Europe during the first quarter of the year, and futher claimed it was the top seller in the U.S., if you exclude full-size pickups. The company lumps deliveries of its Model 3 and Model Y together, but it delivered 412,180 of the vehicles during Q1 — an increase of 40%.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://www.thedetroitbureau.com/2023/04/tesla-misses-some-analysts-targets-for-q1/

- :is

- $2.5 billion

- $UP

- 000

- 15%

- a

- According

- acknowledge

- across

- Adjusted

- among

- Analysts

- and

- announced

- any

- ARE

- areas

- AS

- At

- austin

- automakers

- automotive

- average

- battery

- believe

- below

- bigger

- Billion

- car

- celebrate

- Cells

- ceo

- cfo

- claimed

- come

- Commodities

- company

- Company’s

- compared

- Connectivity

- Consensus

- considers

- continue

- Cost

- cost reduction

- Costs

- cuts

- cybertruck

- day

- Decline

- delivered

- Deliveries

- delivery

- Depending

- DID

- Dont

- down

- Drops

- during

- Earnings

- earnings report

- EBITDA

- efficiency

- estimate

- estimates

- Europe

- EV

- Event

- evolve

- exceed

- expect

- expected

- factories

- factors

- factory

- Falling

- falling short

- First

- focused

- For

- from

- given

- Go

- gross

- higher

- highest

- However

- HTTPS

- Impact

- implemented

- improved

- in

- Including

- Increase

- IT

- ITS

- January

- jpg

- latest

- letter

- Leverage

- lifetime

- logistics

- long-awaited

- long-term

- many

- Margin

- margins

- materials

- max-width

- misses

- model

- models

- Musk

- nearly

- negatively

- net

- New

- Newest

- noted

- number

- of

- on

- ONE

- ongoing

- operating

- Other

- our

- percentage

- Pickup

- picture

- plato

- Plato Data Intelligence

- PlatoData

- points

- poll

- potential

- price

- Prices

- pricing

- Product

- Production

- Profit

- profitability

- promised

- Q1

- Quarter

- ramping

- Rate

- Raw

- Reduced

- refinitiv

- regions

- remain

- repeated

- report

- Reported

- Results

- Reuters

- revenue

- round

- s

- Said

- same

- says

- Scale

- Selling

- Semi

- service

- several

- Share

- shareholder

- Shareholders

- Short

- some

- Strategy

- Take

- targets

- Tesla

- texas

- that

- The

- Through

- to

- together

- top

- track

- u.s.

- upwards

- usually

- value

- vehicle

- Vehicles

- View

- volume

- WELL

- which

- while

- will

- with

- would

- year

- zephyrnet